Are you facing a debt collection dispute and unsure how to address it? Navigating this situation can feel overwhelming, but having a clear plan can make all the difference. A well-structured letter can communicate your concerns effectively and potentially resolve the issue swiftly. If you're ready to learn more about crafting the perfect debt collection dispute letter, keep reading!

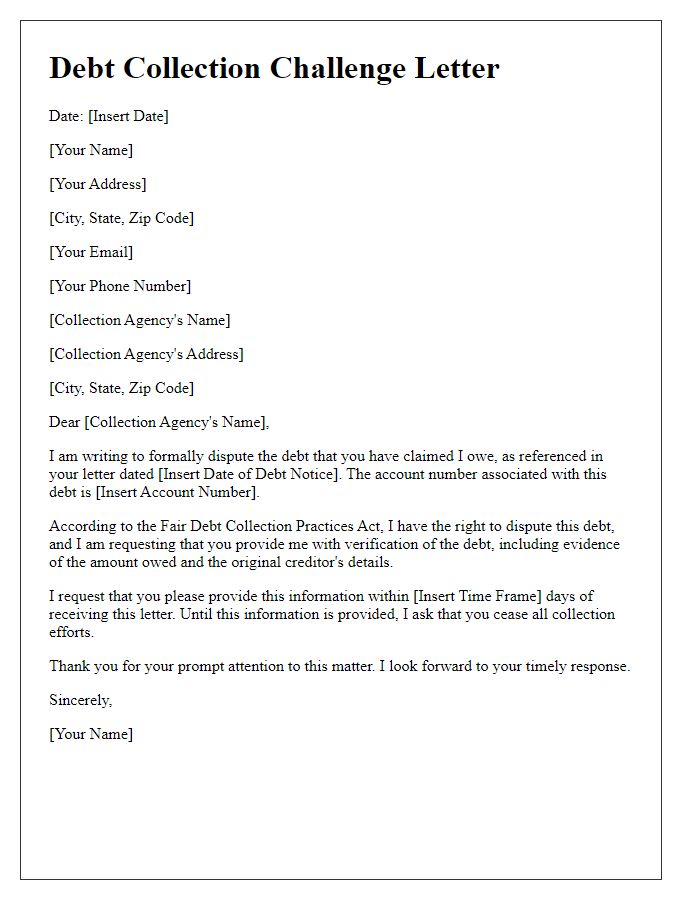

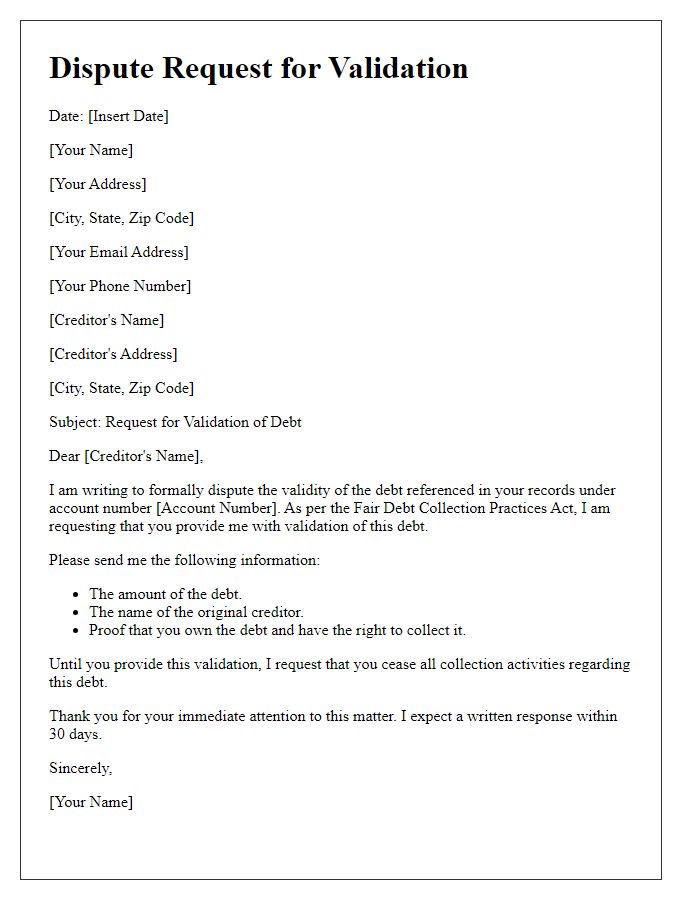

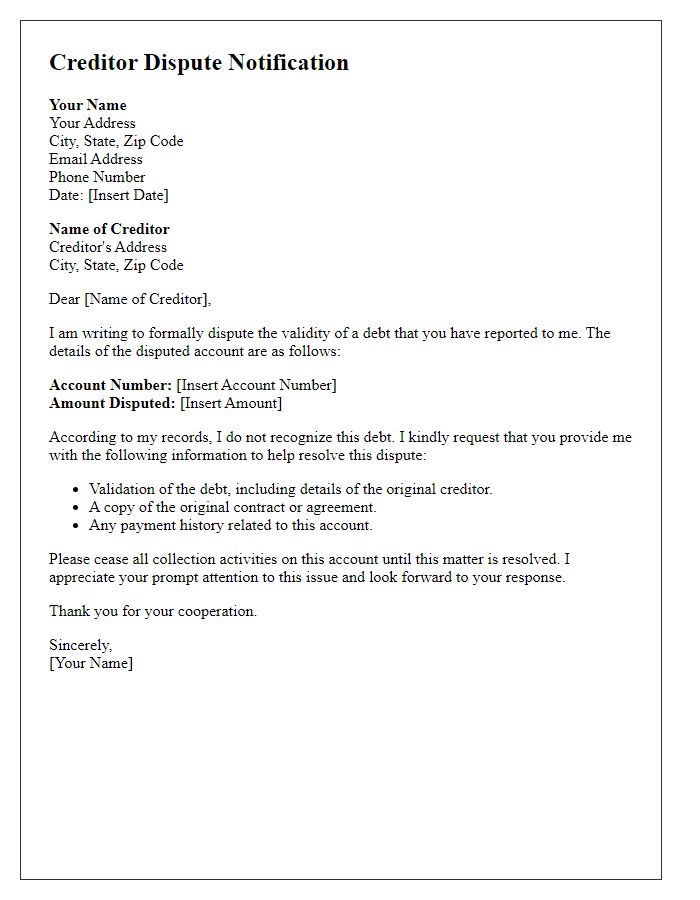

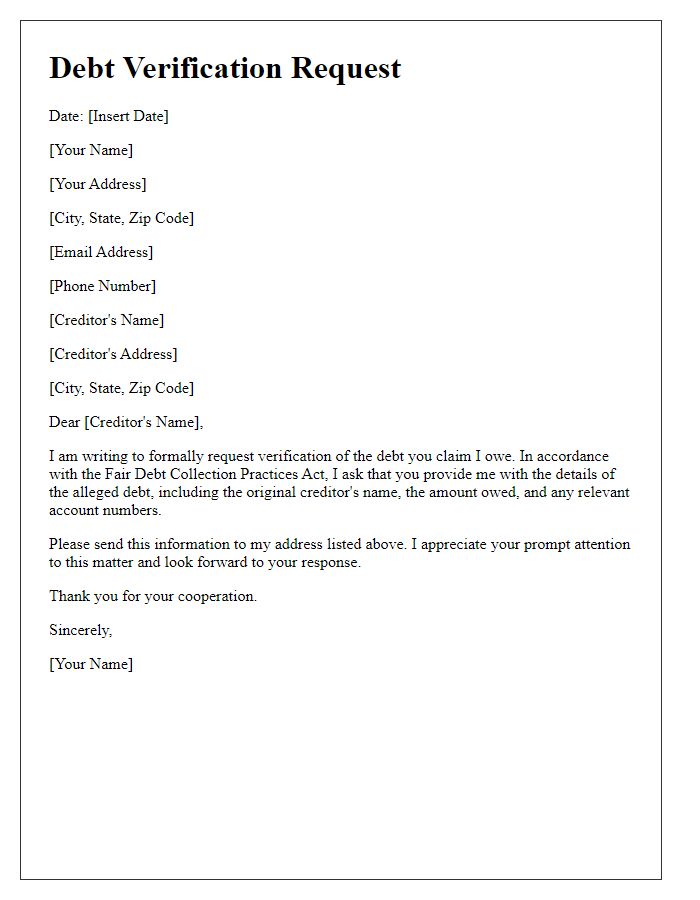

Legal Validation of Debt

The legal validation of debt plays a crucial role in ensuring fair treatment of consumers facing financial disputes. A debt collector, according to the Fair Debt Collection