Have you ever experienced the shock of an unauthorized transaction on your bank statement? It can be both unsettling and confusing, leaving you with a lot of questions. In this guide, we'll walk you through a simple and effective letter template to report such incidents, ensuring your concerns are addressed promptly. So, let's dive in and arm you with the right tools to protect your finances!

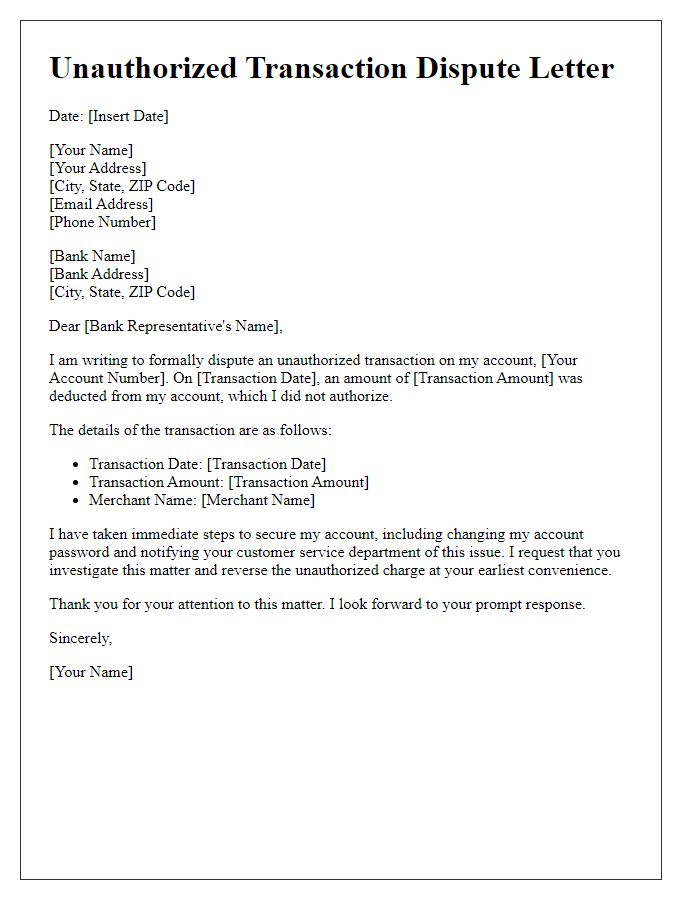

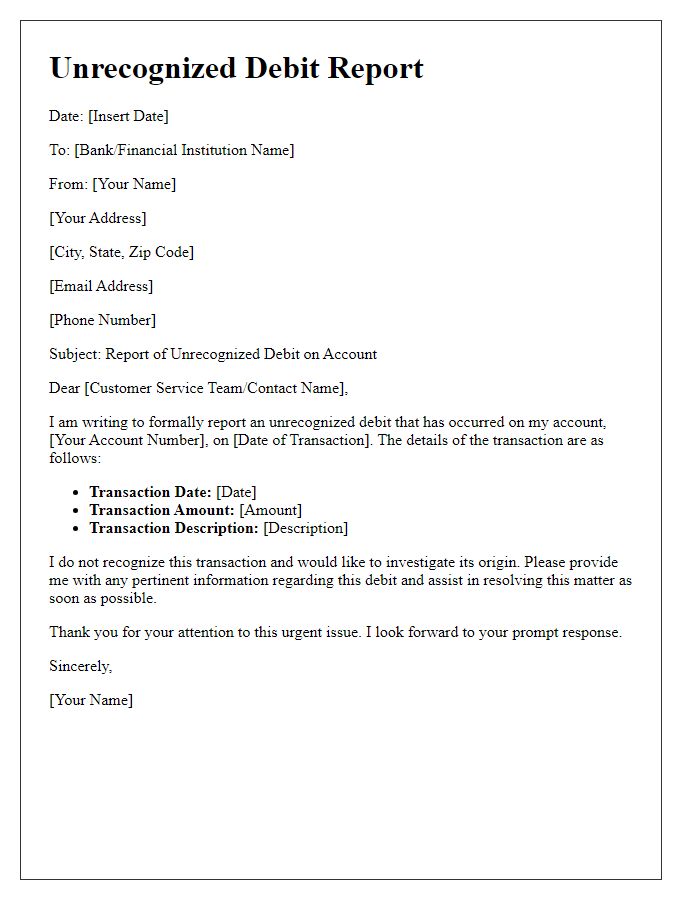

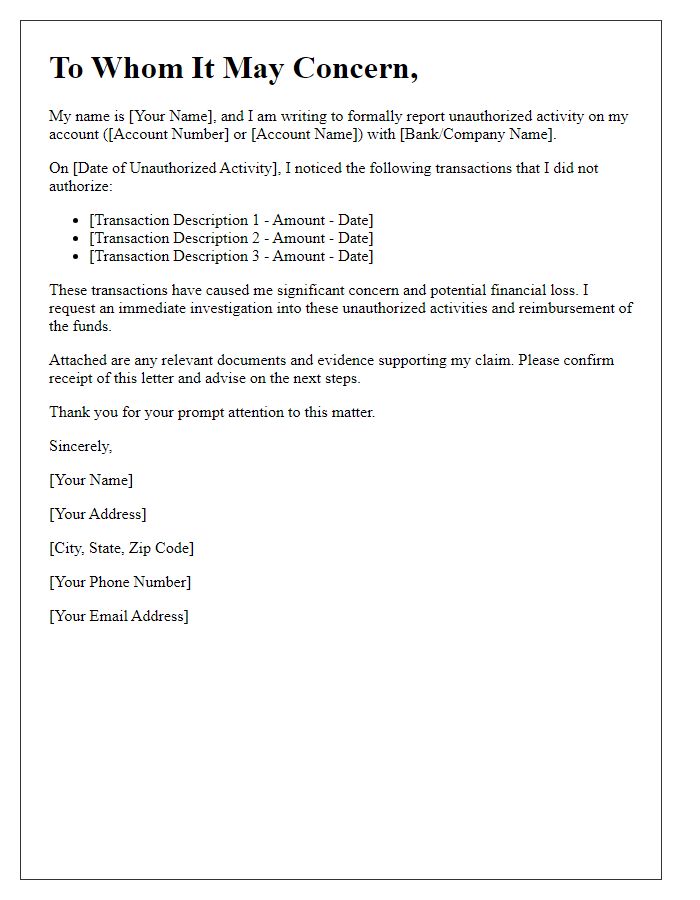

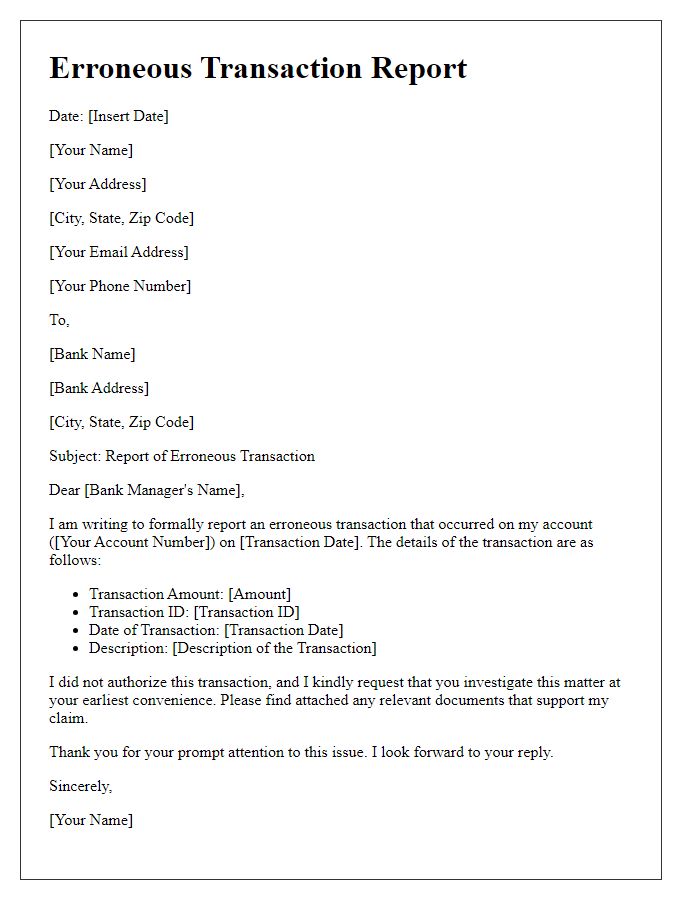

Account Details

Unauthorized transactions can severely compromise financial security and cause significant stress for account holders. Reporting such incidents promptly is crucial to mitigate potential losses. For instance, an account holder may find transactions totaling $500 on their credit card from a retail store in a different state, with no knowledge of having made those purchases. The fraudulent transactions may have taken place on November 15, 2023, highlighting the urgency of notifying the financial institution. Account details include essential information such as the account number, which could be 1234-5678-9012-3456, and the type of account (checking, savings, or credit). Providing identifying information ensures the financial institution can investigate the claim effectively and take action to prevent further unauthorized activity.

