Are you feeling the pinch of unexpected overdraft fees from your bank? You're not alone, and it's completely normal to seek a resolution to these charges. In today's fast-paced financial landscape, understanding how to effectively communicate with your bank can make all the difference. Join me as we explore the steps to settle those pesky overdraft fees in a way that restores your finances and peace of mindâlet's dive in!

Account Information

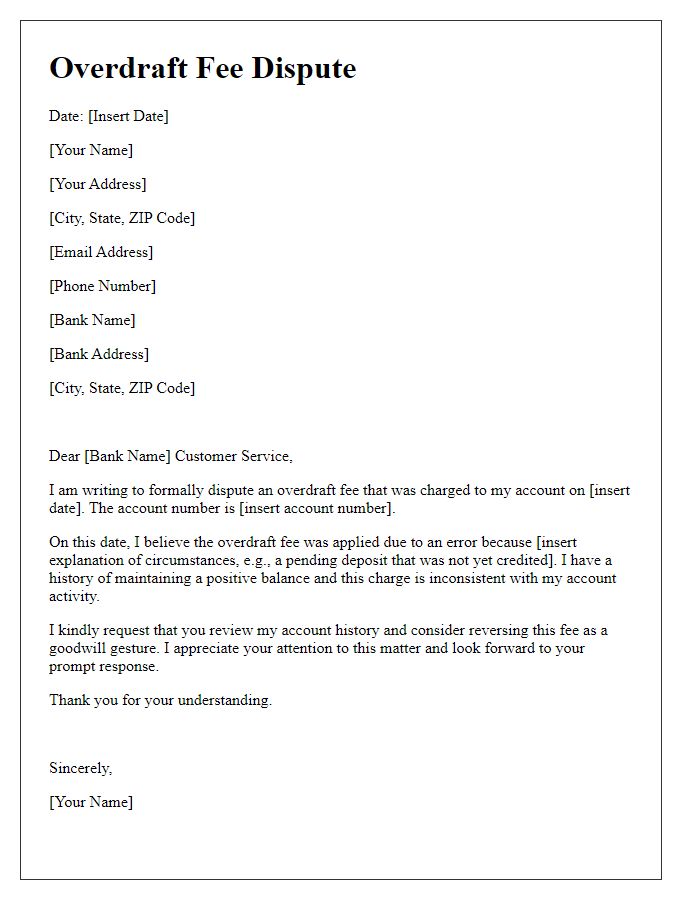

An overdraft fee refers to a penalty imposed by financial institutions when account holders withdraw more money than is available in their checking account. Many banks, such as Chase or Bank of America, charge between $30 to $35 for each overdraft transaction. In certain cases, a bank may choose to waive these fees based on account holder history or specific circumstances. Regular monitoring of account balances can help prevent overdrafts and associated fees. It is also beneficial for account holders to be aware of their bank's overdraft protection options, which include automatic transfers from savings accounts to cover insufficient funds. Effective communication with bank representatives can also aid in resolving disputes over overdraft fees.

Explanation of Overdraft Occurrence

Frequent overdraft occurrences can lead to unnecessary fees in personal banking experiences, particularly in checking accounts. A common scenario involves a lack of sufficient funds, where an individual withdraws or spends more than the available account balance. For instance, if a customer has $100 but makes a purchase of $120, the bank may cover the shortfall, resulting in an overdraft. Typically, banks charge an overdraft fee ranging from $30 to $35 per occurrence. These fees accumulate quickly, especially if multiple transactions trigger the overdraft within the same billing cycle. Clients often experience these issues during high-expense months, such as holiday seasons or emergencies, contributing to financial strain. Understanding the bank's overdraft policy can help individuals avoid excessive charges and manage finances more effectively.

