Are you on the hunt for a straightforward way to request tax documents? Writing a letter for this purpose can feel daunting, but it doesn't have to be! With the right template at your fingertips, you can ensure that your request is clear, concise, and professional. Ready to simplify your tax document request process? Let's dive into the details!

Clear Subject Line

Request for Tax Document: [Your Name/Company Name] - [Tax Year]

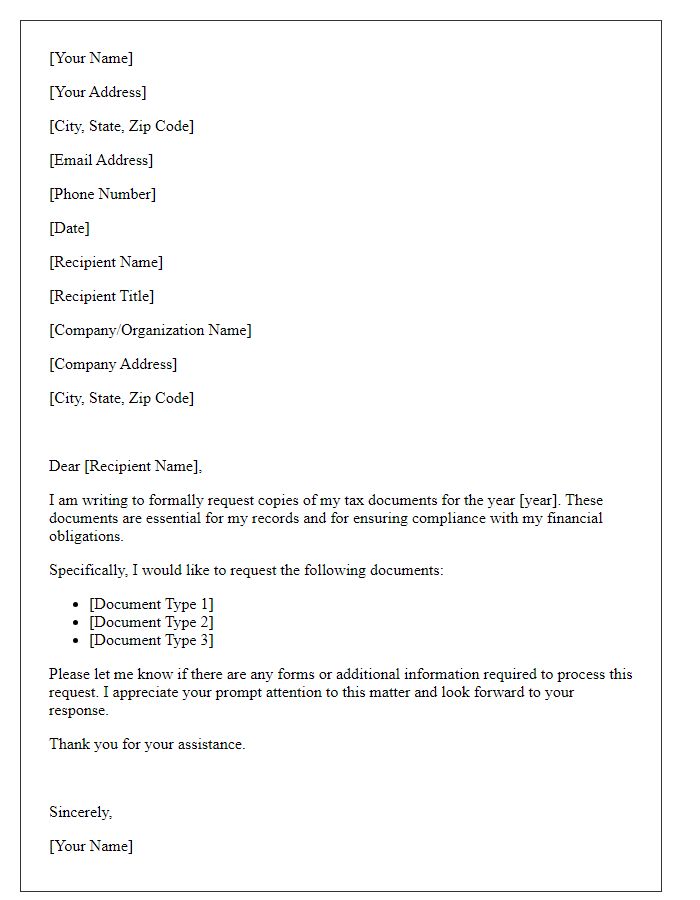

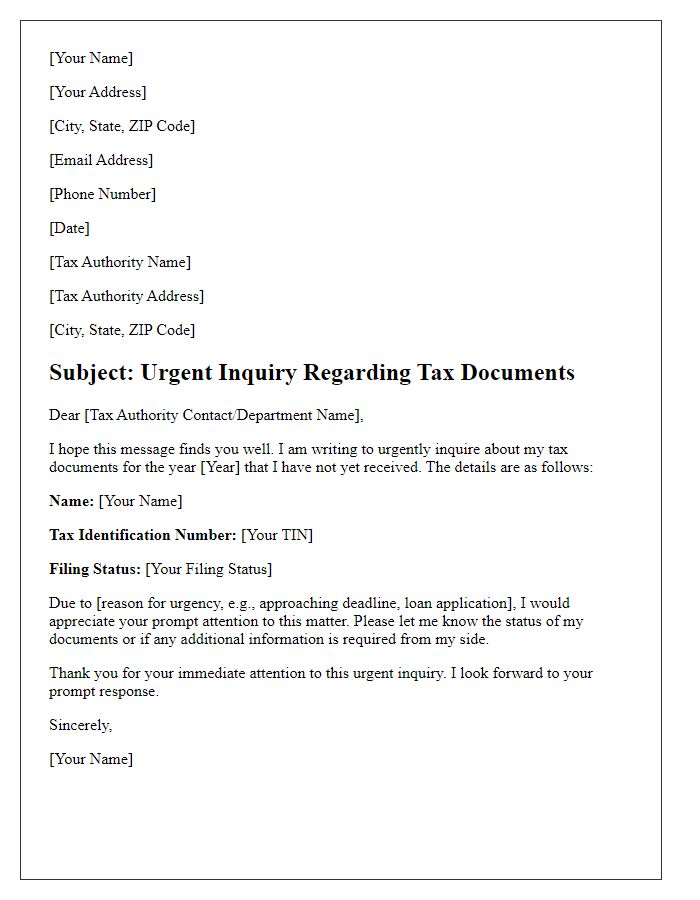

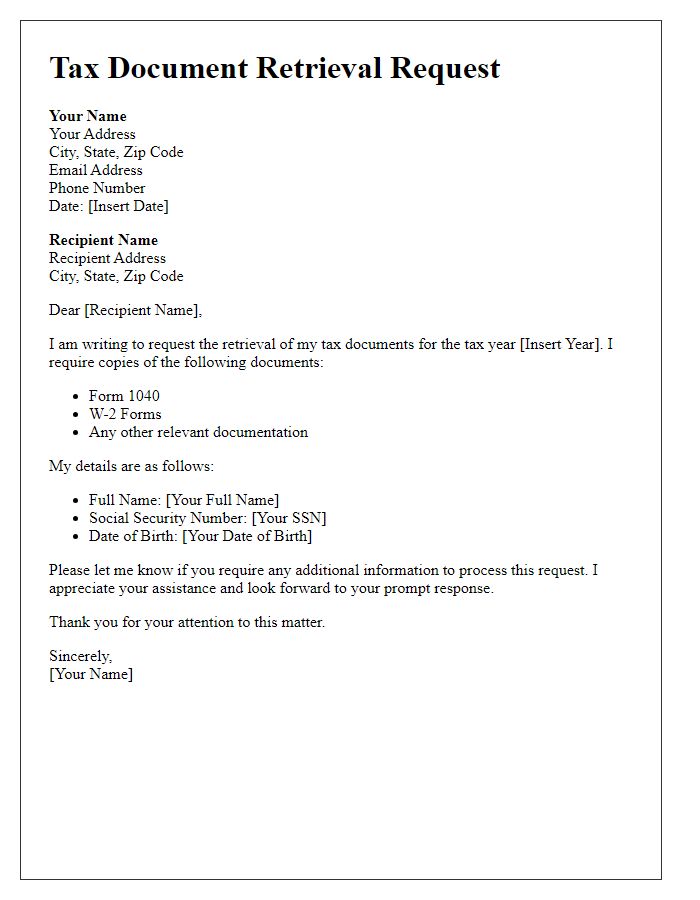

Identification Information

Individuals submitting requests for a tax document must provide specific identification information to ensure proper processing. Full name includes both first and last names (e.g., John Doe) should be clearly stated. Social Security Number (SSN), a crucial nine-digit identifier for taxpayers in the United States, needs to be included to verify identity accurately. Current address, including street number and name, city, state, and zip code (e.g., 123 Main St, Springfield, IL 62701), is required to match records with the Internal Revenue Service (IRS). Date of Birth serves as an additional verification method, typically formatted as MM/DD/YYYY (e.g., 01/15/1985). Contact number, preferably a mobile number for quicker communication, should also be provided should the tax authority need to reach the individual for follow-up. All these elements contribute to safeguarding personal information while facilitating efficient processing of tax document requests.

