Are you considering requesting a corporate credit line increase to support your growing business needs? This is a common strategy for companies looking to expand operations, invest in new projects, or bolster cash flow without the limitations of a fixed budget. Crafting the right letter to your lender can make all the difference in getting the approval you seek. Let's dive into how to effectively articulate your request and improve your chances of successâread on for a helpful template!

Business Details

A corporate credit line increase is essential for businesses seeking to enhance cash flow and support growth initiatives. Companies like ABC Innovations, located in New York City, can benefit from a credit line boost to fund inventory purchases, marketing campaigns, or capital investments. Current revenue figures ($5 million annually) may indicate solid performance, while projected growth rates (15% year-over-year) reflect positive market dynamics. A steady payment history of at least two years with services provided by ABC Bank builds trust and demonstrates fiscal responsibility. Including insights regarding recent successful projects or strategic plans can strengthen the case for this financial request. A clear articulation of how the increased credit limit will directly contribute to operational improvements and competitiveness can significantly impact the decision-making process.

Current Credit Usage

Current credit usage reflects the financial flexibility of a business, demonstrating its ability to manage working capital and invest in growth opportunities. As of October 2023, many companies face fluctuating expenses, with average utilization rates ranging from 40% to 80% of credit limits provided by financial institutions. A significant portion of businesses, particularly in sectors like retail and manufacturing, often experience seasonal variations, leading to spikes in credit usage during peak periods such as holidays or product launches. Monitoring these trends is crucial for understanding borrowing patterns and making informed decisions about potential credit line increases. Financial managers should analyze current and projected cash flow needs, ensuring sustainable credit practices align with overall business strategy.

Justification for Increase

A corporate credit line increase may enhance cash flow management for businesses during expansion phases, such as seasonal peaks or project launches. Increased credit availability enables the procurement of inventory, allowing companies to meet growing customer demand, especially for retail sectors experiencing a surge, projected at 20% growth this quarter. Enhanced credit can also facilitate timely supplier payments, leveraging early payment discounts that can average 2% savings per transaction. Additionally, companies can strategically navigate unexpected expenses, minimizing disruptions related to market volatility or unforeseen operational costs. This flexibility is paramount as businesses strive to maintain competitive advantage in dynamic environments, such as the technology sector where innovation cycles can rapidly change. Ensuring appropriate credit levels is critical for sustaining operational agility and fostering long-term growth across the market landscape.

Financial Statements

A corporate credit line increase request requires comprehensive financial statements, illustrating the organization's fiscal health. These statements, including the balance sheet detailing assets (cash, inventory, equipment), liabilities (loans, accounts payable), and shareholder equity, must demonstrate profitability over recent periods. The income statement should showcase revenue trends, net income figures, and operating expenses; quarterly trends are crucial for lenders' assessment. Additionally, the cash flow statement, displaying cash inflows and outflows from operating, investing, and financing activities, reinforces liquidity capabilities. Providing detailed ratios, such as the current ratio (current assets/current liabilities) and debt-to-equity ratio, offers insights into financial stability and creditworthiness, justifying the requested increase. Proper documentation underpins the credibility of the request, ensuring lenders have a comprehensive view of the company's financial position.

Repayment Plan

A corporate credit line increase can significantly enhance a company's cash flow, providing necessary liquidity for operational expenses or expansion initiatives. A detailed repayment plan structured over 12 months, with fixed monthly payments, ensures that the principal amount can be managed effectively. Additionally, interest rates, typically ranging from 7% to 15%, will impact the overall cost of borrowing. Having a strong financial position, supported by robust revenue projections and a solid credit history, will facilitate discussions with financial institutions. Furthermore, maintaining timely payments on existing obligations strengthens the company's creditworthiness, reassuring lenders of its commitment to responsible financial management.

