Are you curious about how you can inquire about your savings bonds? Whether you're wondering about their current value, interest rates, or how to redeem them, navigating the world of savings bonds can feel overwhelming. Don't worry; we've got you covered with a simple guide that will break down the essential steps you need to take. So, read on to discover how to easily manage your savings bonds and find the answers you seek!

Recipient's contact information

Inquiries regarding savings bonds often require specific recipient information to ensure accurate communication. The recipient's contact information should include the full name, ensuring correct identification, followed by the physical address, typically including the street address, city, state, and zip code. A valid email address facilitates quicker, digital correspondence, while a phone number allows for immediate inquiries or clarifications. Additional details like a reference number or bond serial number can provide context to the inquiry and help streamline the process. Accurate and complete contact information is crucial for a successful resolution of any savings bond-related questions.

Purpose of the inquiry

Individuals often seek information regarding U.S. Savings Bonds for various purposes, including verifying current values, determining redemption options, or understanding interest accrual. The U.S. Department of the Treasury, which manages the sale and redemption of savings bonds like Series EE and Series I, provides resources for tracking bond ownership through the TreasuryDirect website. Investors typically inquire about the current worth of their bonds, which can be impacted by factors such as the issue date, interest rates, and remaining maturity period. This inquiry often stems from financial planning efforts, educational funding needs, or retirement savings strategies, as individuals evaluate their options to optimize their investment returns.

Details of the savings bond

Savings bonds, such as U.S. Series EE and Series I bonds, provide secure ways to save. Each EE bond purchased at half its face value earns interest for up to 30 years. Series I bonds, designed to protect against inflation, combine fixed rates with an inflation rate adjusted every six months. Specific details include current redemption values, purchase dates, and serial numbers crucial for tracking. Additionally, savings bonds can be redeemed through financial institutions or the U.S. Department of the Treasury, with guidelines available online. Understanding maturity periods and tax implications is essential for effective financial planning.

Specific questions or requests

Savings bonds, such as Series EE and Series I bonds, often generate inquiries concerning their status and redemption process. Holders typically seek information about current interest rates, which can vary based on the bond's issue date and type, as well as details regarding maturity dates, such as a 30-year limit for Series I bonds. Additionally, many individuals ask about how to calculate accrued interest, especially if the bond was purchased years ago. Queries may also pertain to the tax implications upon redemption, with considerations for federal tax exemptions on interest when used for qualified educational expenses. The TreasuryDirect website serves as a primary resource for account management and transaction details, allowing bondholders to view their current holdings and address any specific issues with customer service for assistance.

Contact information of the sender

Checking the value of savings bonds, such as Series EE or Series I, requires specific information, including bond series type, issue date, and denomination (common values include $25, $50, $100, $500). Inquiries often involve contacting the U.S. Department of the Treasury or using their online savings bond calculator, which evaluates bonds based on interest rates set by economic conditions. For those seeking to redeem or learn about accrued interest, providing clear contact details, including full name, address, phone number, and email, ensures accurate and timely responses.

