Welcome to our comprehensive guide on preparing financial statements! Whether you're a business owner looking to get your finances in order or an individual seeking clarity on your personal accounting, understanding financial statements is crucial. In this article, we'll walk you through the essential steps and key components involved in preparing accurate and insightful financial statements. So grab a cup of coffee, sit back, and let's dive in to uncover the secrets of effective financial reporting!

Clear purpose and objective

Financial statement preparation serves to provide a comprehensive overview of a company's financial health and operational performance, often through a set of standardized reports. Key documents typically include the Income Statement, Balance Sheet, and Cash Flow Statement, offering insight into profitability, asset management, and cash flow dynamics for a specified fiscal period. The objective is to create transparency for stakeholders, including investors, creditors, and management, facilitating informed decision-making. Accurate financial statements directly influence assessments of creditworthiness and investment potential, thereby impacting the company's market reputation and funding opportunities. Compliance with financial regulations, such as Generally Accepted Accounting Principles (GAAP), ensures the reliability and comparability of these statements, serving critical roles in audits and financial analyses.

Standardized financial terminology

Standardized financial terminology enhances clarity and consistency in financial statement preparation. Key components include the Balance Sheet, a snapshot of assets, liabilities, and shareholders' equity at a specific date, often December 31. The Income Statement, detailing revenue generation and expenses over a defined period, typically quarterly or annually, reveals net income or loss, critical for assessing profitability. The Cash Flow Statement categorizes inflows and outflows into operating, investing, and financing activities, providing insight into liquidity and cash management. Notes to Financial Statements offer additional context and breakdowns of significant accounting policies, contingent liabilities, and other relevant information, essential for stakeholders' understanding. Utilizing terminology like Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) ensures compliance and enhances credibility in various jurisdictions.

Concise and organized structure

Financial statement preparation requires a concise and organized structure to ensure clarity and accuracy. Key components include the income statement, which summarizes revenue (total earnings from sales and services) and expenses (costs incurred in generating revenue) over a specific period, typically annually or quarterly. The balance sheet provides a snapshot of company assets (resources owned, such as cash, inventory, and property), liabilities (debts or obligations owed to creditors), and equity (owner's interest in the business) at a particular point in time, often the end of a fiscal year. The cash flow statement outlines the movement of cash within the organization, highlighting operational, investing, and financing activities, providing insight into liquidity and cash management. Each statement should follow standard accounting principles (Generally Accepted Accounting Principles, GAAP), ensuring consistency and comparability. Proper notes and disclosures detail accounting policies, significant transactions, and risks, enhancing transparency for stakeholders such as investors, creditors, and regulatory bodies.

Regulatory compliance adherence

Regulatory compliance adherence is critical in the preparation of financial statements, particularly in multinational corporations such as those governed by the International Financial Reporting Standards (IFRS) and U.S. Generally Accepted Accounting Principles (GAAP). These frameworks specify guidelines for accurate reporting of assets, liabilities, equity, revenue, and expenses. Compliance ensures transparency for stakeholders, including investors and regulatory bodies such as the Securities and Exchange Commission (SEC). Regular audits, conducted by certified public accountants (CPAs), validate the adherence to these guidelines. Non-compliance can lead to significant penalties, legal repercussions, and loss of investor trust. Ensuring compliance not only fulfills legal obligations but also enhances the credibility of financial reports, influencing investment decisions and overall market reputation.

Confidentiality and privacy considerations

Confidentiality in financial statement preparation is paramount, as sensitive information must be safeguarded to protect individual and corporate privacy. Financial statements, comprising assets, liabilities, revenues, and expenses, are often shared with stakeholders such as investors and lenders. Regulatory frameworks, including the Sarbanes-Oxley Act in the United States, mandate strict protocols to ensure data protection. Utilizing secure systems for document storage, like encrypted cloud services, mitigates risks of unauthorized access. Furthermore, adhering to privacy laws such as the General Data Protection Regulation (GDPR) is crucial for organizations operating in the European Union. Regular audits and employee training on confidentiality protocols enhance the integrity of financial reporting processes.