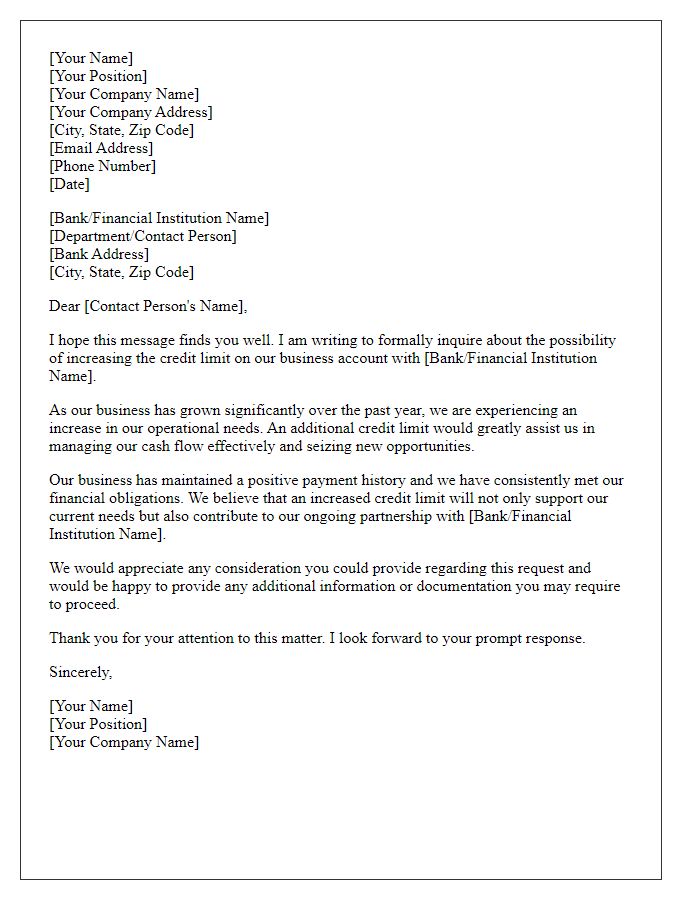

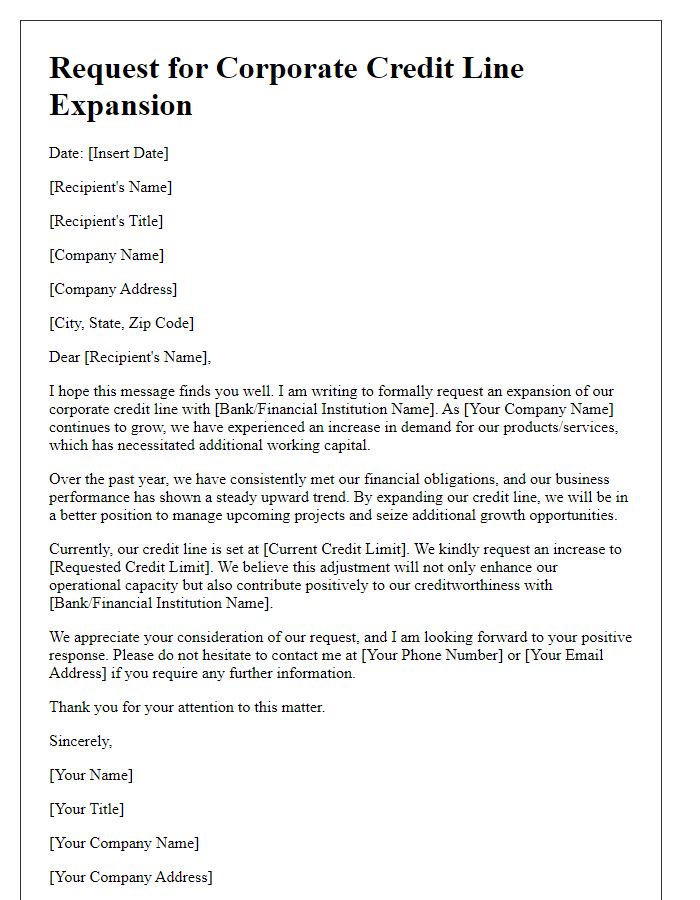

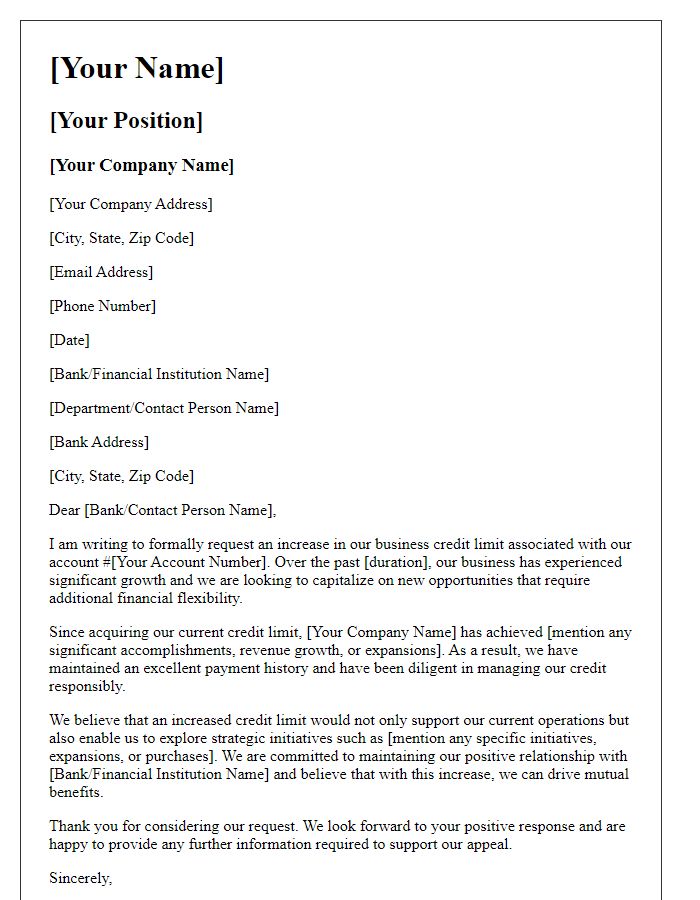

