When life throws us a curveball, sometimes managing our finances can become a bit challenging. If you find yourself in a situation where you need a little extra time to make that loan payment, don't worryâyou're not alone. Requesting a loan payment extension is a straightforward process, and knowing how to craft your request can make all the difference. Ready to learn more about writing an effective letter for your loan extension request? Keep reading!

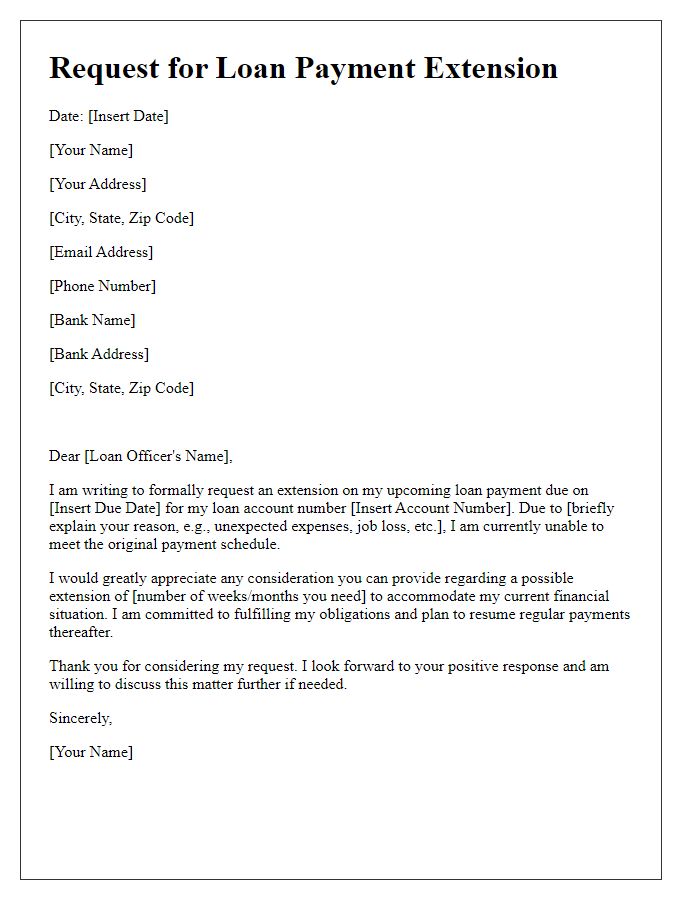

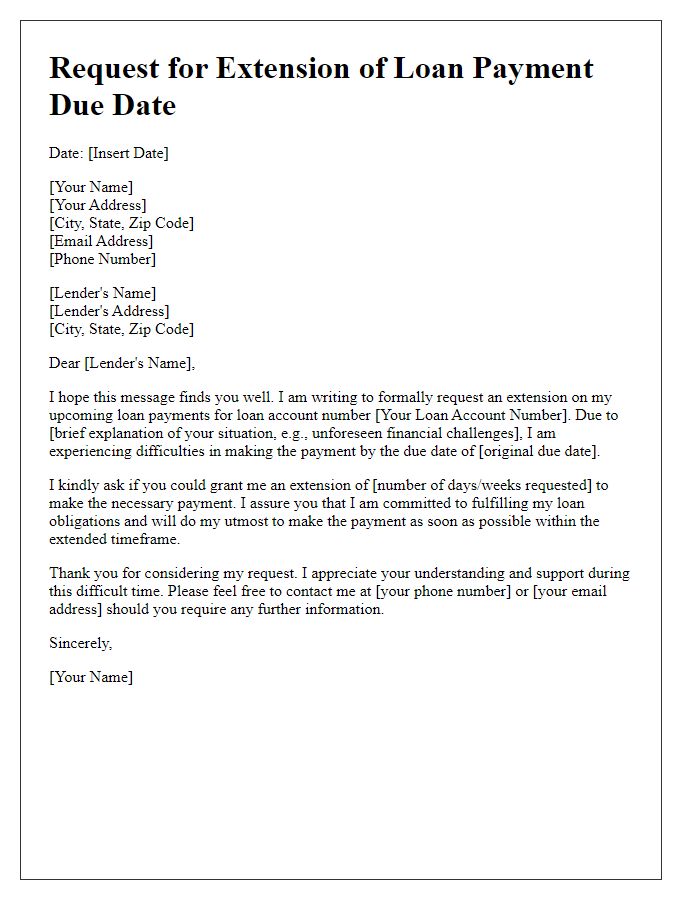

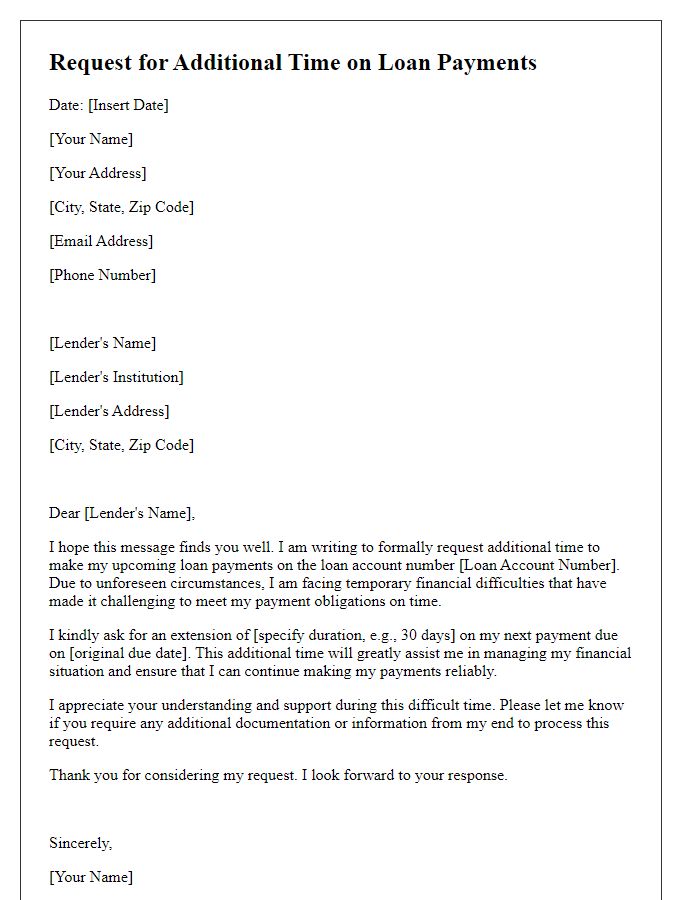

Account numbers and personal identification details

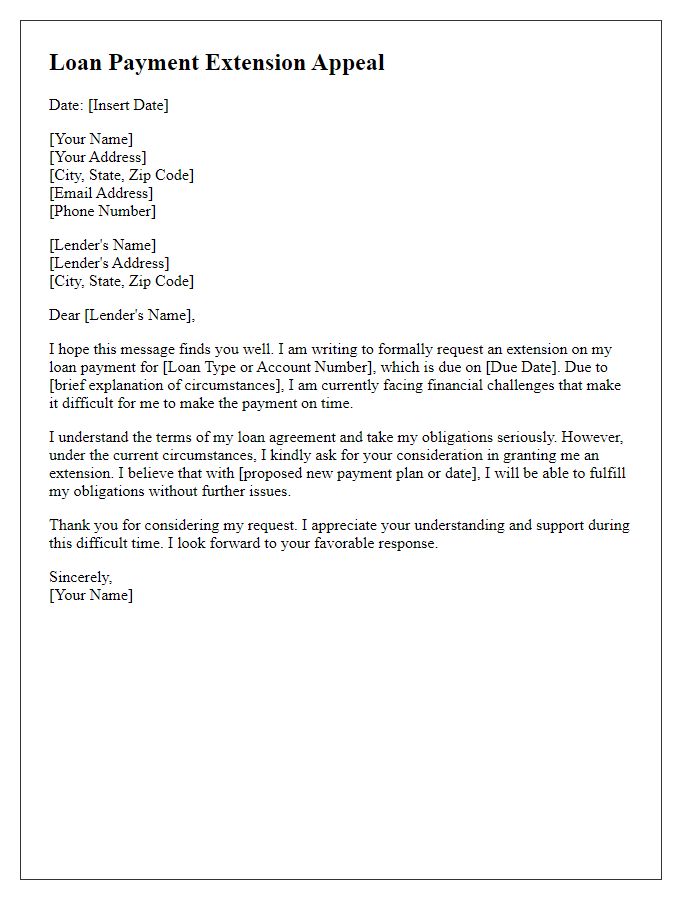

A loan payment extension request requires a clear understanding of the borrower's situation and additional personal details. Many financial institutions offer official channels for requesting adjustments based on valid reasons such as temporary financial setbacks or unexpected expenses. Including specific account numbers, such as your loan account number, ensures accurate identification within the lender's system. Personal identification details, like your Social Security number (or equivalent), may also be required for verification purposes. Always clarify the duration of the requested extension and any relevant changes in your financial circumstances, such as job loss or medical bills. Providing documentation, like pay stubs or expense statements, can substantiate your claim and improve the likelihood of approval. Make sure to submit the request through the lender's formal process to ensure professionalism and proper handling.