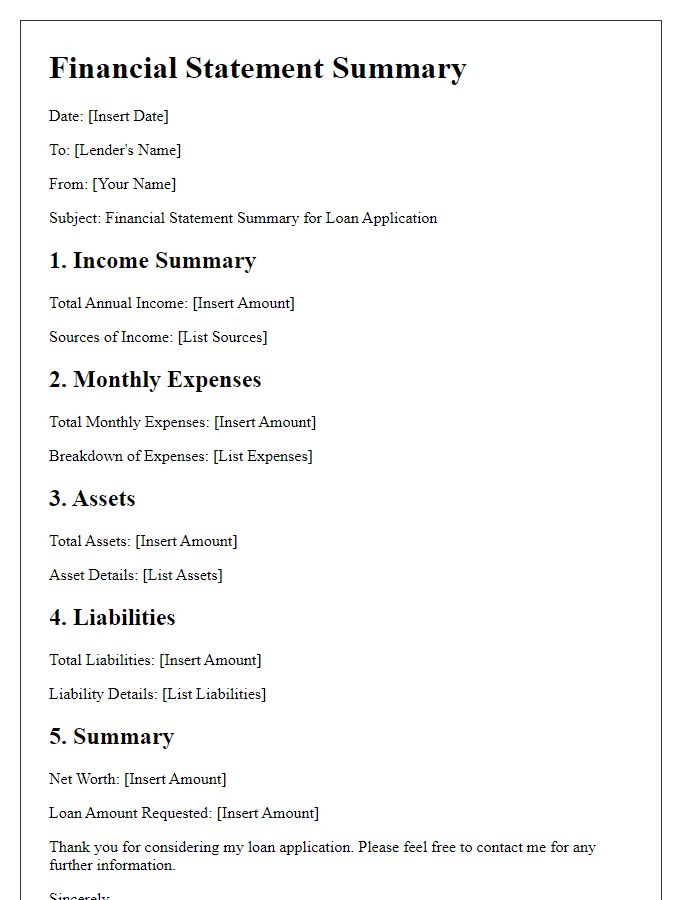

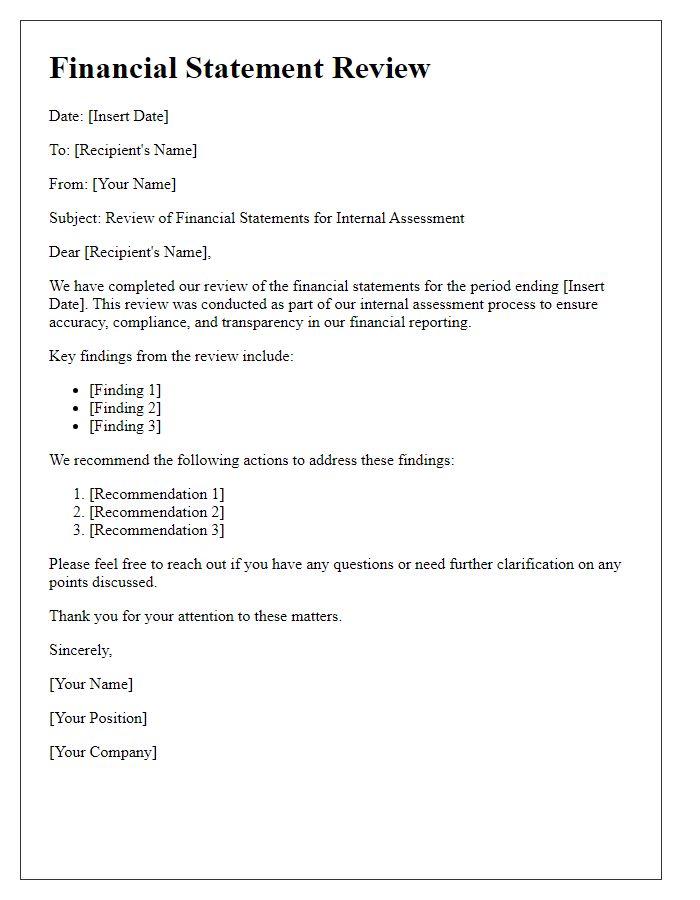

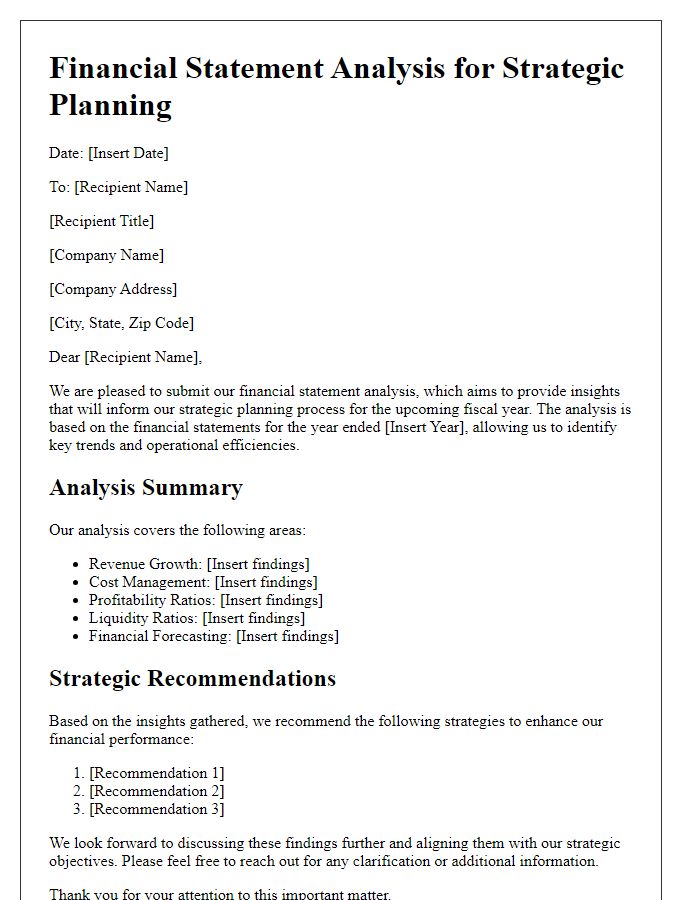

Letter Template For Financial Statement Preparation Samples

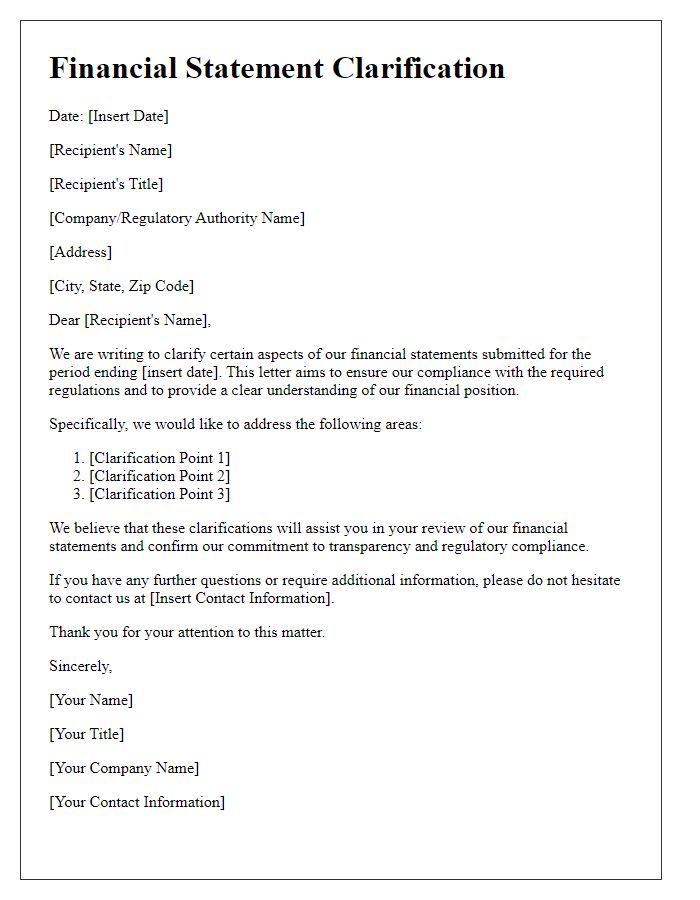

