If you're considering an interest-only mortgage, you're in the right place to seek clarity on its terms and benefits. Many potential homebuyers find themselves puzzled by the distinction between interest payments and principal repayments, and that's completely normal! Understanding how these mortgages work can help you make informed decisions that align with your financial goals. So, if you're ready to dive deeper into the intricacies of interest-only mortgages, keep reading for some essential insights!

Subject Line and Salutation

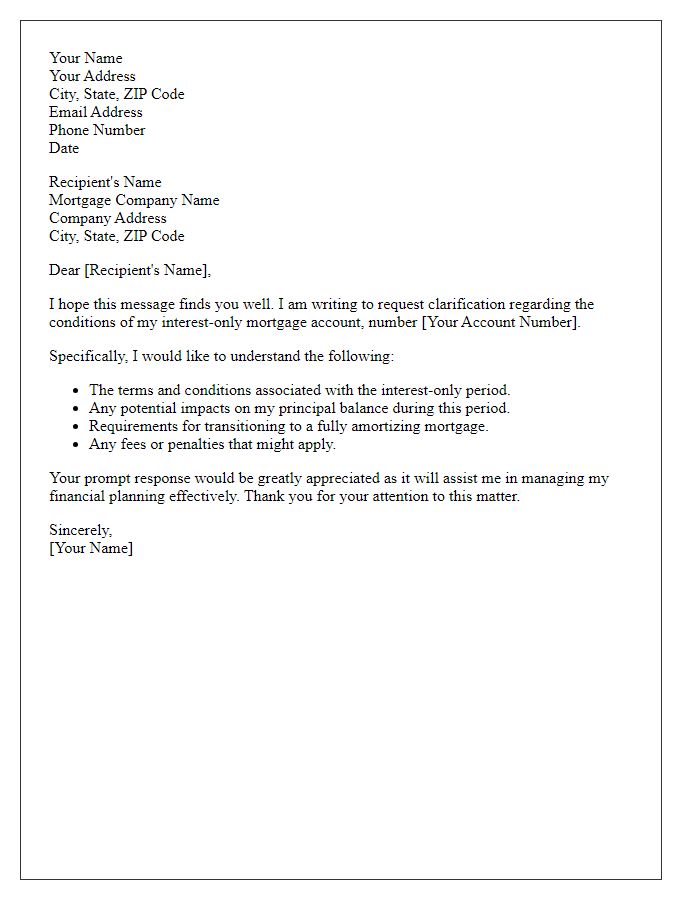

Interest-only mortgages offer unique terms that require careful consideration. Typically, these loans allow borrowers to pay only the interest for a specific period, commonly five to ten years. Borrowers must be aware that after this initial phase, the mortgage converts to a standard repayment model, which significantly increases monthly payments. Interest rates may vary based on market conditions, affecting the overall loan cost. Understanding these terms is crucial, especially for borrowers in fluctuating housing markets like California or New York, where property values can rapidly change. Consulting with financial advisors or mortgage specialists can provide clarity on implications and long-term affordability.

Reference to Mortgage Account Number

Interest-only mortgages can offer flexibility for homeowners seeking affordable monthly payments. This type of mortgage allows borrowers to pay only the interest on the loan, usually for a specified period, such as 5, 10, or even 15 years. During this time, no principal repayment occurs, meaning the original loan amount remains unchanged. Once the interest-only period ends, borrowers typically face an adjustment period where monthly payments increase significantly as they must start repaying both principal and interest. Homeowners should be aware of potential pitfalls, such as property value fluctuations, which may affect equity. Understanding mortgage account details, including associated fees and payment schedules, is crucial for long-term financial planning.

