In the world of business, challenges can arise that might impede timely payments, and that's completely understandable. Writing a letter to request a delay in debt repayment can be a delicate matter, but with the right approach, it can lead to a mutually beneficial resolution. It's important to convey your situation transparently while ensuring that your business relationship remains strong. If you'd like to learn more about crafting the perfect letter for your situation, keep reading!

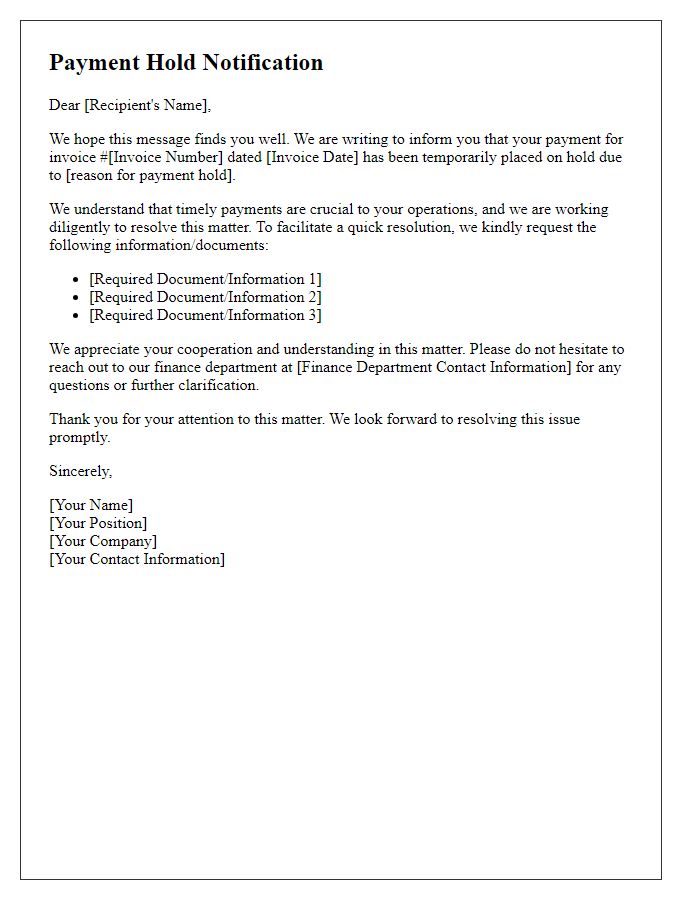

Clear Subject Line

A business receiving a request for a payment delay must review their invoice processes thoroughly. Outstanding accounts receivable, particularly over 30 days, can stall cash flow and impact operations. Companies that specialize in debt management, like XYZ Financial, often provide insights on negotiating payment terms, ensuring both parties maintain a positive partnership while addressing financial challenges. When communicating, businesses should include specific invoice numbers, due dates, and the proposed new timeline for payment to foster transparency and trust.

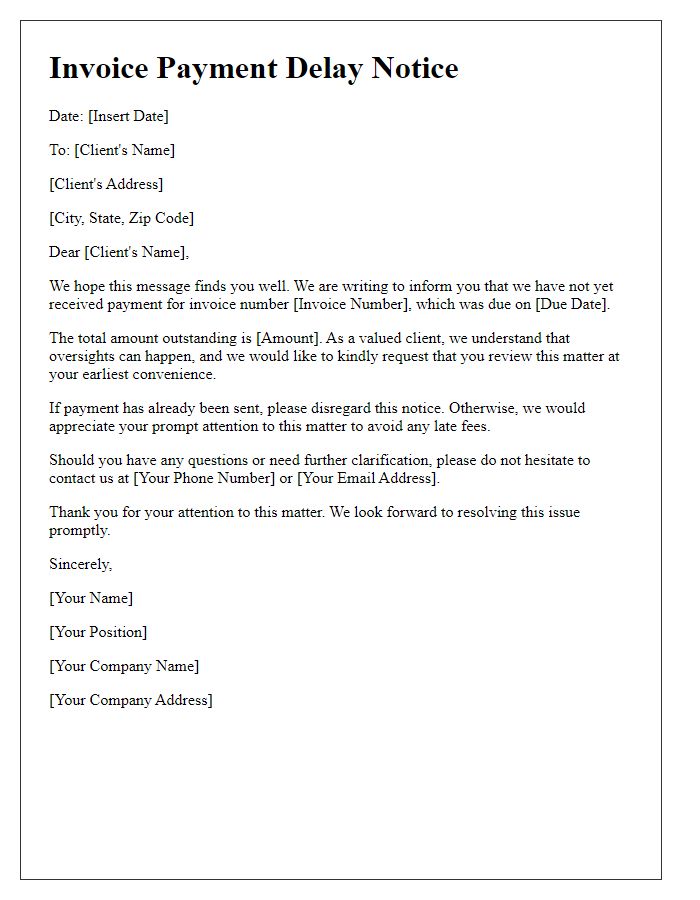

Professional Salutation

Businesses often encounter scenarios where debt repayment schedules require negotiation, particularly in instances of unexpected financial strain. Companies may request a delay in payment terms, citing factors like market fluctuations or supply chain disruptions. This form of communication typically emphasizes the importance of maintaining a strong professional relationship and outlines potential solutions or alternative arrangements, such as revised payment plans or partial payments, to ensure mutual viability while addressing the outstanding obligations.

