Are you tired of inaccuracies on your credit report that could be affecting your financial opportunities? You're not alone, and taking action is essential to maintain your creditworthiness. In this article, we'll guide you through crafting a clear and effective letter to request corrections, ensuring your voice is heard in the credit reporting process. Let's dive in and get those errors fixed!

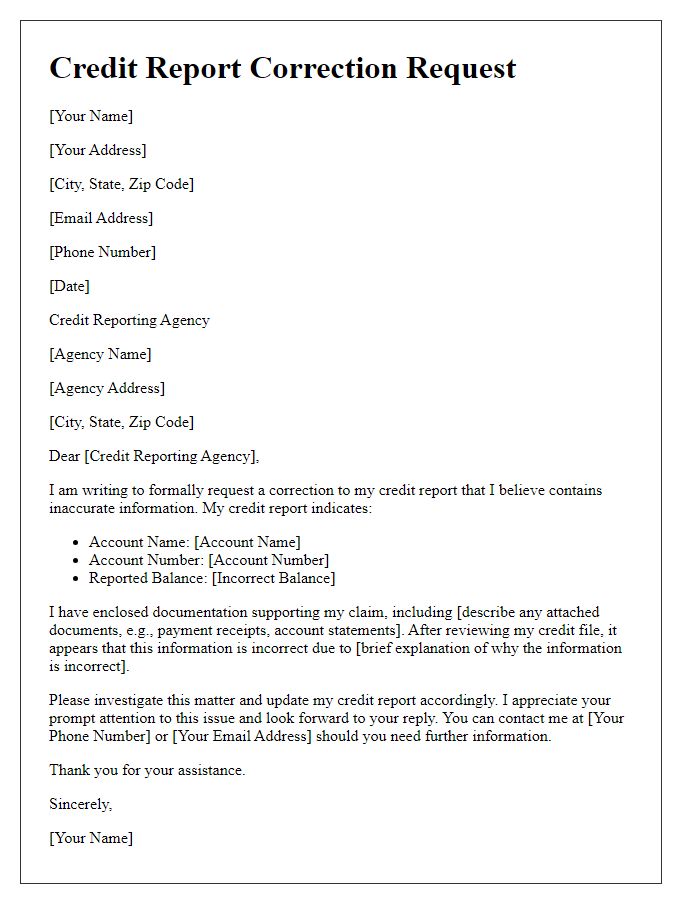

Contact Information

Accurate credit reports are essential for maintaining financial health, as inaccuracies can impact borrowing potential. Credit reports, generated by agencies like Equifax, Experian, and TransUnion, contain vital information such as credit history, account status, and public records. A correction request becomes necessary when discrepancies appear, typically involving incorrect personal details like name, address, or account information that could stem from clerical errors or fraudulent activity. In the United States, the Fair Credit Reporting Act (FCRA) mandates that individuals have the right to dispute inaccuracies, ensuring timely investigations (usually within 30 days) by credit reporting agencies. Such corrections can significantly affect credit scores, ultimately influencing loan approvals and interest rates.

Credit Report Details

A credit report correction request must include specific details to ensure accuracy in addressing disputes. Credit report entries typically list debts, payment history, and account statuses. Verify the account number for identification, as discrepancies can arise from typographical errors. Note the reporting agency's name, such as Experian, TransUnion, or Equifax, to ensure the request reaches the correct department. Reference the date of the disputed report and specify the items needing correction, such as late payments recorded inaccurately or accounts marked as charge-offs. Include supporting documentation, such as payment receipts or cancellation letters, to substantiate claims. Completion of this process ensures improved credit scores, affecting mortgage approvals, interest rates, and overall financial health.

