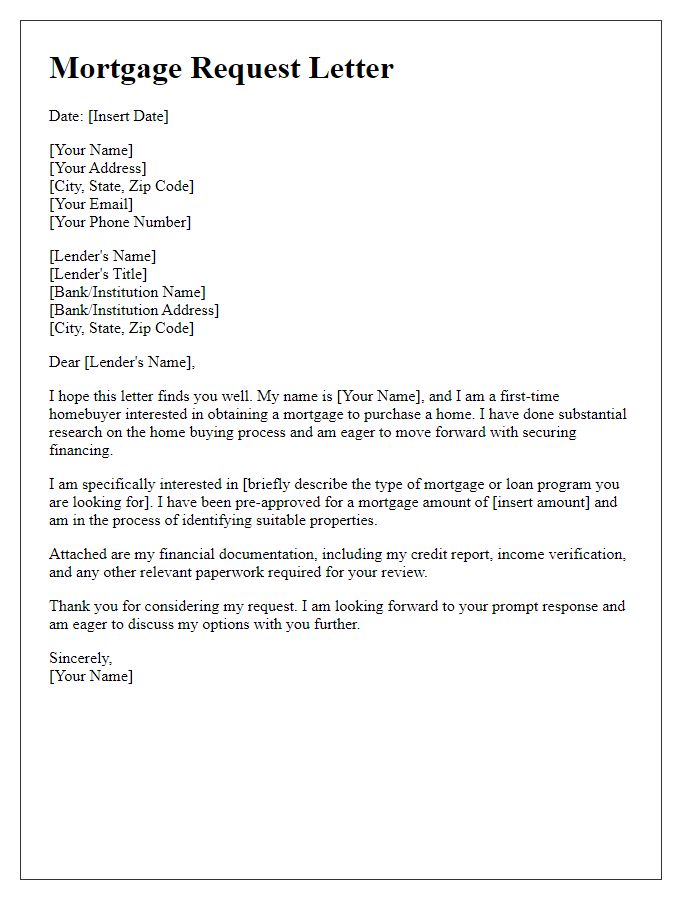

Are you ready to dive into the world of homeownership? Writing a mortgage approval request letter can feel daunting, but it's a crucial step toward securing the home of your dreams. In this article, we'll guide you through crafting a compelling letter that outlines your needs and qualifications effectively. Join us as we explore essential tips and sample templates to help you make a strong impression on lenders!