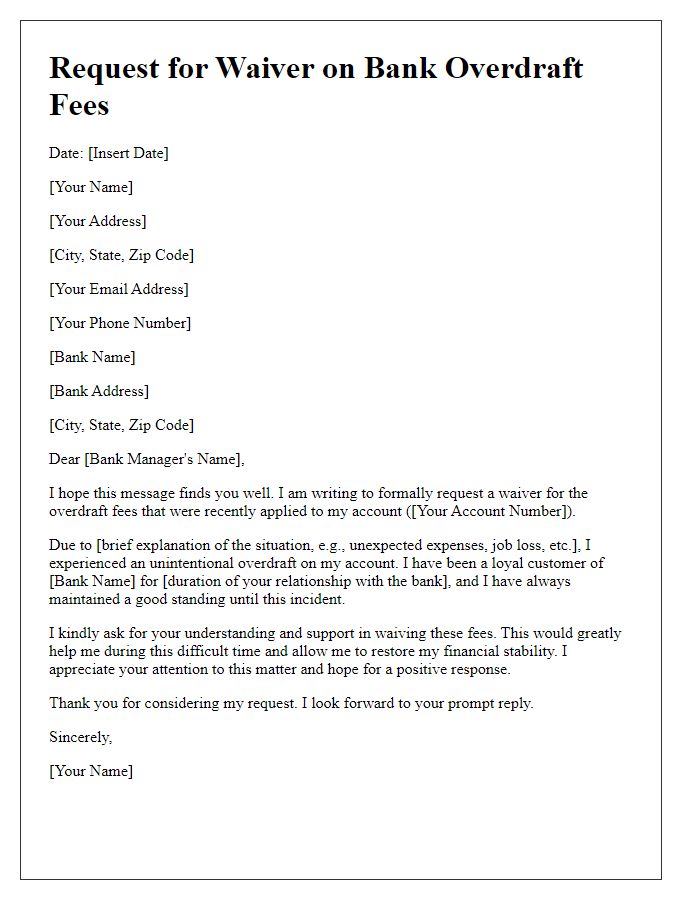

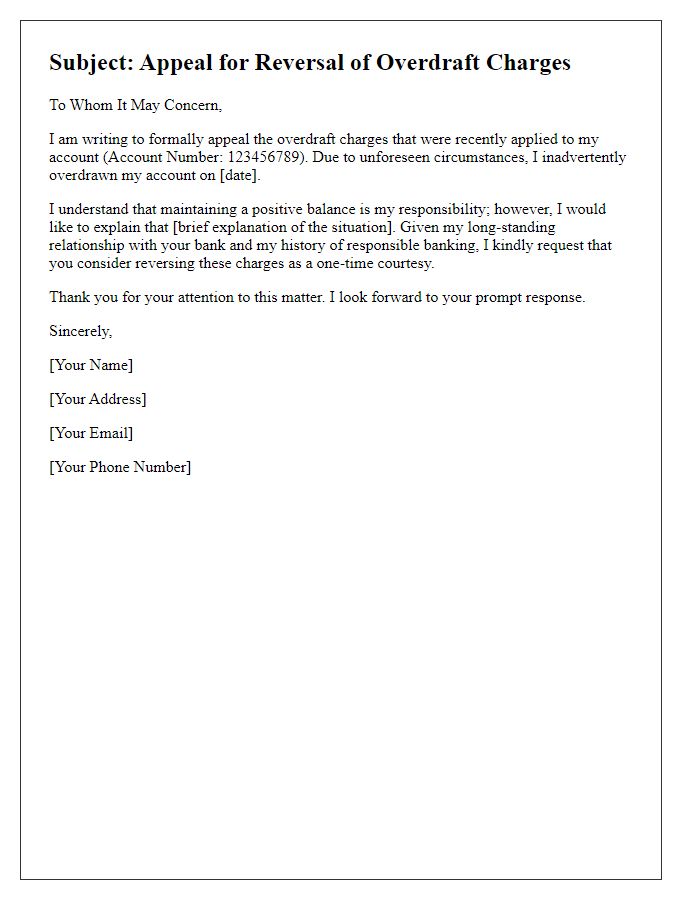

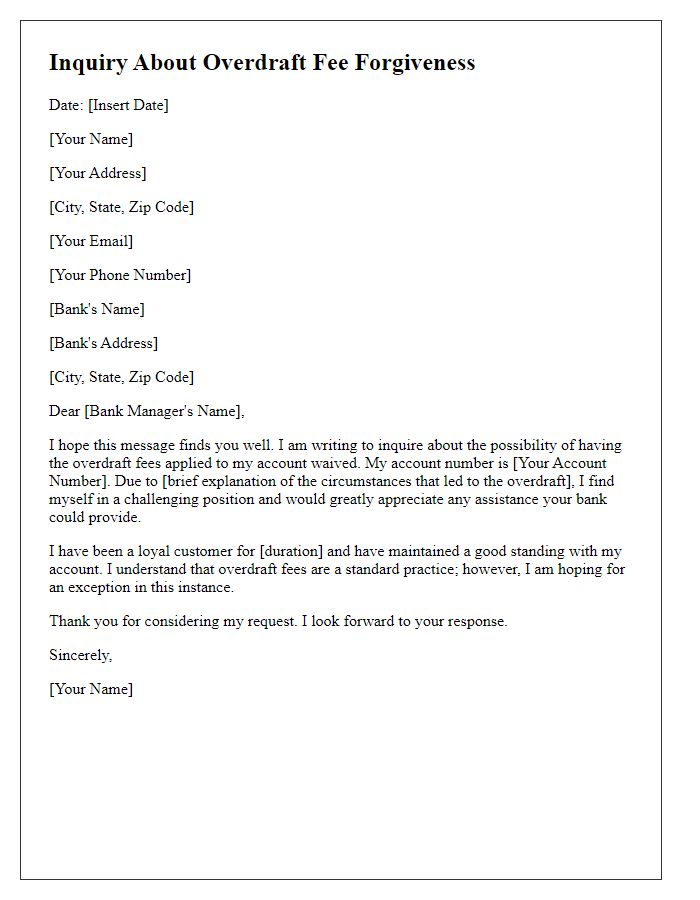

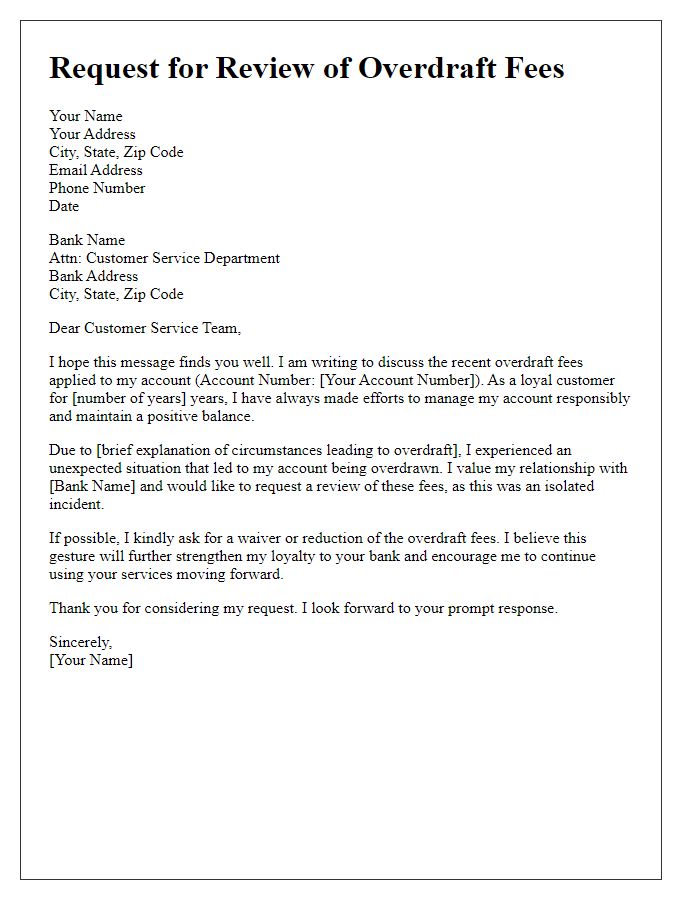

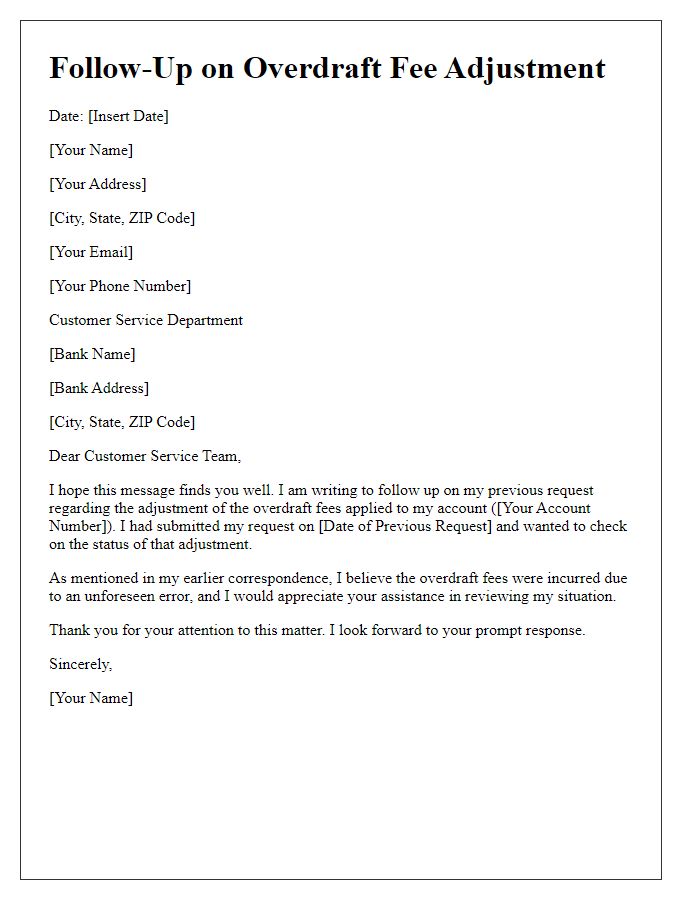

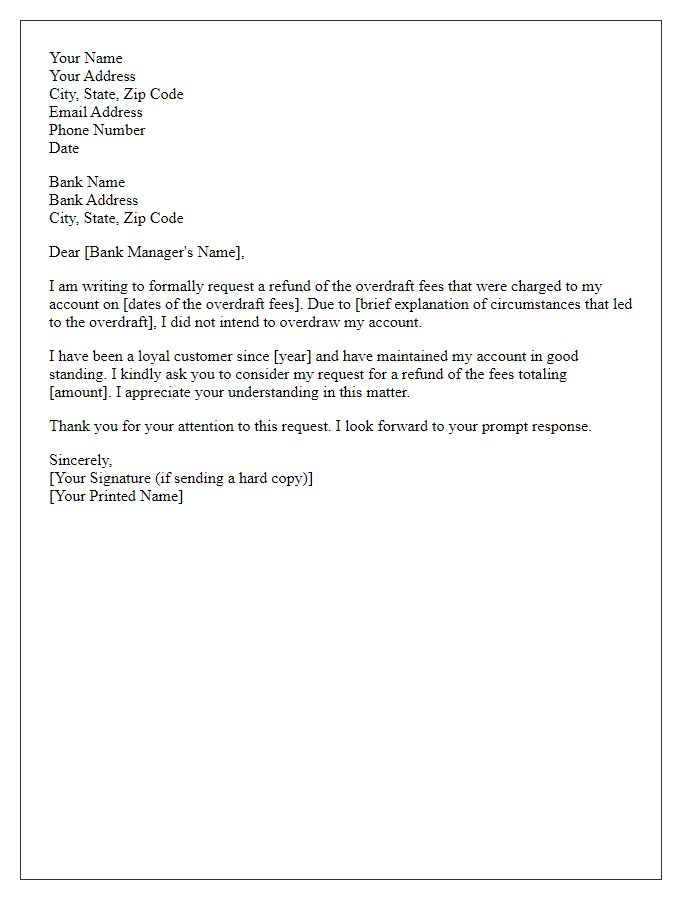

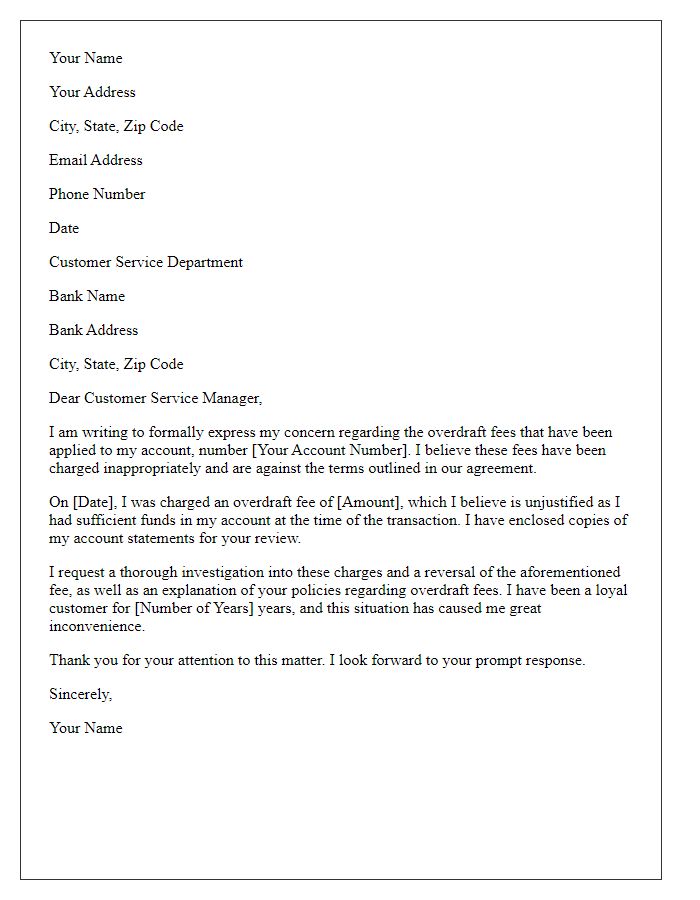

