In today's challenging economic landscape, many homeowners find themselves grappling with the stress of potential foreclosure. It's essential to know that there are options available to seek assistance and prevent the loss of your home. By understanding the foreclosure prevention process and exploring potential solutions, you can take proactive steps to safeguard your financial future. Dive into our article to discover helpful strategies and resources that could make all the difference for you.

Accurate borrower information.

Accurate borrower information is crucial in the process of requesting foreclosure prevention. Essential details include the full name of the borrower, often the individual responsible for the mortgage, as well as recent contact information such as phone number and email address, which facilitate communication with financial institutions. Loan details must also be specified: loan number, property address, and current status of mortgage payments over the past six months. Providing a comprehensive overview of household financial circumstances, such as income sources, monthly expenses, and debts, is vital for establishing a borrower's capability to sustain mortgage obligations. Additionally, documentation that supports claims of financial hardship due to unforeseen events like job loss (detailed starting and ending dates), medical emergencies, or market downturns should be included for assessment. These elements create a clear picture for lenders or counselors assessing the borrower's request for assistance or potential loan modification options.

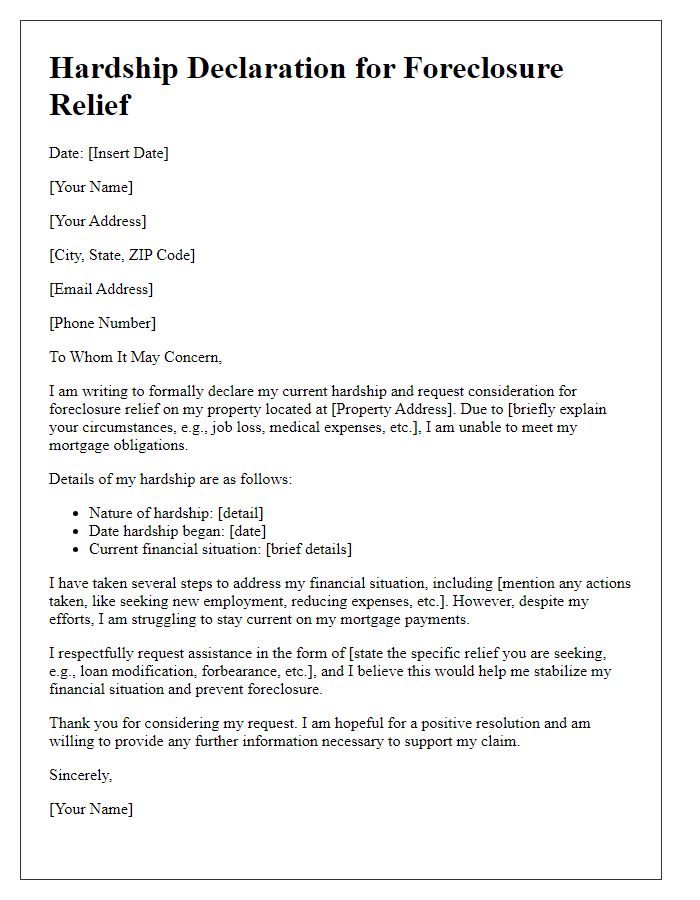

Clear hardship explanation.

Homeowners facing foreclosure often experience severe financial distress, stemming from factors like job loss, medical emergencies, or unexpected expenses. In a situation where monthly mortgage payments become unmanageable, the burden of accrued debt increases stress significantly. For instance, an individual who unexpectedly loses their job might fall behind on payments, risking their home. Support options provided by institutions, including mortgage modification programs, forbearance plans, and government assistance initiatives, can help alleviate the situation. By demonstrating a clear hardship, homeowners can potentially negotiate terms with lenders, aiming for affordable repayments and avoiding foreclosure, a dire outcome that destabilizes families and communities.

Detailed financial situation.

Homeowners facing foreclosure often encounter overwhelming financial challenges. Monthly mortgage payments, typically ranging from $1,500 to $3,000, become burdensome due to unexpected events like job loss or medical expenses. For instance, a sudden job layoff in the retail sector can lead to a 40% decrease in income, complicating the ability to meet obligations. Additionally, rising living costs, including utilities, groceries, and healthcare, can consume an increasing percentage of monthly budgets, diverting funds from mortgage payments. Home equity may also diminish, impacting options like refinancing. Furthermore, communication with lenders is crucial; submitting detailed financial documentation, such as pay stubs and bank statements, enables the establishment of a potential repayment plan or loan modification. Understanding these factors is essential as homeowners navigate the complex landscape of foreclosure prevention.

