Have you ever experienced the frustration of losing your ATM card? It can be a hassle not only to navigate through the replacement process but also to ensure your finances remain secure. Thankfully, drafting a letter to request a replacement is straightforward and can make the process smoother. Let's walk through the essential elements of a letter template for an ATM card replacement request and help you get back to your banking seamlessly.

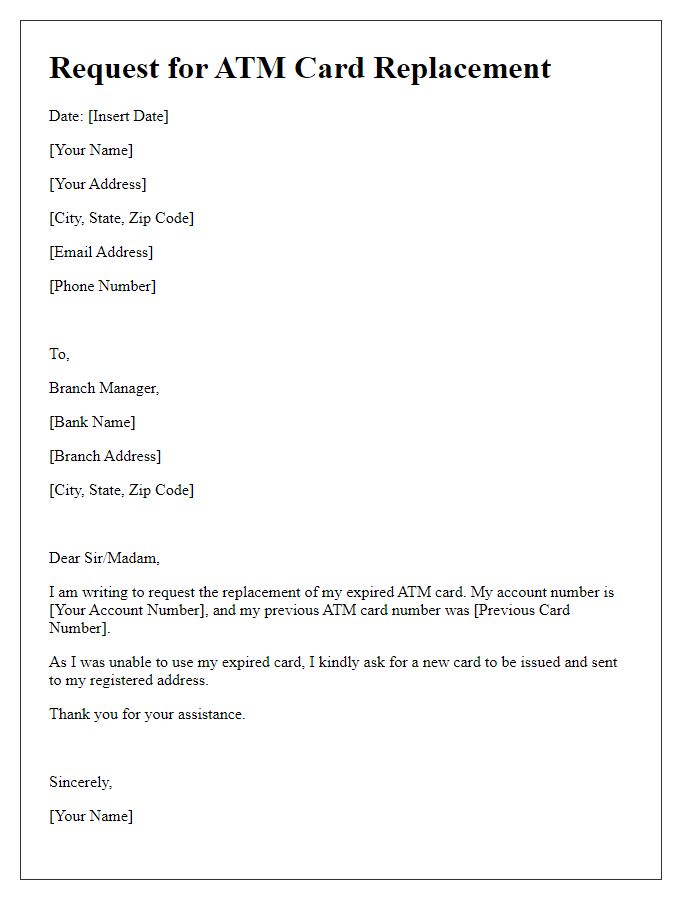