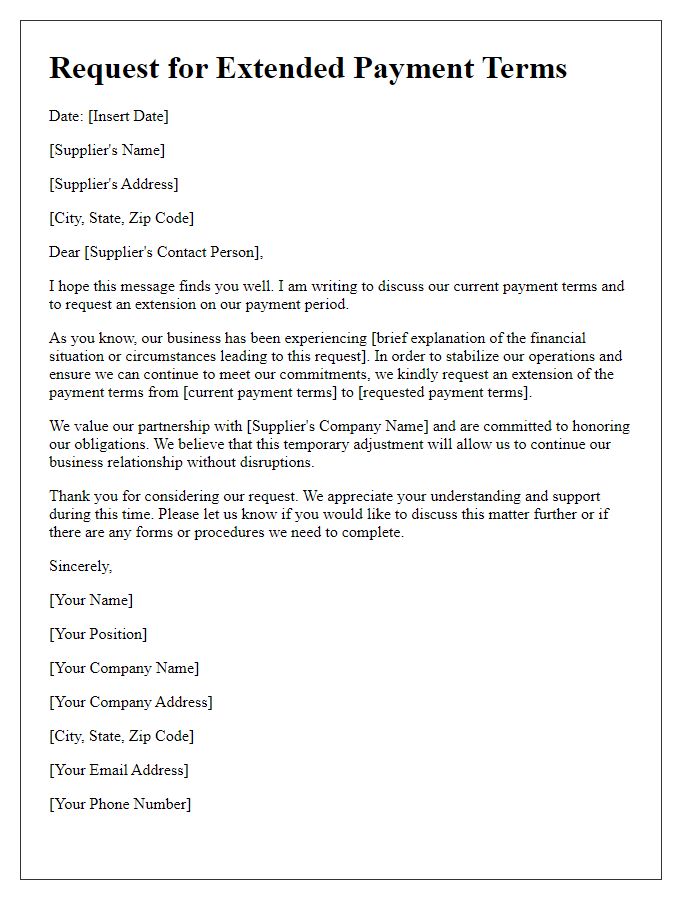

Account Details and Outstanding Amount

Account details are crucial for tracking financial transactions between businesses, with the account number serving as a unique identifier for each partnership, such as Account Number 123456789. The outstanding amount refers to the total unpaid balance on an account, which can significantly affect cash flow. This amount can include specific details such as invoice numbers, due dates, and amounts due that collectively contribute to a clearer understanding of financial obligations, often exceeding a few thousand dollars in overdue invoices. Maintaining accurate records for accounts like these is essential for effective debt management and ensuring timely resolution of any financial discrepancies.

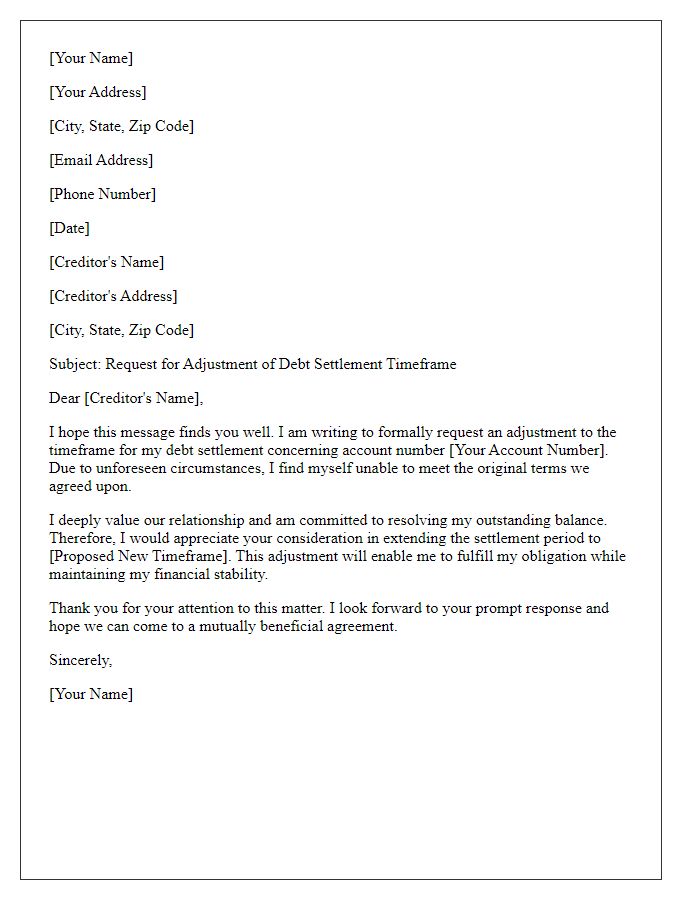

Explanation and Justification for Delay

Financial constraints can lead to delayed payments between businesses, notably due to unforeseen market fluctuations. For instance, in the retail sector, increased supply chain costs and diminished consumer purchasing power have disrupted cash flow. Companies, such as those in the electronics industry, may face delays in invoicing due to supply shortages that hinder product availability. The result can be extended payment cycles, straining relationships between suppliers and customers. Furthermore, factors like interest rate hikes can impact loan repayment capabilities, making timely settlements challenging. Ultimately, businesses must navigate these complexities while providing transparent communication to maintain trust and collaboration.

Proposed Payment Plan or Resolution

A proposed payment plan can assist businesses in managing and resolving outstanding debts effectively, particularly in challenging financial circumstances. For instance, a small manufacturing company facing cash flow issues might suggest staggered payments over three months, allowing time to stabilize operations following unexpected disruptions. Providing a detailed breakdown of the payment structure, including specific dates and amounts, demonstrates commitment to resolving the debt. In addition, incorporating a clause for early repayment incentives encourages timely settlement. Establishing clear communication channels for updates further solidifies trust between both parties, fostering a collaborative approach to financial obligations.

Comments