Are you curious about how to effectively communicate your inquiries regarding electronic funds transfers? In today's digital banking world, understanding the nuances of EFT processes can save you time and ensure your transactions are smooth. Whether you're checking on a pending transfer or clarifying procedural questions, having a well-crafted letter template can make all the difference. So, let's dive in and explore tips on creating the perfect inquiry letter!

Clear Subject Line

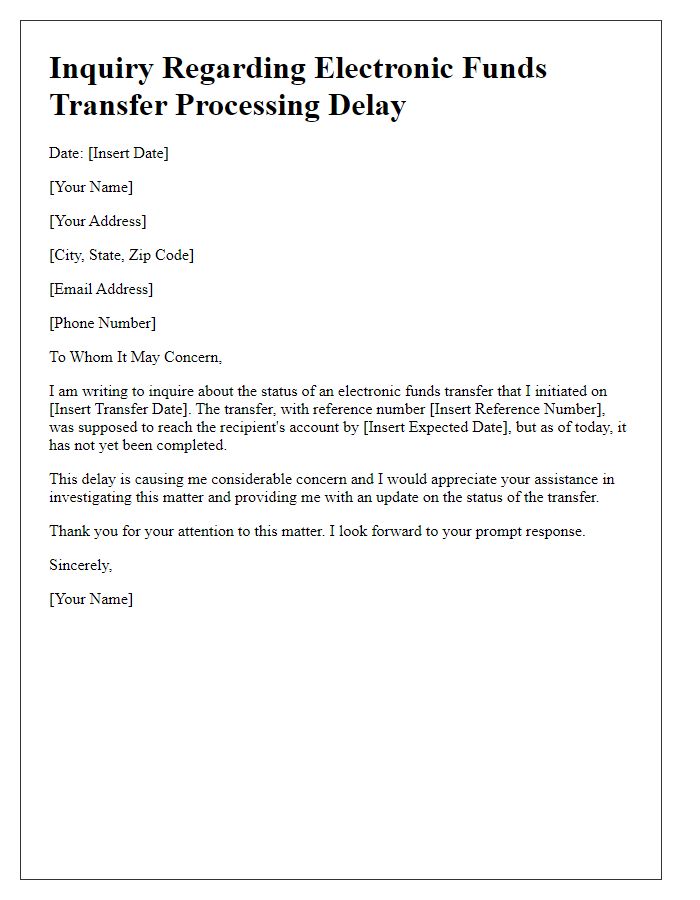

Electronic funds transfer (EFT) inquiries often revolve around transaction discrepancies or delays. Individuals may seek clarification regarding the status of payments, commonly referencing specific amounts like $500 or $1,000. Careful attention to transaction dates (for example, July 15, 2023) is crucial. Additionally, the destination bank (such as Wells Fargo or Chase) should be mentioned for context. Recipients may also appreciate information about the original transaction origin, like the sending party's bank account details. Timely responses ensure transparency regarding transaction completion and expected processing times (typically 1-3 business days).