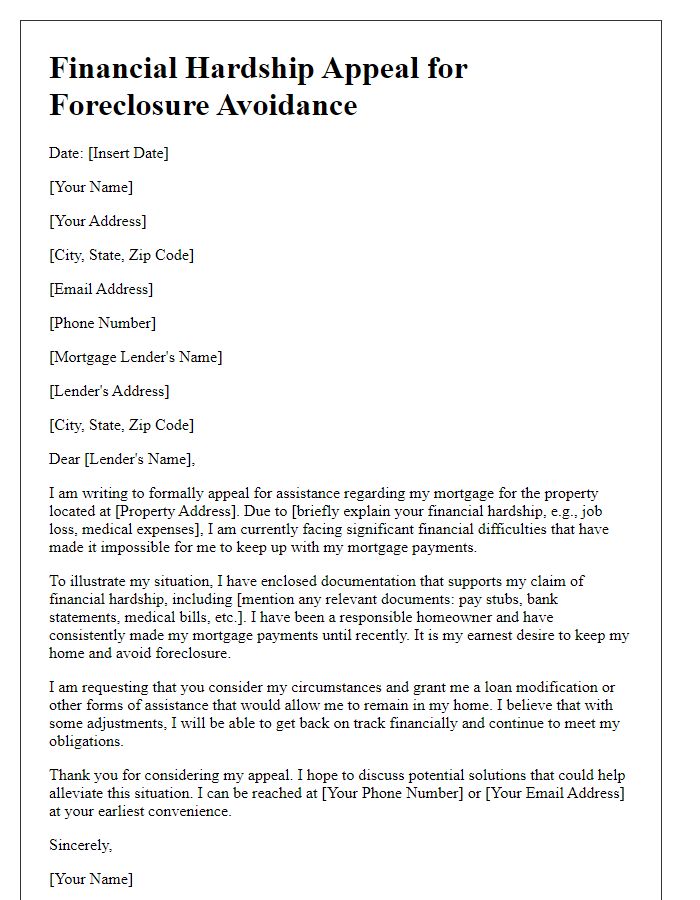

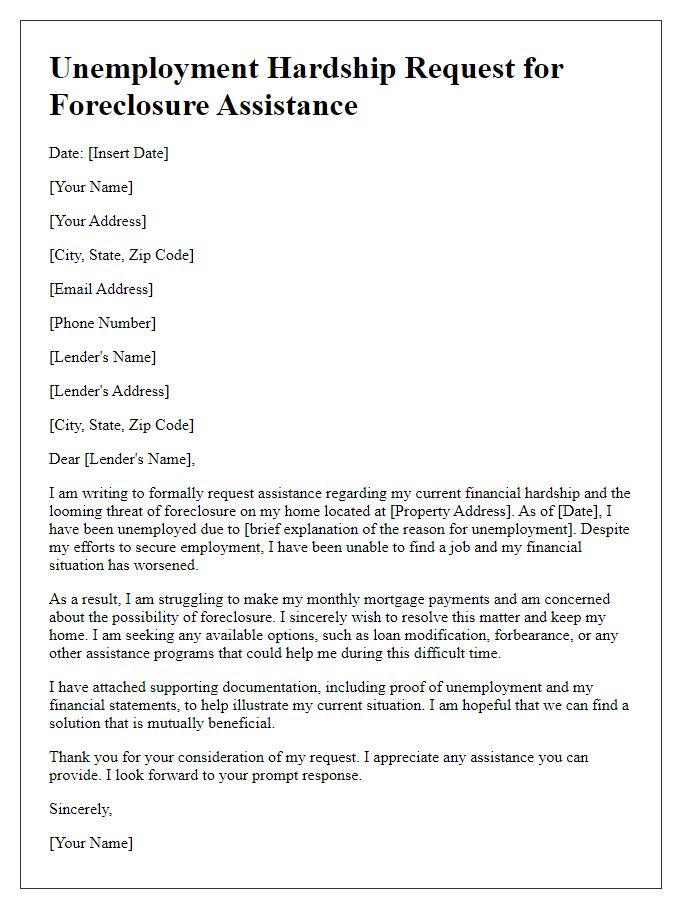

Request for specific solution.

Facing foreclosure can be a distressing experience for homeowners who may struggle to maintain mortgage payments due to various financial challenges. A foreclosure prevention request is crucial in seeking alternatives such as loan modification, repayment plans, or forbearance options. Homeowners should provide detailed information, including their current financial situation, outstanding loan balance, and the specific solution being requested to the mortgage lender or servicer. This communication should highlight the desire to avoid foreclosure and maintain homeownership, referencing relevant programs from entities like the U.S. Department of Housing and Urban Development (HUD) or local housing agencies that offer assistance to struggling borrowers. The urgency of timely communication emphasizes the importance of taking proactive steps to preserve one's home and financial stability.

