Are you feeling overwhelmed by student loan debt? You're not alone; many graduates are seeking relief from the financial burden that often accompanies their education. In this article, we'll explore various options for student loan debt forgiveness and how you can take advantage of them. So, sit tight and read on to discover how you might pave the way to a debt-free future!

Recipient's Contact Information

Student loan debt forgiveness programs offer relief to borrowers struggling with financial burdens associated with their education. These initiatives, often enacted by government entities, aim to alleviate the financial strain on graduates, particularly in fields like education, public service, and healthcare. Eligibility criteria frequently include factors such as years of service, income level, and repayment plan types, such as Income-Driven Repayment Plans (IDR). Programs like Public Service Loan Forgiveness (PSLF) require borrowers to make a specific number of qualifying payments while employed by eligible employers. Additionally, some states and nonprofit organizations provide their own forgiveness programs tailored to attract professionals to underserved communities. As of early 2023, hundreds of thousands of borrowers have successfully qualified for loan cancellation, with data highlighting the importance of these programs in improving financial stability for young adults across diverse sectors.

Borrower's Personal Information

Student loan debt forgiveness can be an essential relief for borrowers grappling with financial strain. Many federal student loans, such as Direct Loans and Federal Family Education Loans (FFEL), may be eligible for forgiveness programs like Public Service Loan Forgiveness (PSLF) or income-driven repayment (IDR) plans. Eligibility criteria often specify employment in qualifying non-profit or government sectors, with a requirement of making a certain number of qualifying monthly payments (typically 120 for PSLF). Note that borrowers must provide detailed personal information, including full name, Social Security number, and contact information, along with specific loan details such as the loan servicer and account numbers for accurate processing of forgiveness applications.

Loan Details and Relevant Account Information

Student loan debt forgiveness programs can alleviate financial burdens for borrowers in the United States. Federal student loans issued through the William D. Ford Federal Direct Loan Program may qualify for forgiveness under various initiatives, including Public Service Loan Forgiveness (PSLF). Eligible borrowers must have made 120 qualifying monthly payments while working full-time for a qualifying employer, such as government organizations or non-profit entities. The outstanding balance after these payments may be forgiven, providing significant relief. Additionally, income-driven repayment plans can adjust monthly payments based on the borrower's income and family size, often resulting in eventual forgiveness after 20 or 25 years of payments. In 2023, the Biden administration announced temporary waivers that could help streamline the pathway to forgiveness for many borrowers, encouraging them to ensure their loan details and employment history are accurately documented.