Practices Act (FDCPA), must provide evidence of the amount owed, such as loan agreements or billing statements, within a specific timeframe, typically five days from the first contact. Failure to validate debt can lead to significant penalties for the collector, reinforcing consumer rights. Key details such as the original creditor's name, account number, and outstanding balance must be clearly outlined in the validation request. In case of discrepancies, consumers have the right to dispute the debt, which can halt collection efforts until proper validation is provided. This process not only protects consumers but also impacts the credibility of the collection agencies operating within the United States.

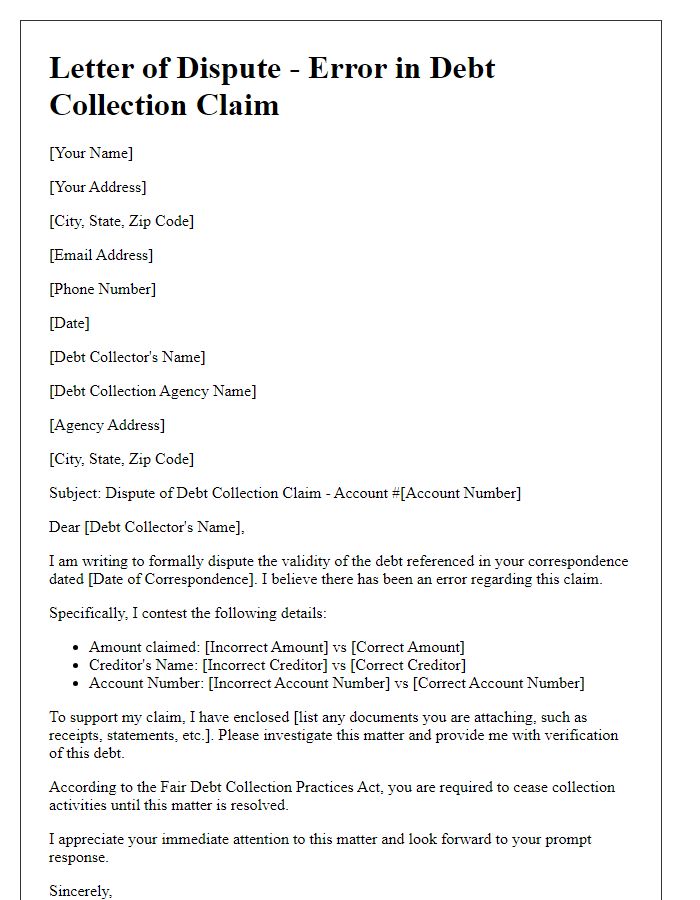

Accurate Account Information

Accurate account information is crucial for effective debt collection processes, ensuring transparency and trust between creditors and debtors. Discrepancies can arise from clerical errors or outdated records, leading to confusion about outstanding balances. Regulatory standards set by the Fair Debt Collection Practices Act (FDCPA) emphasize the need for accurate record-keeping, with requirements to verify debts upon request. Financial institutions must provide detailed documentation, such as account statements or payment history, to support claims. Addressing inaccuracies promptly can prevent disputes and mitigate potential legal issues, fostering better communication and resolution strategies in debt management.

