We're glad you stopped by to get essential information on handling loan defaults. Understanding the steps and procedures involved can make a significant difference in navigating this challenging situation. In this article, we'll walk you through what to include in a loan default notification letter, ensuring you communicate effectively and professionally. Ready to learn more? Let's dive in!

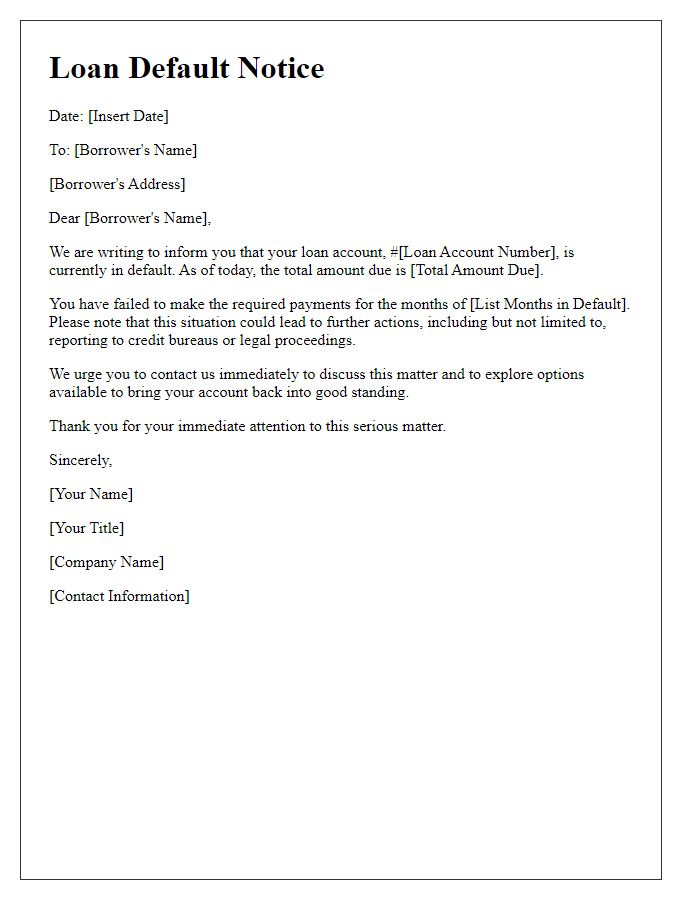

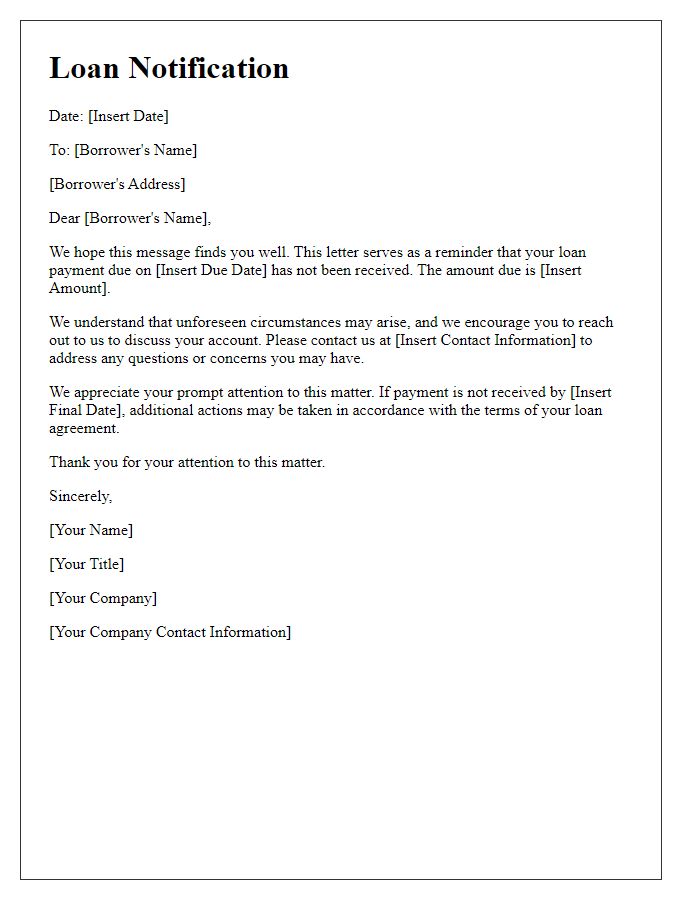

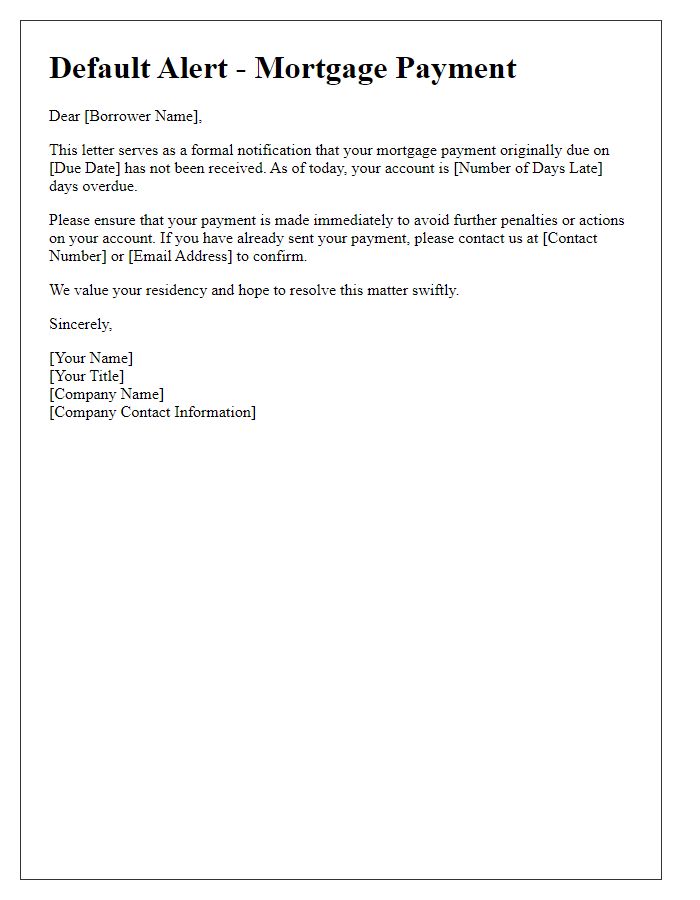

Recipient's Contact Information

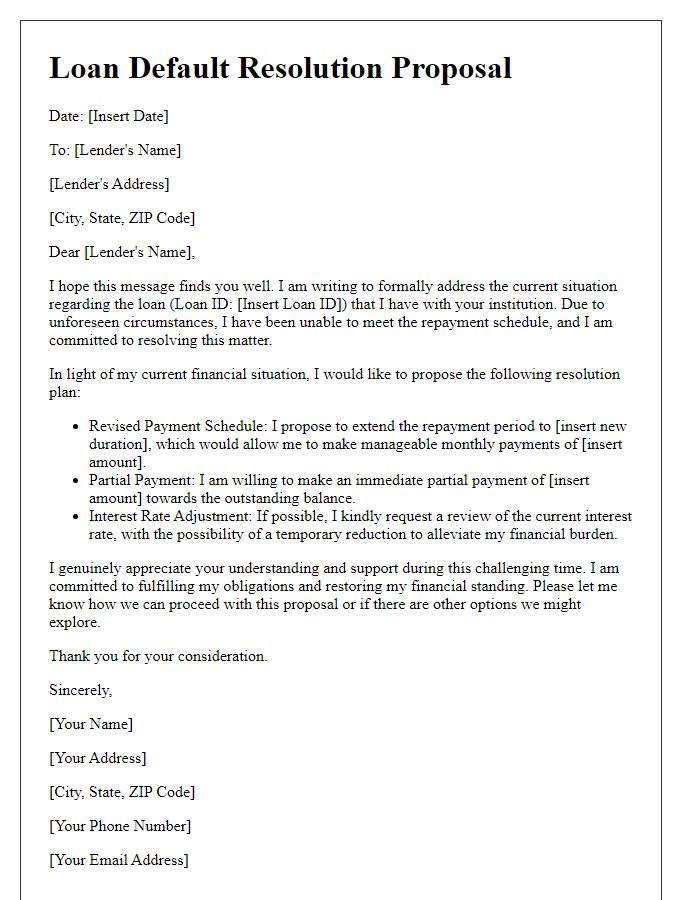

Loan default notification serves as an important communication regarding the status of a borrower's loan repayment. A loan default occurs when an individual fails to make scheduled payments, which can lead to significant financial repercussions. Generally, lenders send such notifications to ensure borrowers are aware of the overdue balance and to outline the necessary actions to remedy the situation. Key details include the loan amount, interest rates, repayment periods, and specific due dates, all of which are crucial for understanding the account's status. This notification typically emphasizes the urgency of resolving the outstanding debts, especially as it can affect the borrower's credit score and future borrowing eligibility. Clear and concise language helps convey the message effectively, urging prompt attention and response from the borrower.

Personalized Salutation

Loan default situations can significantly impact one's financial stability and credit score. A borrower with a personal loan from a bank may find themselves facing severe consequences after missing payments for 90 days. This default status, often reported to credit bureaus, can result in a drop of 100 points or more in their credit score, complicating future borrowing endeavors. Legal ramifications such as collections or wage garnishments may arise, leading to further financial distress. Timely communication from the lender, typically a formal notification detailing outstanding balances and potential repercussions, is critical for the borrower to address the situation. Understanding the full scope of these elements plays a crucial role in navigating the challenging landscape of personal finance.