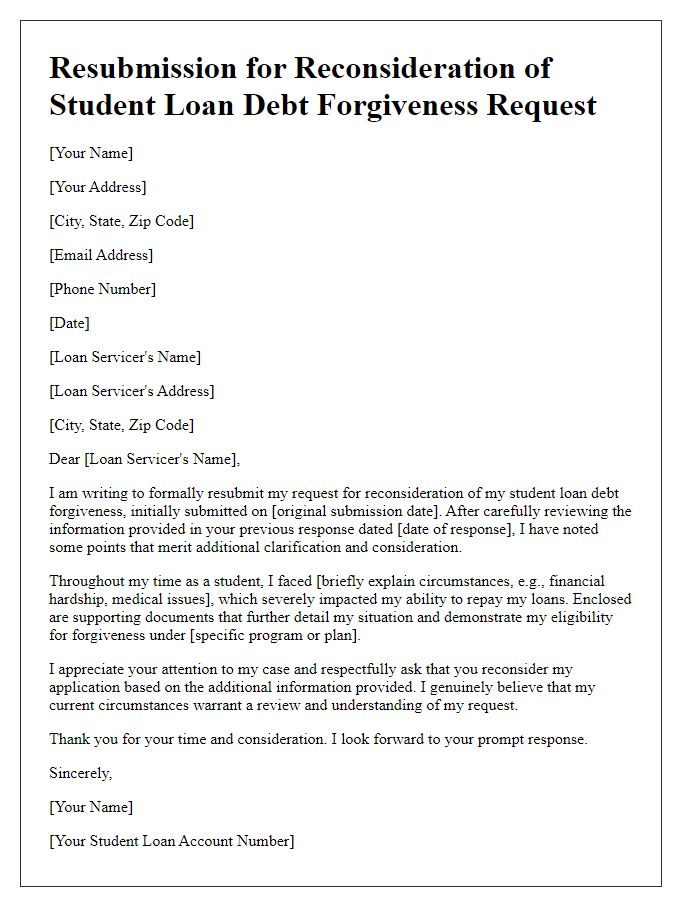

Explanation for Loan Forgiveness Request

Student loan debt forgiveness programs offer financial relief to borrowers burdened by educational loans from institutions such as community colleges, universities or for-profit schools. In the United States, initiatives like the Public Service Loan Forgiveness (PSLF) program aim to eliminate federal loan balances for those working in eligible public service jobs after making 120 qualifying monthly payments. Borrowers often cite financial hardships, like job loss or medical emergencies, as reasons warranting forgiveness requests. Additionally, specific criteria, such as income-driven repayment plan participation or total and permanent disability status, play a significant role in determining eligibility. Resources from federal agencies, including the U.S. Department of Education, provide guidelines on completing necessary paperwork and deadlines crucial for maximizing chances of successful debt relief.

Supporting Documents and Evidence

Student loan debt forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) Program in the United States, require extensive supporting documents to validate eligibility. Applicants must provide proof of qualifying employment, including forms such as the Employment Certification Form, which confirms employment status at approved organizations, like government or non-profit entities. Income-driven repayment plan documentation is essential, highlighting monthly payment amounts based on income, which can be verified through the IRS tax transcripts for accuracy. Additionally, proper identification documents, like a valid state-issued ID or Social Security number verification, are often required to verify personal identity. Maintaining thorough records of loan servicer communications, including correspondence addressing payment history and loan balance information, ensures that all aspects of the application are well-supported and can strengthen the case for debt forgiveness consideration.

Letter Template For Student Loan Debt Forgiveness Samples

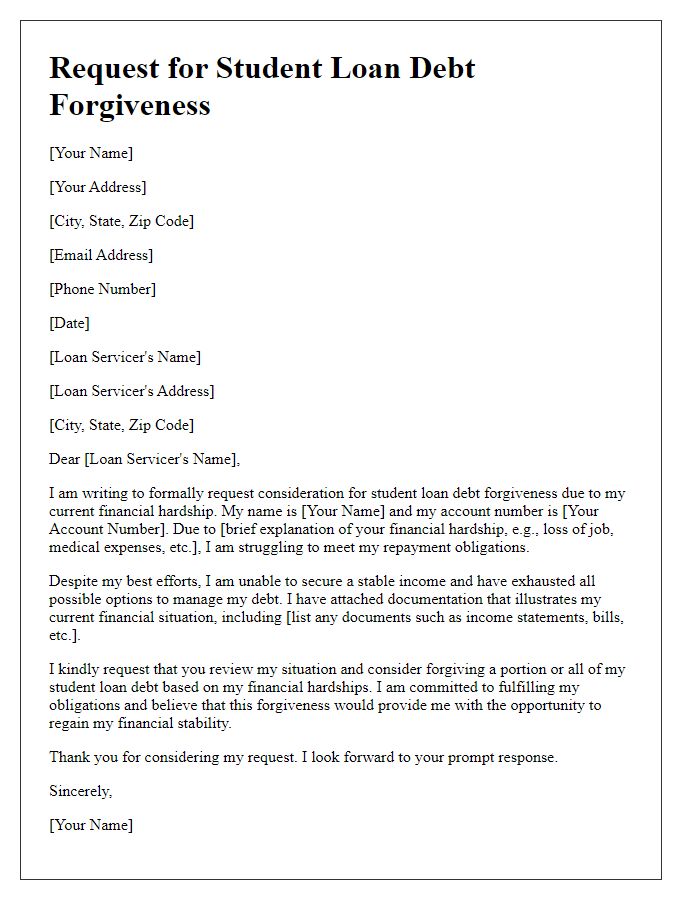

Letter template of request for student loan debt forgiveness for financial hardship.