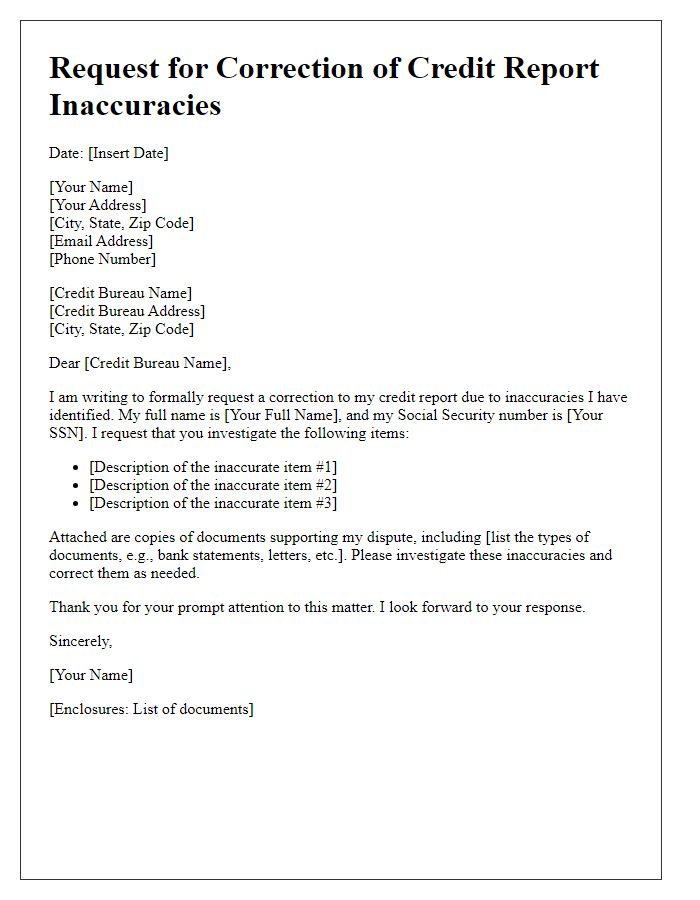

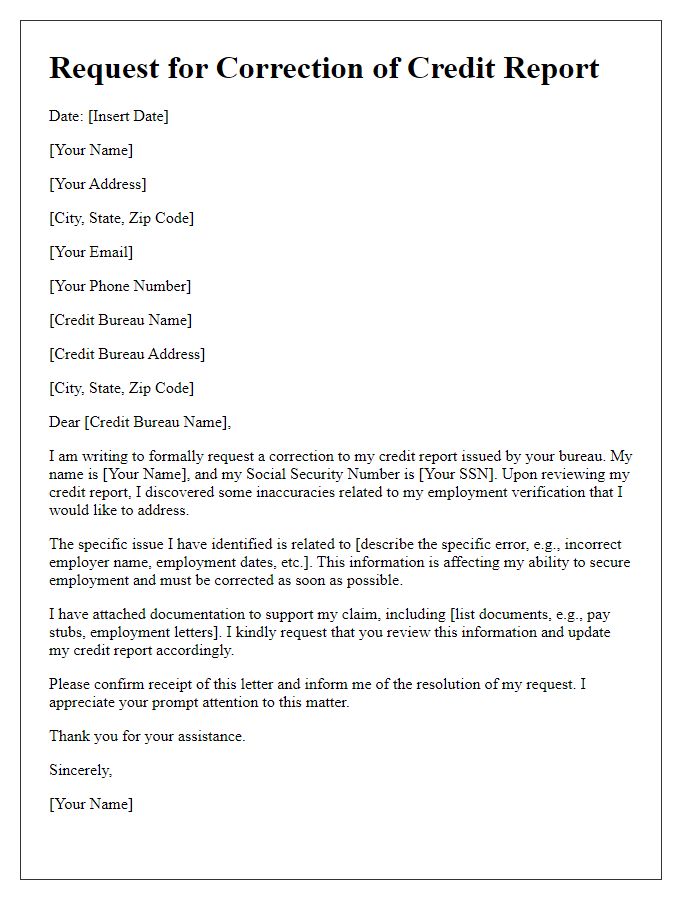

Error Description

Credit report inaccuracies can significantly impact financial health, particularly affecting interest rates and lending possibilities. Common errors include incorrect personal information, such as names or addresses (common instance: John Smith instead of Jon Smith), outdated account status, or erroneously reported late payments for a mortgage (specific example: HSBC Mortgage, July 2022, reported late but paid on time). Credit reporting agencies like Experian, TransUnion, and Equifax must be notified to initiate correction procedures. Timely reporting (within 30 days of notice) can mitigate damage to credit scores, safeguarding future flexibility in obtaining loans or credit lines.