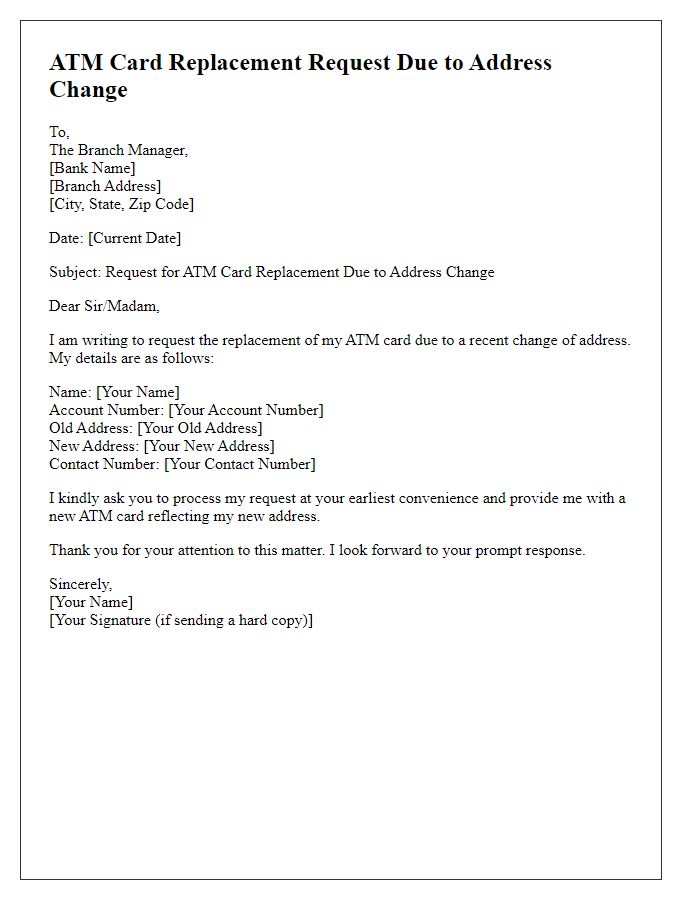

Account Holder's Details

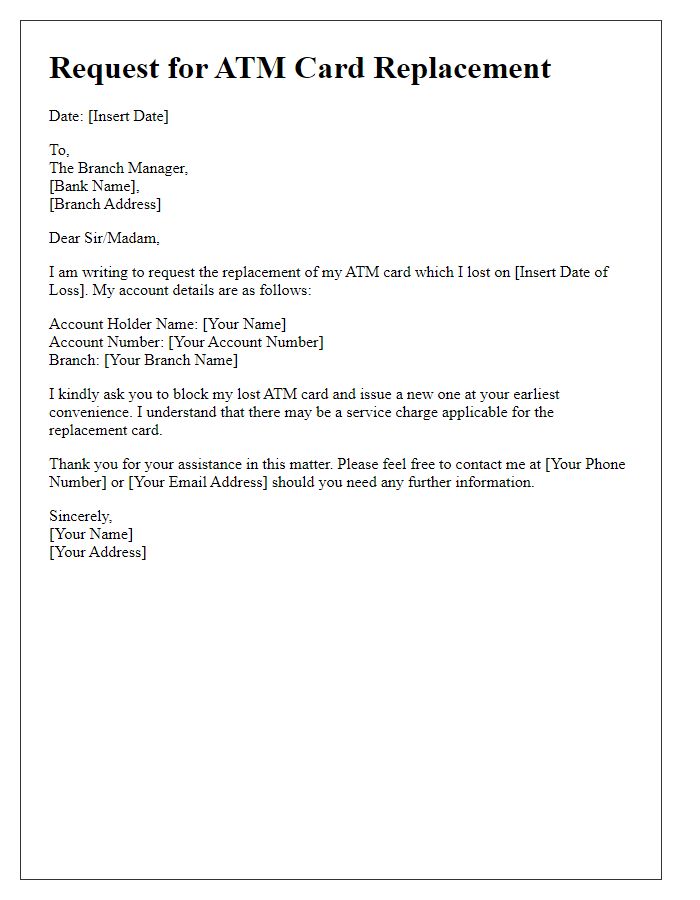

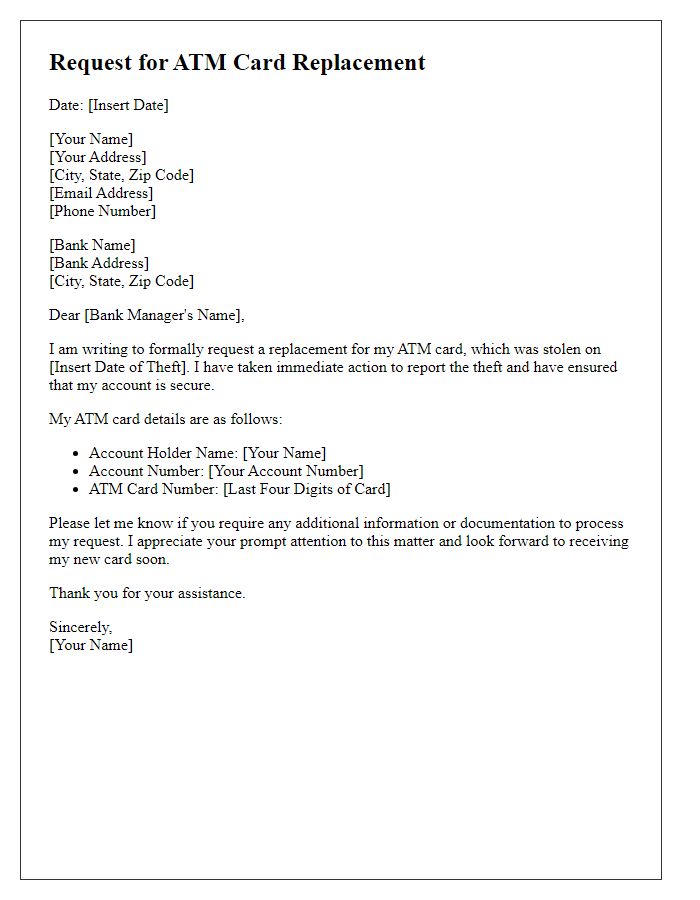

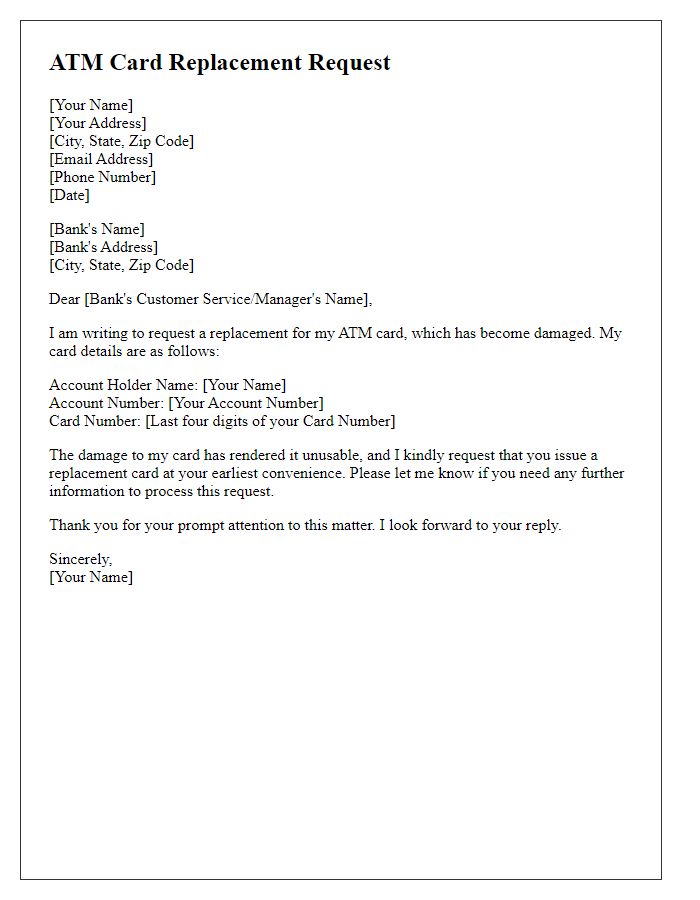

Account holder details play a crucial role in the ATM card replacement process. Typically, this includes information such as the full name of the account holder, ensuring correct identification, and the bank account number, which must be accurate to avoid processing delays. The registered mobile number, linked to the account, serves as a means for verification and communication during the replacement procedure. Additionally, the email address associated with the account may be useful for sending notifications regarding the status of the replacement request. Including the current residential address is essential, especially for mailing the new card. Lastly, providing identification, such as a government-issued ID number, can expedite the verification process, ensuring the account holder's security and swift handling of the request.