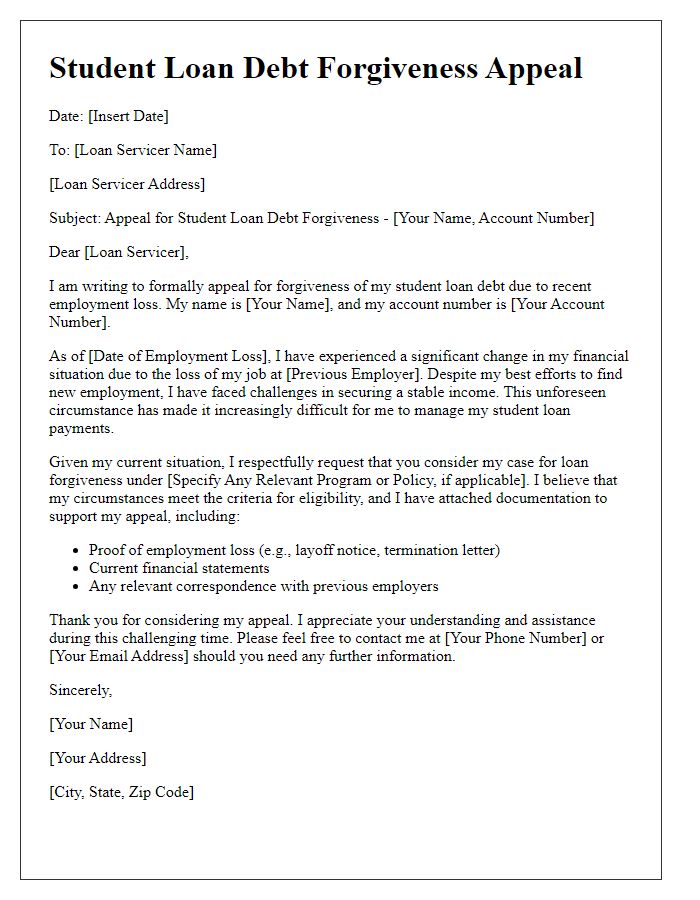

Letter template of appeal for student loan debt forgiveness due to employment loss.

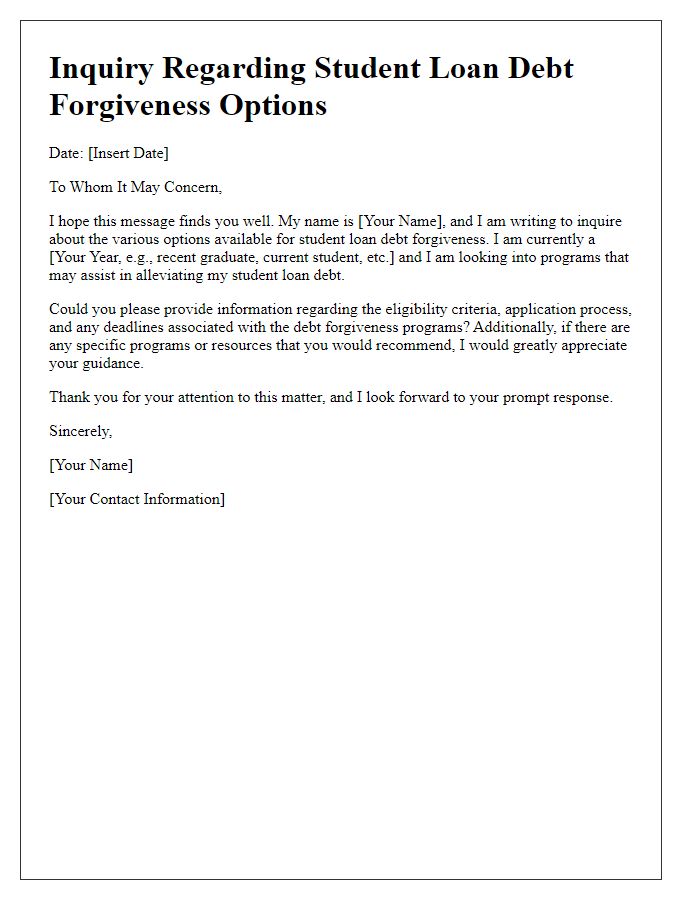

Letter template of inquiry regarding student loan debt forgiveness options.

Letter template of application for student loan debt forgiveness based on disability.

Letter template of support for student loan debt forgiveness for public service workers.

Letter template of justification for student loan debt forgiveness in case of school closure.

Letter template of formal complaint for denied student loan debt forgiveness application.

