When it comes to financial management, an accurate account statement reconciliation is essential for keeping your records in check. Navigating through your statements can often feel overwhelming, but a well-structured letter can make the process smoother and more efficient. This template is designed to help you communicate clearly and effectively about any discrepancies you might encounter. So, let's dive in and explore how you can streamline your account reconciliation with ease!

Subject line clarity and relevance

Account statement reconciliation involves verifying financial records against bank statements to ensure accuracy. The subject line must clearly state the purpose, such as "Monthly Account Statement Reconciliation - [Month/Year]" for immediate identification. Including specific account details (like account number or reference ID) in the subject enhances relevance, facilitating quick access for both the sender and recipient. It sets the expectation that the content pertains to financial accuracy verification, essential for businesses or personal finance management. Ensuring the subject line is succinct yet comprehensive aids in organizing communications effectively.

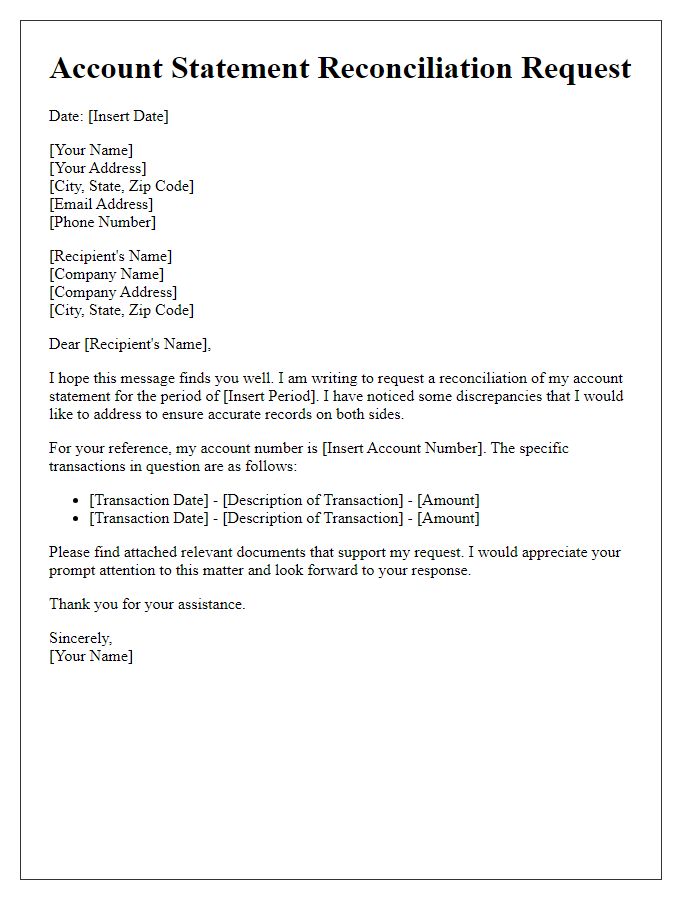

Accurate account and transaction details

Accurate account and transaction details are crucial for efficient account statement reconciliation processes. Timely reconciliation ensures that discrepancies in financial records are identified and corrected. Typically, this involves comparing transaction records, such as deposits and withdrawals, from bank statements, such as those from institutions like Bank of America or Chase, against internal accounting records. Key figures, such as account balances and transaction dates, need thorough examination for irregularities. The reconciliation process may also highlight unauthorized transactions, which, according to data from the Federal Trade Commission, resulted in losses exceeding $1.9 billion in 2020 for consumers. Implementing consistent review protocols fosters transparency and enhances financial accountability, benefiting both individuals and businesses.