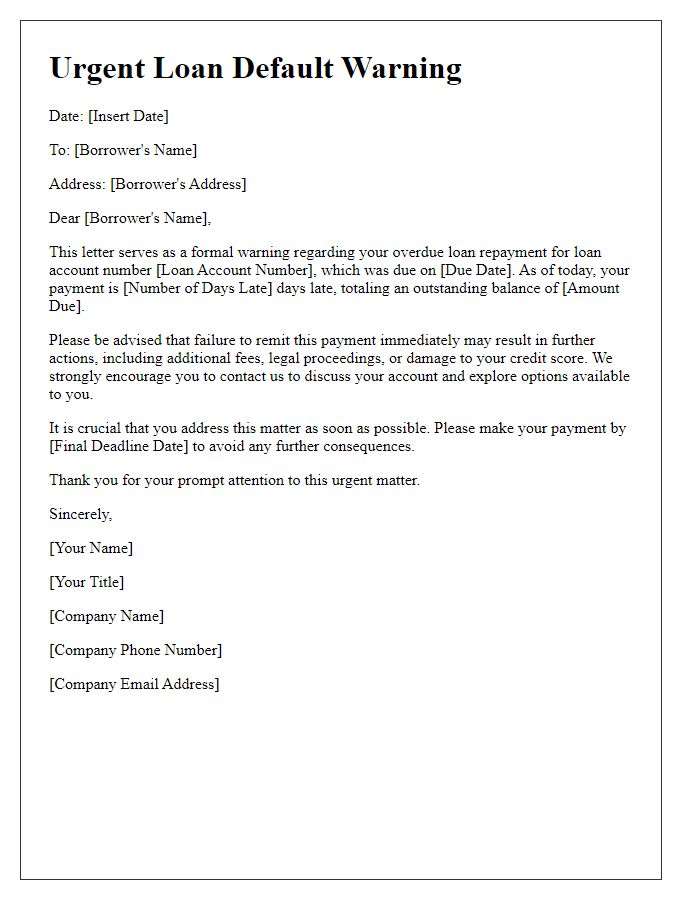

Loan Account Details

Loan account details often include crucial information such as the account number, lender's name, outstanding balance, due dates, and payment history. Timely notifications regarding loan defaults are essential to maintain communication with borrowers. Specific details about the default status can include the date of the missed payment, accumulated late fees, and potential actions for resolution. Furthermore, terms and conditions outlined in the loan agreement provide the legal framework that governs defaults, typically highlighting consequences such as increased interest rates or collections processes. Maintaining accurate records ensures that both lender and borrower understand their rights and obligations throughout the loan term.

Default Amount and Due Date

Loan default notifications are critical communications that inform borrowers about missed payments and outstanding balances. A default amount typically refers to the total sum of overdue payments, which may include principal, interest, and any applicable fees. The due date signifies the date by which the payment was expected; missing this date can lead to significant financial repercussions. For many financial institutions, the default amount becomes a pressing matter if the payment is delinquent beyond 30 days. This scenario often necessitates further actions, such as late fees or even referral to collections, emphasizing the importance of prompt repayment to maintain creditworthiness.

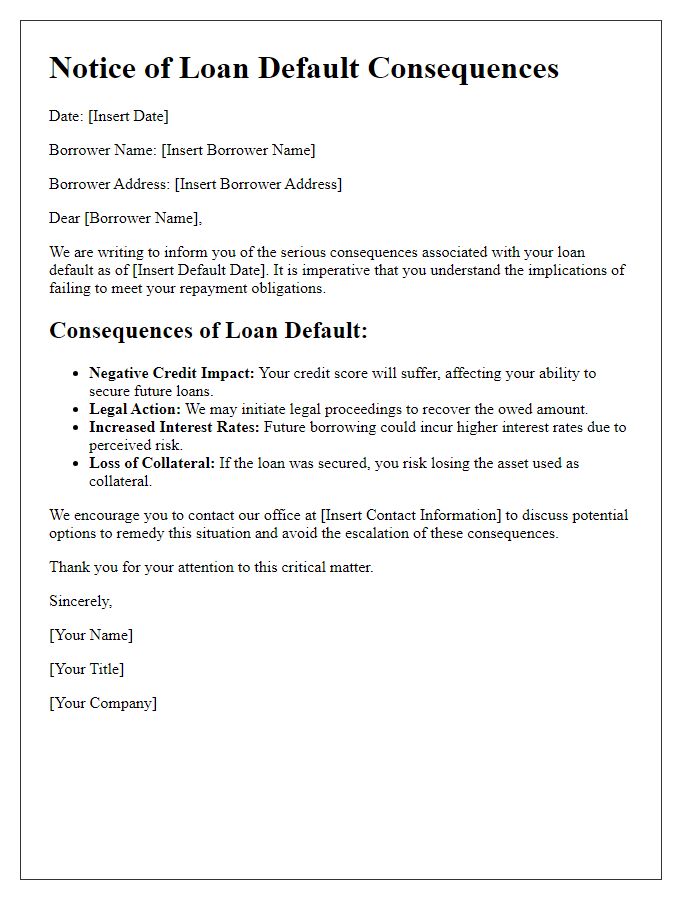

Consequences and Next Steps

Loan default can lead to severe consequences for borrowers, impacting credit scores significantly (often dropping by 100 points or more). The lender, which may be a bank like Wells Fargo or a credit union, has the right to initiate collection procedures, including contacting collection agencies. Assets may be seized through legal action, and wage garnishment may occur, which could take up to 25% of disposable income. Borrowers may also face difficulties securing future loans, as lenders view defaults as high-risk behavior. Exploring next steps, such as reaching out to financial advisors, may help individuals navigate options like loan modification or bankruptcy filing. Additionally, borrowers should regularly monitor credit reports from agencies like Experian or TransUnion for inaccuracies that may worsen their financial situation.

Comments