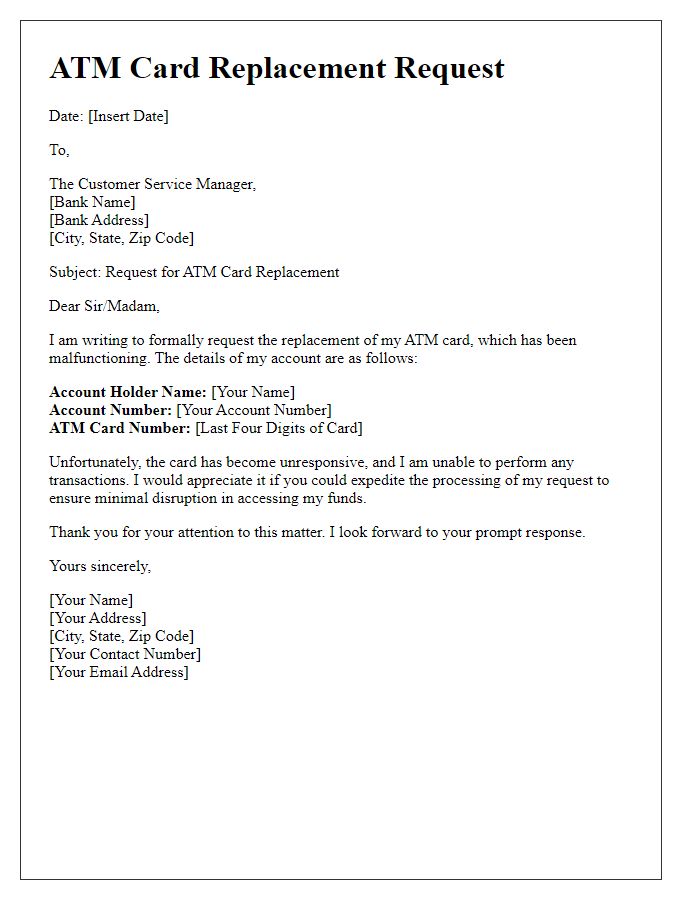

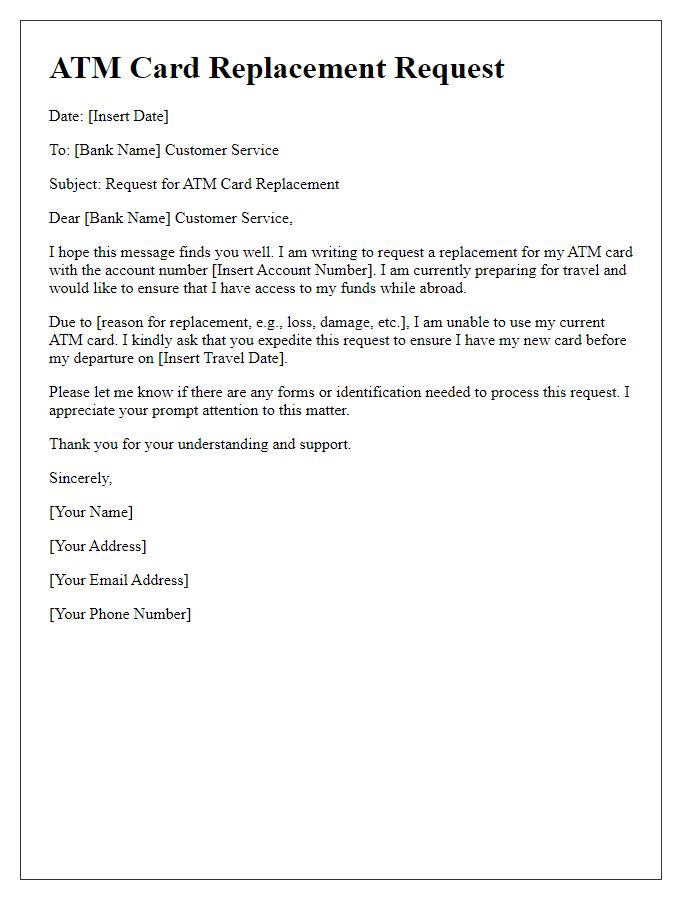

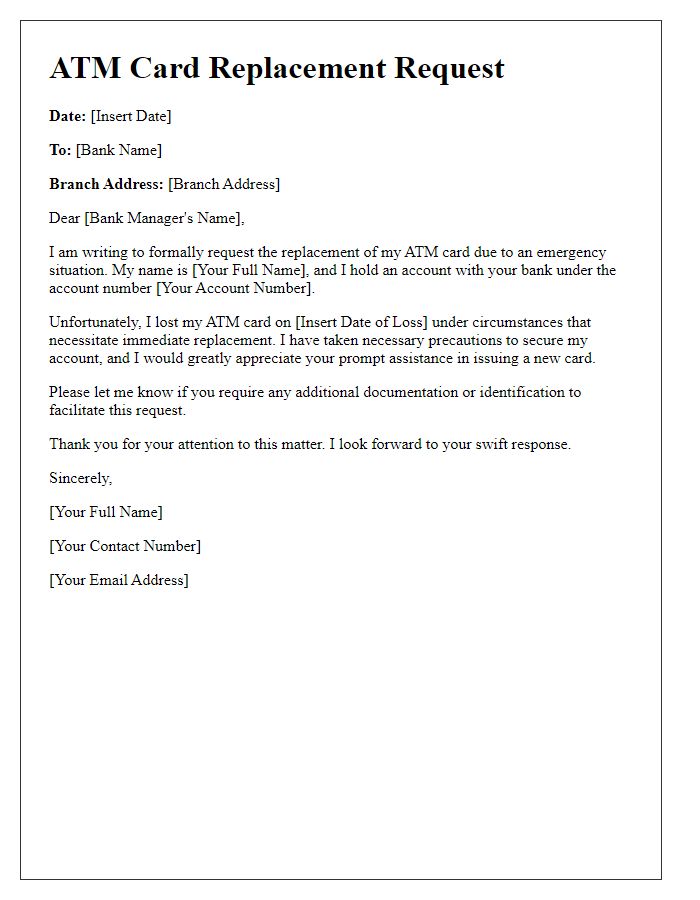

Card Details and Reason for Replacement

The ATM card replacement request process often begins with identifying card details associated with the account holder. Typical card details include the last four digits of the card number, along with the expiration date, linked bank account number, and the cardholder's personal information such as full name and address. Common reasons for requesting a replacement include loss, theft, damage, or technical malfunction of the card that impedes its usage at ATMs or point-of-sale terminals. Providing clear details about the reason for replacement, along with any corresponding incident report or case number if applicable, can expedite the process. Many banks also offer online submission for such requests, aiming for efficiency and security in handling customer data.

