Are you considering a retirement account rollover but unsure where to start? Navigating the process can be overwhelming, but it's essential for ensuring your savings are secure and working effectively for you. In this article, we'll break down the steps involved and highlight key considerations to make the transition as smooth as possible. So, grab a cup of coffee and dive in to discover everything you need to know to make the most of your retirement funds!

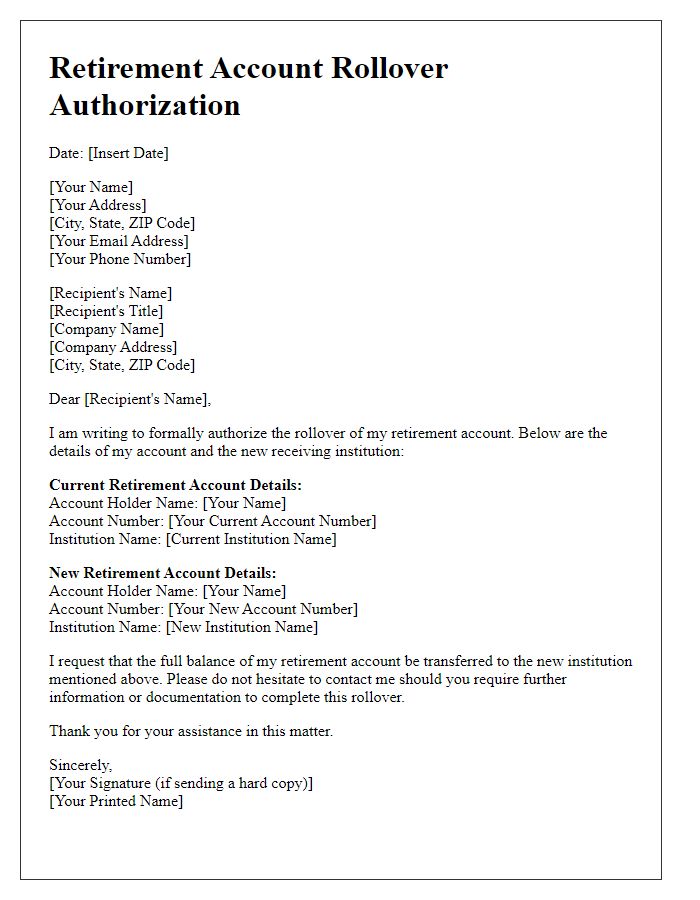

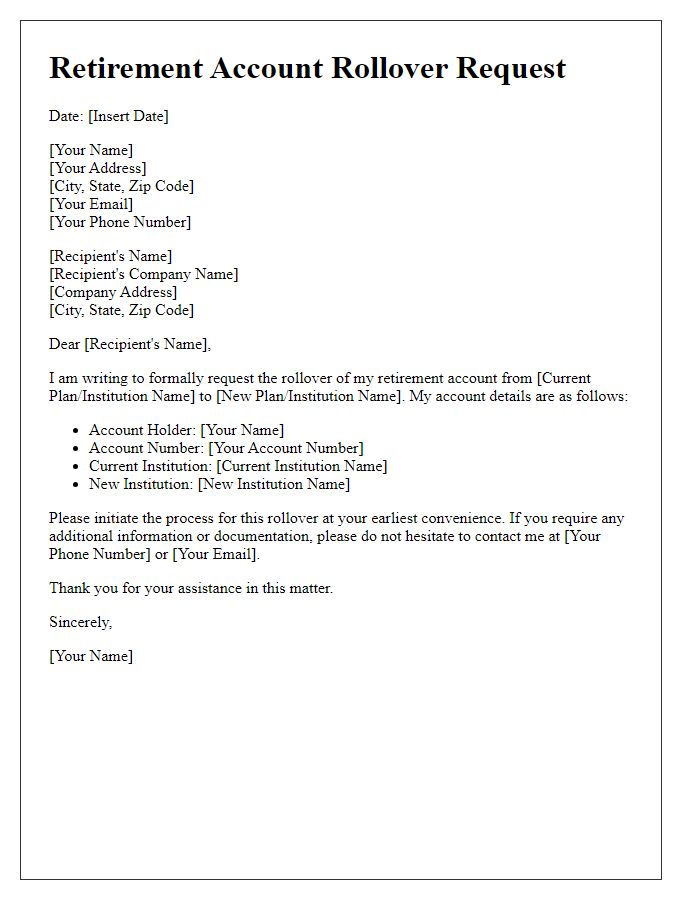

Account Details

A retirement account fund rollover involves transferring assets from one retirement plan, like a 401(k) or IRA, to another. Key details include the account holder's identification, account numbers, and the name of the financial institution involved. For instance, a 401(k) plan may require the account number, which serves as a unique identifier for tracking the funds during the rollover process. Proper documentation, usually provided by the current plan custodian, facilitates a smooth transfer without tax penalties. Ensuring the receiving account details are accurate is vital to avoid delays, ensuring retirement savings efficiently support post-employment financial needs.