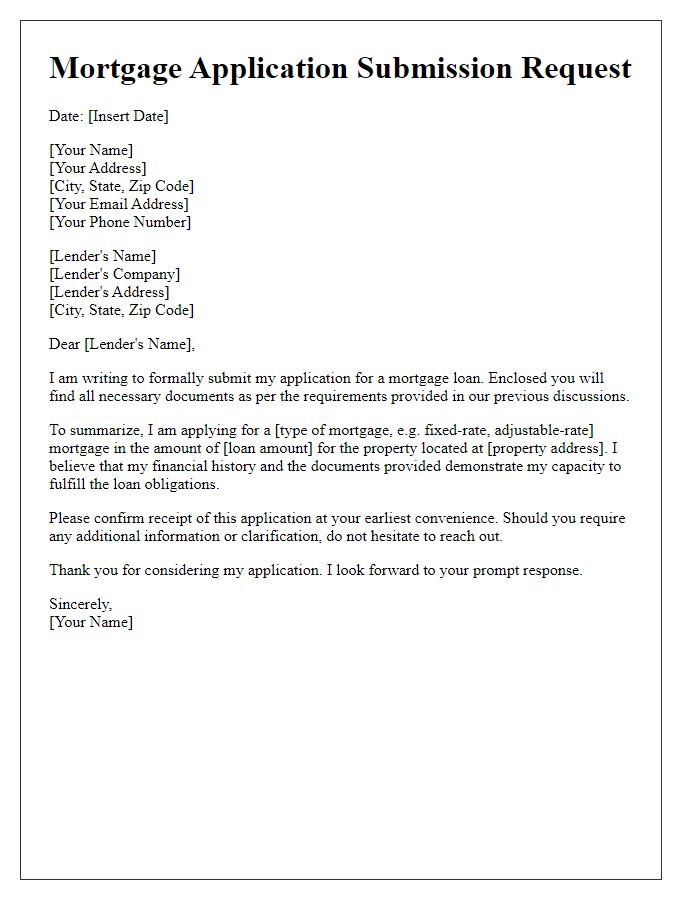

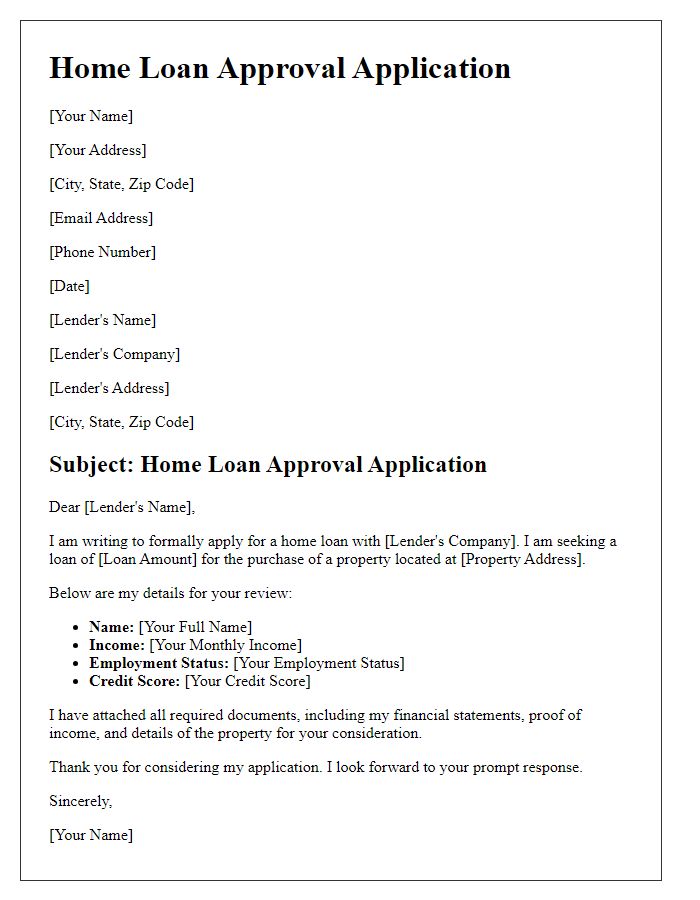

Personal and Financial Information

To successfully obtain mortgage approval, applicants must provide comprehensive personal and financial information. Essential personal details include full legal name, date of birth, and social security number, while financial information should consist of annual income, employment history spanning at least two years, and existing debts like credit card balances or loans. Additionally, applicants must disclose assets such as savings accounts, investment portfolios, and real estate holdings. Documentation, including bank statements and tax returns from the previous two years, should support these details. Applicants should also consider their credit score, as lenders typically evaluate this score using metrics from agencies like FICO, with scores above 740 often considered favorable for securing loans with lower interest rates.

