Creating a proof of account ownership letter can feel daunting, but it doesn't have to be! This simple yet essential document verifies that you are the rightful owner of an account, whether for banking, insurance, or other purposes. In this article, we'll guide you through a straightforward template that ensures you cover all necessary details with ease. So, grab a cup of coffee and let's dive in together!

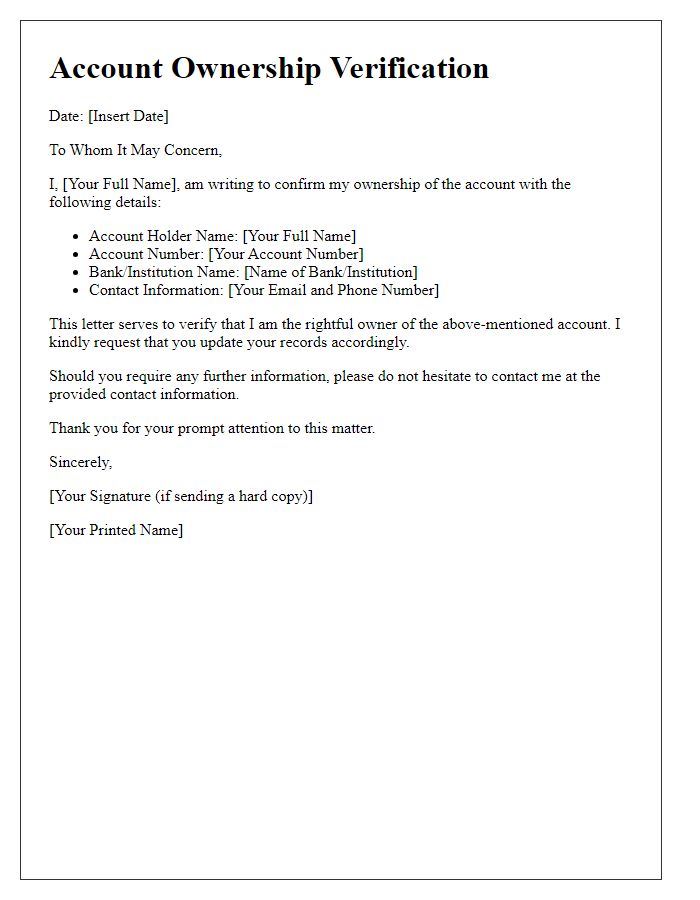

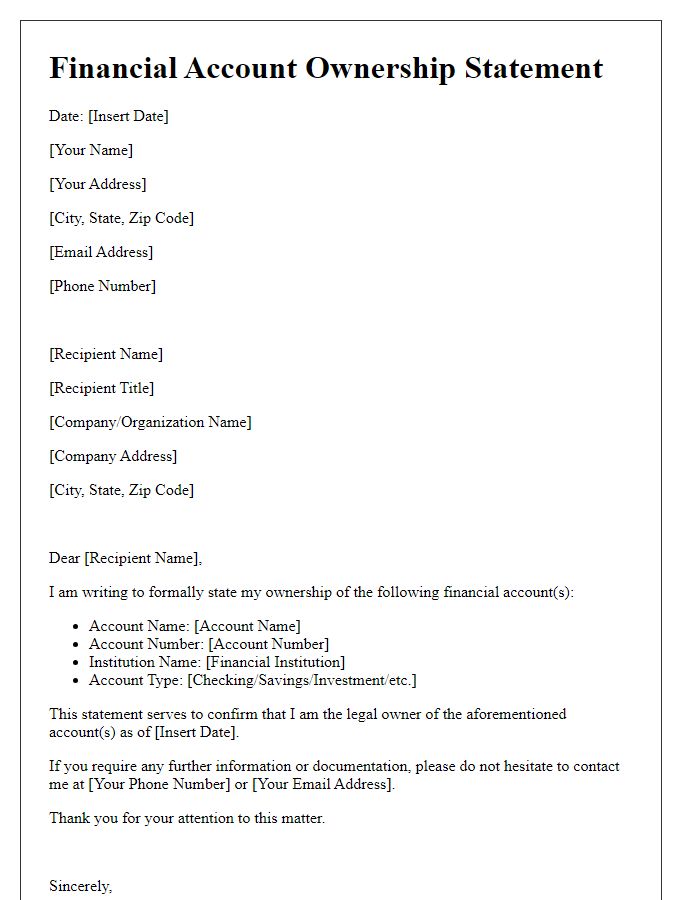

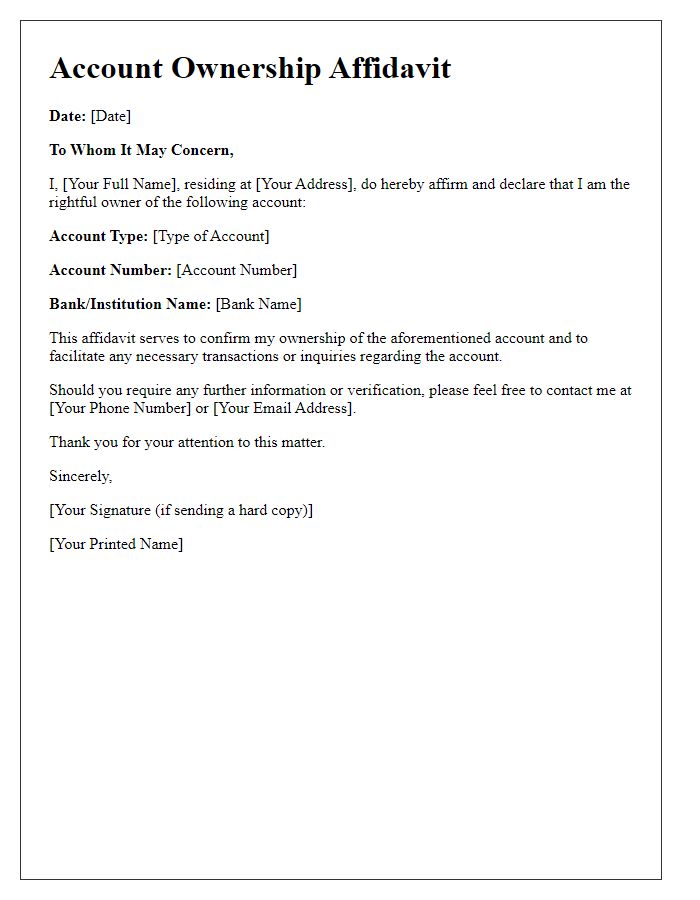

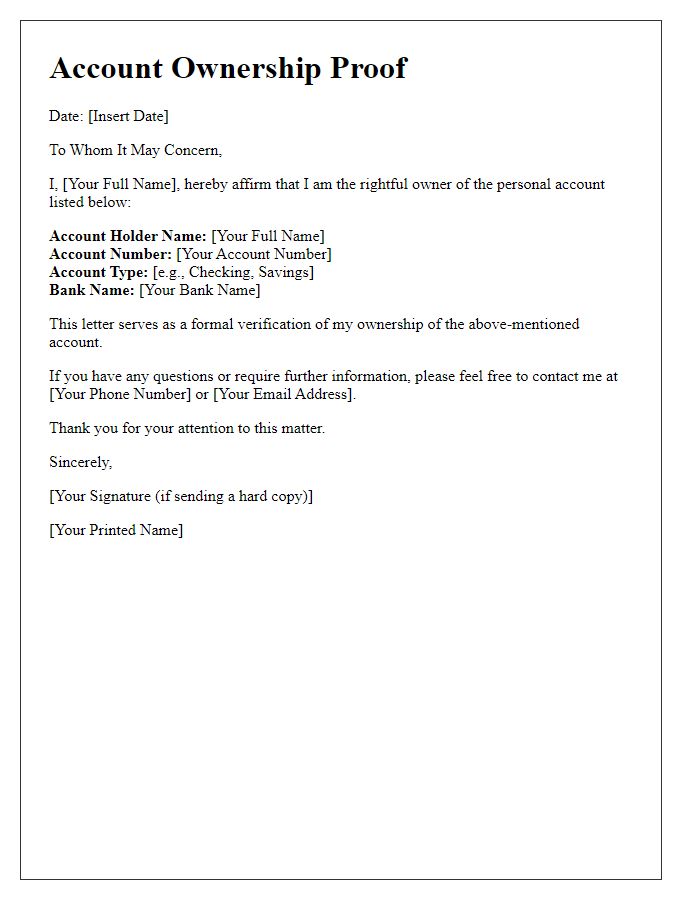

Account Holder's Personal Information

Account ownership verification requires precise details regarding the account holder's personal information. Essential elements include the full name of the account holder, accurate residential address, and contact number. Additionally, the account number linked to the financial institution, such as a bank or credit union, should be included. Vital dates like the account opening date provide context regarding the duration of account ownership. It's crucial to ensure that all provided information corresponds exactly with the records held by the institution, enhancing the legitimacy of the ownership claim.