Payment History Documentation

Payment history documentation serves as a crucial aspect of resolving debt collection disputes. Precise records detailing payment dates (such as monthly installments), amounts paid (in dollars), and outstanding balances provide clarity. Documentation should include invoices (created by the creditor) and bank statements (showing transactions) to verify payments made. Consumers should always retain copies of correspondence (between themselves and the creditor) that outline payment agreements (in written form) and any disputes raised. Accurate records can influence the outcome of disputes, ensuring that consumers are not unfairly held liable for debts already settled. This level of detail is essential when negotiating repayment plans or contesting inaccuracies in collection accounts with agencies.

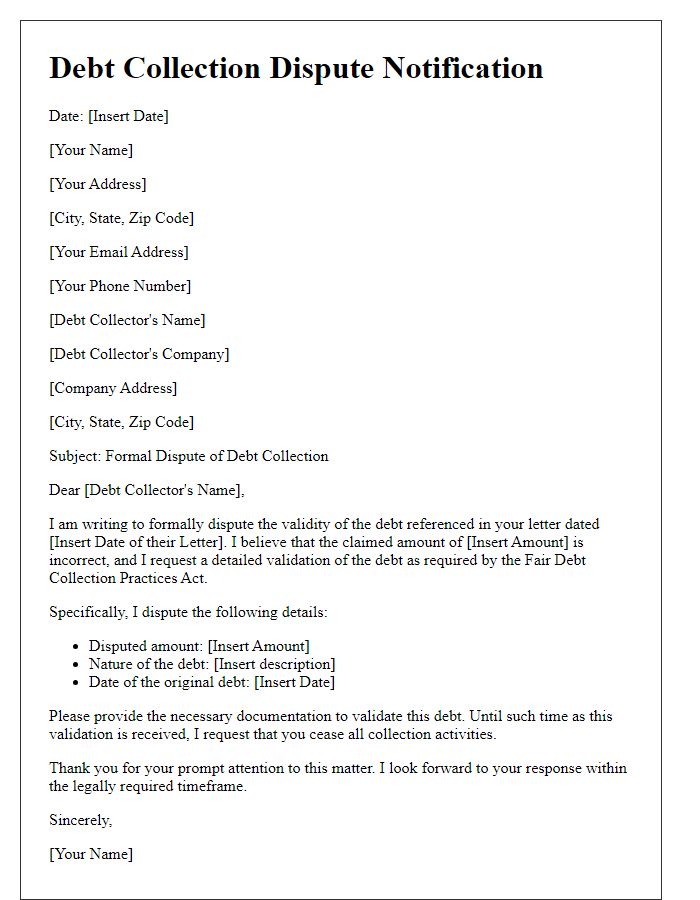

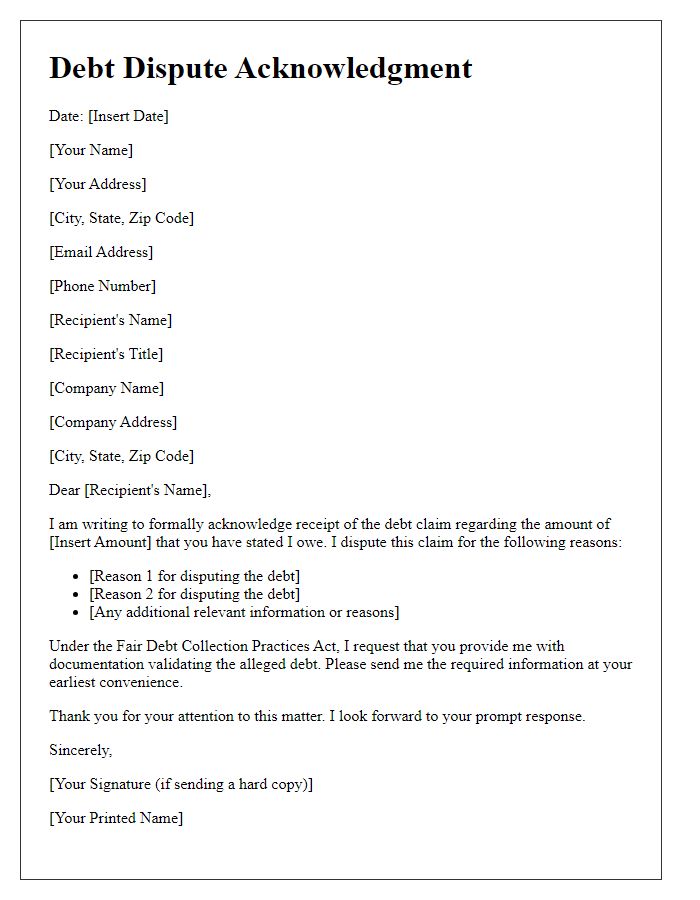

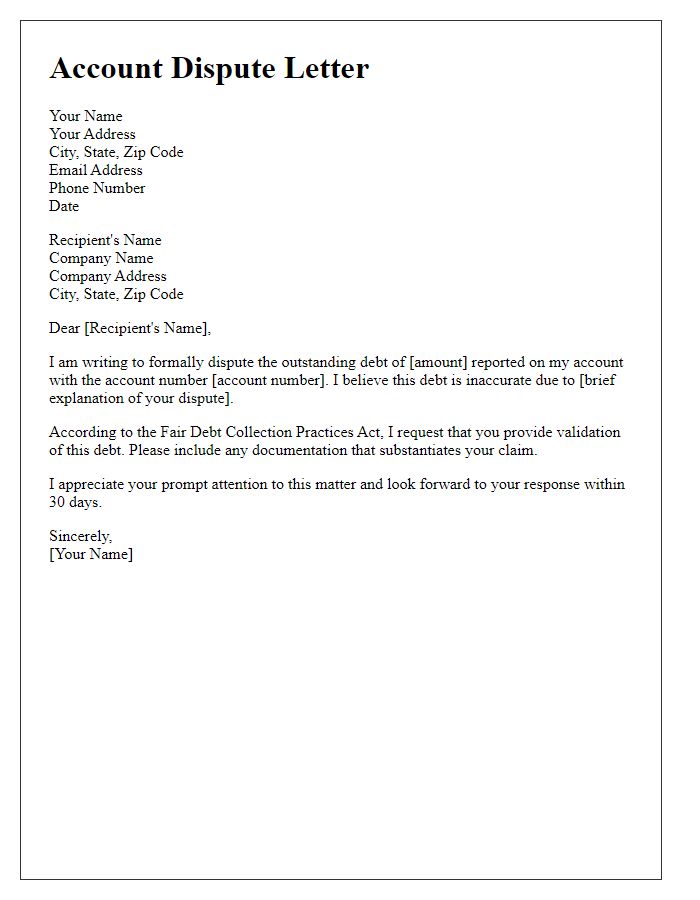

Dispute Resolution Request

Debt collection disputes often involve individuals challenged by financial obligations, such as outstanding balances on credit accounts, medical bills, or personal loans. A dispute resolution request aims to clarify inconsistencies or inaccuracies in account statements, often involving collections from agencies like Equifax or TransUnion. In such scenarios, the Fair Debt Collection Practices Act (FDCPA) plays a critical role by outlining consumer rights, ensuring transparency, and mandating validation of debts before collection efforts escalate. Individuals should include pertinent information such as account numbers, dates of interactions, and specific discrepancies to facilitate effective resolution with creditors or collection agencies.

Response Timeline and Contact Information

A clear debt collection dispute response timeline is crucial for both creditors and debtors. Typically, upon receiving a debt collection notice, a debtor has 30 days to dispute the claim, as outlined by the Fair Debt Collection Practices Act (FDCPA). During this period, communication channels must remain open, with contact information such as phone numbers, emails, and addresses prominently provided on the notice for easy access. Timely responses to disputes can prevent escalated actions, including legal proceedings. Documenting all interactions during this timeline is essential, ensuring both parties have a record of communications and agreements reached, vital for any future references in debt resolution.

Comments