Are you tired of those pesky currency conversion fees eating into your travel budget? You're not alone! Many travelers are looking for ways to save money on international transactions, and understanding how to request a waiver for these fees can make a significant difference. If you're interested in learning more about how you can craft an effective letter for a currency conversion fee waiver, keep reading!

Clear Subject Line

Currency conversion fees can significantly impact international transactions, particularly for businesses operating across multiple countries. Many financial institutions impose a range of fees (typically between 1% to 3%) when converting foreign currency into local currency. These fees can accumulate quickly, especially for frequent transactions involving high volumes, affecting profitability. Requesting a fee waiver can be beneficial. A well-structured request should highlight the long-term relationship with the bank, transaction history, and potential future business, emphasizing how a waiver can enhance international trade efficiency. Specific examples of previous transactions and their costs can strengthen the case for consideration of the request.

Formal Salutation

Currency conversion fees can significantly impact international transactions, particularly for frequent travelers and expatriates. Financial institutions, such as banks and credit card companies, often charge these fees when converting one currency to another, typically ranging from 1% to 3% of the transaction amount. Such fees can accumulate quickly, especially during larger purchases or when traveling to multiple countries. Waiving these fees, especially for loyal customers or during promotional periods, can enhance customer satisfaction and foster loyalty. Institutions, like American Express or Visa, may consider these waivers conducive to retaining clients, allowing for seamless transactions without unexpected costs.

Request Statement

Currency conversion fees can significantly impact international transactions conducted through financial institutions, such as banks and credit card companies. These fees, often around 3% to 5% of the transaction amount, apply when funds are converted from one currency to another, such as USD to EUR. Waiving such fees can provide significant savings for frequent travelers or expatriates, particularly during peak travel seasons when the demand for currency exchange increases. To obtain a fee waiver, customers typically need to provide a written request, including details such as account numbers, transaction dates, and specific amounts. Financial entities, such as Visa or Mastercard, hold policies that may allow for waivers under certain conditions, such as loyalty status or promotional offers, making it essential for users to inquire about eligibility.

Supporting Justification

Currency conversion fees can significantly impact the financial transactions for individuals and businesses, particularly in global markets. Large corporations, such as multinational companies, frequently incur these charges on international purchases, which can reach percentages as high as 3% of the transaction value. In developing economies, this fee burden can hinder growth, particularly for small and medium-sized enterprises (SMEs) striving to access foreign markets. Waiving these fees can stimulate trade, foster international relationships, and encourage economic development. Supporting this proposal involves demonstrating the potential for increased transaction volumes, enhanced customer satisfaction, and the overall positive impact on market competitiveness. This initiative aligns with broader goals of promoting fair trade practices and reducing barriers to global commerce.

Polite Closing

Currency conversion fees can significantly impact travelers and international transactions. Financial institutions often charge these fees, which can range from 1% to 3% of the transaction amount. When cross-border transactions occur, such as sending money to countries like Canada or the United Kingdom, these fees can accumulate quickly, leading to unexpected costs. Institutions like banks and credit card companies usually apply these charges but may waive them under specific circumstances. For instance, long-standing customers or those holding premium accounts may request a fee waiver, especially during special promotions or for humanitarian purposes. Understanding these nuances can help consumers maximize their finances while navigating global transactions.

Letter Template For Currency Conversion Fee Waiver Samples

Letter template of request for currency conversion fee waiver for international business transactions.