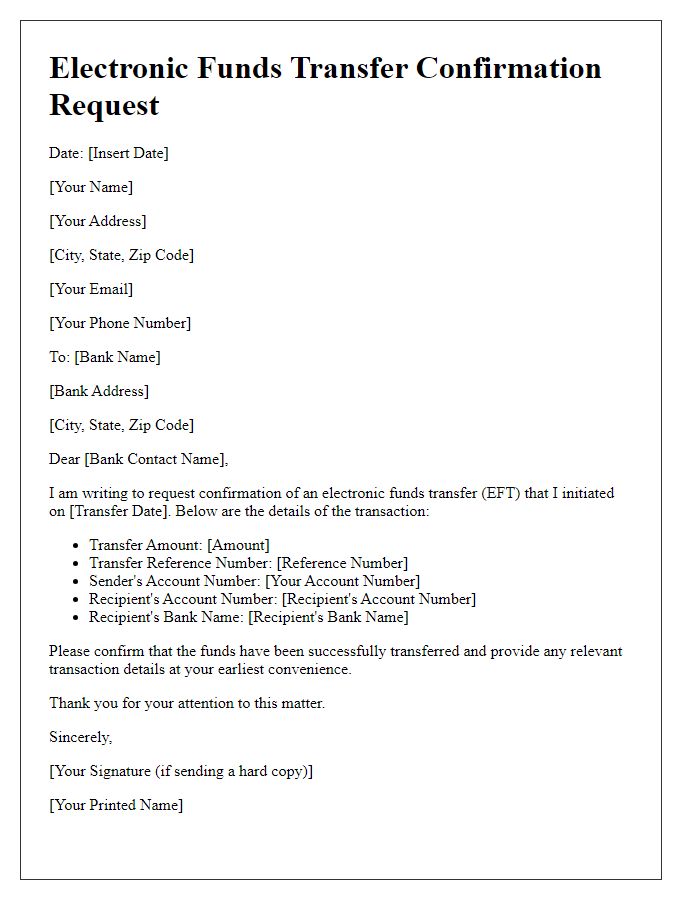

Recipient's Contact Information

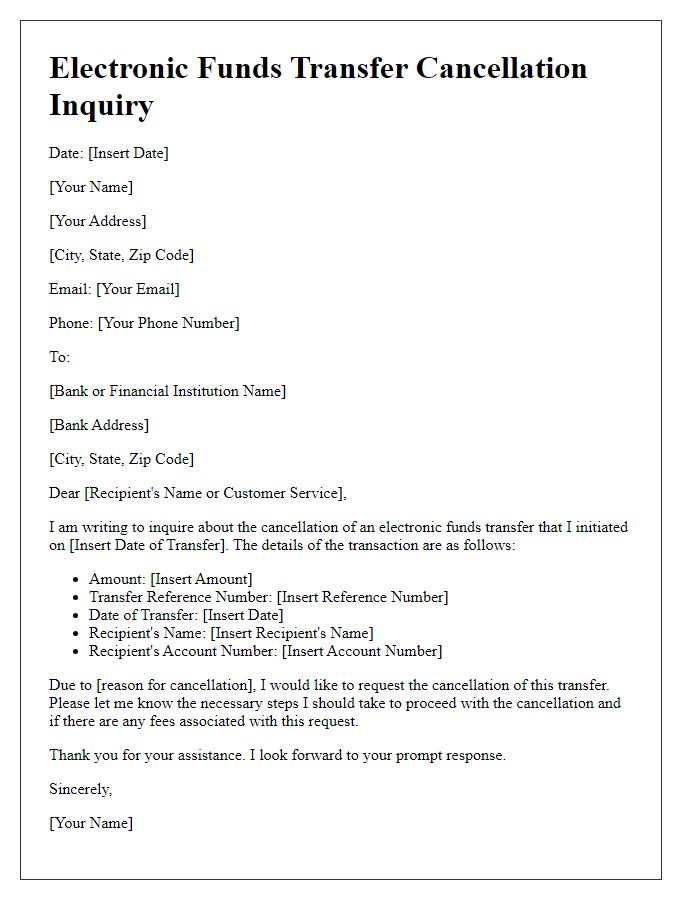

For electronic funds transfer inquiries, recipient contact information is essential, including the recipient's full name, email address, and phone number. Accurate details ensure timely and efficient communication. Typically, full names should be followed by any relevant titles or affiliations, especially for business transactions. Email addresses should reflect professionalism, preferably containing the recipient's name or company domain. Phone numbers should include area codes to facilitate direct and correct contact. Additionally, including the recipient's physical address can be beneficial for verification purposes or if further documentation is required.

