Are you looking to put a halt on a pending check payment? Whether it's due to a lost check, a change in circumstances, or a discrepancy that needs addressing, understanding how to properly request a stop payment can save you a lot of hassle. In this article, we'll cover the essential steps and important considerations you need to keep in mind when drafting your stop payment letter. So, let's dive in and explore everything you need to know to get the process right!

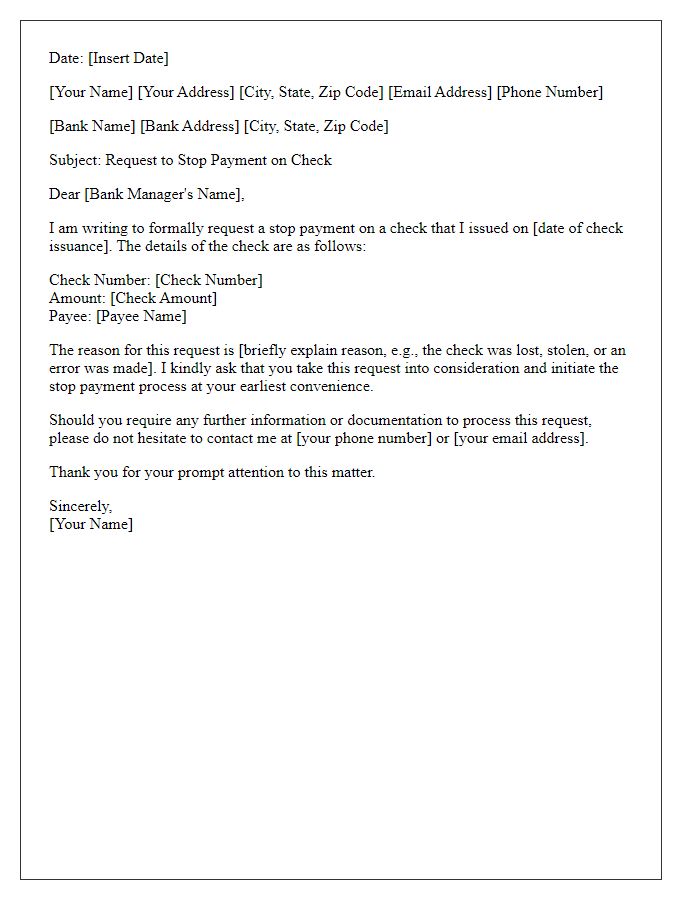

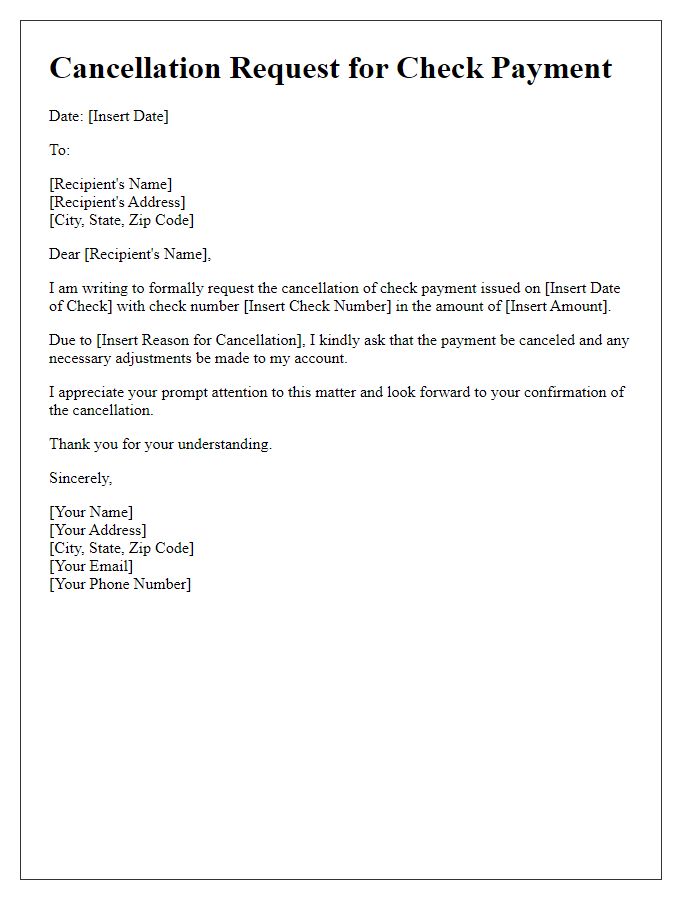

