Are you looking to reclaim your mortgage insurance premium? If so, you're not aloneâmany homeowners are unaware that they may be eligible for a refund on their premium payments. Understanding how to navigate the refund process can be a bit daunting, but it doesn't have to be! Join us as we break down the steps and provide a convenient template that will help you secure your hard-earned money back.

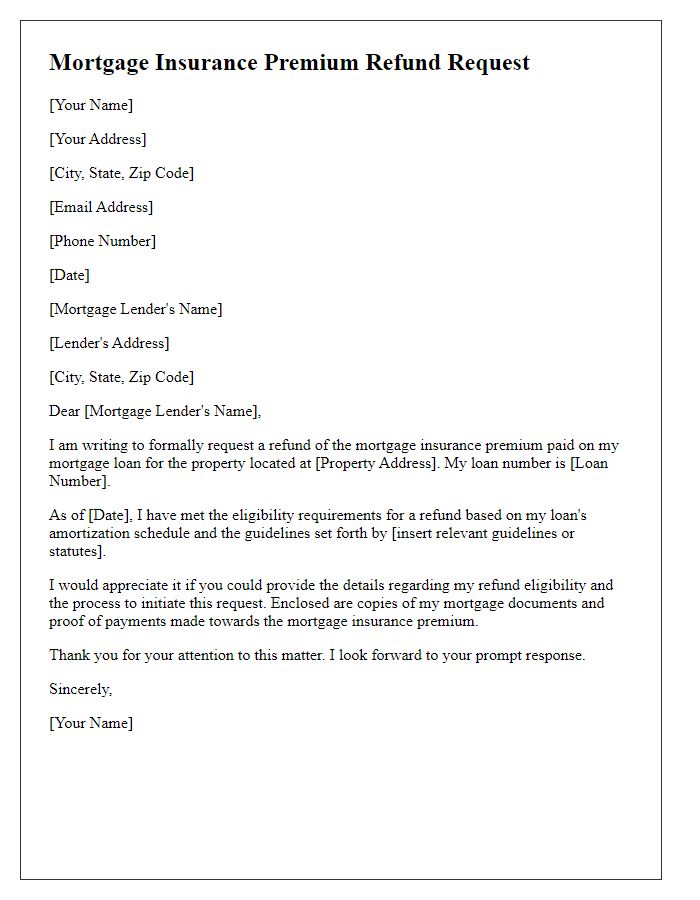

Borrower Information

To request a mortgage insurance premium refund, borrowers must provide specific information. Include full name such as John Doe, property address like 123 Maple Street, Springfield, loan number 123456789, and contact information including phone number 555-1234 and email address johndoe@email.com. Details about the original mortgage are important, including the initial loan amount of $250,000 and the date of loan closing, July 15, 2019. Specify the lender's name, for example, ABC Mortgage Company, and the type of mortgage insurance, whether it is FHA or private mortgage insurance (PMI). Additionally, mention the reason for the refund request, such as refinancing or the cancellation of mortgage insurance due to an increased property value.

