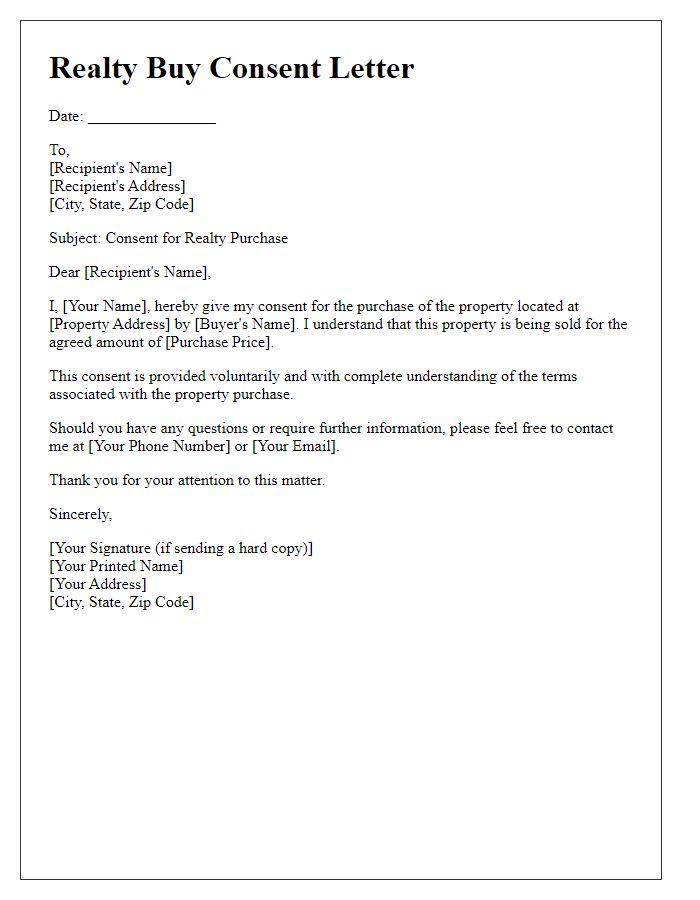

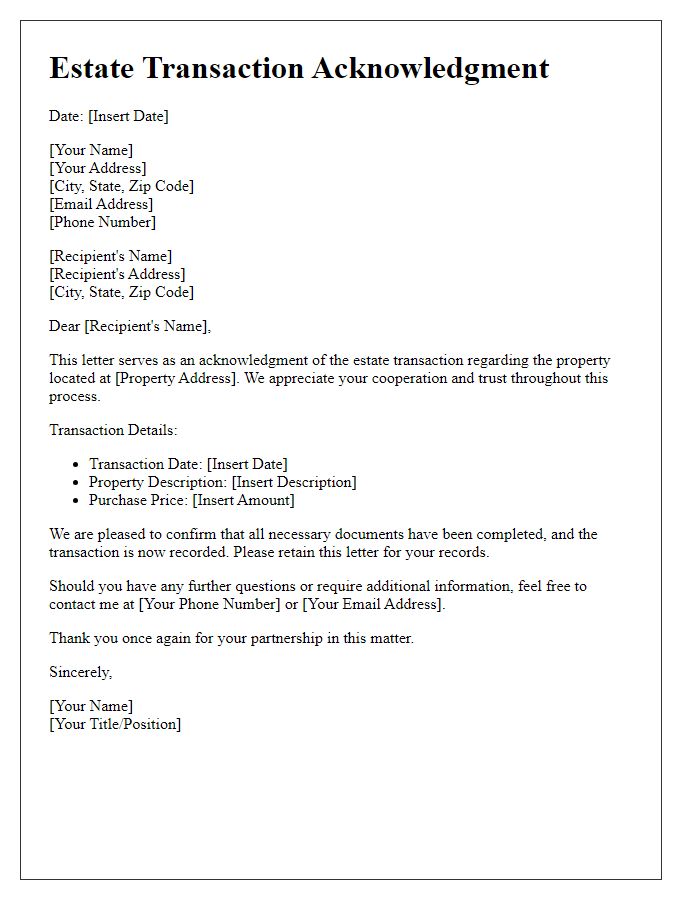

Are you excited about taking the plunge into homeownership? A real estate purchase confirmation letter is an essential step in sealing the deal on your new property. This document not only outlines the agreed-upon terms but also serves as a reminder of your investment in the future. If you're looking for the perfect template to guide you through this process, keep reading to discover more!

Buyer and seller information

In real estate transactions, buyer and seller information is crucial for accurate and legally binding agreements. The buyer, often an individual or corporation, is typically identified by their full name, address, and contact details, ensuring proper representation in the sale process. For instance, if the buyer is John Doe, residing at 123 Elm Street, Springfield, Illinois, his contact number would also be included for ease of communication. The seller's information follows the same format; for example, Jane Smith, owning the property at 456 Maple Avenue, Springfield, Illinois, would be listed alongside her contact information. Additional details such as the property address (including city and zip code), property type (single-family home, condo, etc.), and purchase price form essential parts of the confirmation. This structured format guarantees that all parties involved have the necessary information for future correspondence and legal clarity during the purchase process.

Property details and location

The property located at 123 Maple Street in Springfield is a modern three-bedroom, two-bathroom single-family home built in 2015. This residence features an open floor plan spanning 1,800 square feet, with a spacious living area, contemporary kitchen equipped with stainless steel appliances, and a cozy fireplace. The property sits on a well-maintained 0.25-acre lot, complete with a landscaped backyard and a two-car garage. Nearby amenities include Springfield High School, which is ranked in the top 10% of the state, and Maple Park, a popular spot for families offering playgrounds and walking trails. The negotiation began on July 15, 2023, with a final purchase agreement reached on August 1, 2023, securing the property for $350,000.

Purchase price and payment terms

Confirmation of a real estate purchase involves several critical details, including the purchase price, payment terms, and property specifics. The purchase price, a pre-agreed amount between the buyer and the seller, typically represents the market value of the property located at a specific address (e.g., 123 Main St, Springfield) as assessed by local market conditions. Payment terms may include the down payment percentage (commonly between 5% to 20%), the timeline for full payment (e.g., 30 days post-agreement), and financing arrangements, such as mortgage details from lenders like Wells Fargo or Bank of America. Documentation also includes contingencies based on inspection results or appraisal values assessed by certified appraisers, ensuring a transparent transaction for both parties.

Closing date and conditions

A property transaction represents a significant financial commitment, with both buyers and sellers needing to establish clarity on essential details. The closing date marks the official transfer of property ownership, typically scheduled for 30 to 60 days post-offer acceptance depending on the regional market norms. Conditions may include inspections, appraisals, and financing contingencies that ensure buyer protection before finalizing ownership. In addition, local regulations might dictate additional requirements, such as title searches and necessary disclosures, influencing the timeline and thoroughness of the closing process. Understanding these elements is crucial for a smooth and successful real estate purchase transition.

Legal and contractual obligations

Real estate purchase confirmations involve critical legal and contractual obligations that protect the interests of both buyers and sellers. The purchase agreement typically outlines essential details such as property address, purchase price, and closing date. Legal stipulations often include contingencies involving inspections, financing approval, and title verification, ensuring that the buyer can withdraw without penalty under specific conditions. The earnest money deposit, usually ranging from 1% to 3% of the purchase price, confirms the buyer's serious intent to complete the transaction. Additionally, disclosures regarding property condition, liens, and zoning laws are vital for transparent negotiations. Understanding these obligations fosters trust in the transaction, safeguarding the parties against potential disputes.

Comments