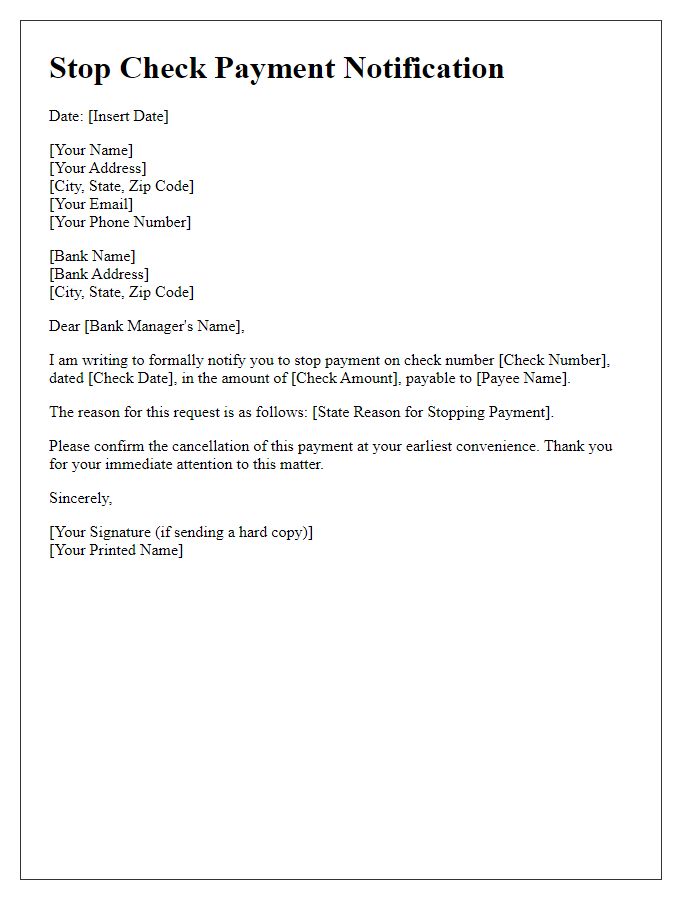

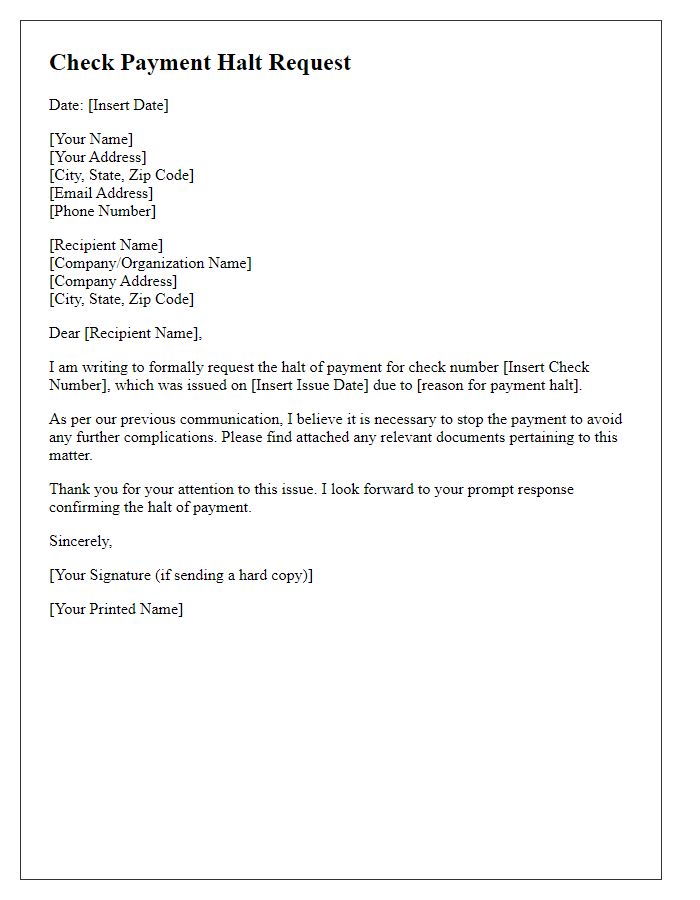

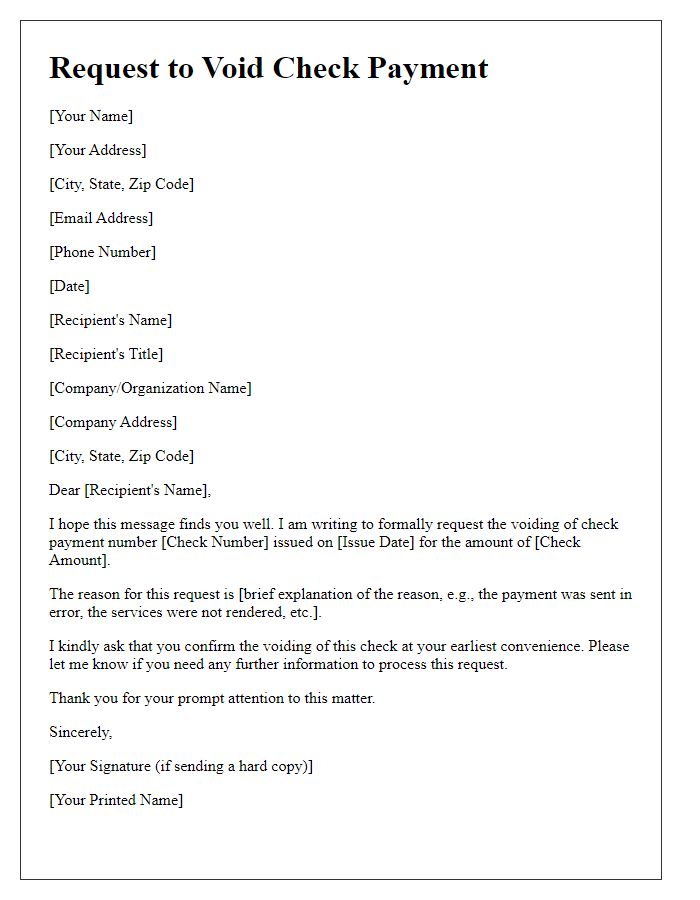

Payee's Name and Contact Information

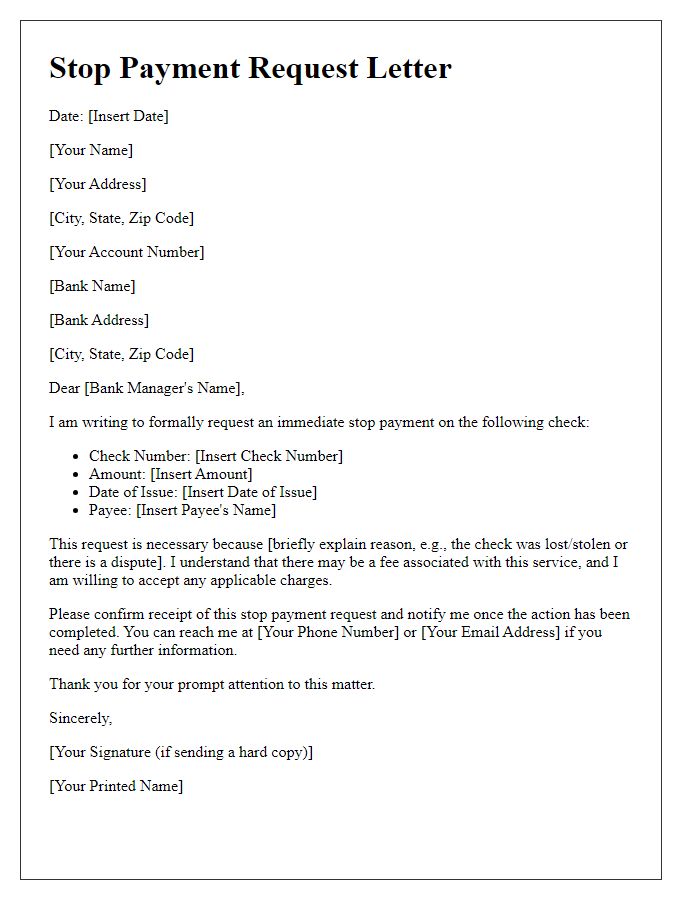

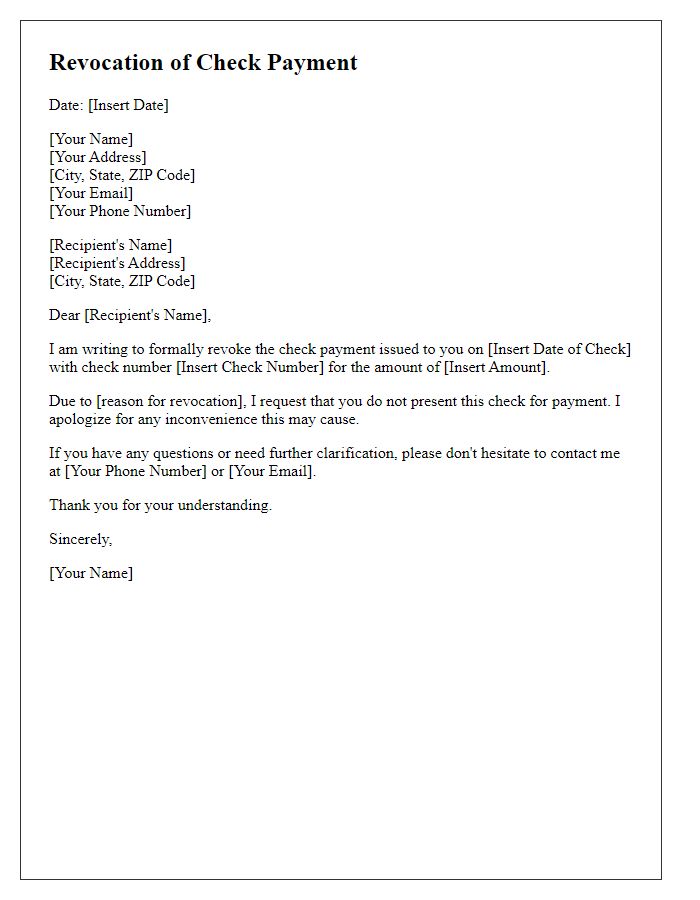

A formal request to stop payment on a check can be crucial for preventing unauthorized transactions. The payee, often a business or individual receiving funds, must ensure to provide accurate information, including their full name, address, phone number, and email. The details should specify the check number, the amount, and the date issued to facilitate swift processing by the bank. Additionally, including the bank's name and account number can offer extra authentication. Promptly sending this request, preferably via certified mail, can ensure that the bank addresses the stop payment efficiently, protecting the payee's financial interests.

Check Details (Number, Amount, Date)

A request to stop payment on a specific check requires detailed information to ensure accuracy and effectiveness. The check number, for instance, denotes the unique identifier assigned to the check, facilitating tracking. The amount represents the total value written on the check, which could range significantly, impacting the request's urgency. The date refers to when the check was issued, providing context for the transaction and potential cancellation timeline. Additionally, personal details such as the payee, along with the bank details where the check was drawn, aid in processing the request efficiently, ultimately preventing unauthorized transactions or potential financial losses.

