Are you struggling with a charge-off on your credit report and unsure of how to tackle it? You're not aloneâmany people find themselves in this difficult position, but there's hope on the horizon. Negotiating with creditors can be a game changer, and with the right proposal, you could potentially turn that charge-off into a manageable payment plan or even full removal from your record. Ready to learn more about crafting an effective charge-off negotiation proposal?

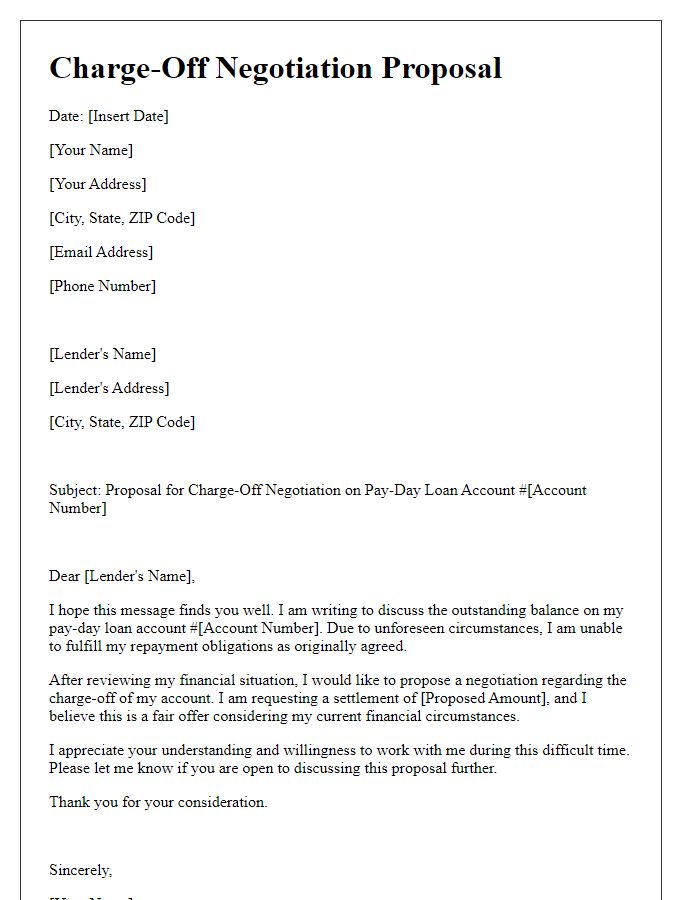

Clear Subject Line

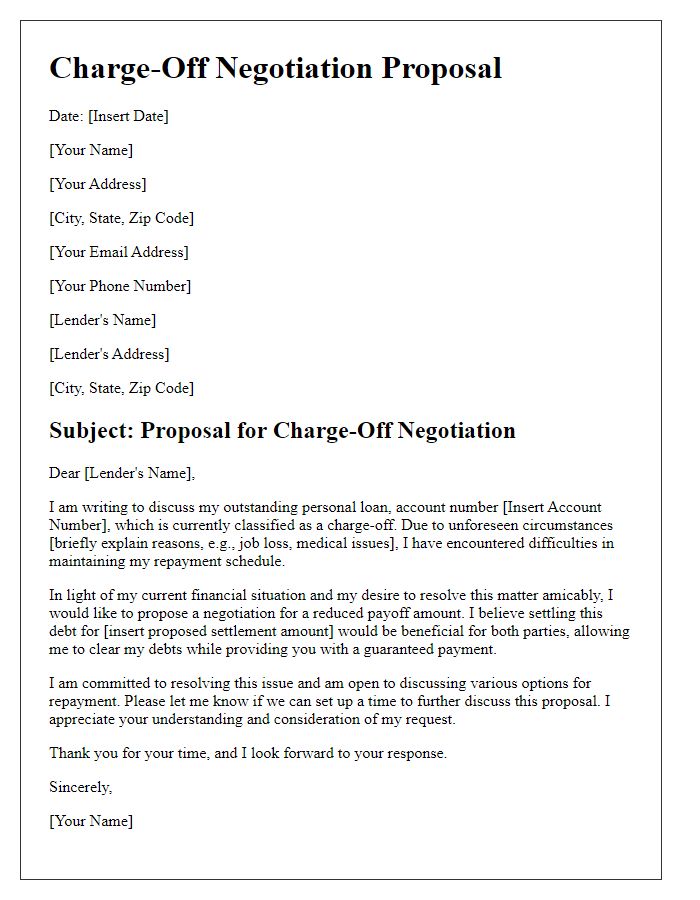

A charge-off negotiation proposal involves communicating directly with a creditor regarding a debt that has been charged off, typically after a prolonged period of non-payment. A clear subject line for this proposal could be "Proposal for Charge-Off Negotiation on Account [Account Number]." This subject line should succinctly indicate the purpose of the email, helping the recipient easily identify its relevance. The account number provides specificity, while the phrase "Charge-Off Negotiation" clarifies the intention to discuss an unresolved financial obligation.

Account Information

Account information refers to specific details related to a financial account, such as outstanding balances, default status, and creditor details. It typically includes the account number, which signifies the unique identifier assigned