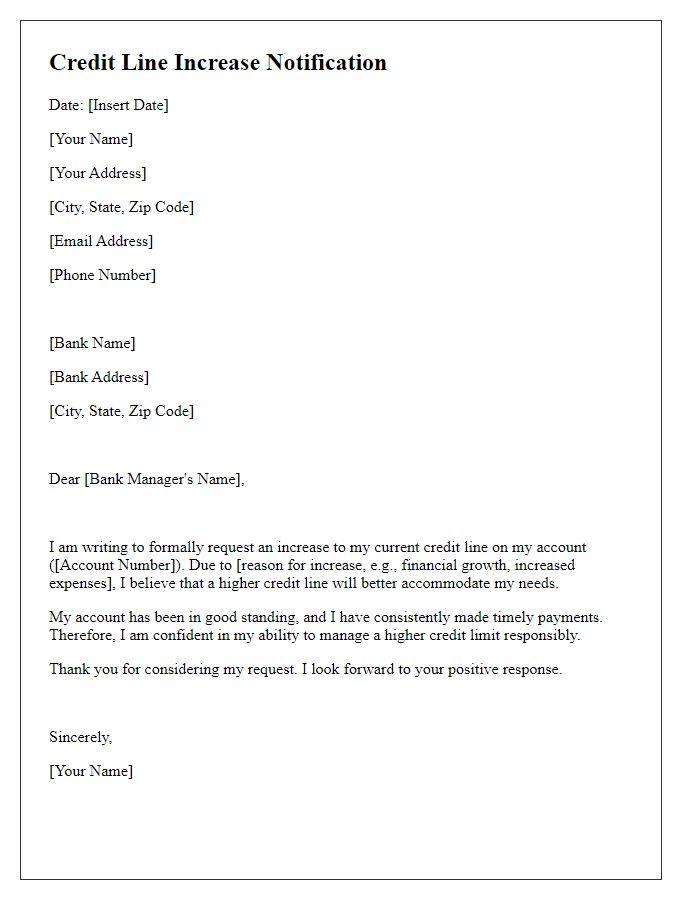

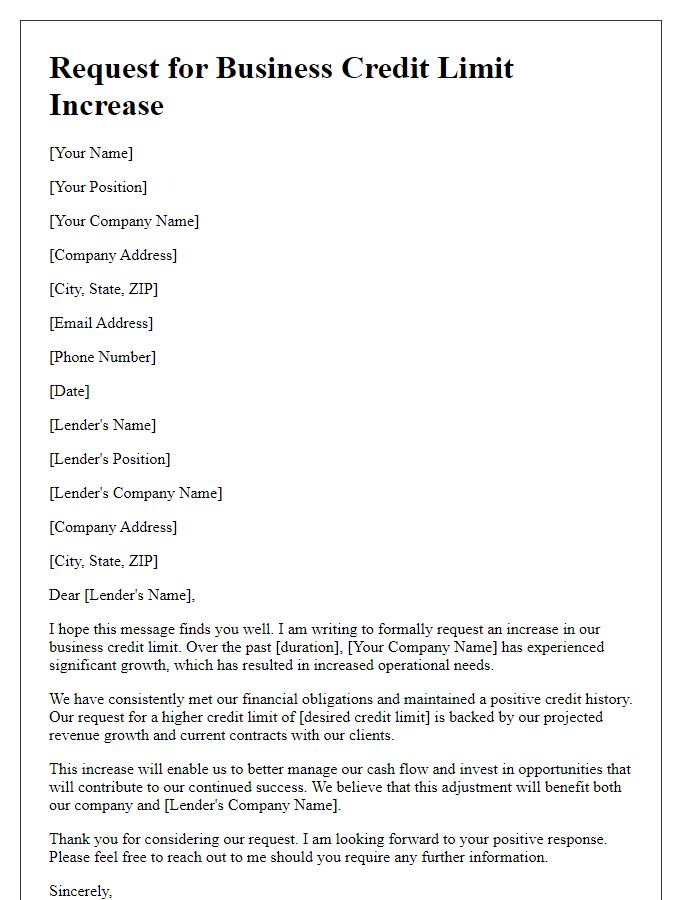

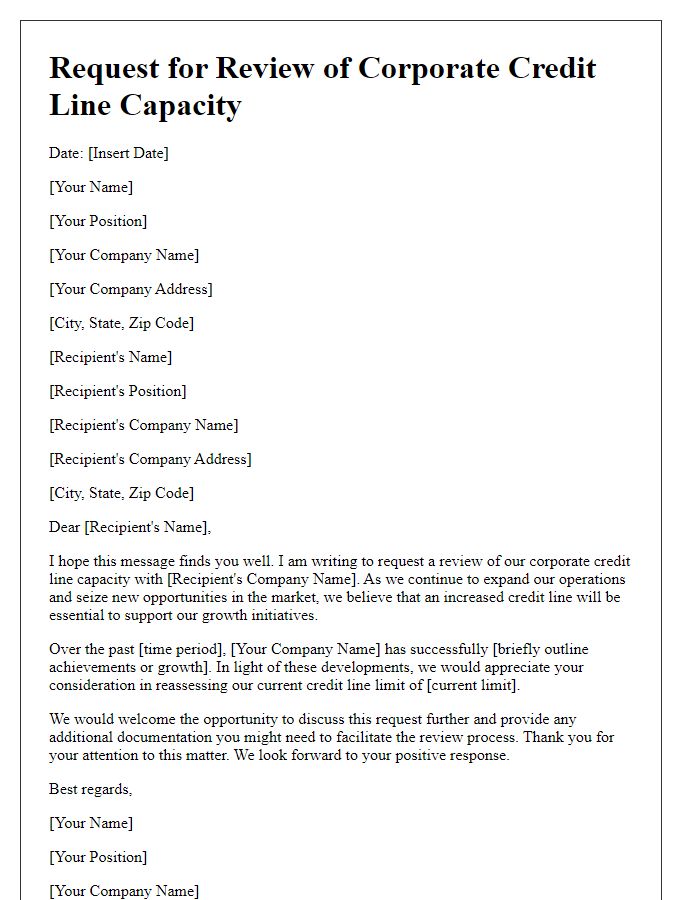

Letter Template For Corporate Credit Line Increase Samples

Letter template of inquiry for additional credit limit on business account

Comments