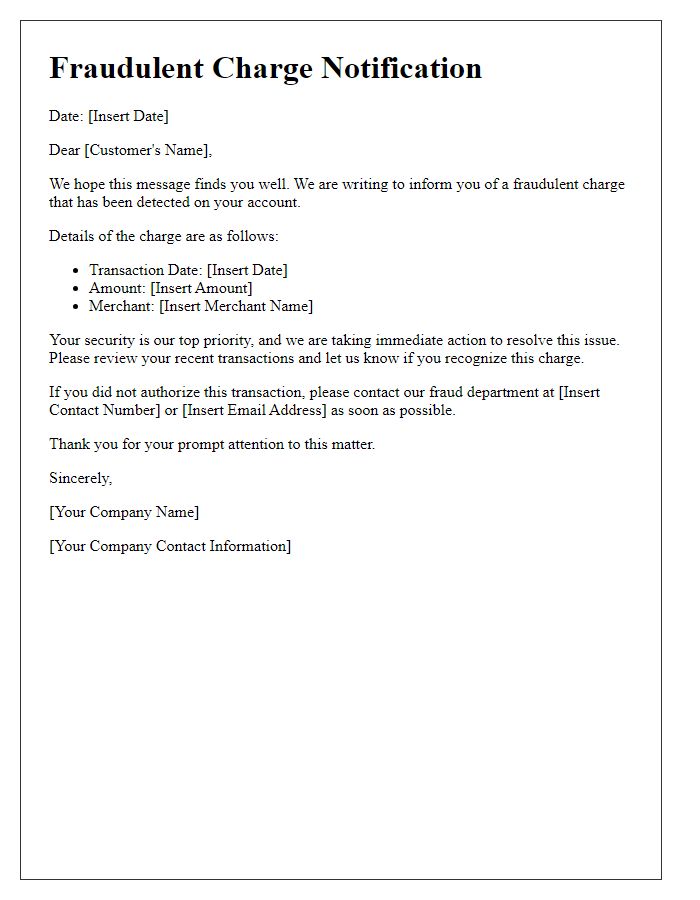

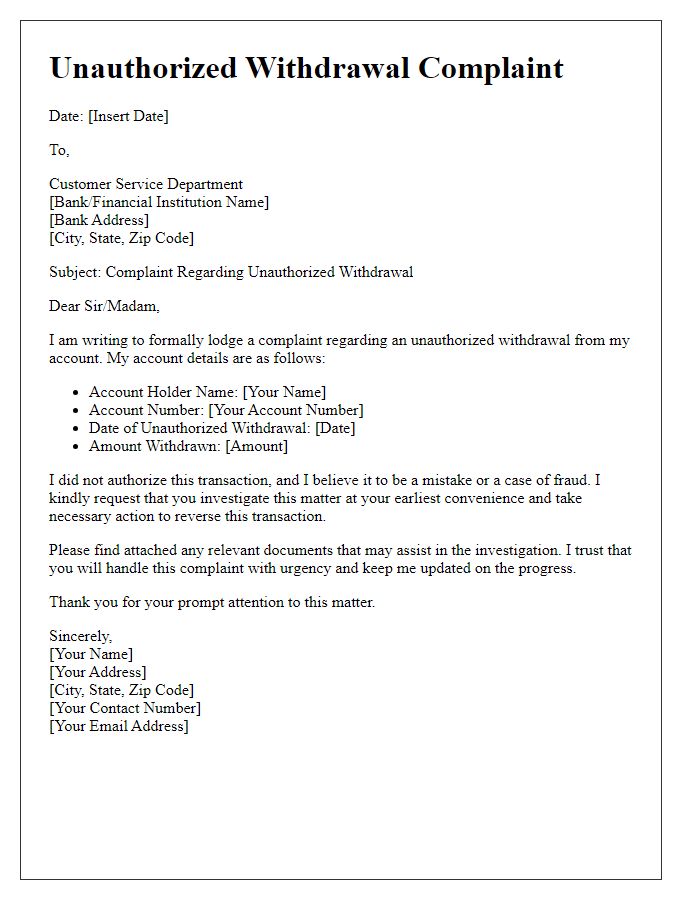

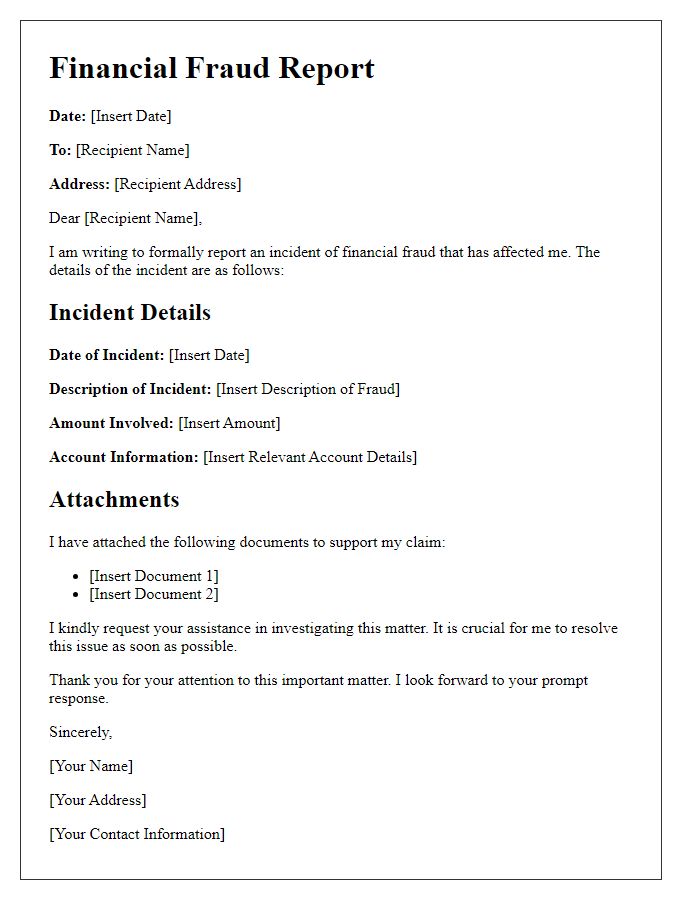

Transaction Information

Unauthorized transactions can lead to significant financial consequences for individuals and businesses alike. An example includes fraudulent purchases made using credit cards, where a hacker obtains sensitive information through phishing attacks or data breaches. Statistics indicate a 33% increase in reported cases of unauthorized credit card transactions between 2022 and 2023, highlighting the urgency of addressing these incidents promptly. Victims often face lengthy investigations and potential loss of funds, making it crucial to report such transactions immediately to financial institutions. Locations such as New York, California, and Texas have seen the highest rates of reported cases, emphasizing the need for heightened awareness and preventive measures.