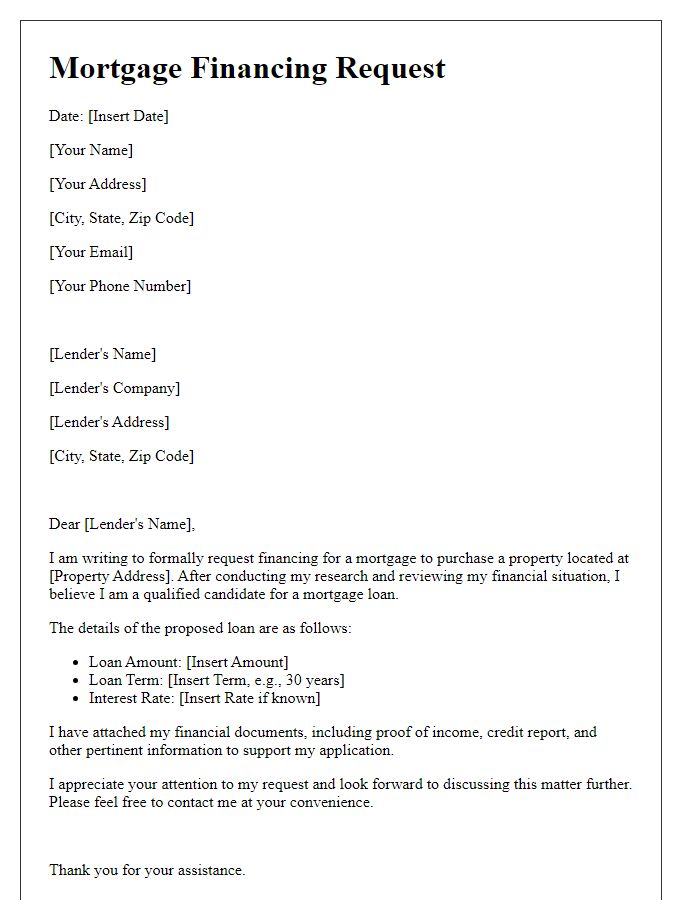

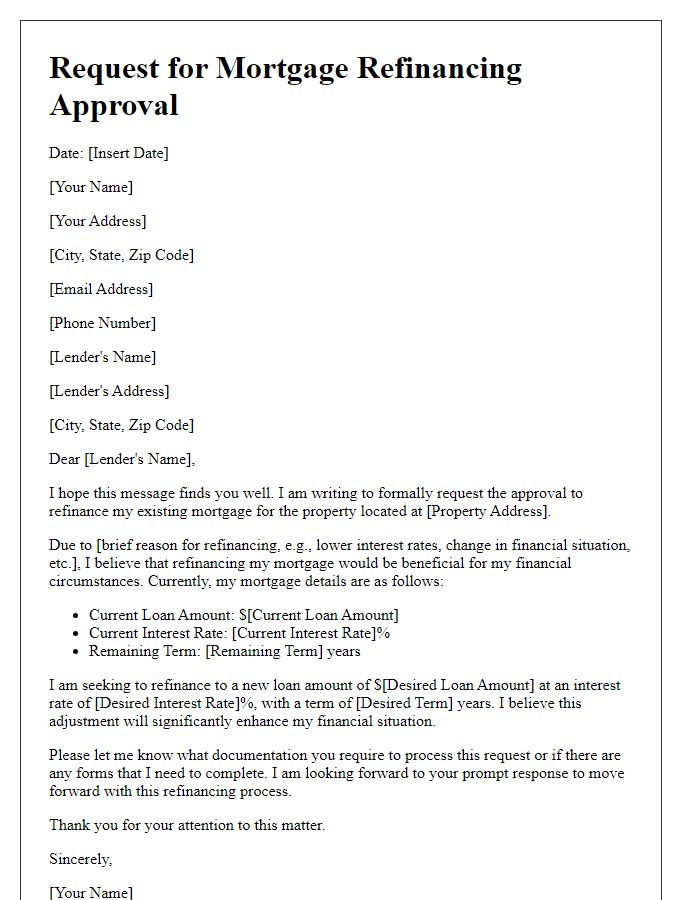

Property Details and Purpose

A mortgage approval request typically includes critical property details along with the intended purpose for the loan. For instance, a property located at 123 Maple Street, Springfield represents a residential single-family home built in 2015, valued at approximately $350,000. The purpose of the mortgage, in this case, is to secure funds for the purchase of the property to establish a primary residence for a family of four. This includes necessary aspects like a secure yard for children and proximity to local schools, which enhances its desirability in the real estate market. Additionally, the historical appreciation of home values in Springfield has averaged 5% annually, making this a sound investment for long-term financial stability.