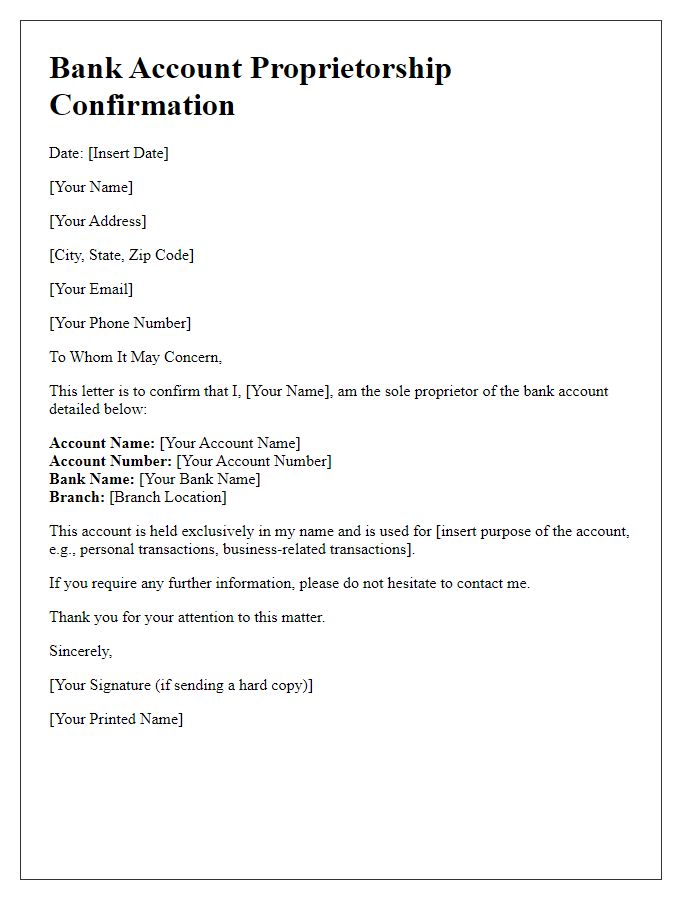

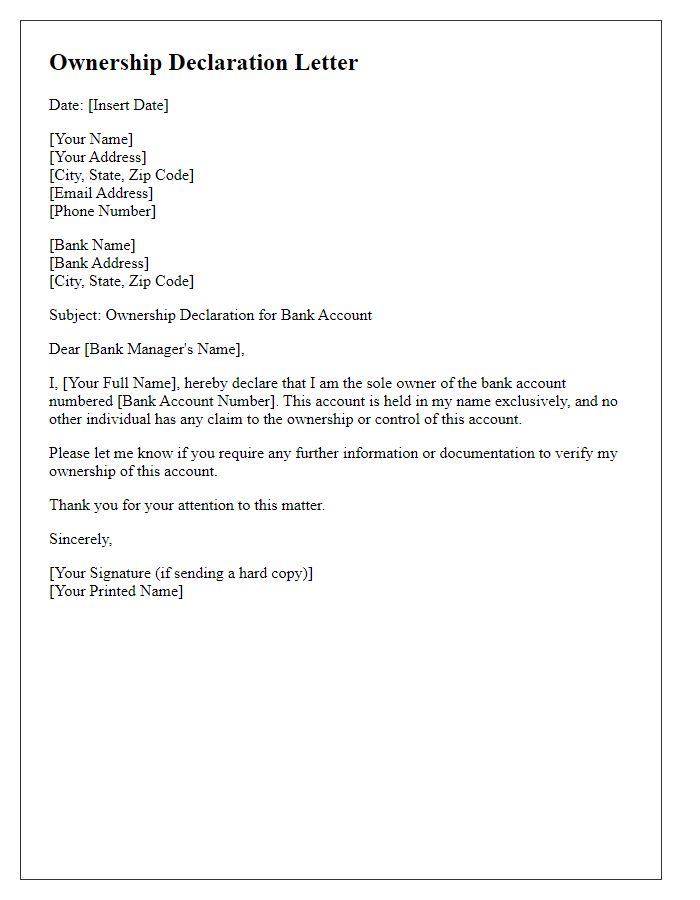

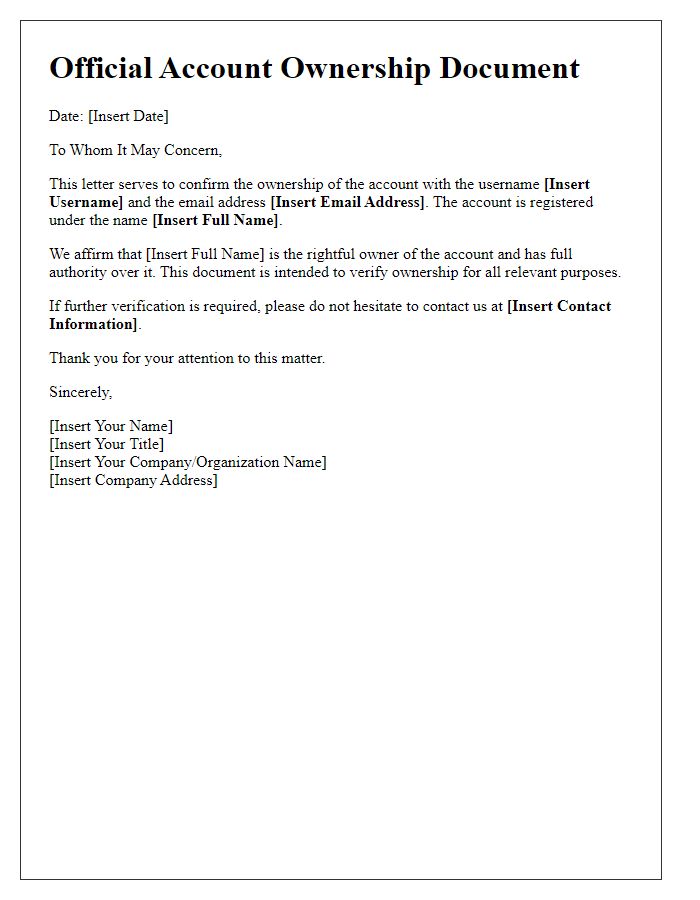

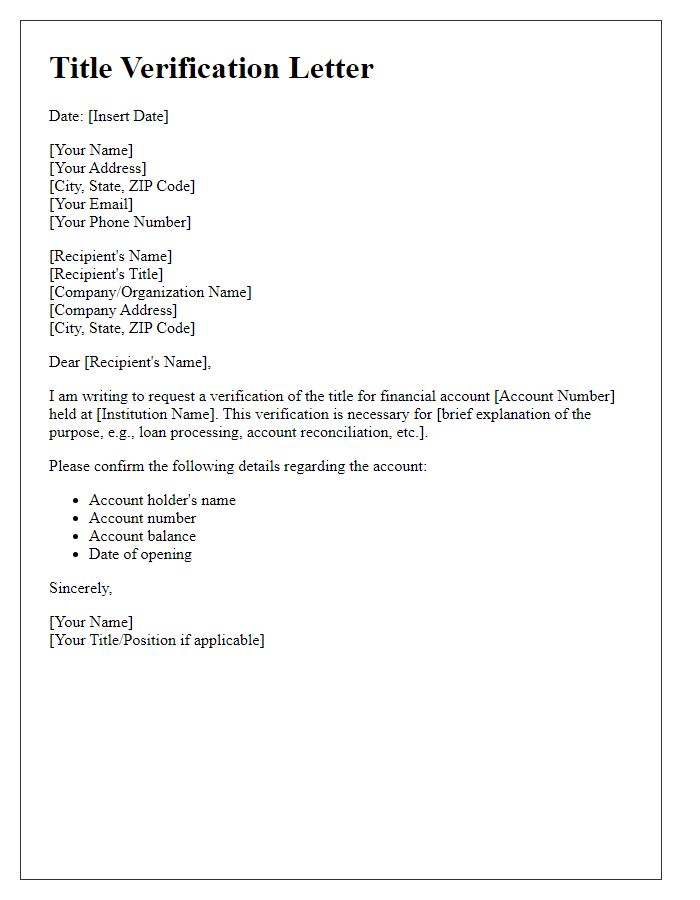

Financial Institution Details

Financial institutions play a critical role in verifying account ownership for various purposes, including loan applications and fraud prevention. The financial institution details, such as name (e.g., Bank of America), address (e.g., 123 Main St, Charlotte, NC), account number (e.g., 987654321), and account holder name (e.g., John Doe), must be clearly stated. Specific data points can include the date of account opening (e.g., January 15, 2020) and account type (e.g., checking or savings). Institutions may also reference regulatory guidelines (such as the Gramm-Leach-Bliley Act) that mandate secure customer verification processes. Providing a formal statement on official letterhead enhances credibility and assures recipients of the authenticity of the information provided.