Supporting Documents

A credit report correction request requires supporting documents to substantiate claims of inaccuracies. Essential documents include proof of identity such as a government-issued ID (driver's license or passport), recent utility bills showing your current address, and bank statements verifying financial information. Additional materials may consist of payment receipts or statements from creditors indicating discrepancies in account status. Ensure that scanned documents are clear and legible, highlighting the relevant information. Keep copies of all submissions for personal records and tracking purposes. These documents facilitate communication with credit bureaus like Experian, TransUnion, and Equifax, speeding up the correction process.

Correction Request Statement

Credit report discrepancies can significantly impact an individual's financial health and credit score. A credit report correction request is essential for addressing inaccuracies related to personal information, account status, or payment history. Individuals should carefully document the errors, specifying details such as account numbers, dates of erroneous transactions, and the nature of the inaccuracies. Providing supporting documents, such as payment receipts or statements, enhances the credibility of the claim. Submitting this correction request to credit reporting agencies (like Experian, Equifax, or TransUnion) ensures that these organizations conduct thorough investigations within a 30-day timeframe as mandated by the Fair Credit Reporting Act. Prompt resolution of these discrepancies can improve an individual's credit score and overall financial opportunities.

Letter Template For Credit Report Correction Request Samples

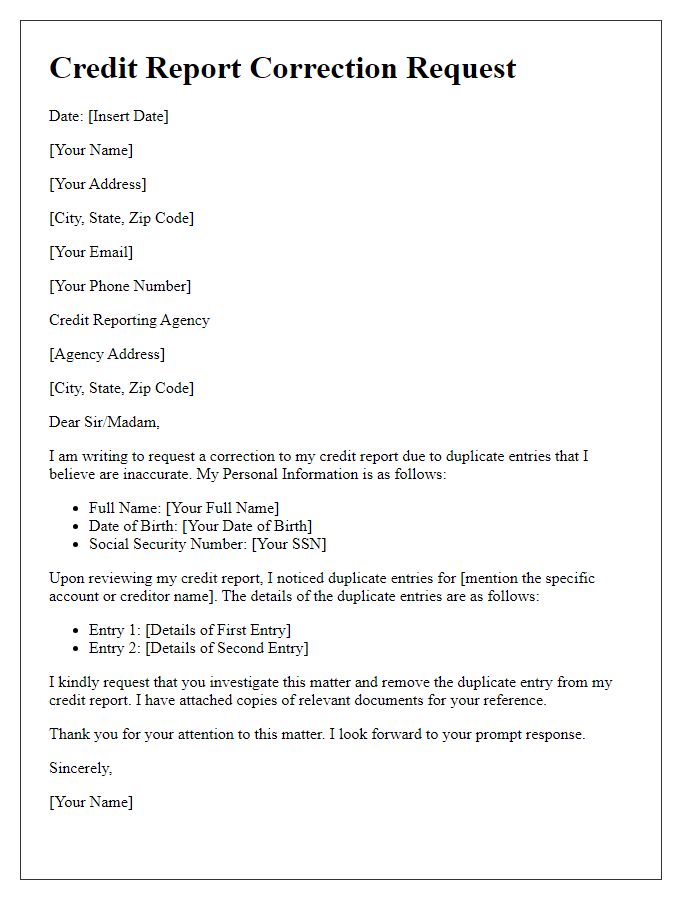

Letter template of credit report correction request for duplicate entries

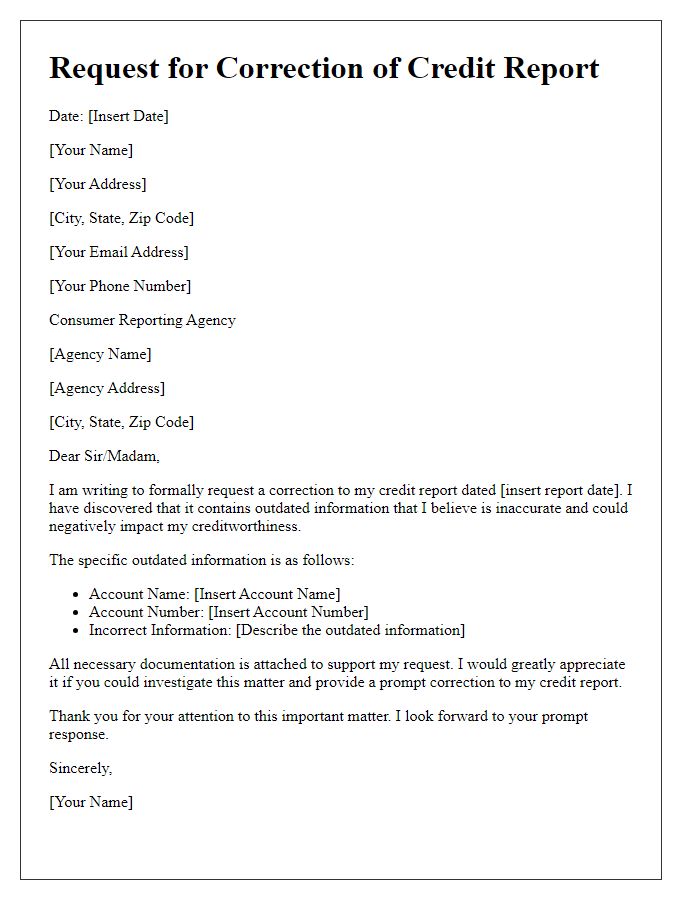

Letter template of credit report correction request for outdated information

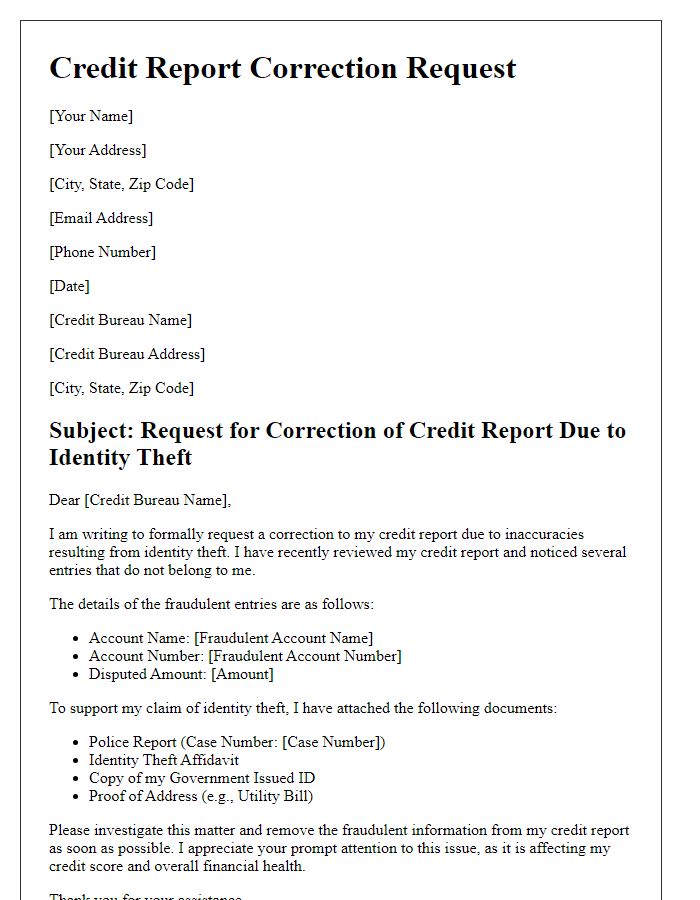