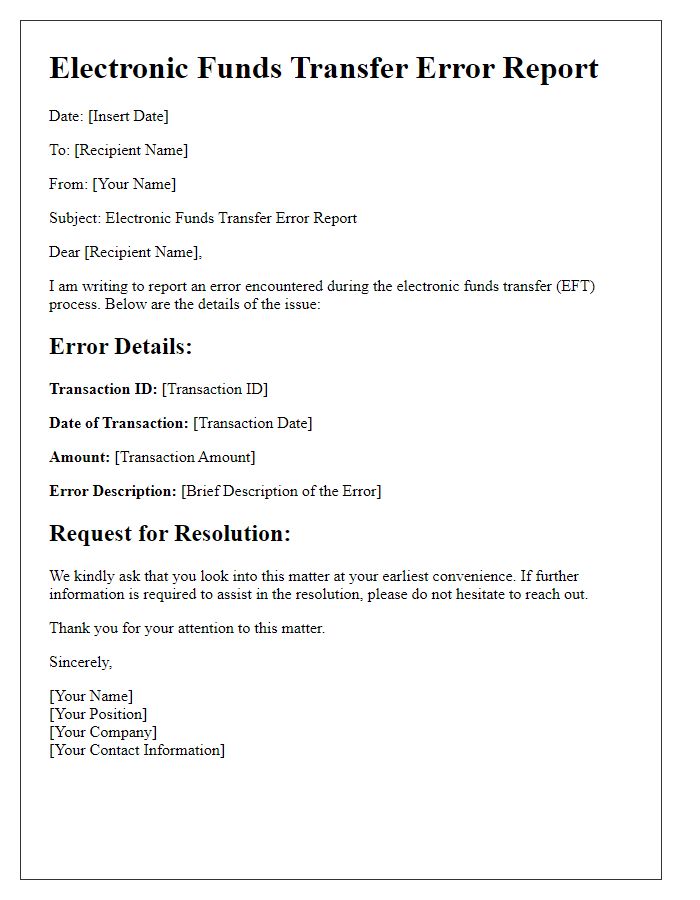

Precise Inquiry Details

Electronic funds transfer (EFT) transactions can pose various challenges for users, particularly regarding transaction speed and accuracy. Delays (often exceeding 1-3 business days) may result from banking procedures or technical issues within financial institutions such as banks and credit unions. Users may require clarity on specific transactions, particularly regarding recipient details (including full name, account number, and routing number), amounts (dollar value), and timestamps (date and time of transaction) to resolve potential discrepancies. Furthermore, ensuring compliance with regulations set forth by governing bodies like the Federal Reserve System affects the processing of these funds, impacting financial liquidity and cash flow for both individuals and businesses.