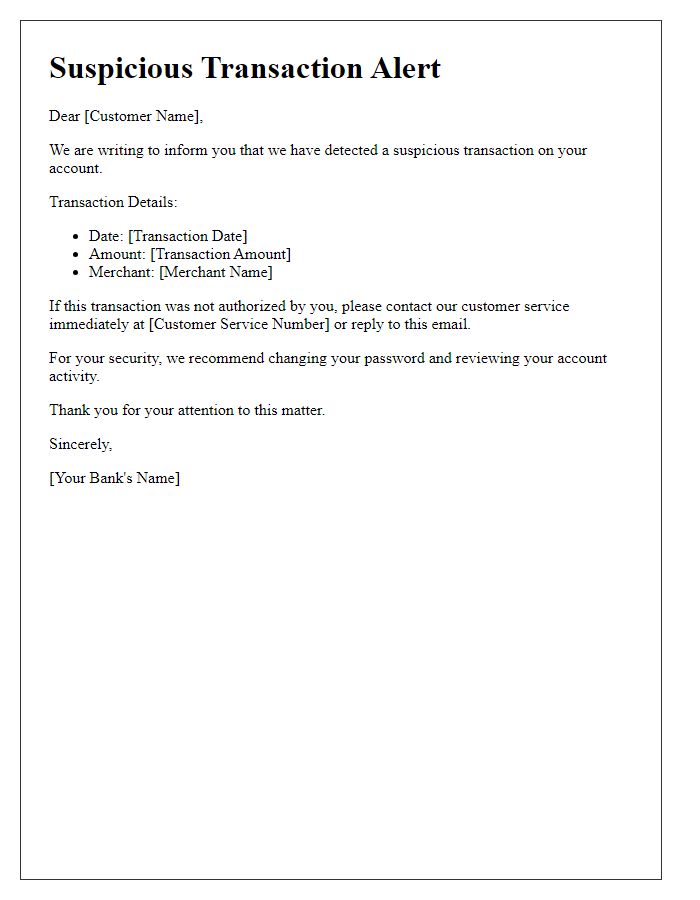

Description of Unauthorized Activity

Unauthorized transactions can severely impact financial security and consumer trust. For instance, fraudulent charges on credit cards, occurring frequently in e-commerce transactions, can range from small amounts of $10 to significant sums exceeding $10,000. Consumers often report these incidents to their banks or financial institutions, such as JPMorgan Chase or Bank of America, where immediate investigation can lead to temporary account freezes. In 2021 alone, the Federal Trade Commission recorded over 2.1 million reports of fraud, with unauthorized transactions encompassing a significant portion, highlighting the need for vigilance. Victims' accounts may reveal suspicious activity, including unfamiliar merchant names or unexpected withdrawals on specific dates. Timely reporting within 60 days is crucial for potential refunds and minimizing further losses, emphasizing the importance of monitoring financial activity regularly.