Letter template of credit report correction request for identity theft claims

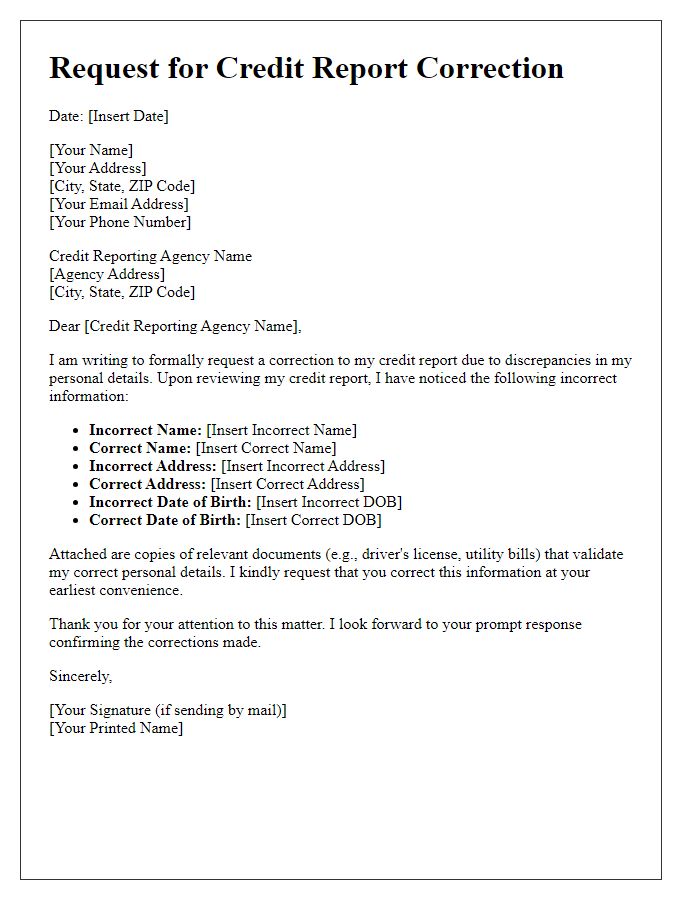

Letter template of credit report correction request for wrong personal details

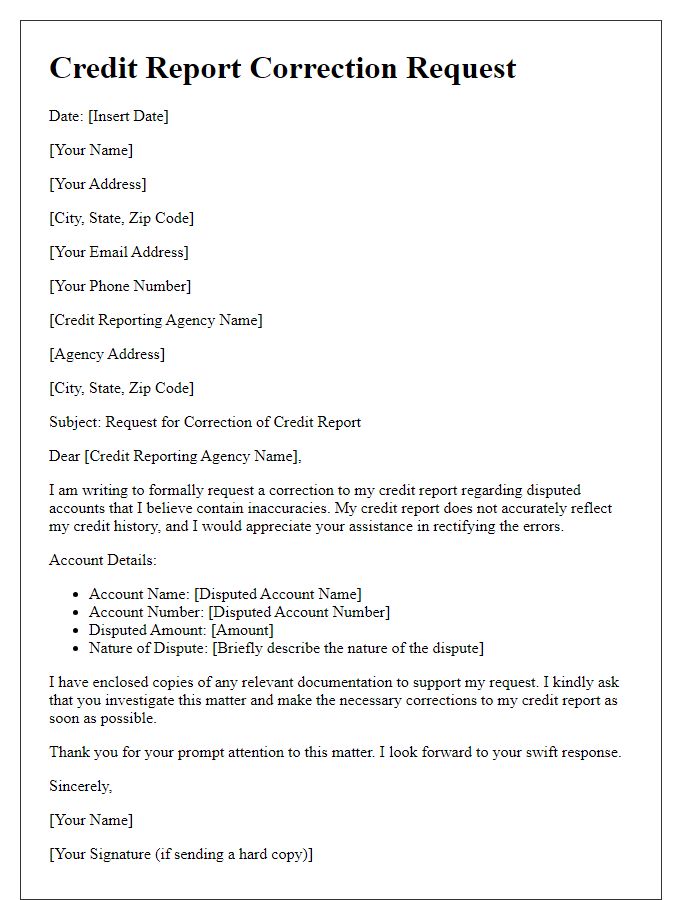

Letter template of credit report correction request for disputed accounts

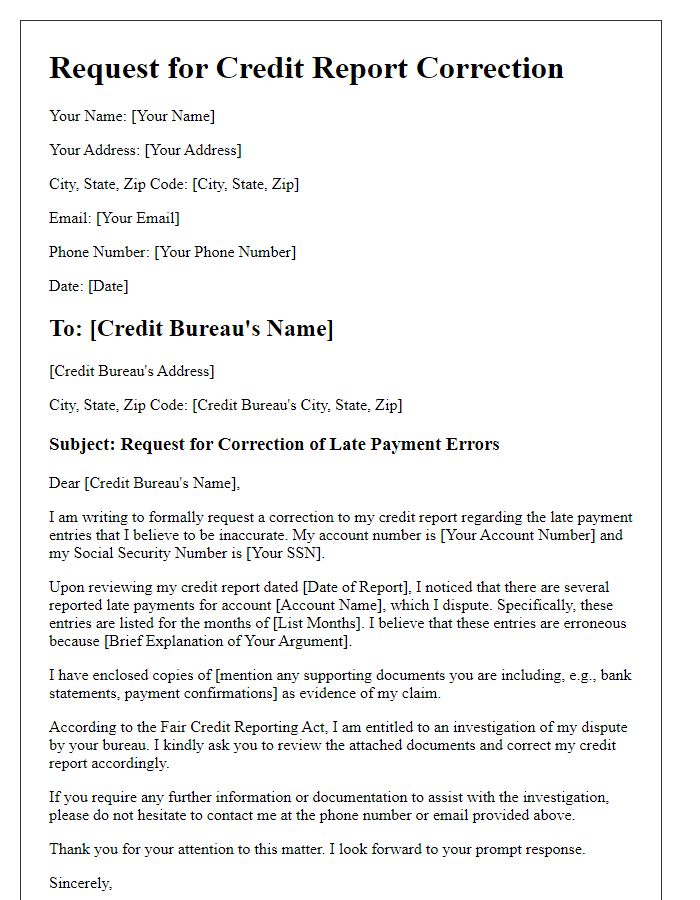

Letter template of credit report correction request for late payment errors

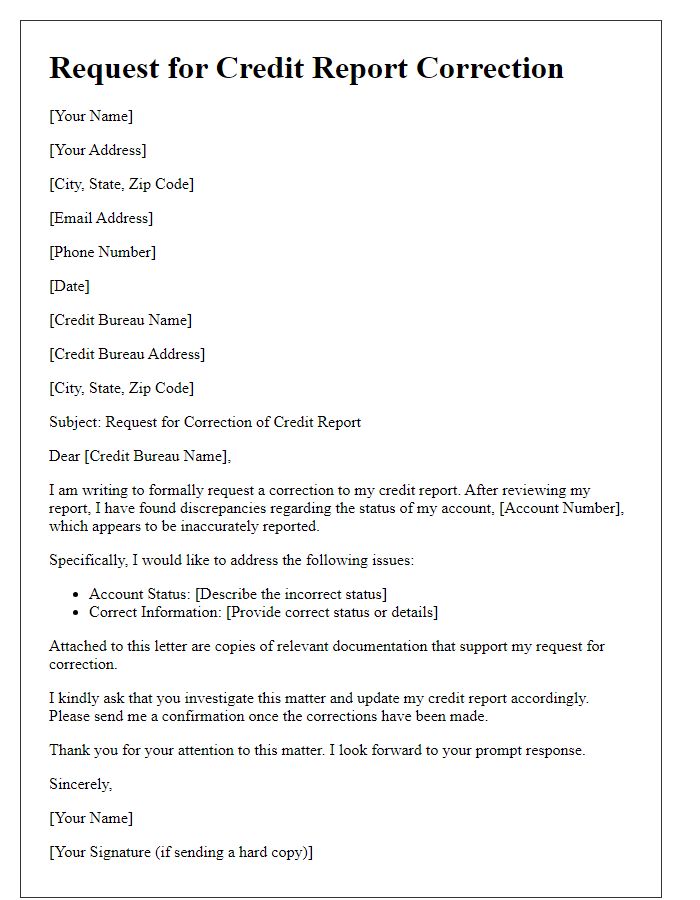

Letter template of credit report correction request for account status updates

Letter template of credit report correction request for reporting agency mistakes

Comments