Are you feeling the stress of managing your finances while aiming to keep up with your payments? It's common to find ourselves in situations where a little flexibility can go a long way. That's why crafting a well-thought-out letter to request a payment plan agreement can help ease your burden and foster a positive relationship with your creditors. Join me as we dive into effective tips and templates to make your request clear and compelling!

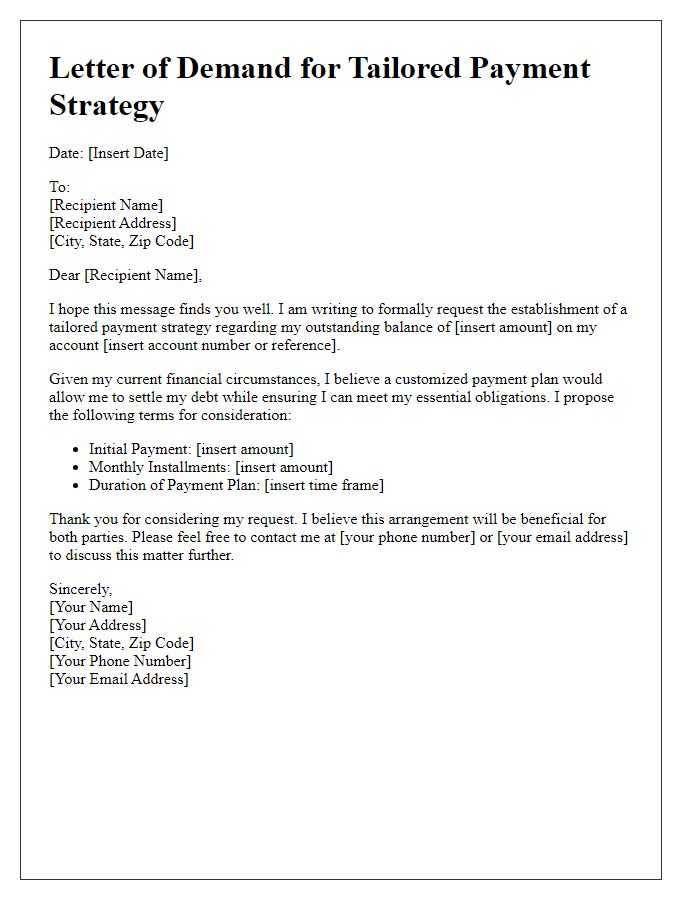

Personal and account information

A payment plan agreement for managing outstanding debts can provide financial stability for individuals facing unforeseen circumstances. Essential personal information includes full name, address, and contact details for easier communication. Account information consists of a unique account number assigned by the creditor, outstanding balance amount, and payment history. A clear outline of proposed payment terms, including monthly installment amounts, due dates, and duration of the plan, ensures transparency. Additional documentation could include income statements or proof of hardship, demonstrating the need for a structured repayment approach. This formal request can alleviate stress and foster cooperation between parties.

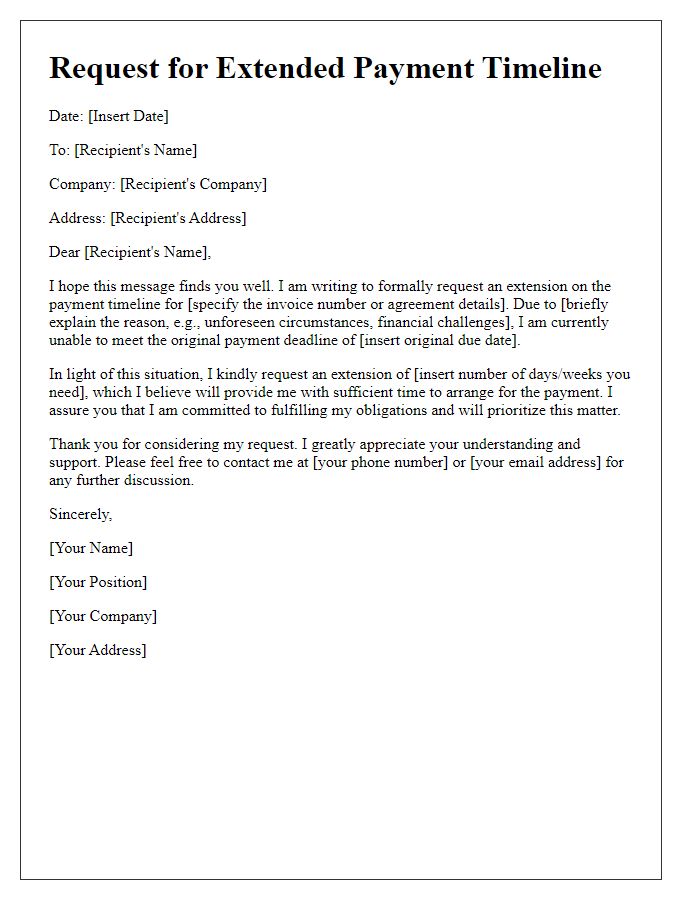

Specific payment plan details

A payment plan agreement can offer relief for individuals managing financial obligations, such as medical bills or education expenses. This document outlines specific terms for repayment, including the total amount owed (e.g., $2,000 for a medical procedure), the monthly payment amount (e.g., $200), and the payment duration (e.g., ten months). Important details may include the interest rate applied, payment due dates (e.g., the 15th of each month), and consequences for missed payments, such as late fees (often a percentage or a flat fee like $25). Additionally, both parties may agree on potential adjustments in case of unforeseen circumstances, ensuring flexibility. Accurate and clear documentation fosters trust and accountability, essential elements for a successful payment arrangement.

Justification for request

Financial difficulties can necessitate a payment plan adjustment, allowing for manageable debt resolution. Factors such as unexpected medical expenses (which can average thousands of dollars) or job loss--affecting over 12 million individuals annually--can strain budgets. A payment plan enables structured repayments over time, reducing immediate pressure. Monthly installments of affordable amounts foster consistent payments without jeopardizing other essential expenses, such as rent (often exceeding $1,500 in urban areas). Establishing an agreement also demonstrates commitment to fulfilling obligations while providing relief during challenging economic circumstances.

Contact information for follow-up

A payment plan agreement can provide individuals relief during financial hardship. For example, in the case of medical bills (often surpassing several thousand dollars), many hospitals or healthcare providers offer flexible payment options that can be tailored based on income, expenses, and outstanding debt. Establishing a clear communication channel (like a dedicated phone number or email address) enhances collaboration, ensuring that both parties understand the terms of the plan, including interest rates (if applicable) and payment deadlines. A well-defined agreement can ease the recovery process and allow timely resolutions without further financial strain.

Professional tone and language

Requesting a payment plan agreement can help individuals or organizations manage financial obligations in a structured way. A well-crafted payment plan request should clearly state the reasons for the request, detail the payment amounts and timelines, and express a willingness to discuss terms. For example, a small business located in San Francisco with outstanding invoices totaling $10,000 might propose a monthly payment plan of $1,000 over ten months, allowing for manageable installments without compromising cash flow. This approach not only maintains a professional relationship with creditors but also demonstrates responsibility in fulfilling obligations while navigating financial challenges. Effective communication and transparency can foster understanding and pave the way for mutually beneficial agreements.

Comments