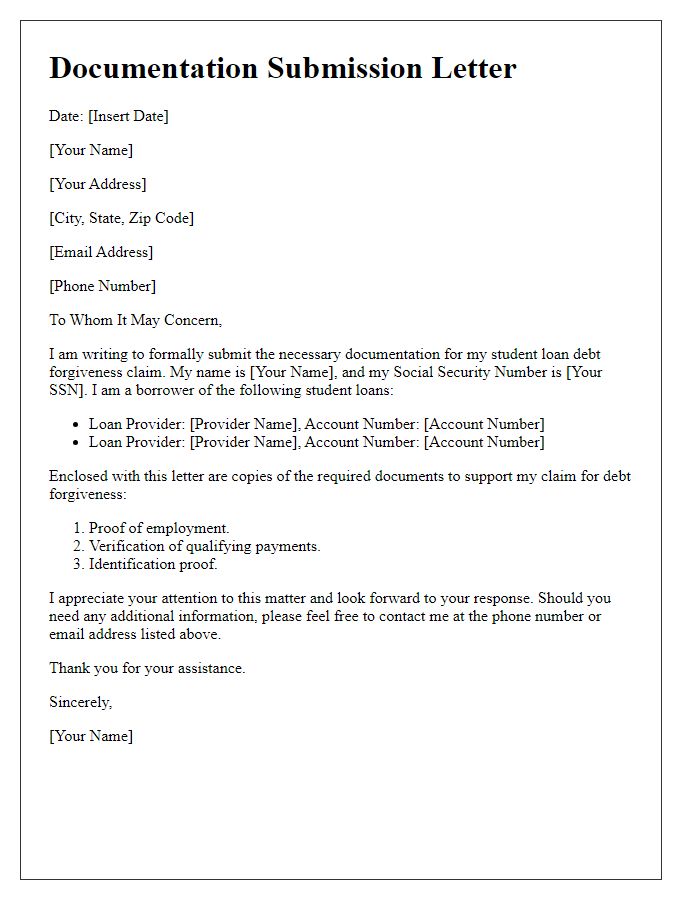

Letter template of documentation submission for student loan debt forgiveness claim.

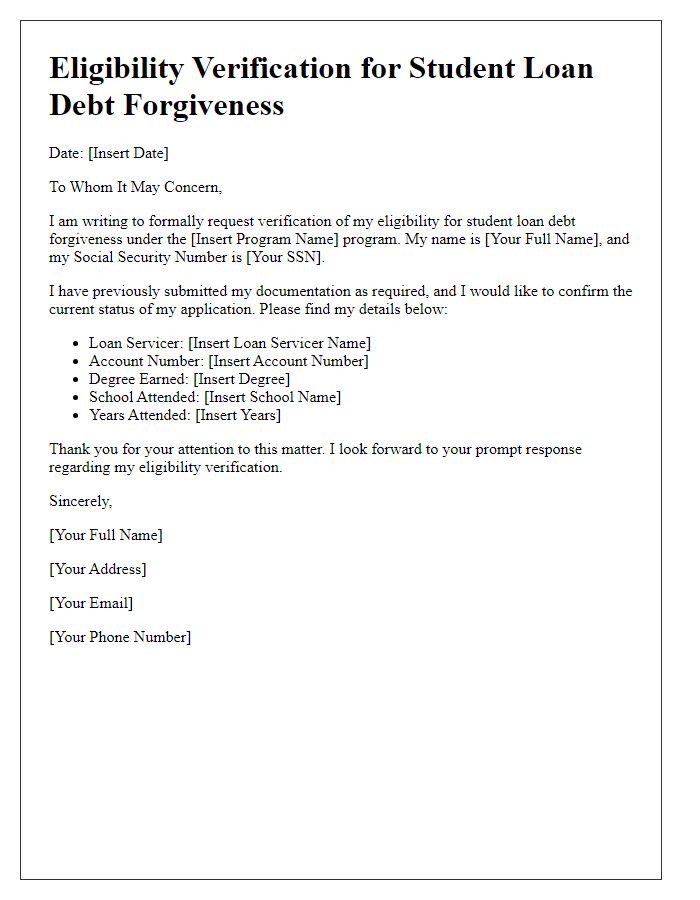

Letter template of statement for eligibility verification for student loan debt forgiveness.

Comments