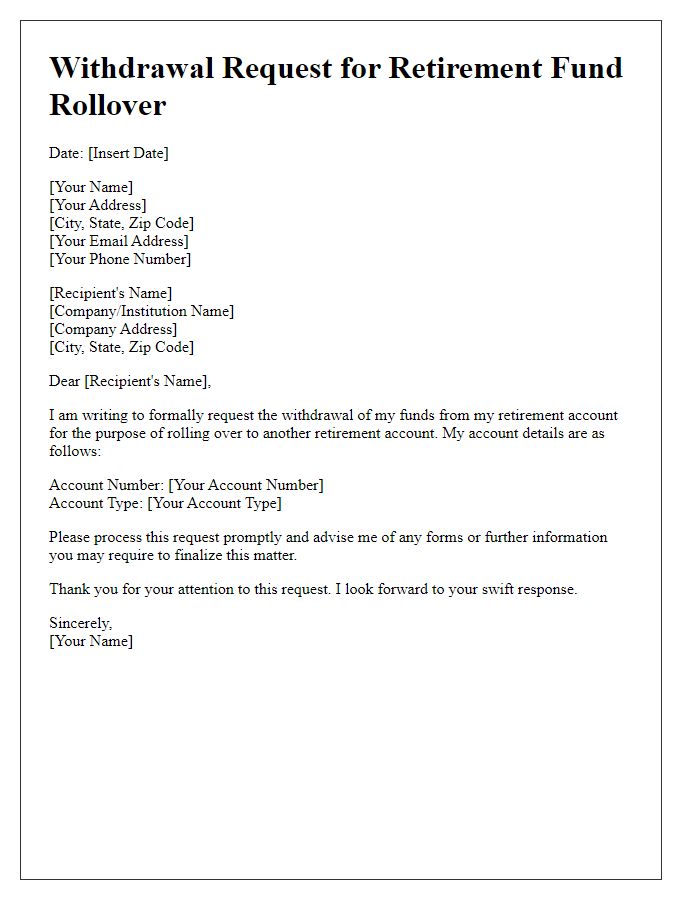

Rollover Instructions

Rollover instructions for a retirement account fund transfer involve several critical steps that ensure compliance with IRS regulations. Firstly, the initiating account holder must contact their current retirement plan administrator, such as a 401(k) plan from a previous employer, to obtain the necessary paperwork for a direct rollover. This step is essential, as direct rollovers avoid mandatory income tax withholding, ensuring the full amount transfers. Secondly, the account holder must select the receiving institution, often an Individual Retirement Account (IRA) at a financial institution like Vanguard or Fidelity. Providing accurate account details, including account number and type of IRA, is crucial to facilitate the transfer. Lastly, it is important to monitor the process, ensuring that the funds transfer within the 60-day window prescribed by the IRS to prevent tax penalties on the rollover amount. Completing these steps helps maintain the tax-advantaged status of the retirement savings.