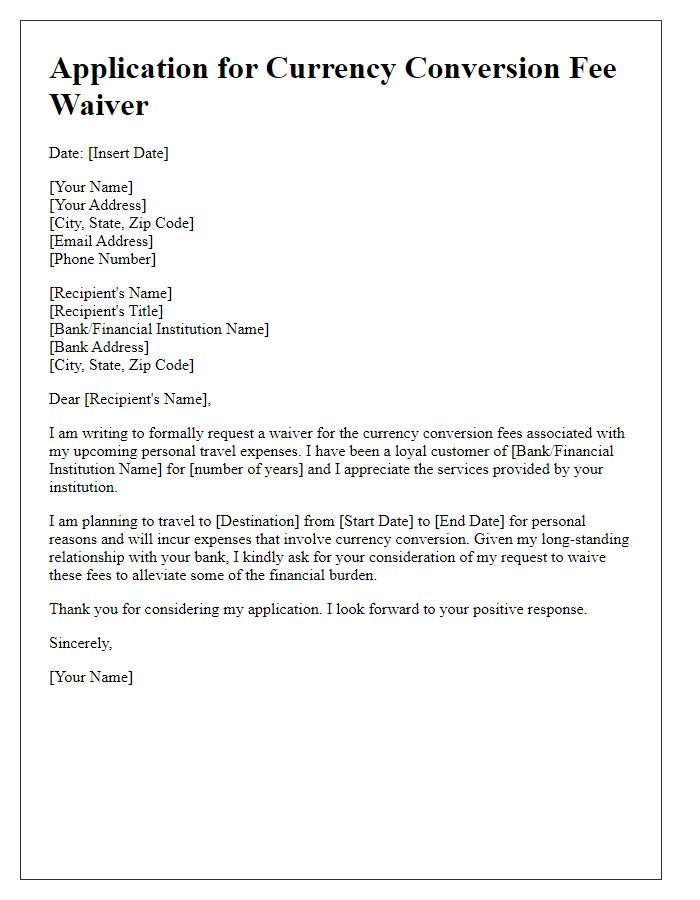

Letter template of application for currency conversion fee waiver for personal travel expenses.

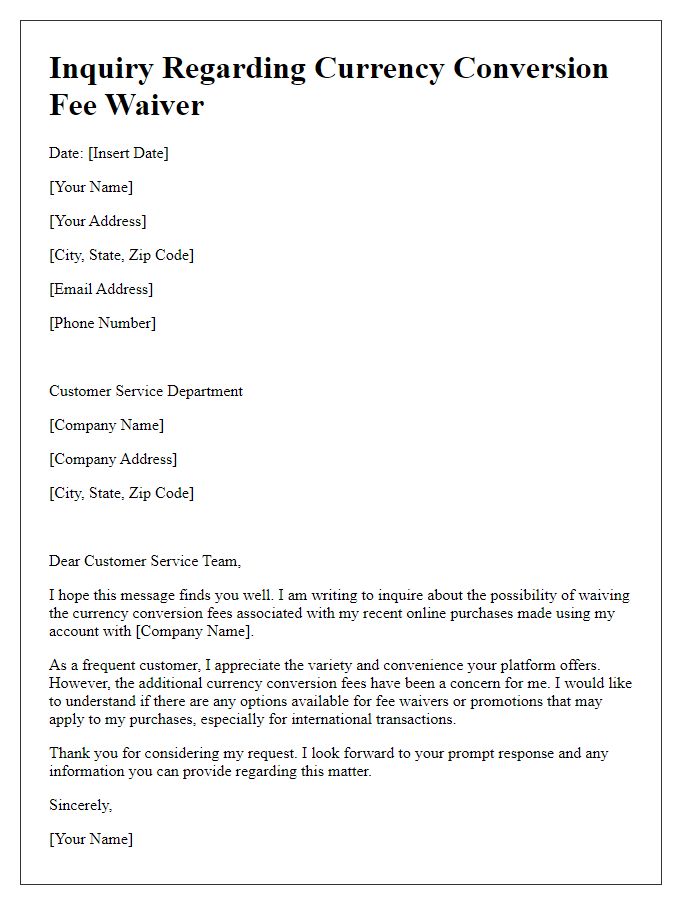

Letter template of inquiry regarding currency conversion fee waiver for online purchases.

