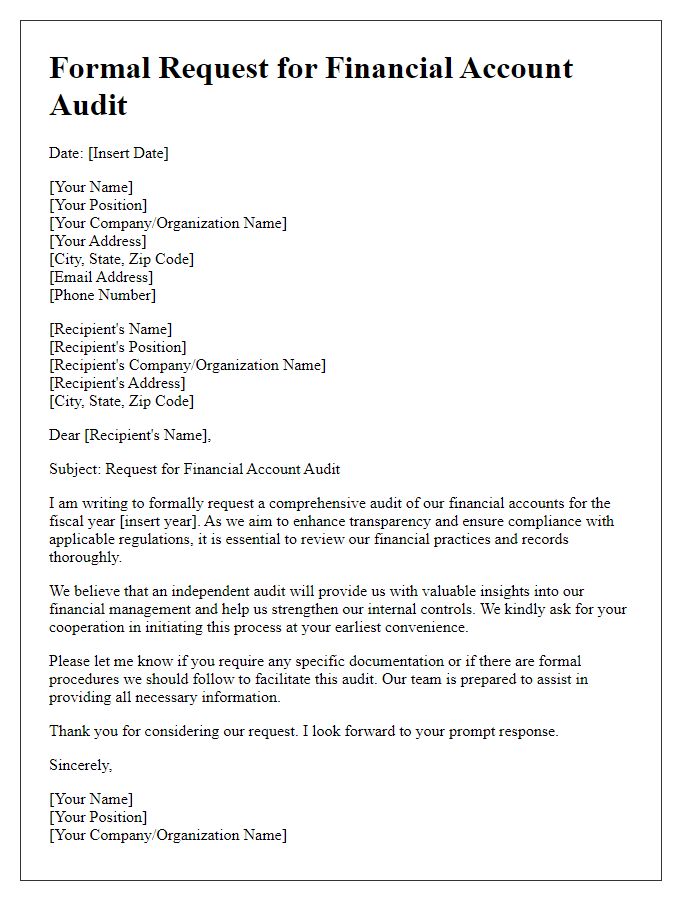

Are you gearing up for a financial account audit but not quite sure how to get the ball rolling? Crafting a clear and professional request letter is key to ensuring a smooth audit process. In this article, we'll walk you through a handy letter template that you can easily customize for your needs. Ready to dive in and simplify your audit preparation?