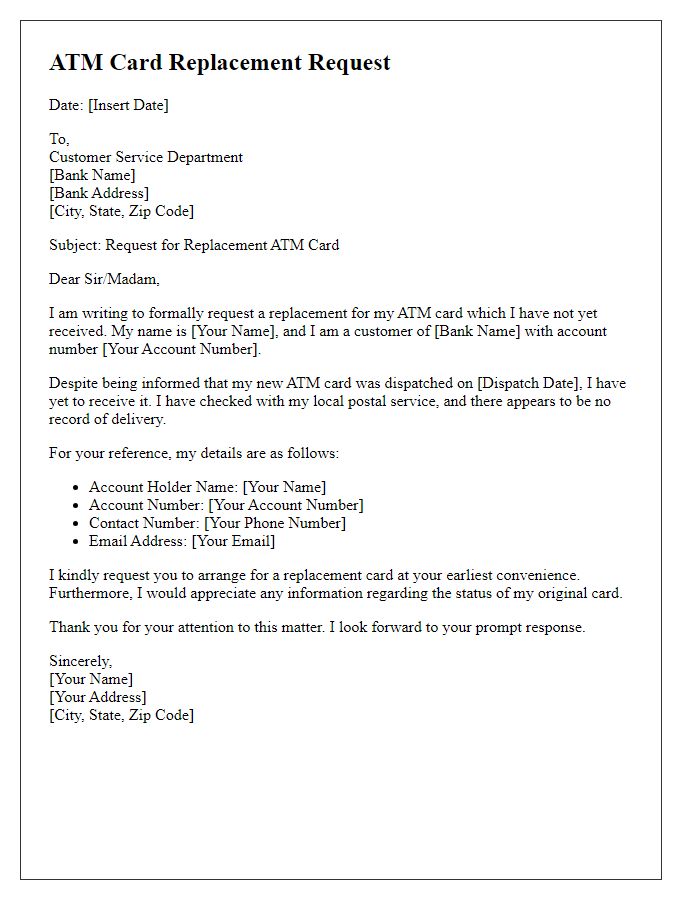

Contact Information

Replacing a damaged or lost ATM card is crucial for maintaining access to banking services. Customers must submit a formal request to their bank's customer service department. Key information includes account number, full name, and contact information (e.g., phone number and mailing address). Banks typically require identification verification (for instance, a government-issued ID or recent utility bill) to process the request efficiently. Processing times can vary, with many institutions offering expedited service for urgent cases, often within 1-3 business days. Ensuring timely communication prevents disruptions in accessing funds, making the request process essential for account security.

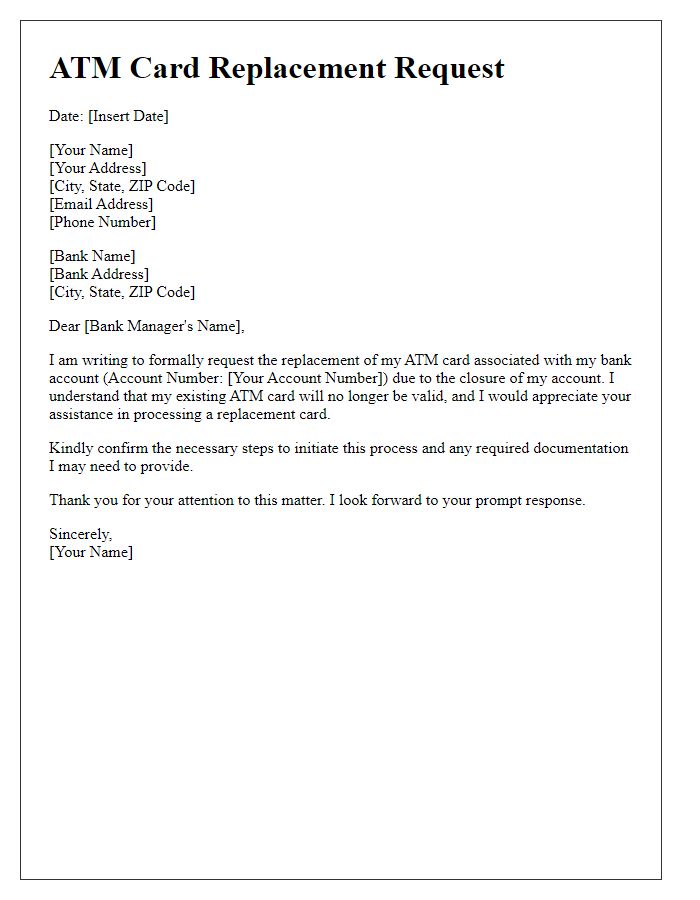

Request for Urgent Processing

Replacing a lost or damaged ATM card requires prompt action for continued access to funds. An ATM card, often linked to a checking or savings account, provides essential banking services. The request for urgent processing emphasizes the need for swift response due to potential inconvenience caused by a non-functional card. Key details include personal identification information, such as account number or customer ID, and a brief explanation of the circumstances leading to the replacement request. Mentioning the financial institution's name, such as Wells Fargo or Bank of America, adds specificity to the context. Additionally, outlining the preferred methods of receiving the new card, such as standard mail or expedited shipping, can further streamline the process.

Confirmation Methods and Signature

For individuals seeking to replace an ATM card, it is essential to understand the confirmation methods required by financial institutions. Typical procedures involve verifying identity through personal identification documents such as a passport or driver's license. Some banks may also require recent transaction history from the account, demonstrating account ownership and legitimacy. Additionally, a signature may be requested, either in person at a branch or electronically via secure online banking platforms. This signature ensures that the request for the replacement ATM card is authorized by the account holder, protecting against potential fraudulent activities. Security measures are increasingly significant in confirming requests, thus providing peace of mind to users during the replacement process.

Comments