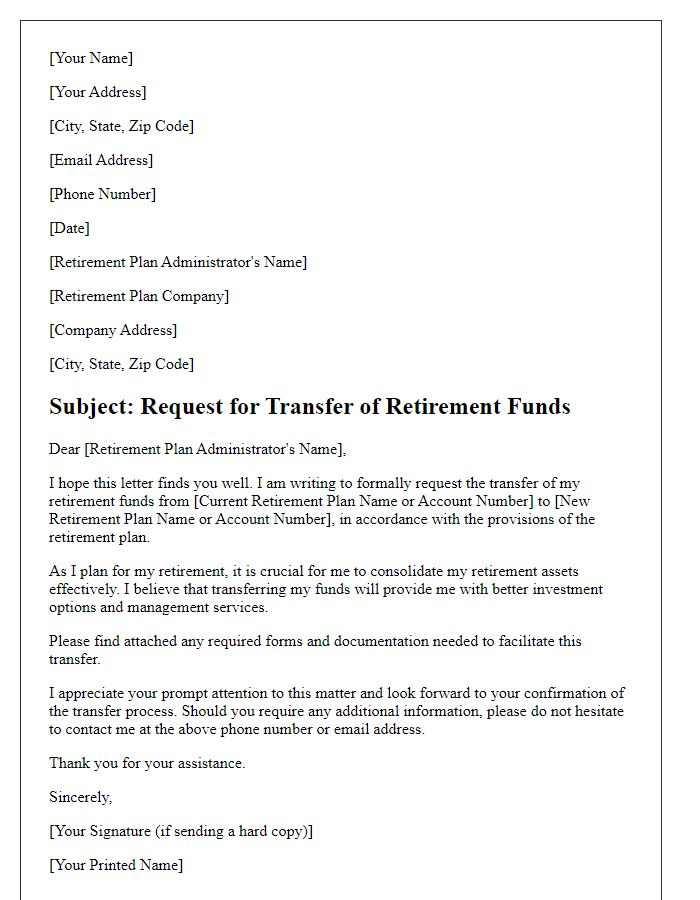

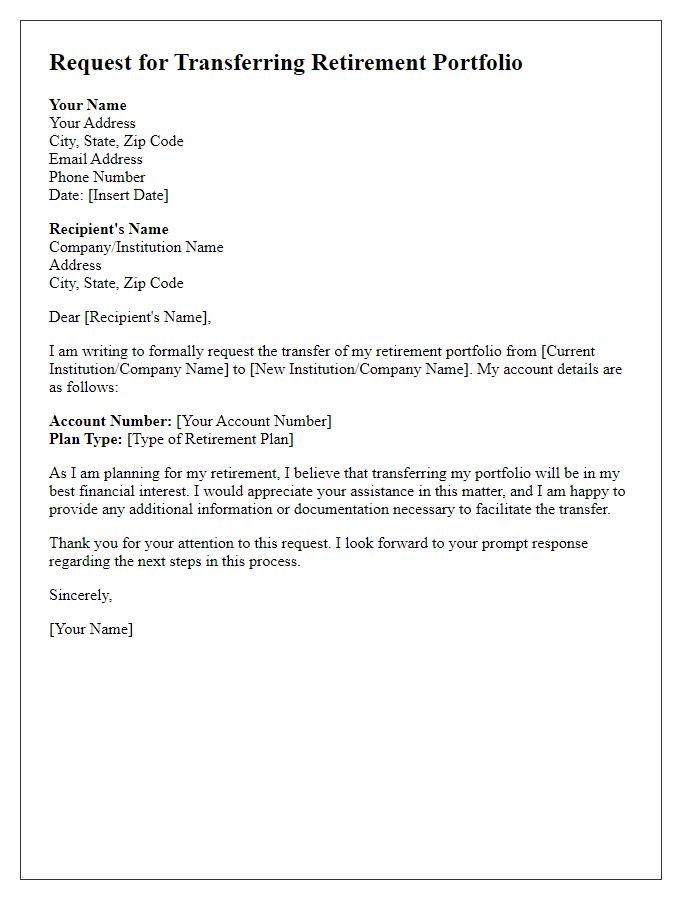

Beneficiary Information

Navigating the retirement account fund rollover process can ensure a smooth transition of assets to beneficiaries. When a retirement account, such as a 401(k) or an Individual Retirement Account (IRA), is rolled over, crucial information about designated beneficiaries must be updated and verified. The Federal Employee Retirement System (FERS) guidelines specify that beneficiaries can include individuals, trusts, or estates. It is essential to accurately report the names, Social Security numbers, and relationships of all beneficiaries to the financial institution overseeing the rollover. This information not only facilitates the proper disbursement of funds but also can affect tax implications for the beneficiaries. Accurate completion of these details ensures compliance with IRS regulations and enhances transparency during the estate planning process.

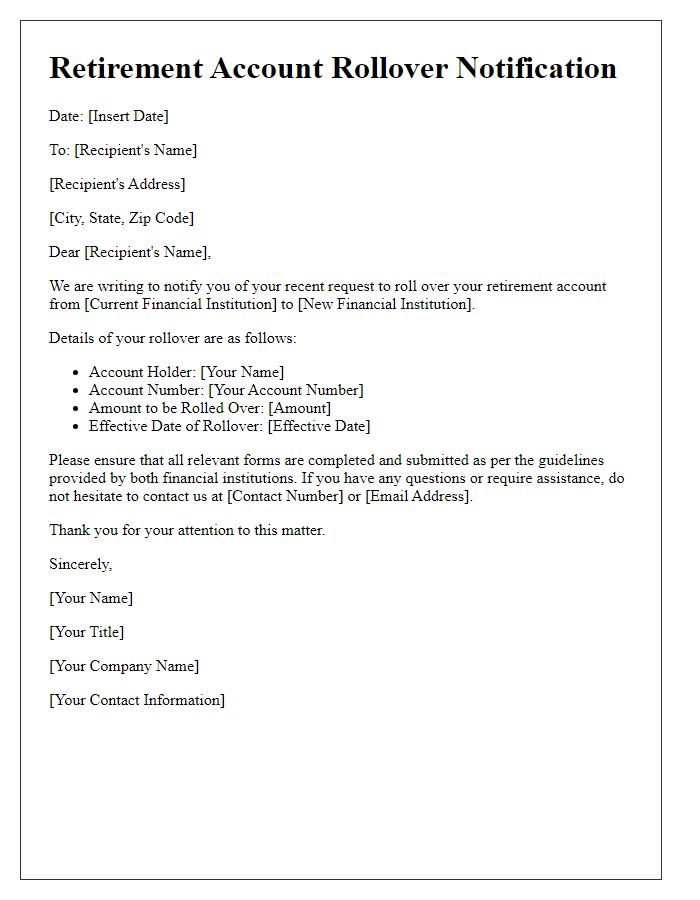

Tax Implications

When considering a retirement account fund rollover, such as from a 401(k) plan to an Individual Retirement Account (IRA), it is essential to be aware of the potential tax implications. A direct rollover, where funds transfer directly from one financial institution to another, typically avoids taxation and penalties, preserving the full value of the retirement savings. However, an indirect rollover may lead to mandatory tax withholding (usually 20%) unless the entire distribution is redeposited within 60 days. If not completed timely, the IRS may impose ordinary income taxes on the amount not rolled over, and early withdrawal penalties (10% for individuals under age 59 1/2) may apply. Always consult the latest Internal Revenue Service (IRS) guidelines and a financial advisor to ensure adherence to regulations and optimize tax outcomes during retirement planning.

Contact Information

A retirement account fund rollover involves transferring assets from one retirement plan, like a 401(k) from an employer, to another, such as an IRA (Individual Retirement Account). This process typically necessitates careful documentation and clear contact information to ensure accurate handling of funds. Essential elements include the full name, address, phone number, and email of the account holder. The receiving institution, whether a brokerage firm or bank, requires specific details, including their name, address, and designated account number, to facilitate a seamless transfer. Important notes, such as potential tax implications or penalties for early withdrawal, are crucial for account holders to understand before initiating a rollover.

Comments