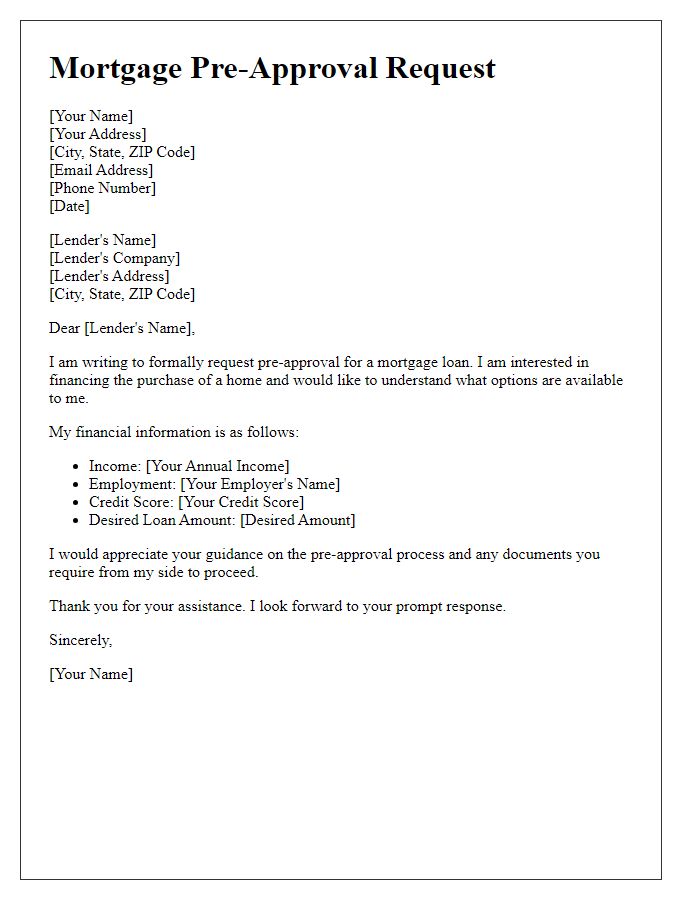

Income and Employment Verification

Income and employment verification is a critical component in the mortgage approval process, as lenders seek to confirm an applicant's financial stability and ability to repay. A recent paycheck stub, reflecting earnings from a full-time job (typically requiring a verification period of at least two years) serves as primary documentation. Additionally, a recent tax return, especially IRS Form 1040, can provide an overview of annual income. Employers, particularly Fortune 500 companies, often verify employment through a standard template that includes job title, length of employment, and salary details. Self-employed individuals may need to produce profit and loss statements alongside bank statements to reinforce their income claims. Timely submission of these documents, usually requested within 30 days of application, significantly enhances the likelihood of mortgage approval, especially in competitive real estate markets like those seen in metropolitan areas such as New York City or San Francisco.