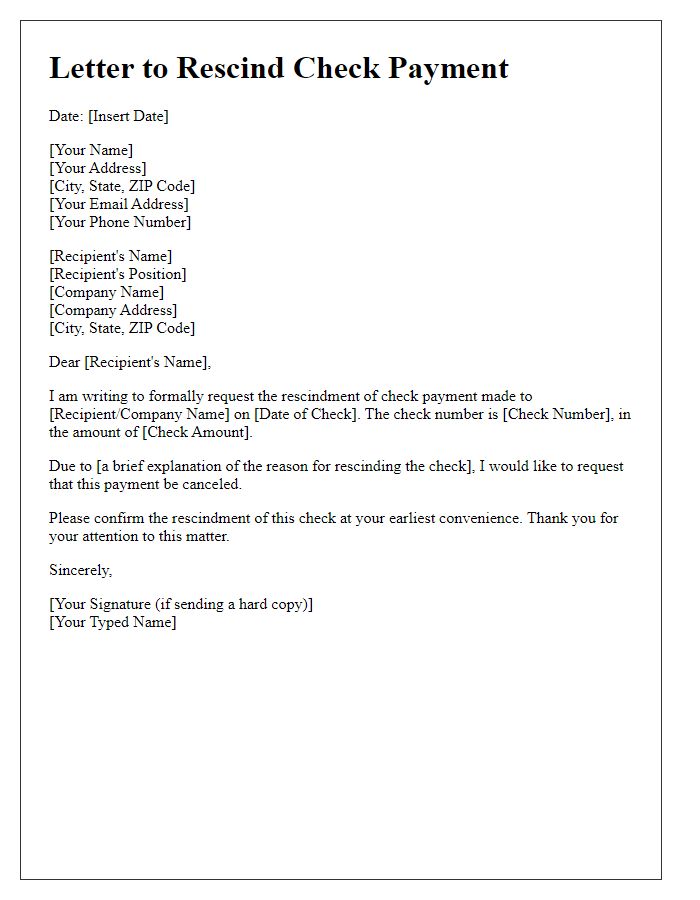

Reason for Stop Payment

A request for a stop payment on a check typically revolves around specific reasons that necessitate halting the transaction. Common reasons include instances of fraud, loss, theft, or disputes regarding the check's intended payment. For example, if a check issued for $500, dated September 15, 2023, was lost during transit, it would be crucial to act promptly to prevent unauthorized cashing. Additionally, if the payee (such as a service provider or vendor) failed to deliver the promised goods or services, an individual may seek to stop payment on that check. Swift communication with the bank is essential, as they may impose fees or require certain documentation to process the request efficiently.