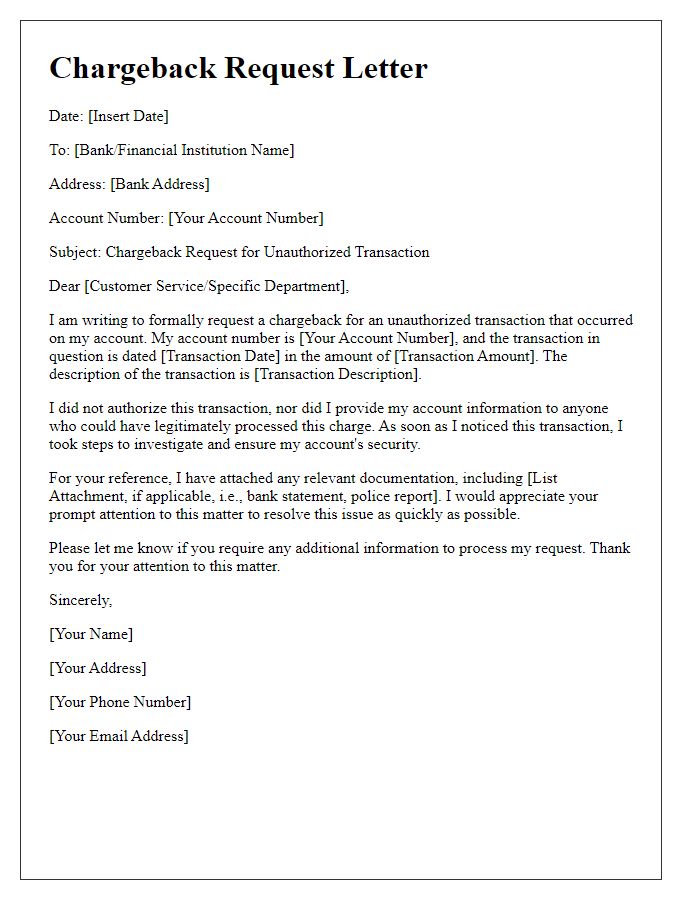

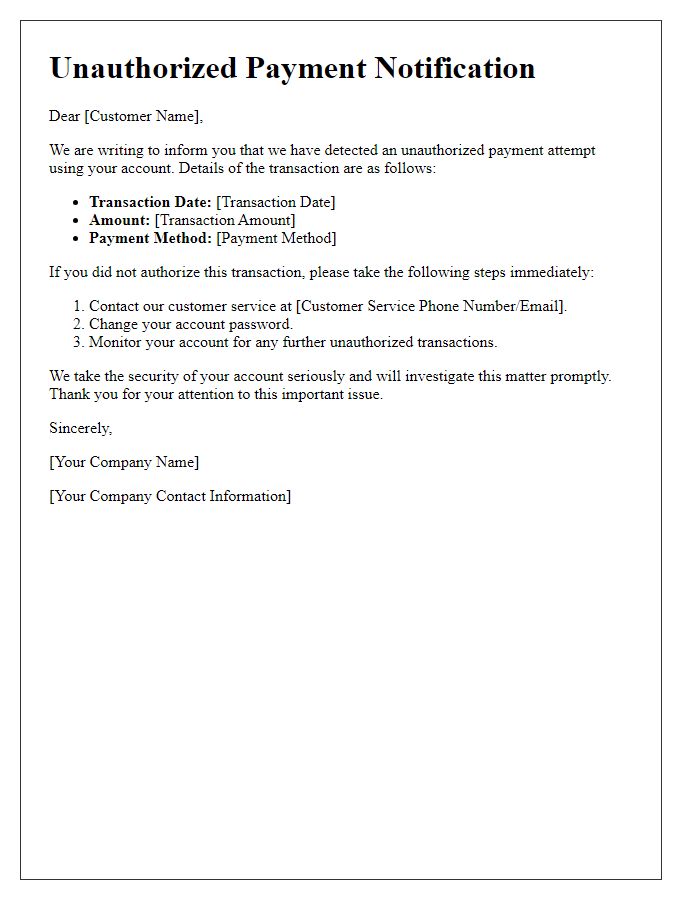

Request for Investigation and Reversal

Unauthorized transactions pose significant risks for consumers, often leading to financial losses and security concerns. Immediate reporting to the financial institution is essential, enabling prompt investigation by fraud departments. For example, if a unauthorized credit card charge of $150 occurs on January 15, 2023, the bank should look into the transaction history and account details, examining locations and timestamps (such as an online purchase made from a suspicious IP address) to trace potential fraudsters. Furthermore, reviewing customer account security measures, including two-factor authentication (2FA) usage and transaction alerts, ensures protection against future incidents, reinforcing trust in the financial system.

Contact Information and Signature

Unauthorized transactions can lead to significant financial consequences for consumers. Reporting these incidents promptly is crucial for mitigating potential losses. Victims should provide relevant contact information, including full name, address, phone number, and email address. Additionally, including specific transaction details is essential, such as transaction amount, date, and merchant name. Users may need to sign the report, affirming the accuracy of the provided information. This documentation is vital for financial institutions, such as banks or credit card companies, to investigate the issue thoroughly and implement necessary measures to protect the account.

Comments