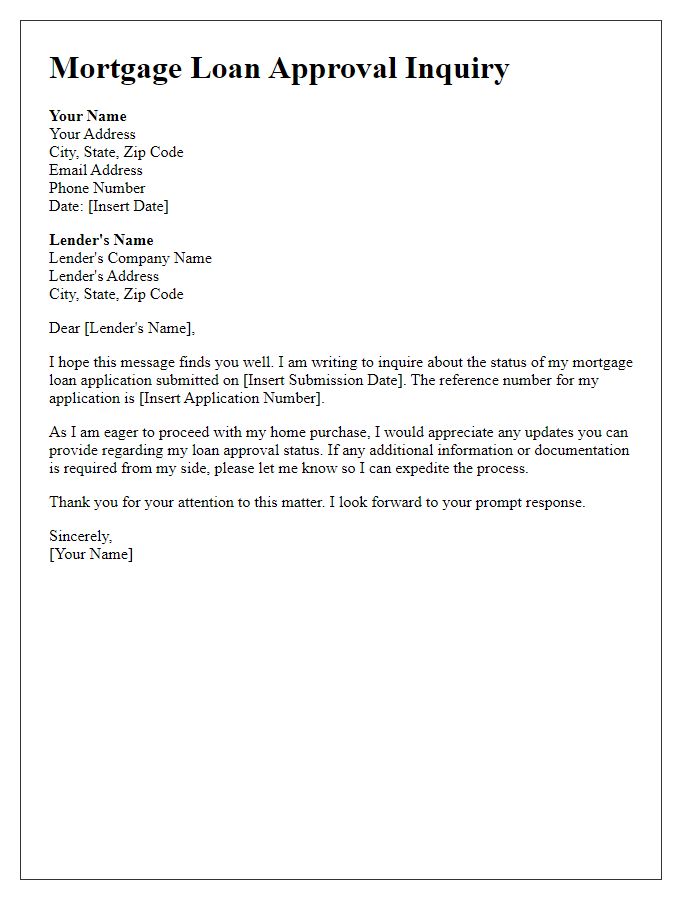

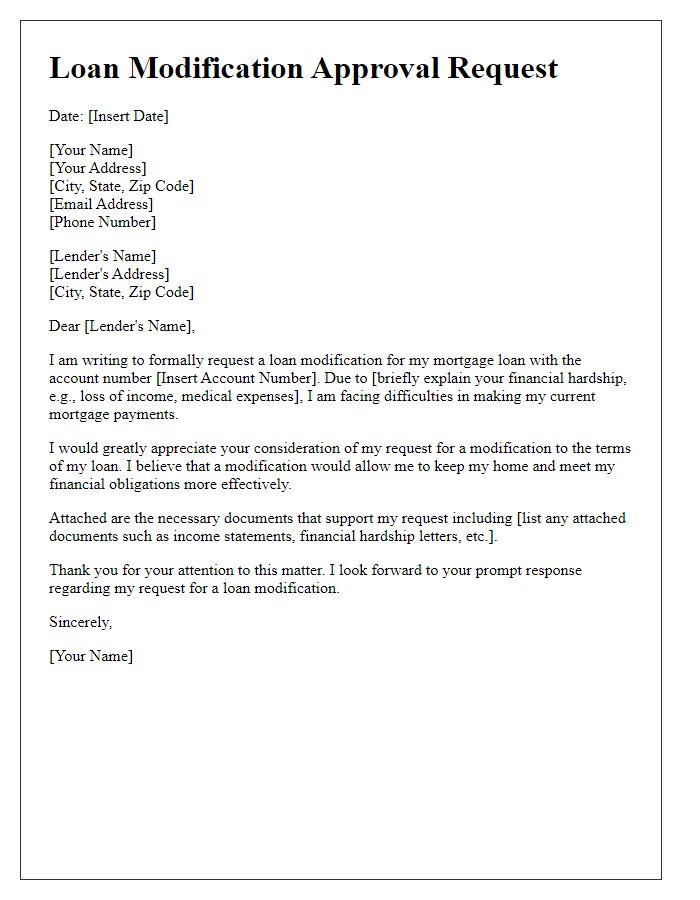

Credit History and Score

A strong credit history and high credit score play critical roles in the mortgage approval process. Lenders often prefer a credit score of 720 or higher, denoting exemplary creditworthiness, as demonstrated by FICO scoring. This score reflects an individual's borrowing habits, payment history, and credit utilization ratio. A consistent record of on-time payments over several years contributes positively to this assessment, while late payments or defaults can negatively impact the score. In addition, a diverse credit mix, including credit cards and installment loans, can further enhance overall creditworthiness. By maintaining a low debt-to-income ratio, typically below 43%, applicants present themselves as responsible borrowers, increasing their chances of securing favorable mortgage terms from lending institutions such as banks or credit unions.

Supporting Documents and Attachments

A mortgage approval request involves the submission of essential supporting documents and attachments to demonstrate financial stability and creditworthiness. Key documents include a credit report, bank statements for the last three months, and W-2 forms from the previous two years. Property-related documents encompass the purchase agreement, property appraisals, and title insurance information. Additionally, income verification documents such as pay stubs for the last month and tax returns for the last two years are crucial. These documents provide lenders with a comprehensive financial snapshot to facilitate the mortgage approval process, which can vary based on the lender's specific requirements. Employing a detailed checklist can ensure that all necessary attachments are included, expediting the review timeline.

Comments