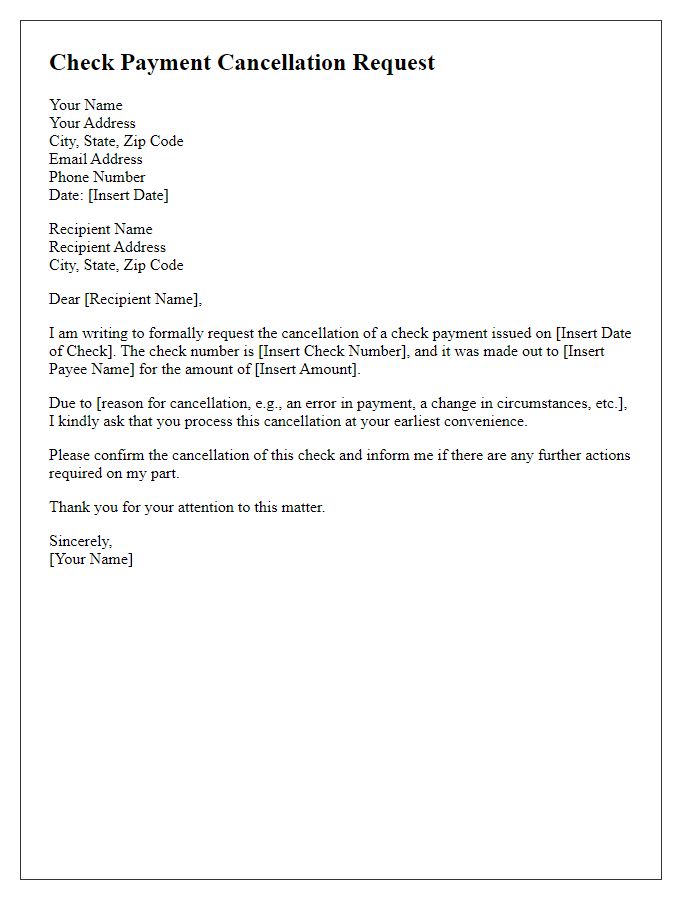

Bank Account Information

Instructing a bank to halt a check payment requires providing specific account details and reasons for the request. A standard format includes the bank's name, account holder's name, account number (usually 10-12 digits), check number (typically 3-6 digits), and the date the check was issued. Include the reason for stopping payment, such as a lost check or suspected fraud. It's advisable to refer to the original transaction amount (e.g., $250.00) and any relevant dates (e.g., the check date of October 1, 2023). Providing contact information for further inquiries adds clarity. Ensure the request is signed and dated to authorize the action officially.

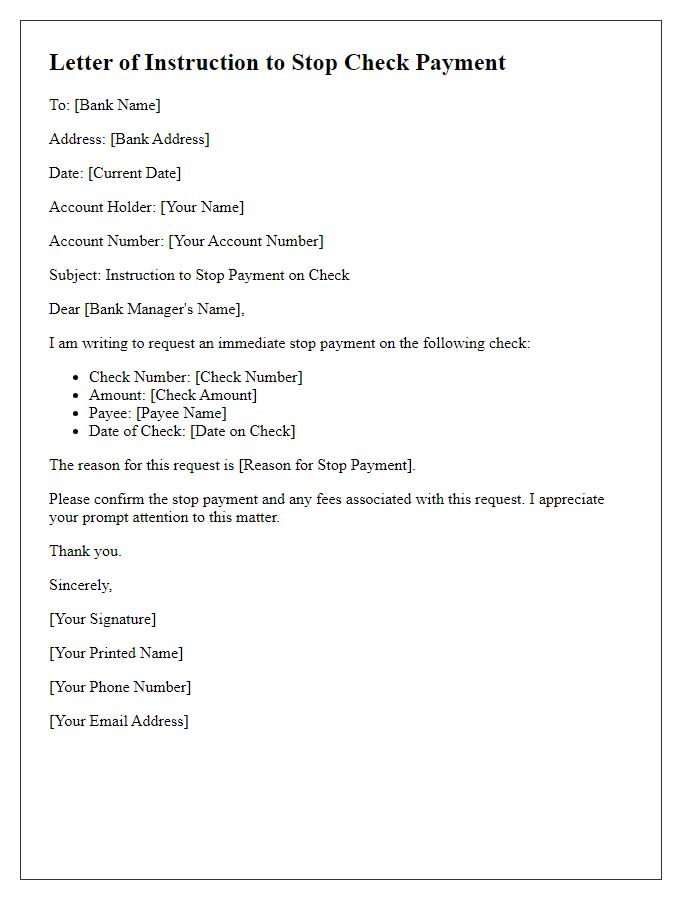

Confirmation and Signature

A check payment stop request serves to prevent unauthorized use of a specific check, safeguarding funds from potential loss. When initiating this procedure, the account holder must include critical details, such as the check number, amount, and payee's name. Submit this request to the bank or financial institution, typically in writing or through an online banking platform, ensuring a prompt response. Confirmation of the stop payment, usually provided via email or standard mail, includes an acknowledgment and may require the account holder's signature for validation. Fees for this service may vary, often around $30 to $35, depending on the institution. Maintaining vigilance helps protect against fraud while ensuring peace of mind regarding personal finances.

Comments