Supporting documentation references.

In the process of seeking foreclosure prevention, it is crucial to gather and present the appropriate supporting documentation, which includes financial statements (such as bank account balances and monthly income), tax returns (typically from the last two years), and hardship letters detailing the specific circumstances leading to financial distress. Additionally, lenders may require property-related documents, including the mortgage statement, proof of insurance, and recent property tax assessments. This comprehensive collection ensures a clear representation of the borrower's financial situation and emphasizes the necessity for assistance, potentially influencing the lender's decision in favor of loan modification or forbearance options.

Letter Template For Foreclosure Prevention Request Samples

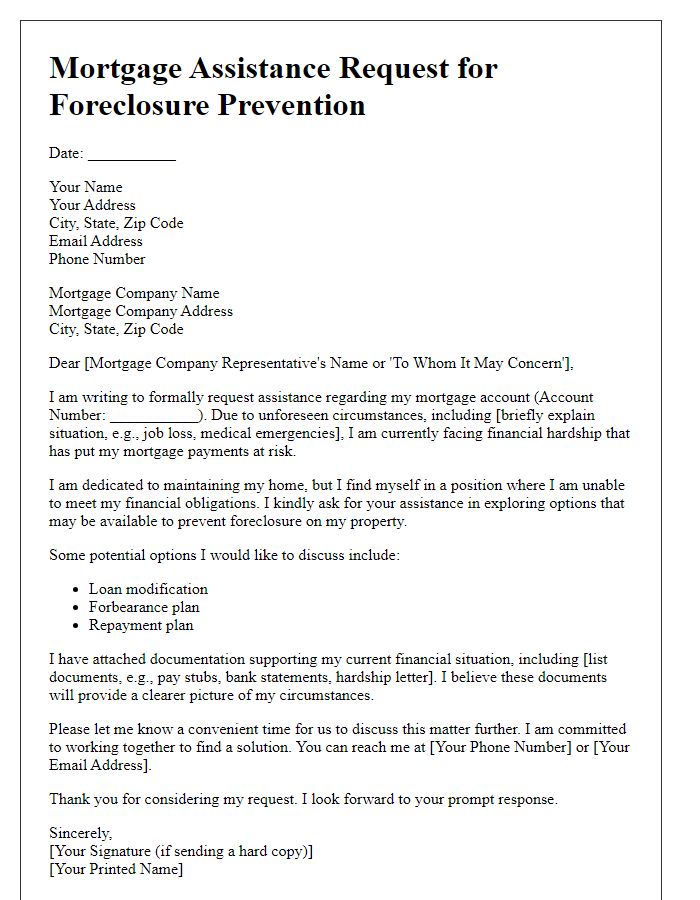

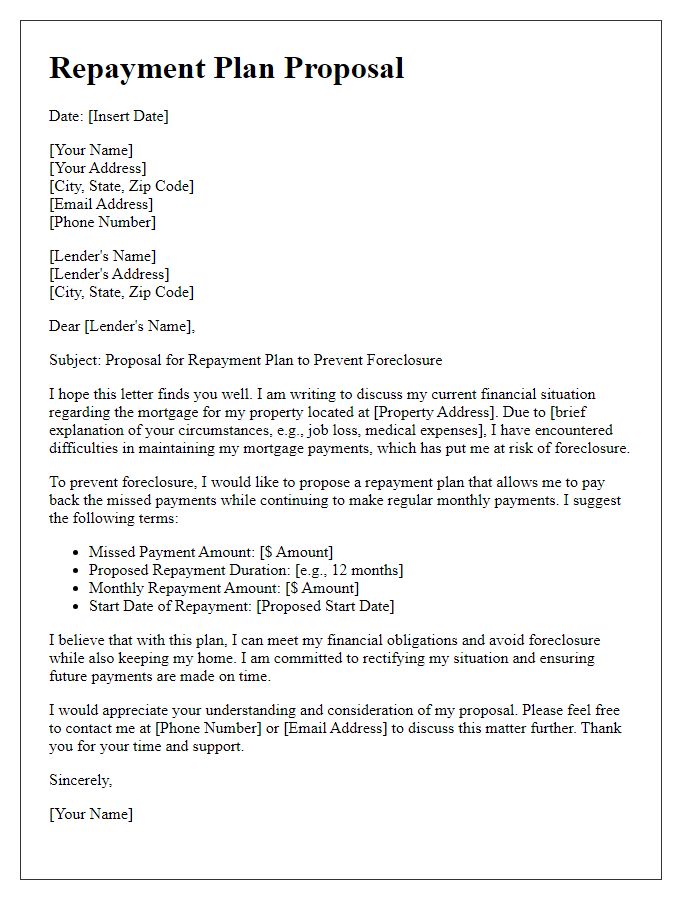

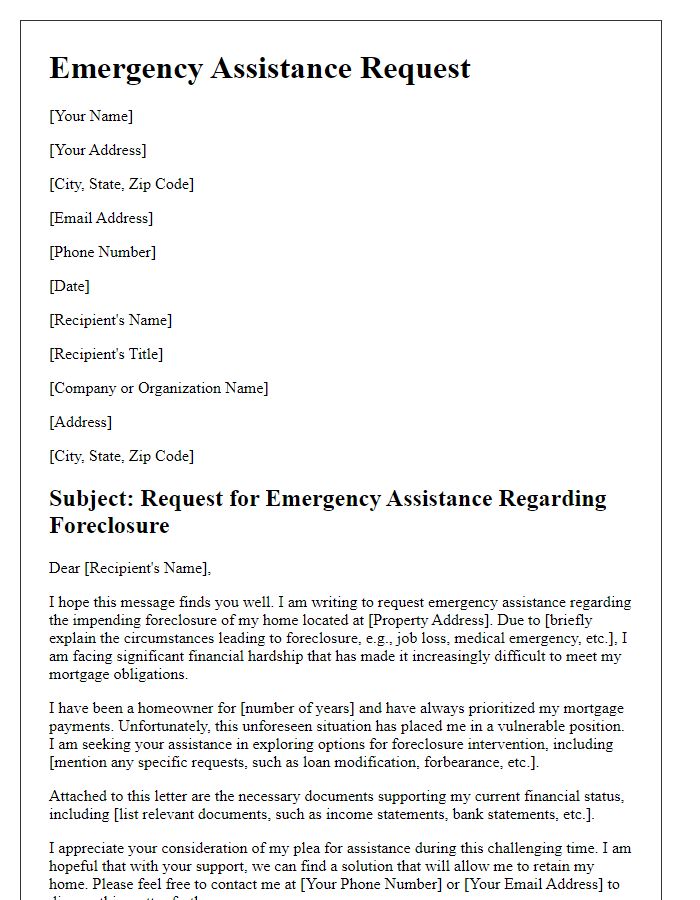

Letter template of mortgage assistance request for foreclosure prevention.

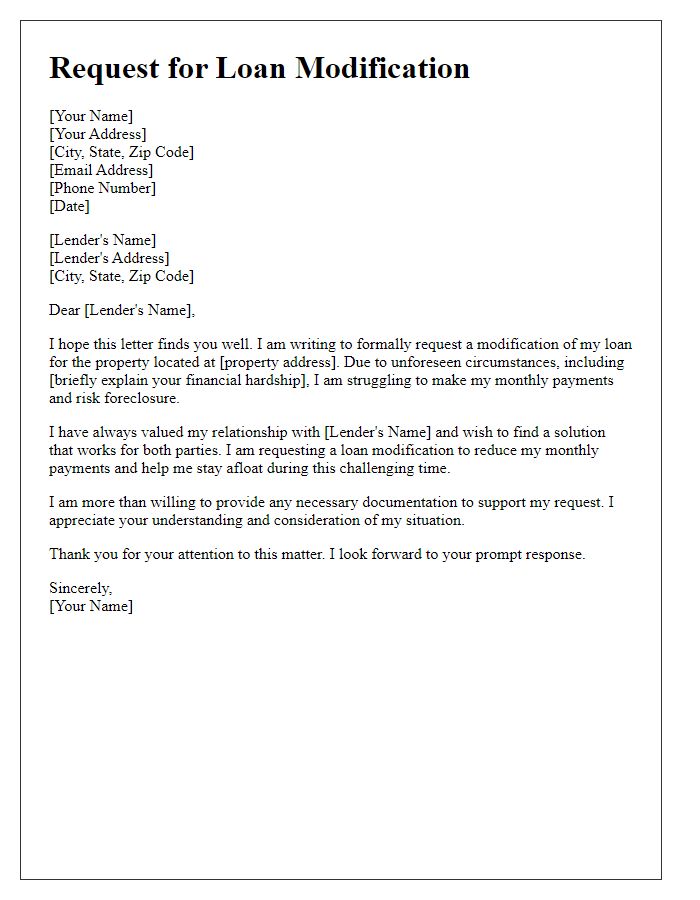

Letter template of request for loan modification to prevent foreclosure.