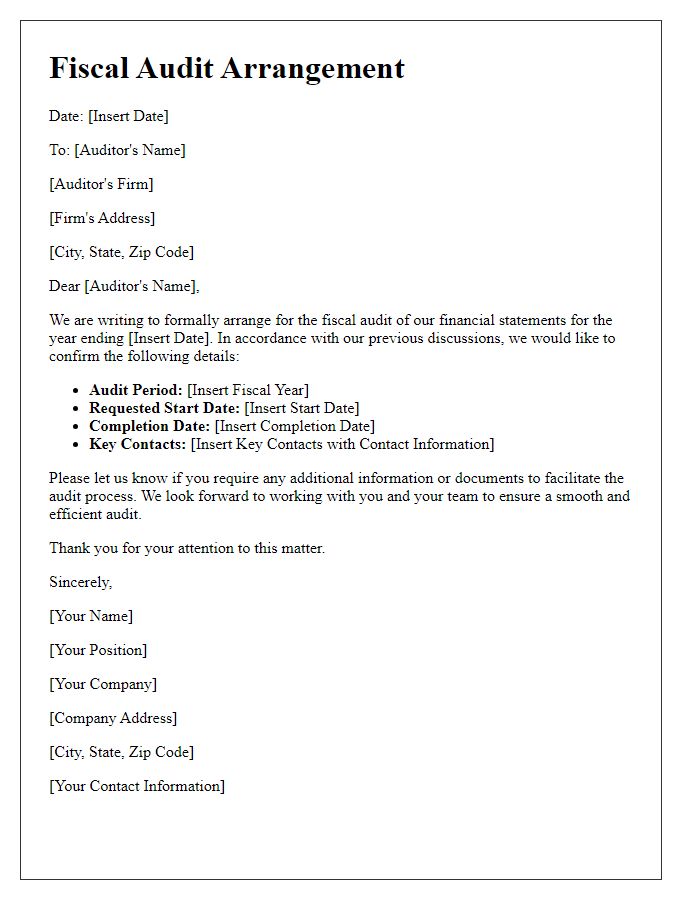

Clear Purpose Statement

A financial account audit request serves as a formal communication tool aimed at validating the accuracy and integrity of financial records. This process involves examining transactions, account balances, and compliance with accounting standards. It is typically initiated by stakeholders, such as management, investors, or regulatory bodies, who seek transparency and assurance about financial reporting. The audit may focus on specific areas, such as revenue recognition or expense categorization, and it often requires access to various documents, including bank statements, invoices, and financial statements. Conducted by certified auditors, this process helps identify discrepancies, assess financial health, and ensure adherence to laws, ultimately strengthening trust among stakeholders and enhancing organizational accountability.

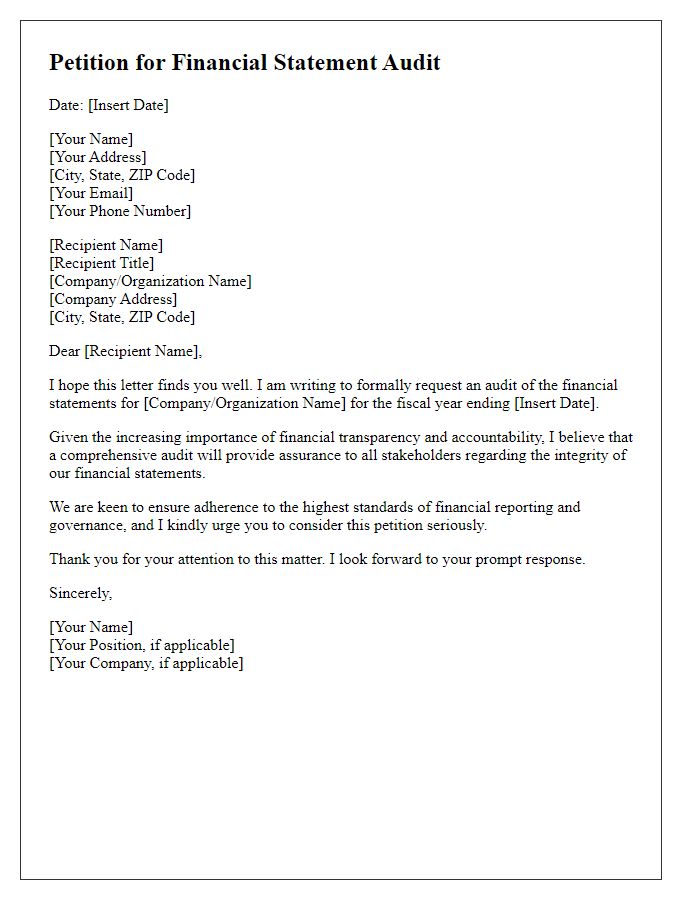

Detailed Account Information

A financial account audit request entails a thorough examination of financial statements, transactions, and relevant documents. Entities such as businesses or financial institutions typically initiate this process to ensure compliance with regulations and accuracy of financial reporting. Key financial metrics, including balance sheets, income statements, and cash flow reports, provide crucial insights during the audit. Specific timeframes, such as the fiscal year ending on December 31, 2023, become essential in identifying pertinent transactions. Auditors employ standardized procedures, ensuring transparency and integrity; this often involves cross-referencing data with bank statements, invoices, and payroll records. Furthermore, collaboration with regulatory bodies, like the Securities and Exchange Commission (SEC), may be necessary to meet legal obligations and uphold trust with stakeholders. Detailed documentation ensures a comprehensive audit process, critical for sustaining financial health and organizational credibility.