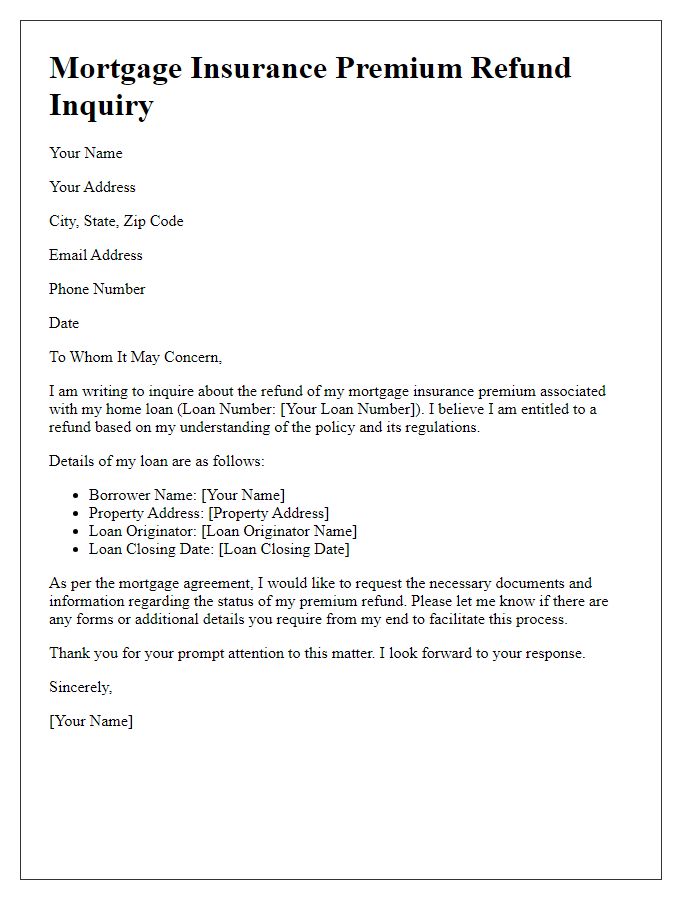

Loan Details

Mortgage insurance premium refunds can provide financial relief to homeowners, especially in cases such as loans backed by the Federal Housing Administration (FHA) and private mortgage insurance (PMI). Homeowners with FHA loans might be eligible for a refund if they refinance, sell, or pay off the loan early, depending on the date of closing and loan terms. Typical refund amounts vary based on the premium paid and remaining loan balance, sometimes reaching thousands of dollars. To claim a refund, homeowners should gather key documents, including the loan number, property address, and payment history, ensuring they meet specific eligibility requirements outlined by FHA guidelines or PMI providers. Understanding the timeline and procedures for requesting the refund can optimize the chances of receiving the full entitled amount.

Insurance Payment History

Mortgage insurance premium refunds can provide financial relief to homeowners, particularly those who have substantial equity in their properties. The specific eligibility for refunds usually hinges on the length of time the mortgage insurance has been active and the original loan-to-value ratio when the mortgage, most commonly a Federal Housing Administration (FHA) loan, was secured. In cases where homeowners have paid a significant insurance premium--averaging around $1,500 annually for FHA or private mortgage insurance--they may qualify for a partial refund after cancellation of the mortgage insurance. Homeowners should meticulously review their insurance payment history, ensuring they note payment dates, amounts, and any changes in the insurance policy. This careful documentation assists in the refund request process, helping to expedite a resolution and potentially recoup thousands of dollars.

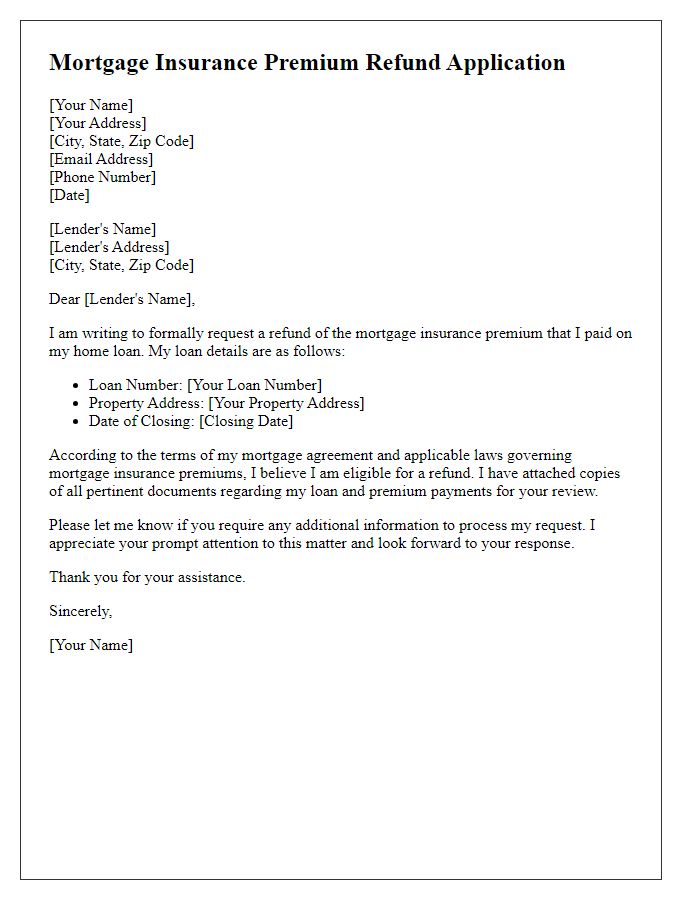

Refund Calculation

Mortgage insurance premiums (MIP) are amounts paid by borrowers to insure home loans, commonly required for FHA loans. The refund calculation of MIP requires determining the total amount paid throughout the life of the loan, often influenced by factors such as loan amount, loan duration, and the specific MIP rates set by the Federal Housing Administration. If a borrower pays off their FHA loan early or refinances, they may be eligible for a partial refund of the MIP paid. Refund percentages vary (up to 68% in cases depending on the length of the insurance coverage) and must be calculated based on the date of cancellation or payoff. Accurate calculation necessitates reviewing the HUD's guidelines which outline the specific MIP refund procedures, including necessary documentation and timeframes for submission.

Contact Information

Mortgage insurance premiums, typically required for loans with less than 20% down payment, can be eligible for a refund under certain conditions. Homeowners who have refinanced their loans or have reached a loan-to-value ratio of 80% or below may request a refund. The Federal Housing Administration (FHA) and private mortgage insurers often have specific guidelines regarding refunds. Documentation such as the original loan agreement, proof of payments, and a current mortgage statement will typically be required for processing the claim. The refund amount may vary based on the length of insurance coverage and the terms of the original financing agreement, with some borrowers receiving substantial reimbursements depending on their payment history.

Comments