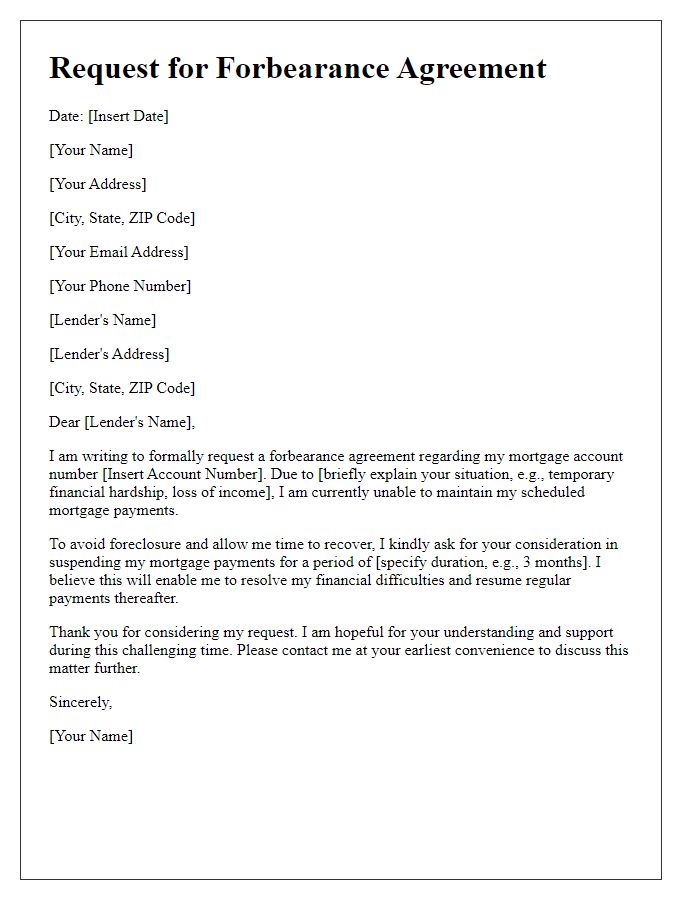

Letter template of request for forbearance agreement to stop foreclosure.

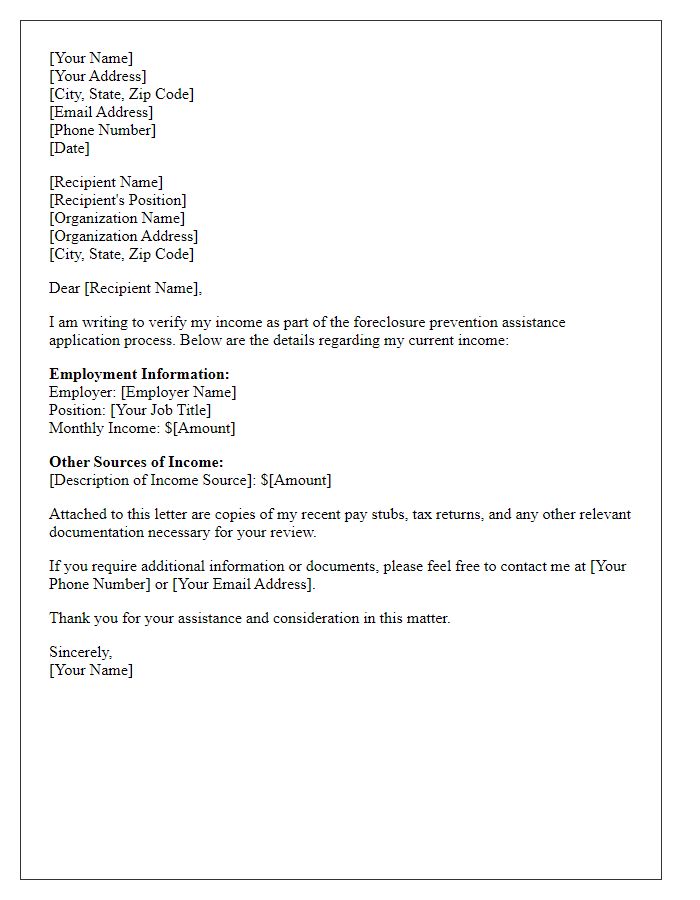

Letter template of income verification for foreclosure prevention assistance.

Comments