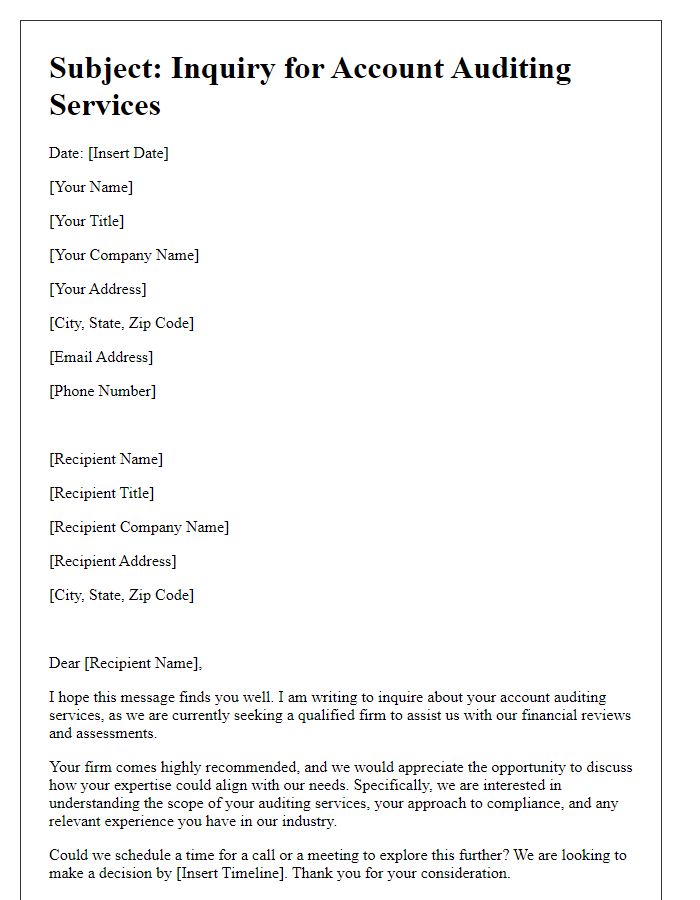

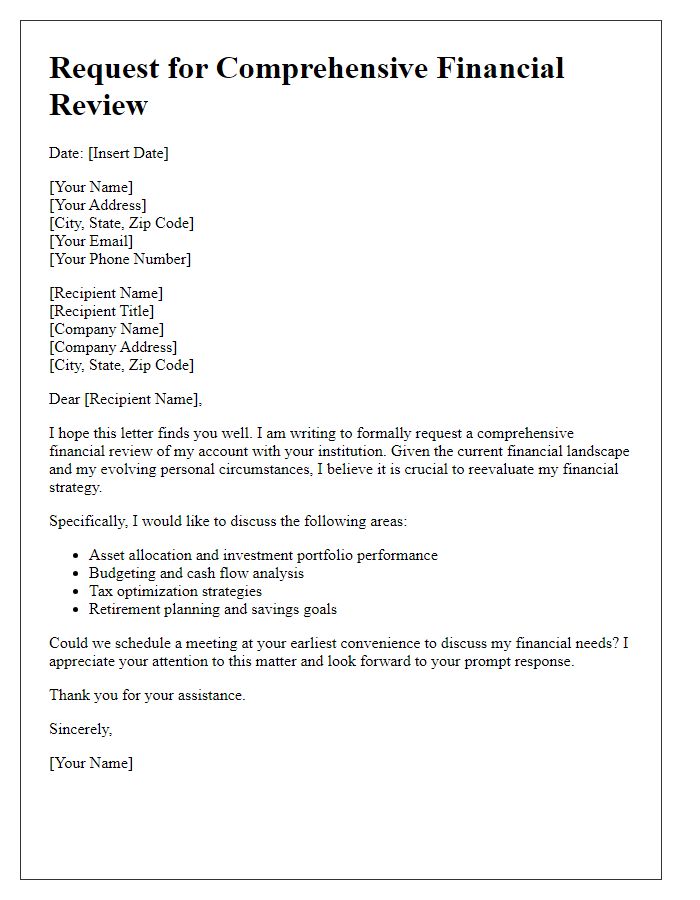

Specific Audit Period

An audit request for financial accounts encompasses a structured approach to gather relevant documents, ensuring transparency and compliance with regulations. The audit period typically refers to a designated timeframe such as January 1, 2023, to December 31, 2023, permitting auditors to assess financial transactions, supporting documents, and accounting practices. Essential records include income statements, balance sheets, and cash flow statements, which provide insight into the organization's financial health. Critical areas, such as revenue recognition, expense reporting, and asset valuation, necessitate thorough examination to ascertain accuracy and adherence to the Generally Accepted Accounting Principles (GAAP). Auditors may also require access to subsidiary ledgers and bank statements to verify cash transactions and account reconciliations.

Authorized Personnel Contact

The authorized personnel contact for financial account audit requests is essential for ensuring compliance and transparency in the financial operations of organizations. In many cases, this contact includes individuals designated by regulatory bodies or internal compliance teams, such as a Chief Financial Officer (CFO) or an Audit Manager, who operate within companies based in specific locations, like Sydney or New