by the creditor, and current balance, which denotes the amount owed. The charge-off status indicates a significant delinquency, often ignored by lenders after being overdue for approximately 180 days. Important entities include the creditor's name, which reflects the financial institution or company managing the debt, and the date of default, crucial for understanding the timeline of the account's delinquency. Additional remarks may reveal previous payment history and any attempts at resolution.

Offer and Justification

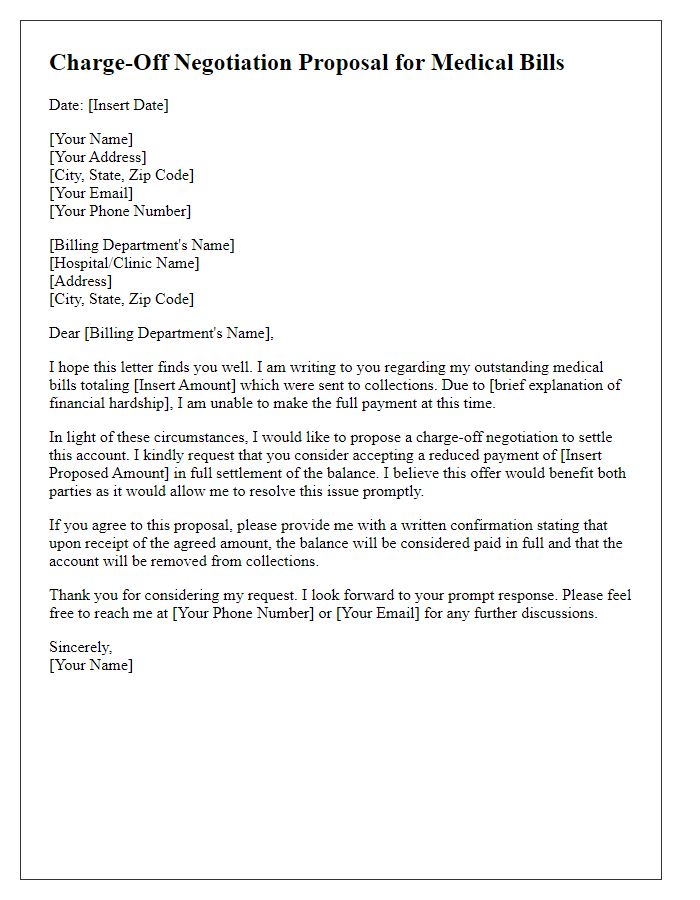

In the context of negotiating charge-off accounts with creditors, a charge-off refers to a declaration by a creditor that an amount of debt is unlikely to be collected, typically after an account remains unpaid for six months. A proposal for negotiation might include an offer to settle a debt for a reduced amount, which often appeals to creditors seeking to recover some of their losses. Providing justification for the offer may include details such as financial hardship (loss of income or unexpected medical expenses) experienced by the debtor. This can establish credibility and highlight the practical inability to fulfill the original debt obligations. Additionally, references to similar settled accounts can strengthen the proposal, demonstrating that a reduced payment is a common outcome in charge-off negotiations.