Letter template of financial statement clarification for regulatory compliance

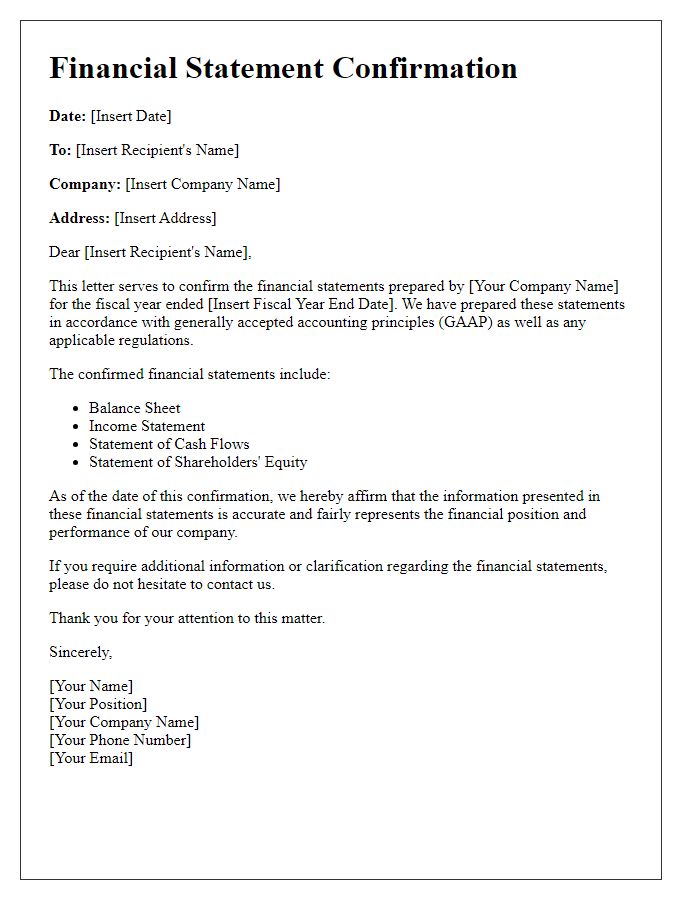

Letter template of financial statement confirmation for external reporting

Comments