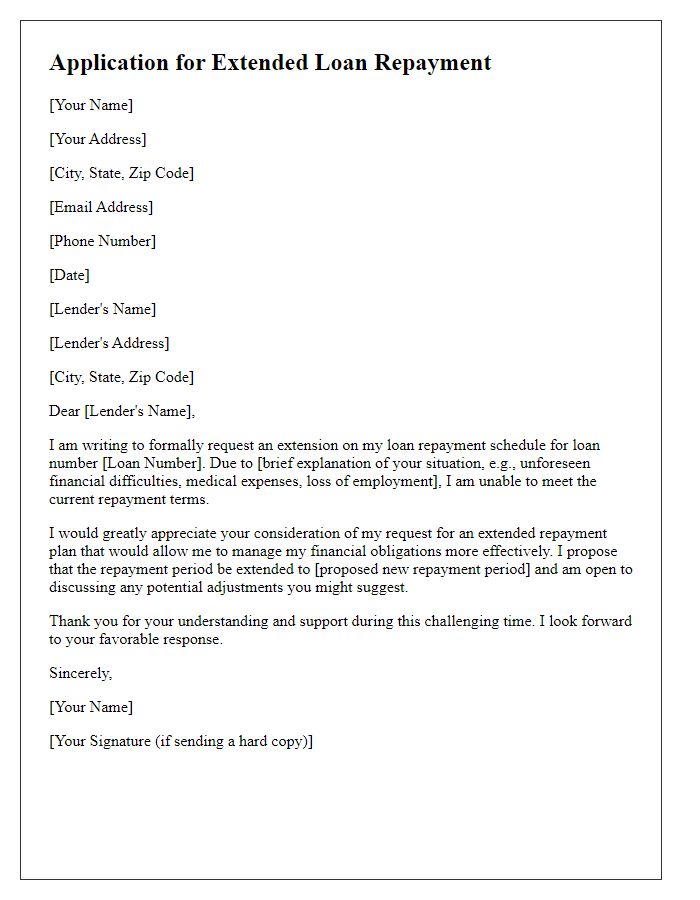

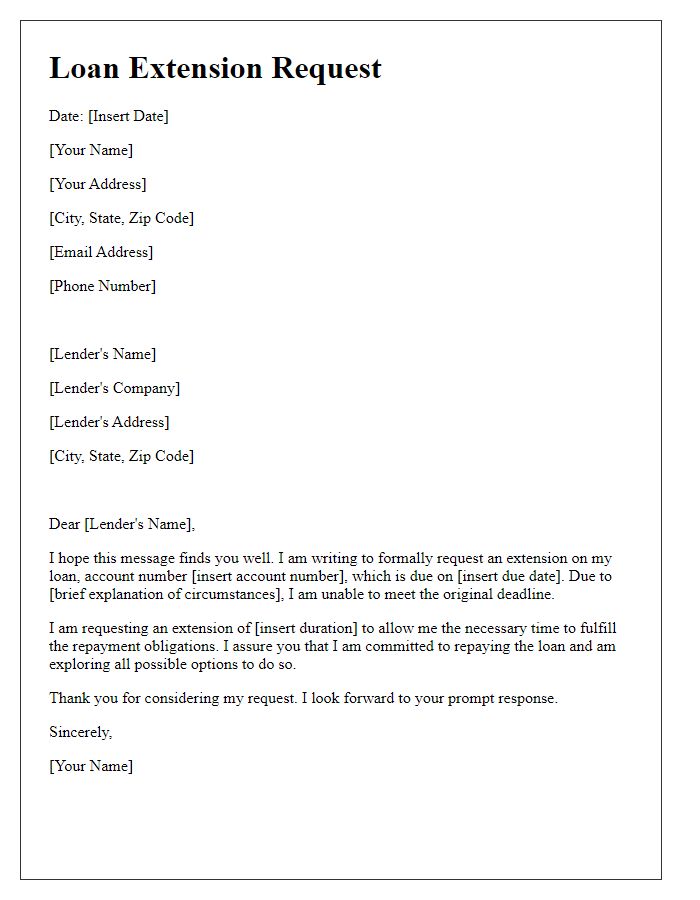

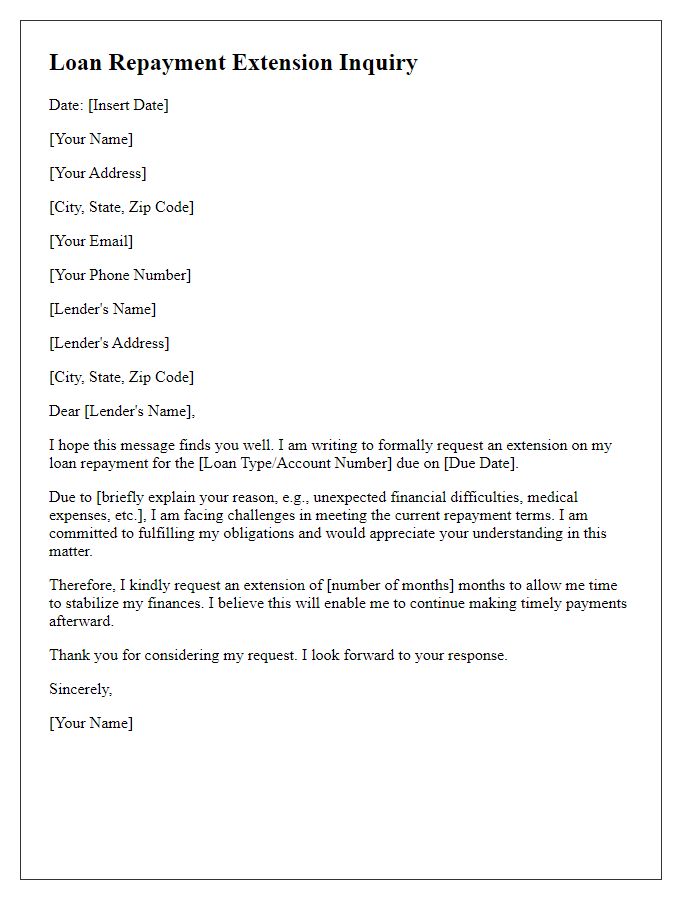

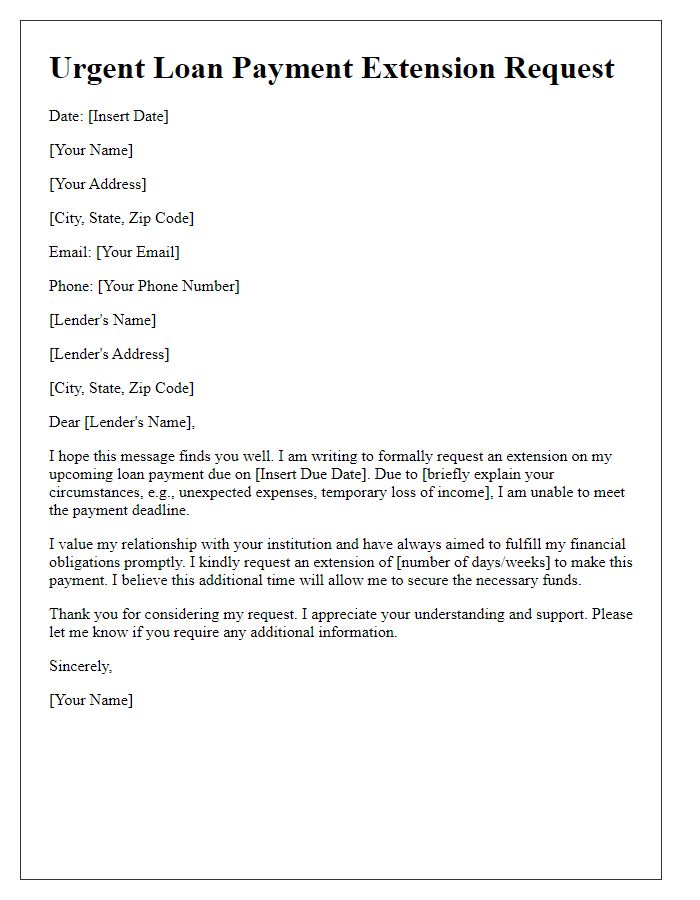

Reason for the extension request

Financial hardships often arise unexpectedly, impacting the ability to meet loan payment deadlines. A significant factor contributing to this situation may include job loss or reduced income (sometimes as much as 30% less), medical emergencies resulting in high expenses (surpassing $5,000 in some instances), or unanticipated repairs in essential home systems like plumbing or HVAC units, which can easily exceed $1,500. The request for a loan payment extension is a proactive measure to align financial obligations with current capabilities, ensuring the preservation of credit standing and preventing defaults during challenging times. The goal involves maintaining a responsible financial approach while navigating through these temporary difficulties.