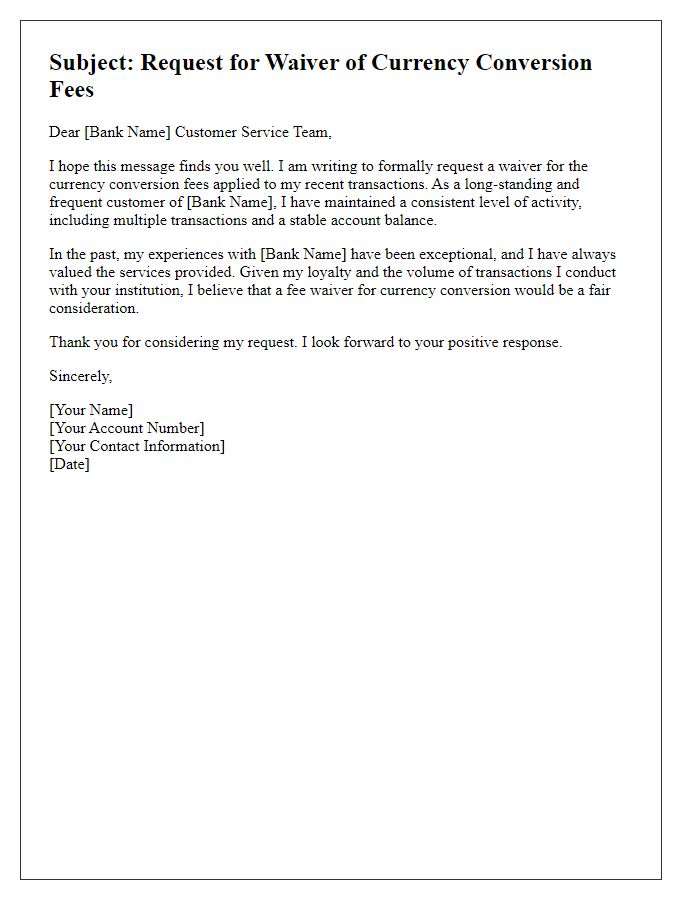

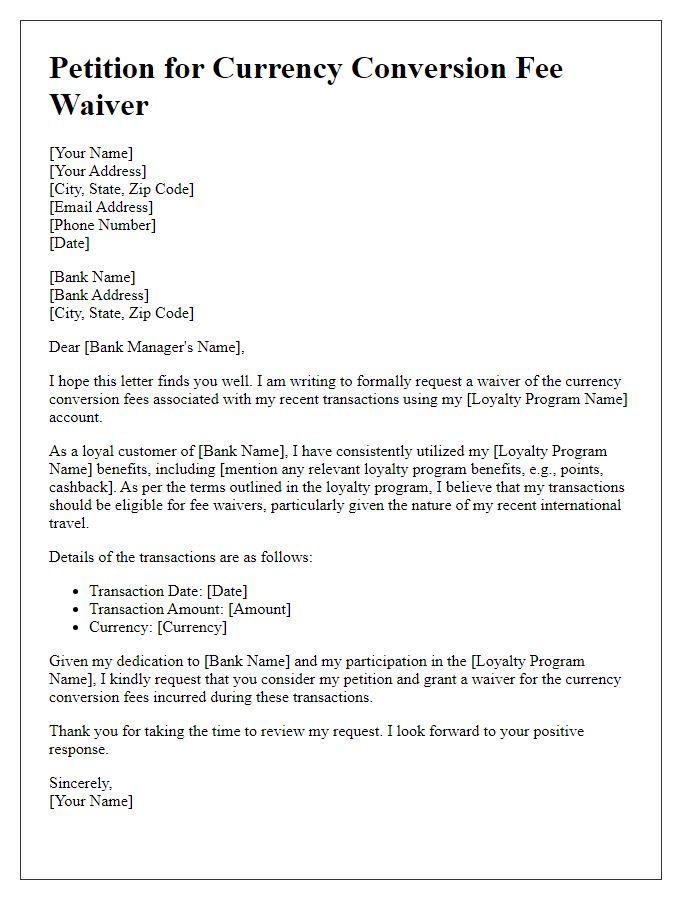

Letter template of appeal for currency conversion fee waiver based on frequent customer status.

Letter template of notification for currency conversion fee waiver due to financial hardship.

Letter template of justification for currency conversion fee waiver for charitable donations.

Letter template of recommendation for currency conversion fee waiver for student tuition payments abroad.

Letter template of request for special currency conversion fee waiver for expatriates.

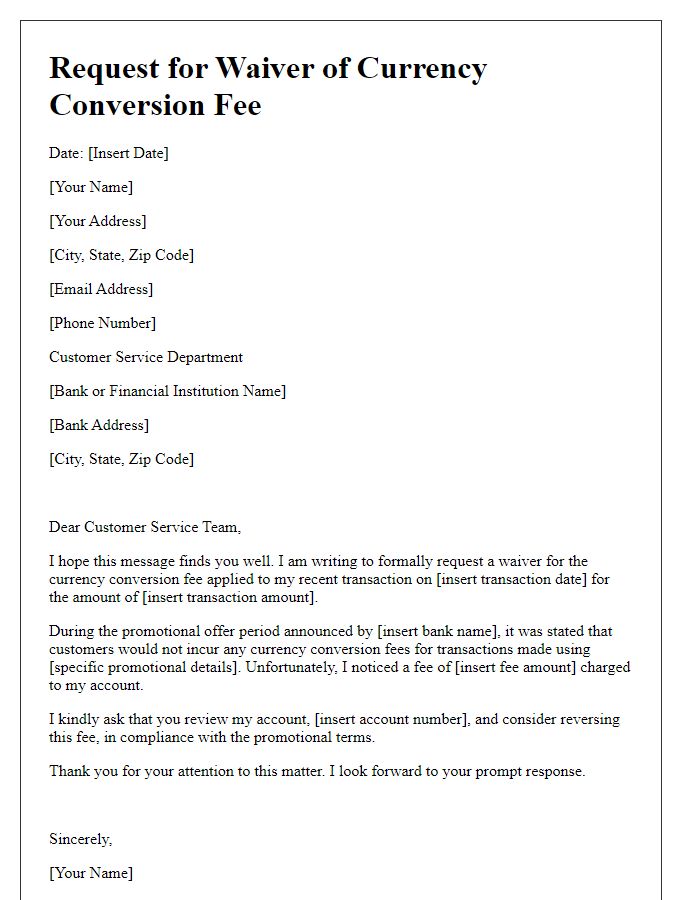

Letter template of demand for currency conversion fee waiver during promotional offers.

Comments