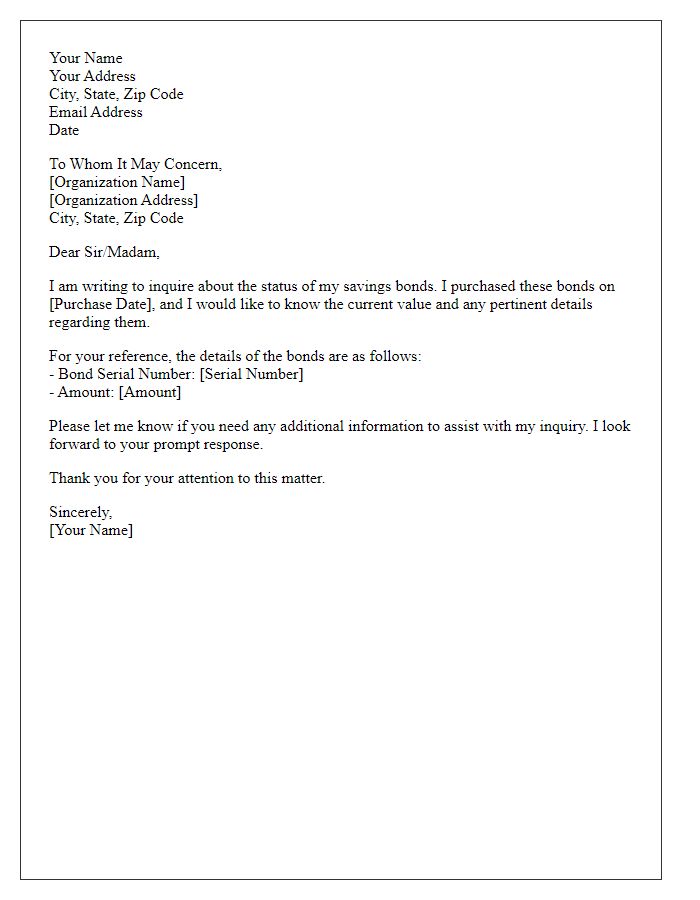

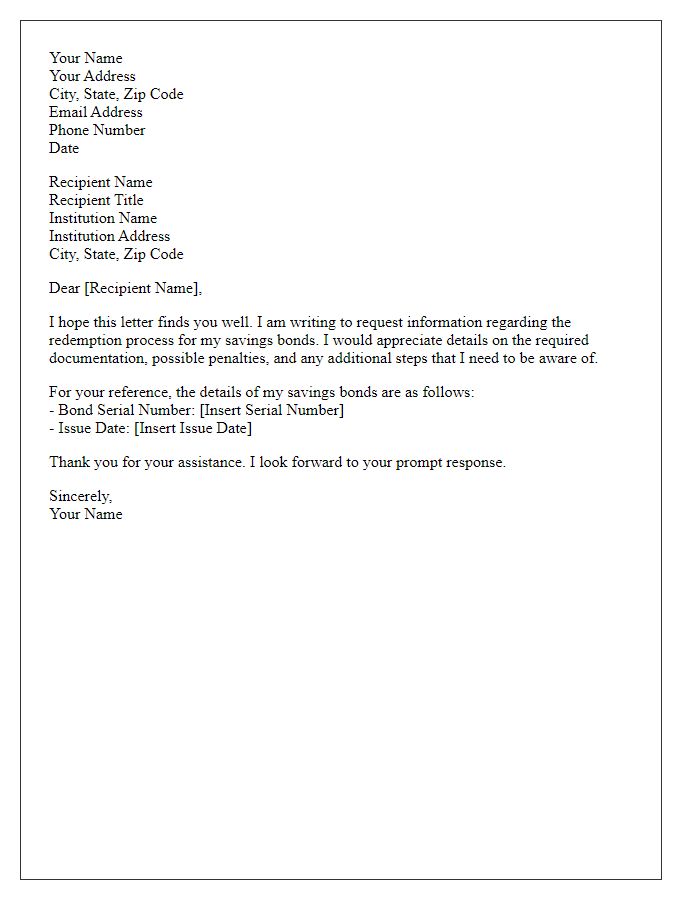

Letter Template For Savings Bond Inquiry Samples

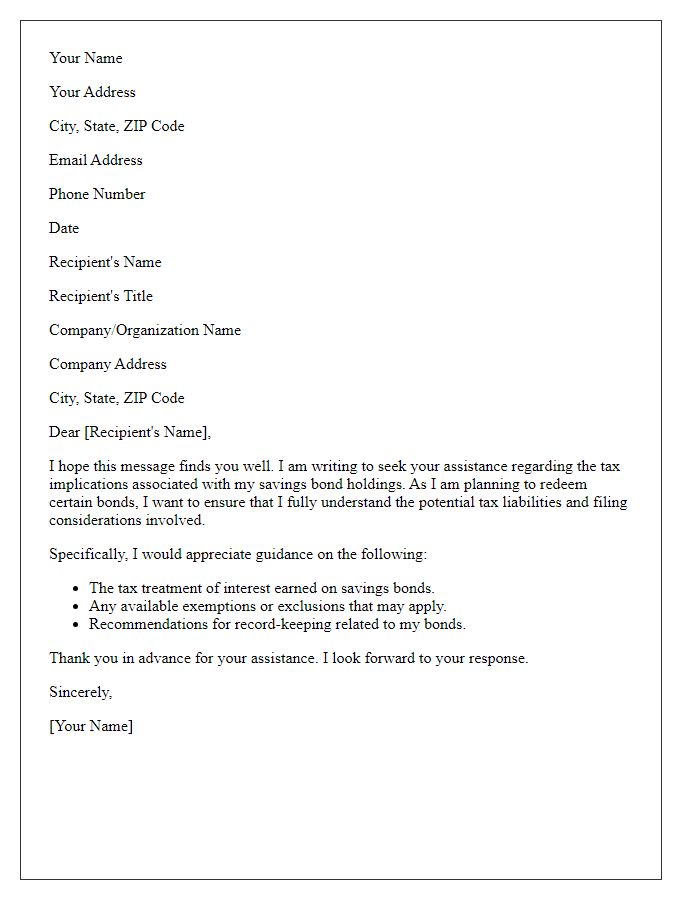

Letter template of request for assistance with savings bond tax implications

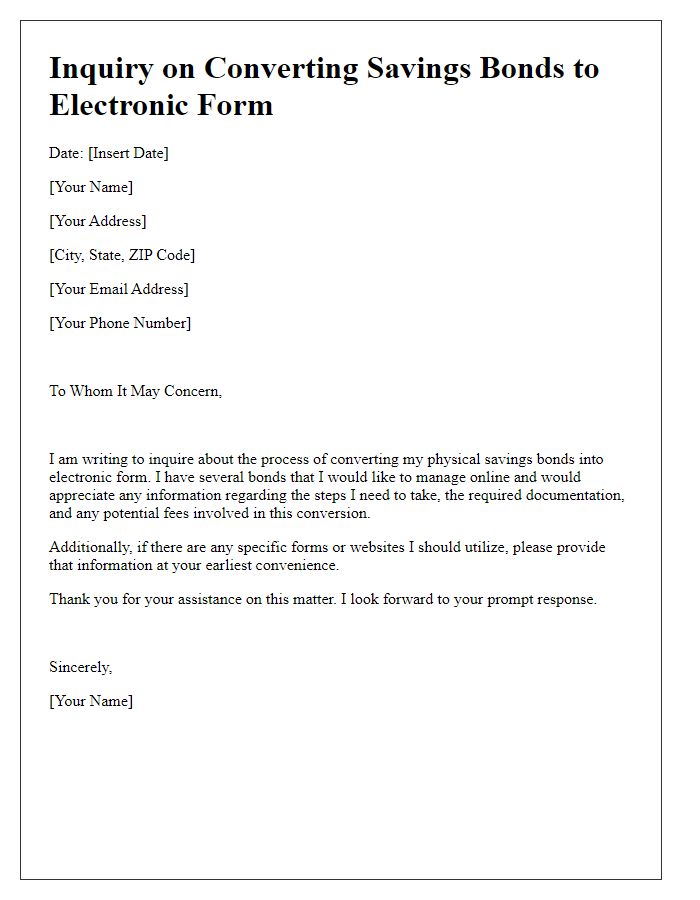

Letter template of inquiry on converting savings bonds to electronic form

Comments