Payment Terms

A charge-off negotiation proposal addresses outstanding debts, particularly with credit card companies or loan providers, typically when accounts become severely delinquent (typically over 180 days). Effective proposals include specific payment terms, which often suggest a reduced lump sum payment (possibly 30-50% of the total debt amount) in exchange for debt forgiveness. This negotiation frequently occurs in instances where the debtor is experiencing financial hardship, with proposed monthly payments outlined based on the debtor's ability to pay. It is essential to emphasize the intention to resolve the debt amicably, highlighting the benefits to the creditor, such as recovering a portion of the debt rather than risking total loss. Alternative routes, such as payment plans over several months, may be an option, ensuring clarity on the agreed terms and timeline to foster a cooperative agreement.

Contact Information

To successfully negotiate a charge-off, it's crucial to include relevant contact information, such as name, phone number, email address, and mailing address. This ensures that creditors or collection agencies can easily reach you to discuss payment arrangements or settlement options. Including the date of the proposal can also demonstrate the urgency and seriousness of your intention to resolve the debt. Always ensure that the details provided, such as company names and account numbers, are accurate to streamline communication and processing of your negotiation request.

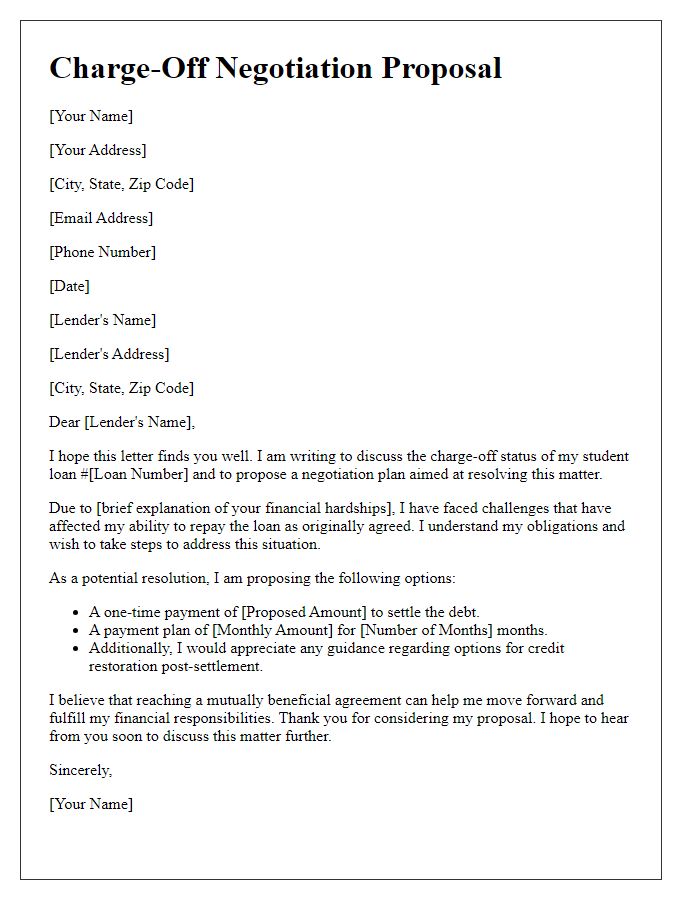

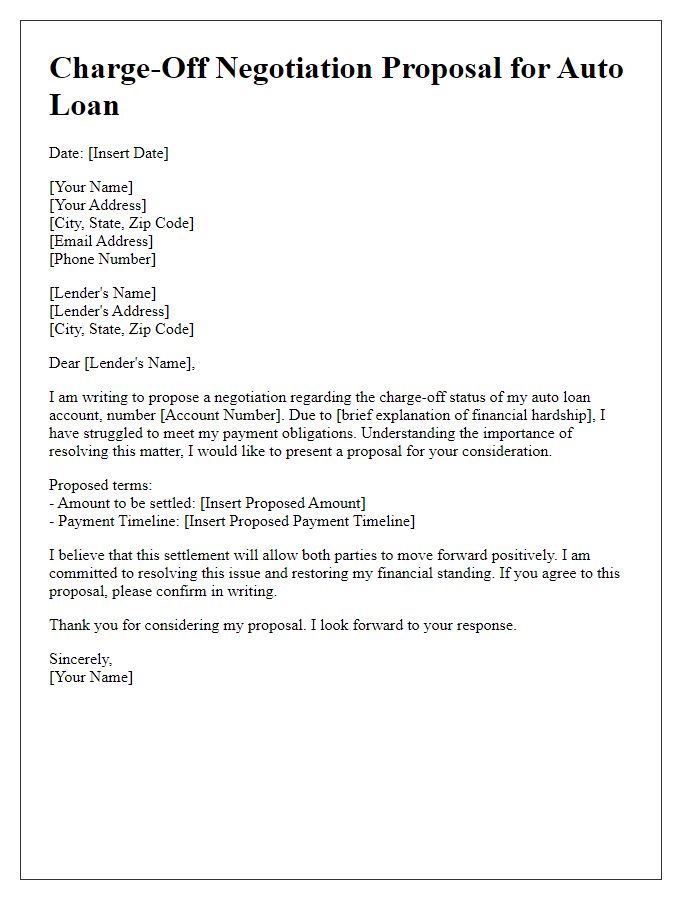

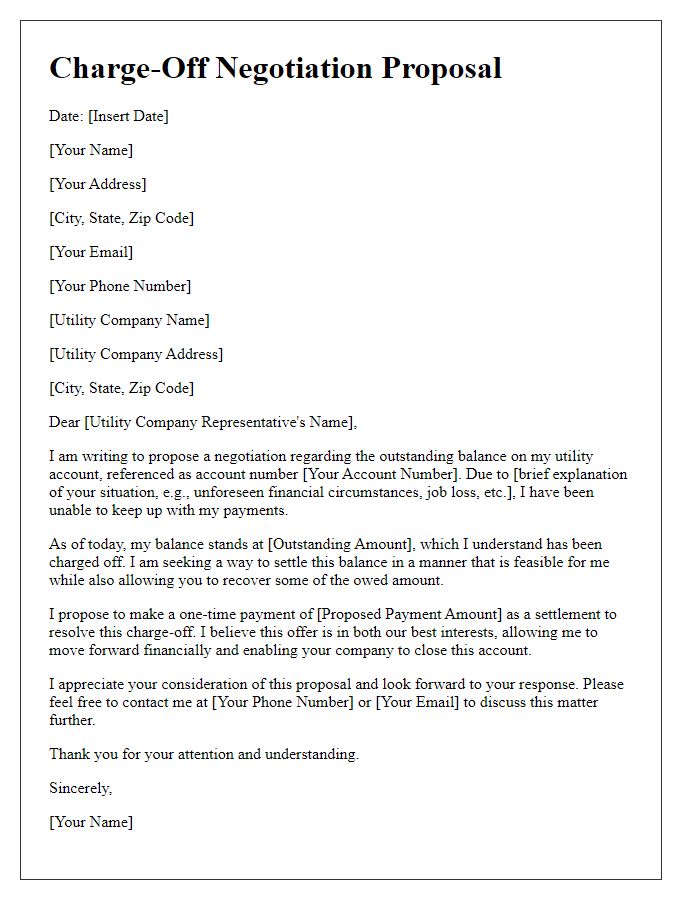

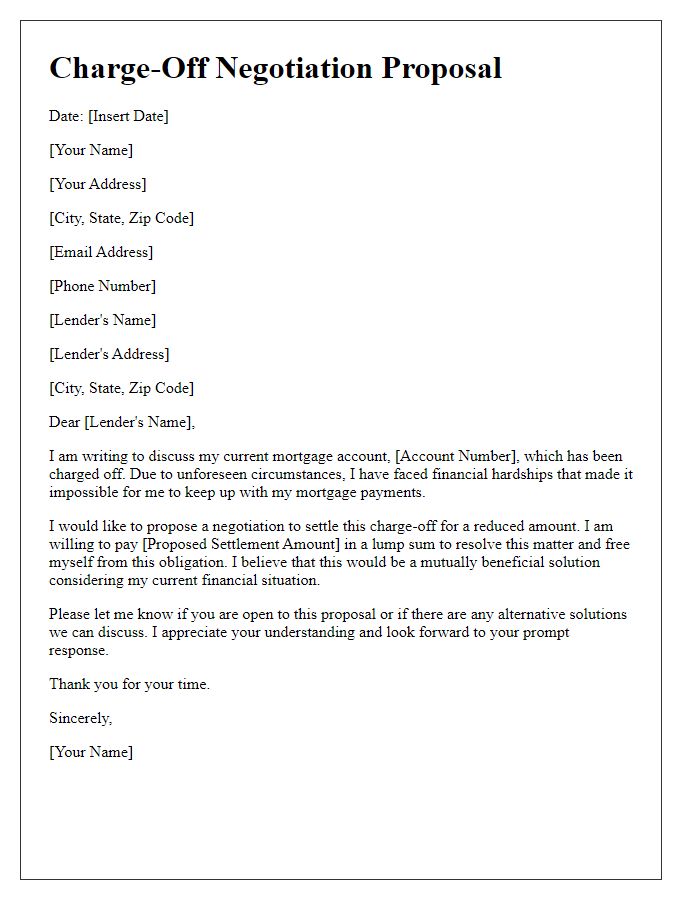

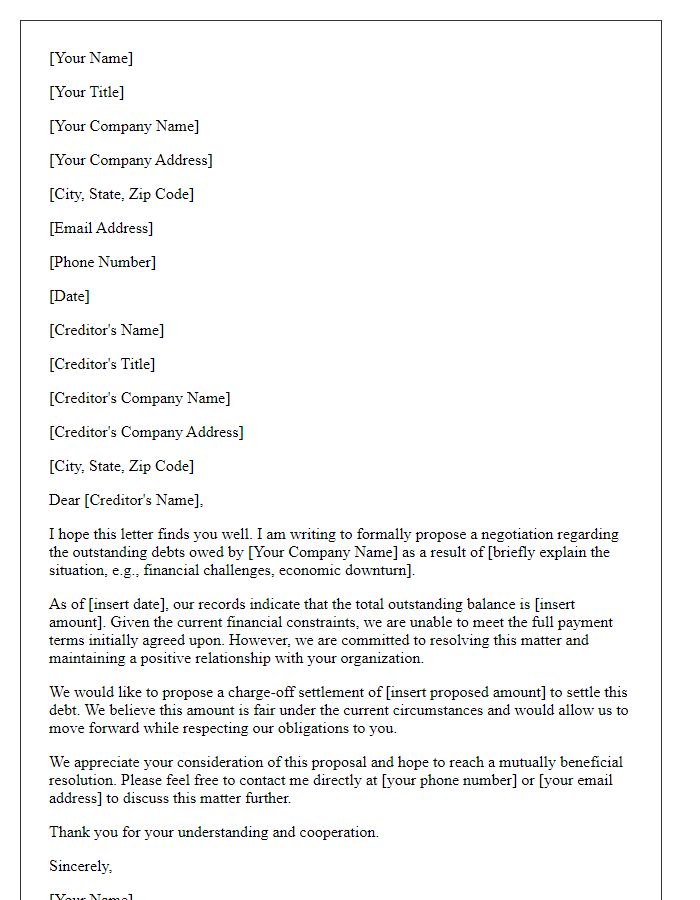

Letter Template For Charge-Off Negotiation Proposal Samples

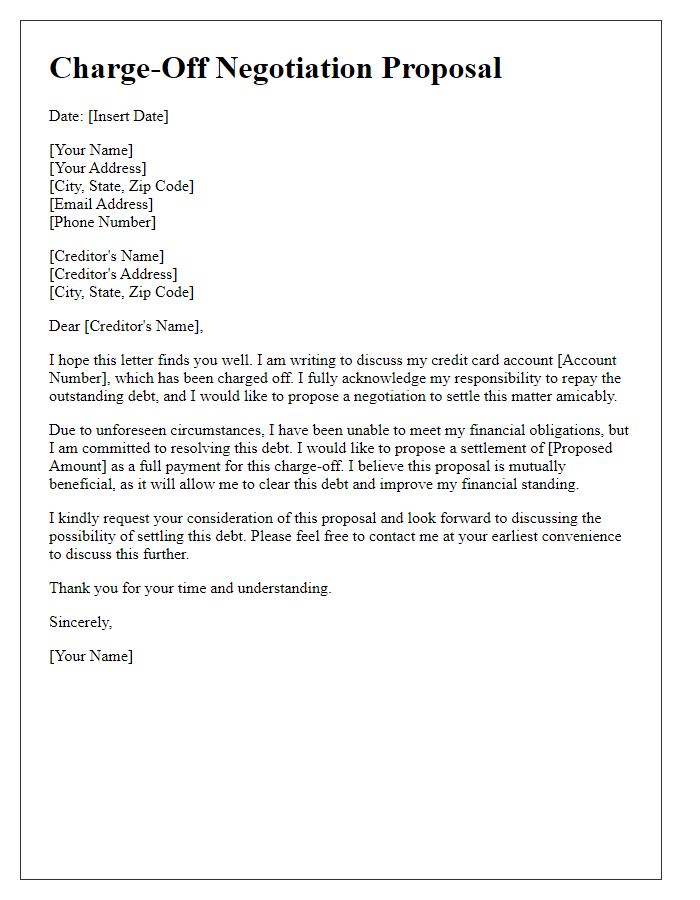

Letter template of charge-off negotiation proposal for credit card debt.

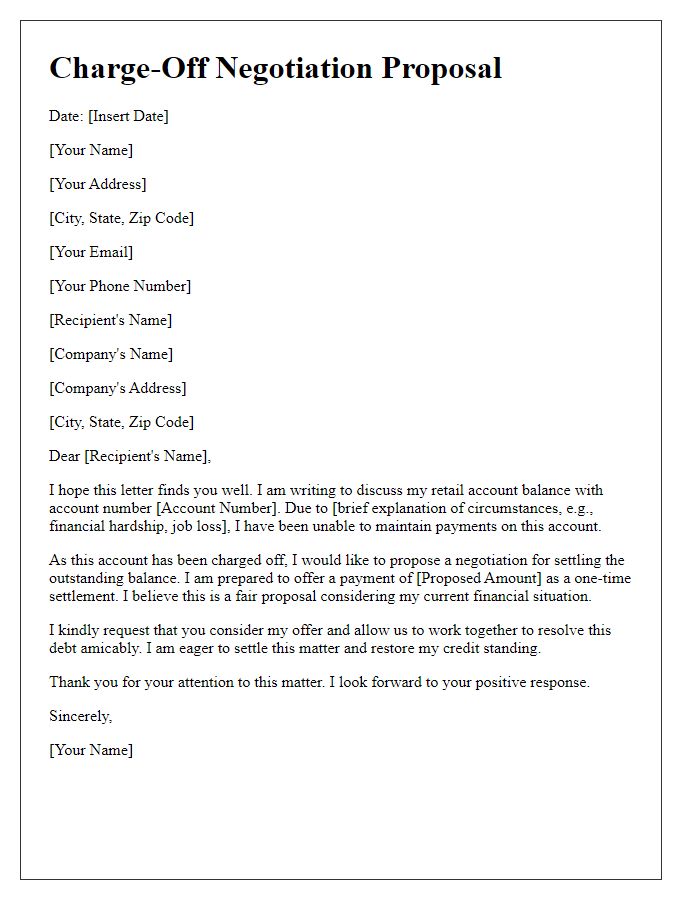

Letter template of charge-off negotiation proposal for retail account balances.

Comments