York. Their responsibilities involve coordinating the audit process, providing necessary documentation, and facilitating communication between auditors and the organization. The timelines for responses might be laid out in audit schedules, usually indicating a 30-day response period, ensuring that all inquiries are addressed and supporting evidence, such as financial statements or transaction records, is readily available. Proper identification of this personnel is crucial for the integrity of the audit process and for maintaining the organization's fiscal accountability.

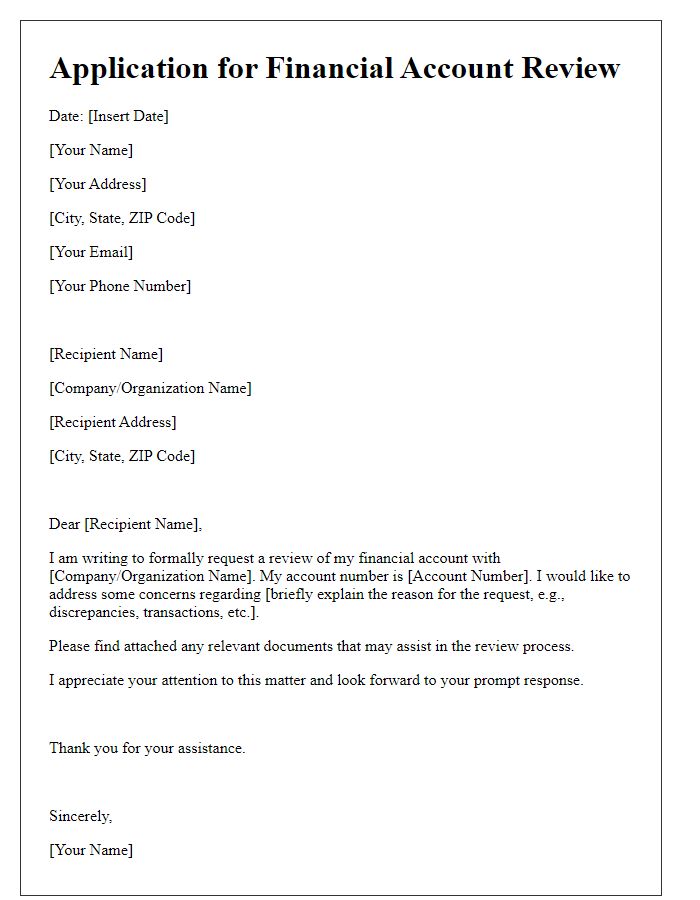

Request Submission Deadline

The request for a financial account audit submission, typically scheduled within a structured timeline, falls under strict deadlines set by regulatory frameworks. Effective management ensures that all relevant documents, including bank statements, invoices, and financial records from January 2023 to June 2023, are compiled and submitted by the deadline of November 15, 2023. Key stakeholders, including the finance department and external auditors, must ensure that audits are conducted thoroughly to ensure compliance with standards such as Generally Accepted Accounting Principles (GAAP). Any failure to meet this deadline may result in potential fines or penalties, impacting the organization's financial standing and credibility within the public sector.

Comments