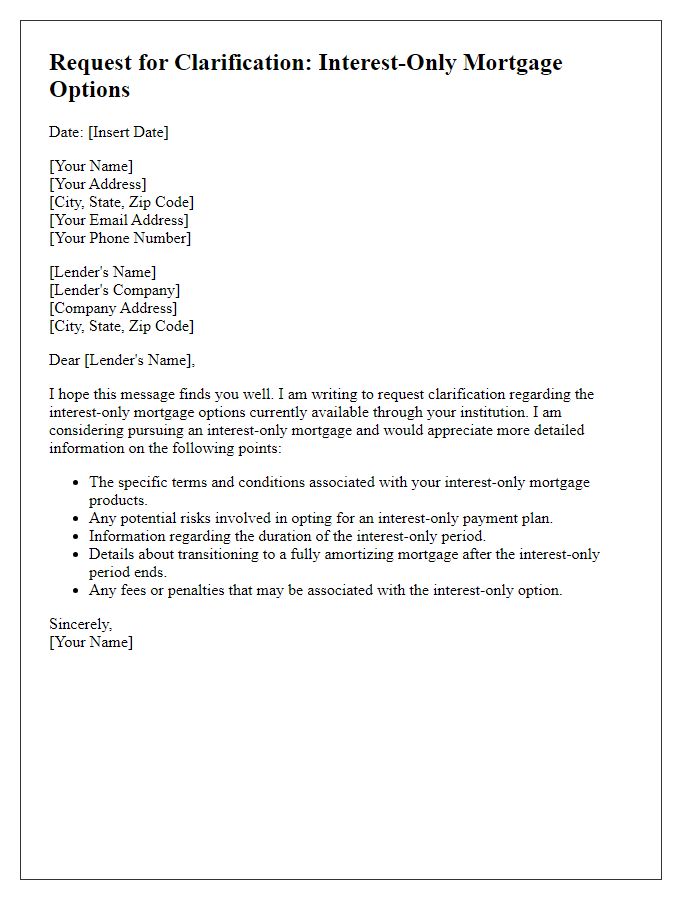

Request for Specific Clause Clarifications

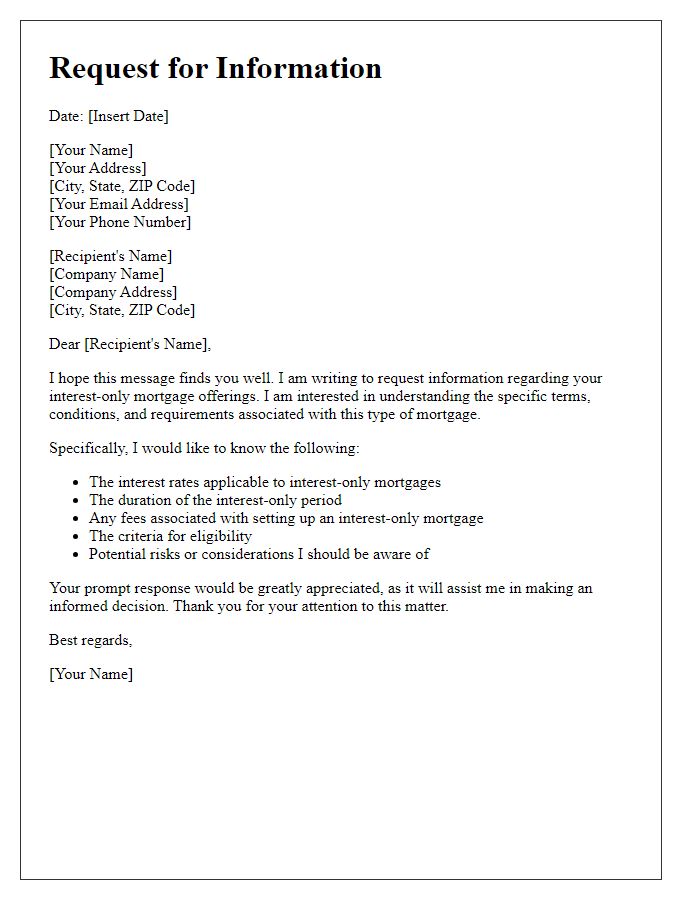

Interest-only mortgages often involve specific terms that can significantly influence financial planning and repayment strategies. Borrowers typically engage in a payment schedule where only the interest component is paid, resulting in lower monthly payments compared to traditional mortgages. However, when the loan period concludes, the entire principal amount becomes due, requiring awareness of potential risks. Notably, these mortgages can vary based on lender policies, market conditions, and the borrower's credit profile. It's critical to explore clauses related to interest rates, payment structures, and potential penalties for early repayment. Understanding these terms ensures borrower preparedness for significant financial obligations, especially considering changing economic landscapes such as fluctuating interest rates or housing market corrections. Clear clarifications on these clauses can aid in making informed decisions and avoiding pitfalls associated with repayment periods.

Interest Rate and Payment Details

Interest-only mortgages allow borrowers to pay only the interest on the principal balance for a specified term, typically 5 to 10 years. During this period, the monthly payments remain lower, as they do not contribute to the principal repayment. Interest rates for these loans can vary significantly; adjustable-rate mortgages (ARMs) may start lower but can increase over time based on market conditions, while fixed-rate options maintain stability throughout the term. Borrowers must be aware that after the interest-only period ends, payments will increase significantly as they will need to start paying down the principal amount. This change can result in a payment shock, often leading to higher financial stress if not planned accordingly. Potential long-term implications include total interest costs over the life of the loan and the overall impact on creditworthiness.

Contact Information for Follow-Up

Interest-only mortgage loans, such as those offered by lenders like Quicken Loans and Chase, allow borrowers to pay only the interest for a specific period, often ranging from 5 to 10 years. During this interest-only phase, monthly payments remain lower, which can be beneficial for budgeting. After this initial timeframe, the loan transitions to principal and interest payments, leading to potentially higher monthly costs depending on the remaining loan balance and term. Key factors influencing these terms include the loan amount, prevailing interest rates (which can fluctuate and affect total repayment), and the borrower's credit profile. Understanding these details is crucial for effective financial planning and avoiding payment shocks at the end of the interest-only period.

Letter Template For Interest-Only Mortgage Terms Clarification Samples

Letter template of request for clarification on interest-only mortgage conditions

Letter template of request for information on interest-only mortgage specifications

Letter template of clarification request for interest-only mortgage options

Letter template of inquiry about interest-only mortgage repayment structure

Letter template of request for details regarding interest-only mortgage eligibility

Letter template of assistance request with interest-only mortgage complexities

Comments