Transaction Reference Number

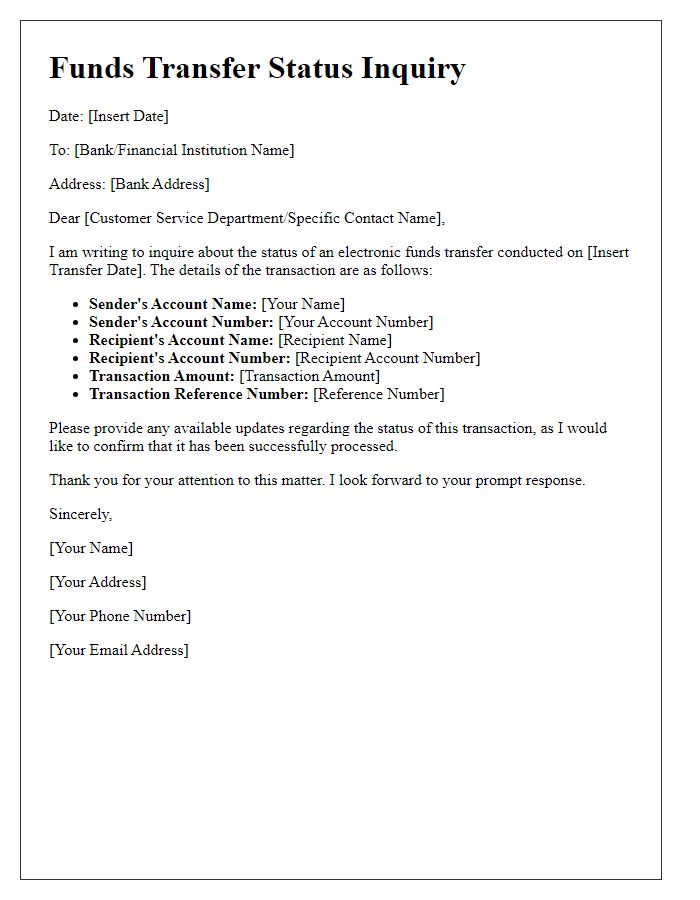

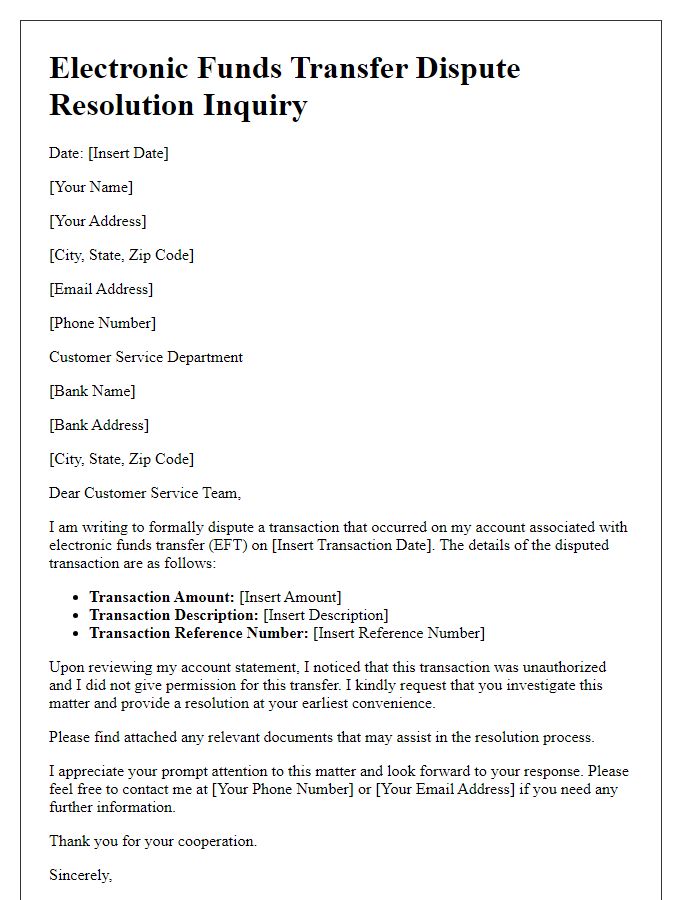

An electronic funds transfer (EFT) inquiry can involve various aspects such as transaction reference numbers, timestamps, amounts, and involved banks. When investigating a transaction, details like the transaction reference number (for tracking, typically a string of alphanumeric characters unique to each transaction) assist in identifying the specific transfer. Additionally, the date and time of the transaction (usually recorded in UTC or the local timezone) provide context for the request. Parties involved include sender and receiver banks, which may vary in branches or geographical locations, impacting the transfer's speed (often 1-3 business days for domestic transfers) and fees (usually a small percentage of the transfer amount). Any discrepancies, such as incorrect amounts or missing funds, can lead to further inquiries that require detailed records for resolution.

Contact Information for Follow-Up

Electronic funds transfer (EFT) inquiries often involve banks or financial institutions providing essential details about transactions. Key elements such as transaction numbers (usually 10 to 20 digits) and date ranges (a specific start and end date, like October 1, 2023, to October 31, 2023) are critical for establishing the query. Contact information includes phone numbers (generally 10 digits) for customer service, such as toll-free lines (e.g., 1-800-555-0199), and email addresses that usually follow the format of name@institution.com. Additionally, including branch location details, like street address, city, and state, enhances the context for follow-up, ensuring the query is directed efficiently within the institution's operational framework.