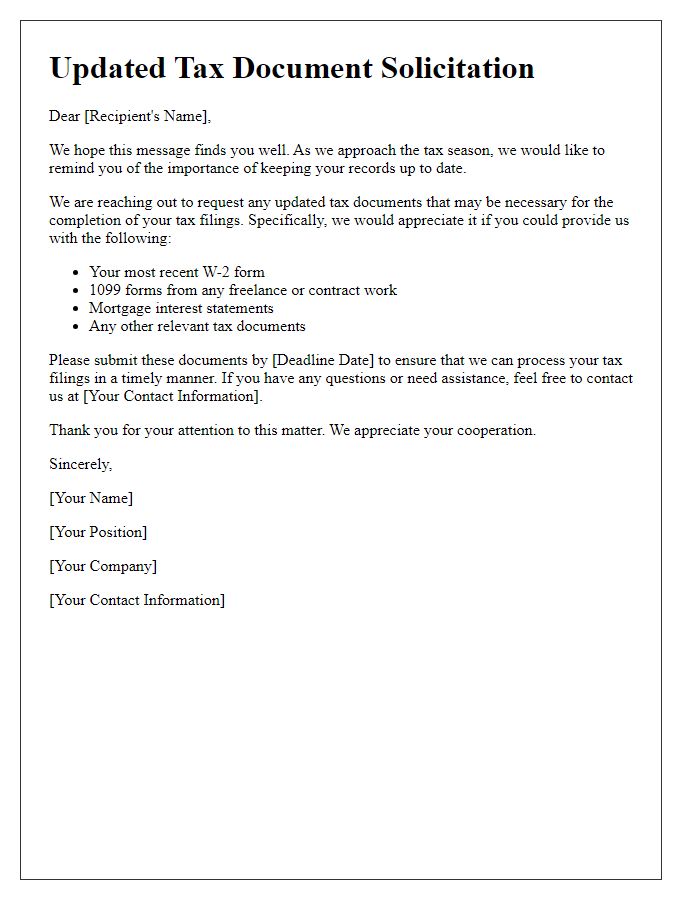

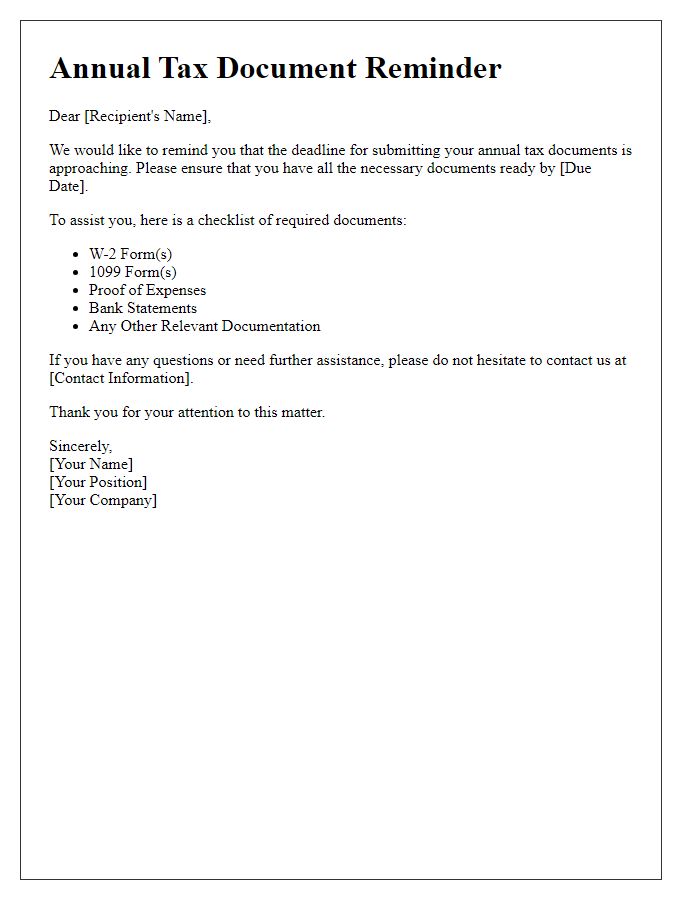

Detailed Request Description

A tax document request should clearly outline the specific forms needed for accurate financial reporting and compliance, such as IRS Form W-2 (Wage and Tax Statement) for employees or IRS Form 1099-MISC (Miscellaneous Income) for independent contractors. Timely procurement of these documents is crucial, especially ahead of the April 15 tax filing deadline, ensuring compliance with federal tax laws. The request should specify the tax year required (e.g., 2022) and any additional deductions or credits being claimed, such as education credits or medical expenses, which may necessitate supplementary documentation, such as receipts or supporting statements. All correspondence should be directed to the payroll or accounting department of the respective company or organization to facilitate prompt processing and delivery.

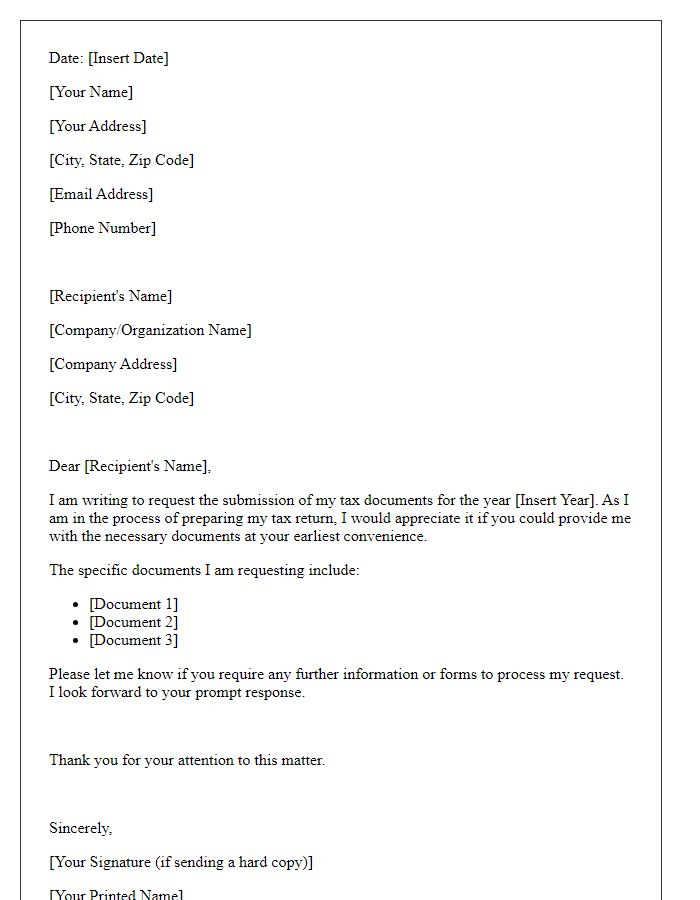

Contact Information

Tax document requests often require specific contact information for legitimacy and processing. A sender should include their full name, title, and the IRS (Internal Revenue Service) identification number or taxpayer identification number (TIN). Additionally, it is essential to provide the complete mailing address, including street number, city, state, and ZIP code for sorting and delivery purposes. A phone number with the area code and an email address can facilitate communication regarding the request status and provide alternative means of contact. Including this detailed contact information is crucial for ensuring that the request is efficiently handled by the tax authority.

Polite Closing Remarks

Polite closing remarks in a tax document request can emphasize gratitude and professionalism. A suitable example would be expressing appreciation for their assistance and understanding of the importance of the requested documents. Acknowledging the effort involved in gathering those documents shows respect. Requesting timely feedback or communication can facilitate a smoother process. Lastly, wishing them well or offering thanks in advance reinforces goodwill.

Comments