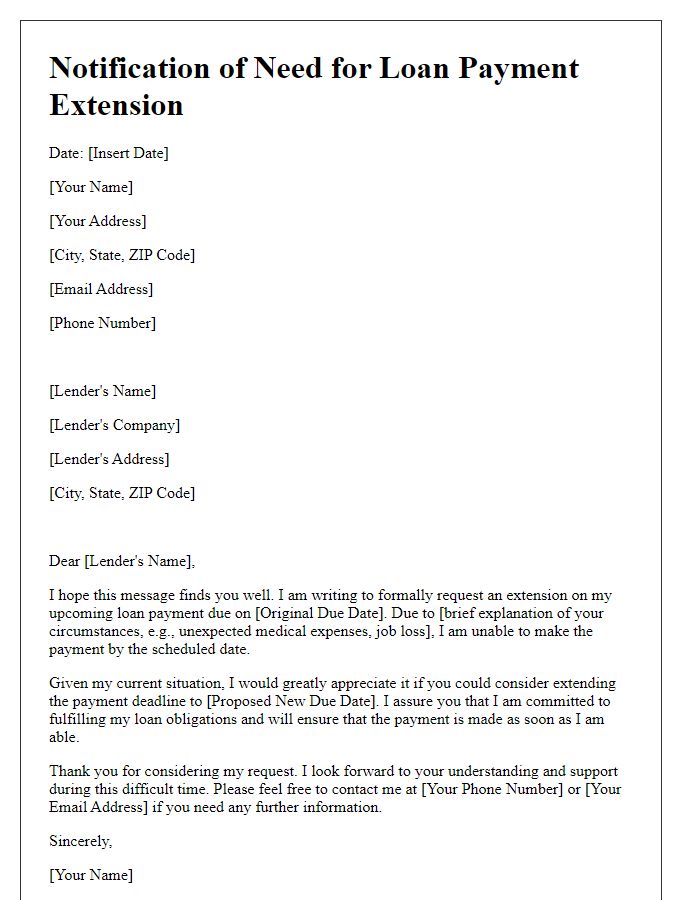

Proposed new payment schedule

A loan payment extension can provide borrowers with financial relief, enabling timely repayments without the stress of immediate financial burdens. A proposed new payment schedule typically outlines a revised timeline for installments, ensuring borrowers can navigate their obligations more effectively. Key details include adjusted monthly payments, starting dates, and the overall duration of the extension. For instance, a borrower may suggest extending a 12-month repayment plan to 18 months, allowing smaller payments that accommodate fluctuating income. This approach fosters communication with lenders, such as banks or credit unions, often enhancing rapport and trust while facilitating financial stability for the borrower. Proper documentation detailing the borrower's current financial situation, such as income statements and expense reports, supports the request and demonstrates the necessity for the extension.

Assurance of future financial stability

Financial difficulties can prompt borrowers to seek loan payment extensions, particularly during unexpected circumstances such as job loss or medical emergencies. A request for a loan payment extension often highlights the borrower's current financial challenges, which may include reduced income or increased expenses. Documentation may include recent pay stubs, medical bills, or letters from employers outlining job status. Borrowers may also express confidence in their future financial stability, potentially through job opportunities or skills development programs. By detailing these points, borrowers can present a comprehensive picture of their situation to lenders, increasing the likelihood of a favorable response.

Contact information for follow-up discussions

When seeking a loan payment extension, providing clear contact information for follow-up discussions is essential to facilitate effective communication. Include your full name, which is critical for identifying your account, alongside your phone number, where you can be reached during business hours (preferably including the area code). Additionally, incorporate your email address to ensure written correspondence can occur. Provide your home address, linked to the loan account, making it easier for the lender to verify your identity. If your contact methods include alternative options, such as a secondary phone number or a preferred time for communication, mentioning these can help streamline the follow-up process. Ensure that your contact details are up-to-date to avoid miscommunication or delays in addressing your request.

Comments