Letter Template For Electronic Funds Transfer Inquiry Samples

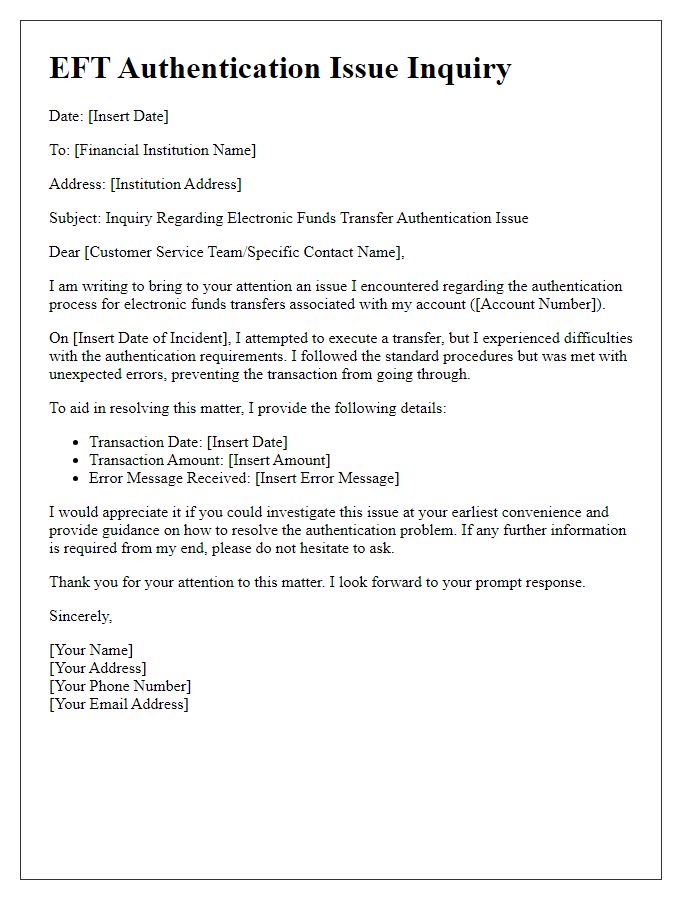

Letter template of electronic funds transfer authentication issue inquiry

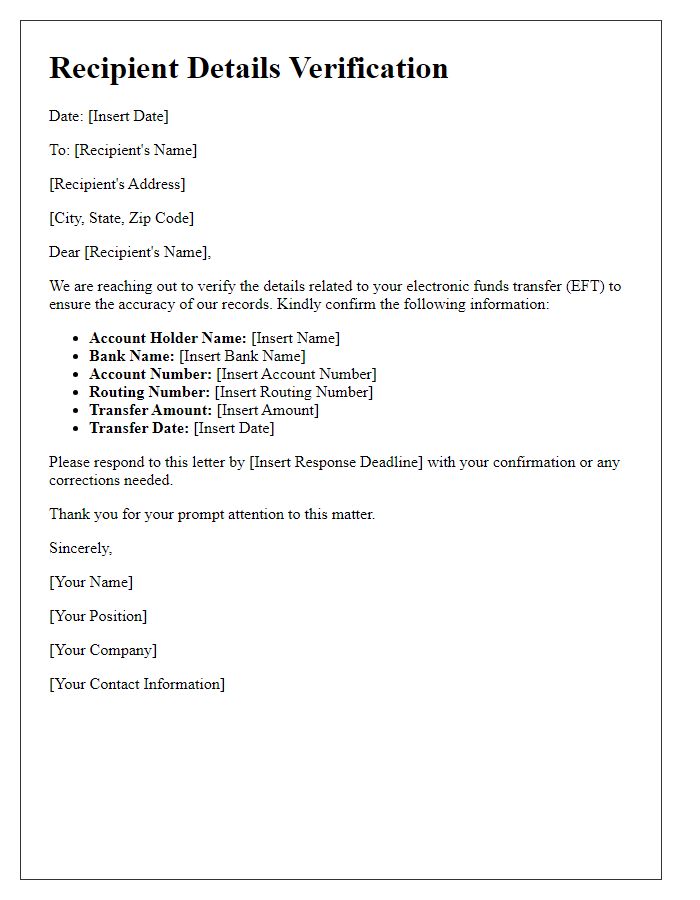

Letter template of electronic funds transfer recipient details verification

Comments