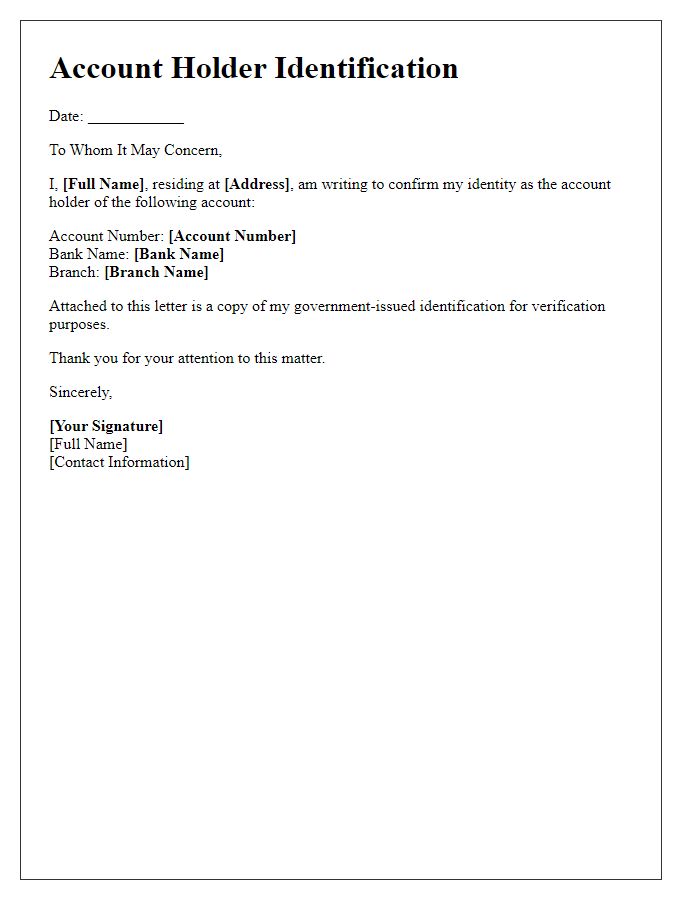

Account Details and Verification

Account ownership verification is crucial for financial institutions, especially in the context of identifying legitimate account holders. When providing proof of account ownership, essential account details need to be included, such as the account number, full name of the account holder, and the official name of the financial institution, like Bank of America or Chase. Verification methods may involve attaching official documents, such as bank statements (dated within the last 90 days), identification cards (like a driver's license or passport), or signed letters from bank representatives confirming account details. Including accurate contact information ensures responsiveness for any follow-up requirements. Clear and concise documentation can expedite the verification process, solidifying the account holder's claim to ownership.

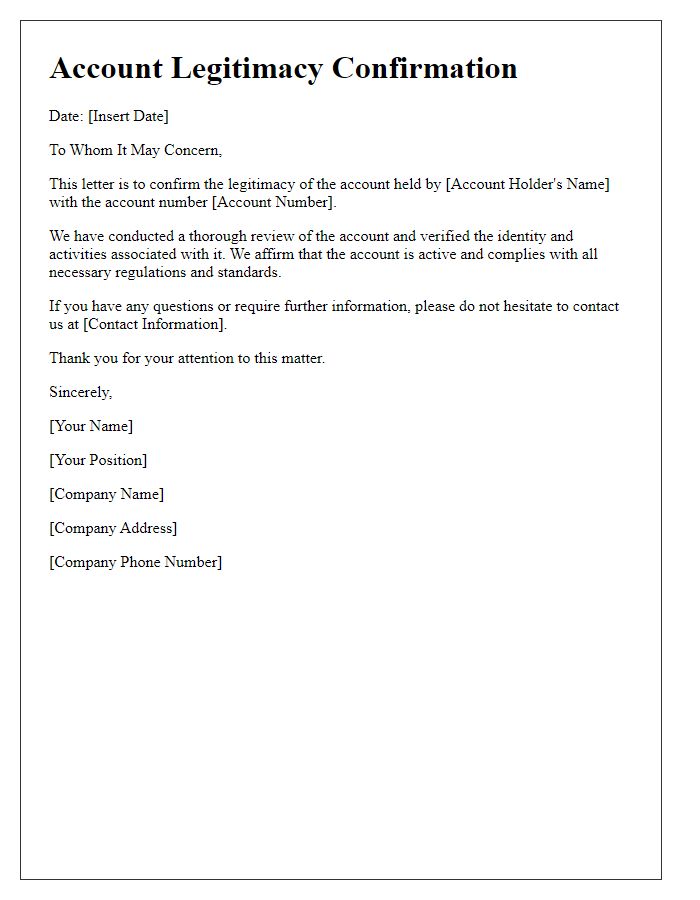

Purpose of the Letter

A proof of account ownership letter serves to verify the identity of an individual concerning their financial account with a specific institution, such as a bank or credit union. This letter typically includes essential details, including the account holder's name, account number, and relevant contact information of the institution like branch name and address. This document may be required for various reasons, such as verifying eligibility for loans, applying for credit cards, or confirming the legitimacy of transactions. Institutions often require this verification to protect against fraud and ensure that sensitive financial information remains secure. It adds an official element that can streamline processes, enhance trust, and facilitate clear communication between the account holder and financial institutions.

Contact Information for Further Verification

When requesting verification of account ownership, it's essential to provide clear contact information for any necessary follow-ups. Including your full name (for accurate identification), existing account number (for quick reference), official email address (for correspondence), and phone number (for immediate communication) ensures efficient verification. Additionally, it may be beneficial to state the purpose of the request, such as confirming ownership for security reasons, in order to expedite the process. Providing this information reduces delays, enhances clarity, and fosters a smoother verification experience.

Comments