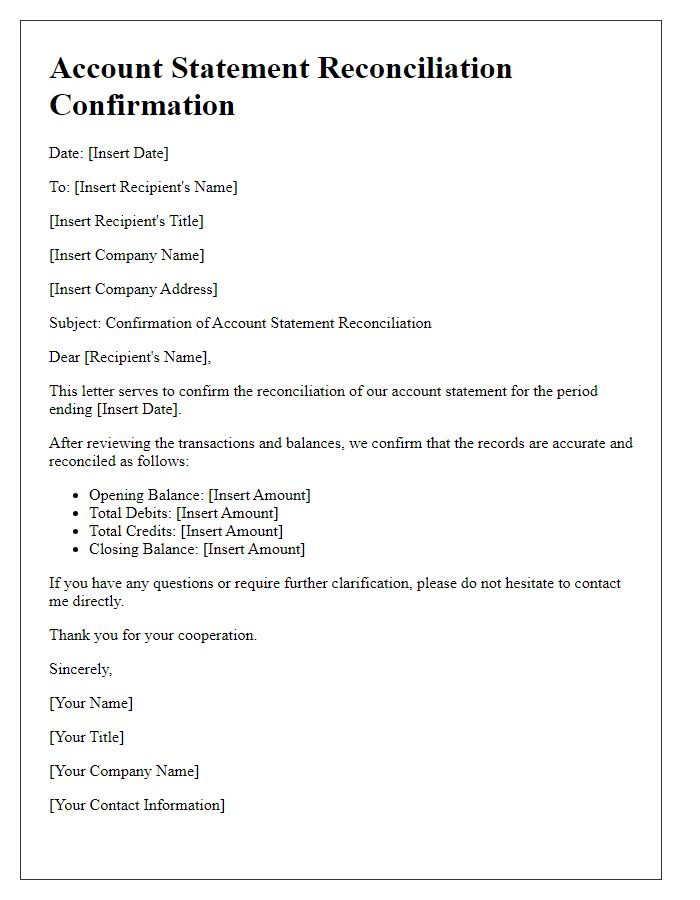

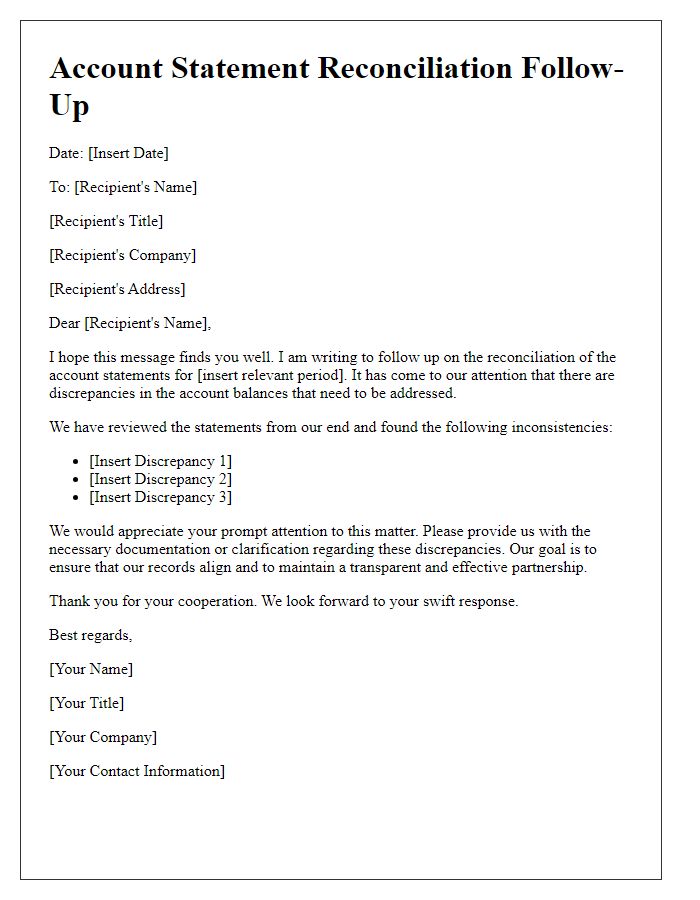

Clear request for reconciliation

An account statement reconciliation involves verifying and matching transactions recorded in financial statements with actual transactions reflected in bank records. This process is essential for maintaining accurate financial records, ensuring discrepancies are identified, and adjusting entries are made promptly. For instance, a company might review its monthly financial statements from August 2023 against bank statements to ensure all deposits and withdrawals are correctly reflected. Common discrepancies may arise from outstanding checks or deposits in transit, which can lead to differences between the company's books and the bank's records. Accurate reconciliation bolsters financial integrity and aids in effective financial management.

Contact information for queries

An account statement reconciliation is a vital process for verifying and aligning financial records between entities, such as businesses and banks. It typically includes detailed statements with transaction dates, amounts, and descriptions for specific accounts. For any queries regarding discrepancies or clarifications, individuals are encouraged to contact the accounting department directly. Contact information often includes a designated email address, such as accounting@company.com, and a customer service hotline available from 9 AM to 5 PM, which ensures prompt assistance. Maintaining accurate contact protocols aids in efficient resolution of financial inquiries and enhances overall communication effectiveness for stakeholders involved in the reconciliation process.

Professional and polite tone

Account statements serve as essential documents reflecting financial transactions over specified periods, typically monthly. Accurate reconciliation of these statements is crucial for individuals and businesses to maintain financial integrity. Anomalies might arise from differences in recorded transactions, causing the need for thorough examination of entries. Regular reviews can help identify discrepancies, ensuring timely resolution. Utilizing components such as transaction dates, amounts, and descriptions facilitates clarity and understanding of financial activities. Implementing systematic reconciliation practices fosters effective financial management and strengthens trust in financial reporting.

Comments