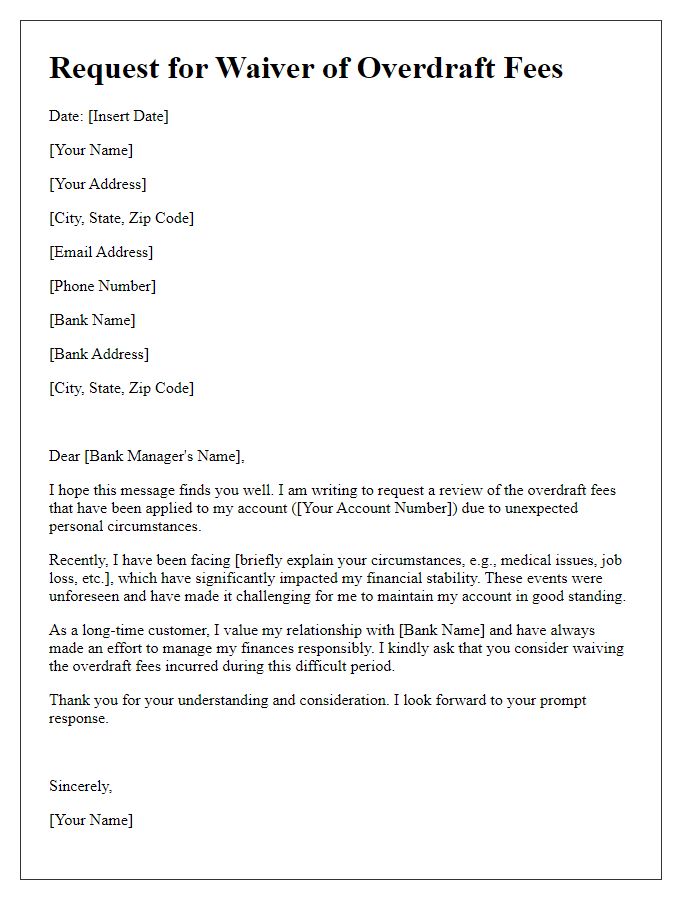

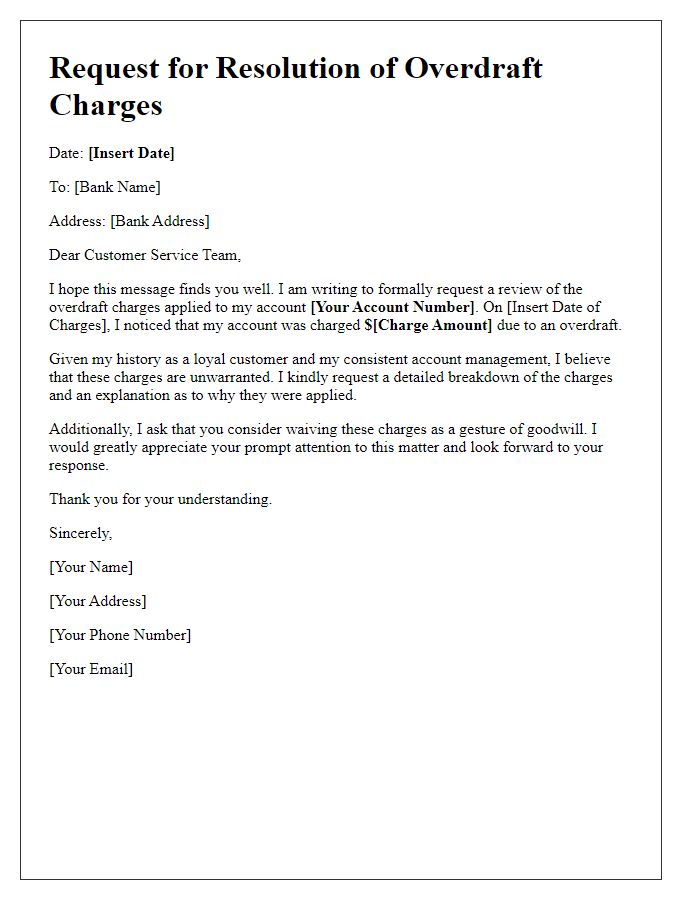

Request for Fee Waiver

Banks often impose overdraft fees, usually around $30 to $35, when an account balance is insufficient to cover a transaction. As of 2023, some banking institutions report that approximately 20% of customers incur these fees annually, leading to substantial revenue. The request for a fee waiver typically involves outlining the circumstances of the overdraft, such as an unexpected medical expense or a job loss, and providing context regarding account history, including timely payments and prior balances. Engaging in a polite conversation with customer service representatives at bank locations or calling dedicated support lines can significantly enhance the chances of successfully obtaining a waiver, especially if the account holder has demonstrated a consistent saving behavior or loyalty to the institution over time. Consistency in communication and clarity of the situation are vital in achieving a favorable outcome.

Demonstration of Financial Stability

Demonstrating financial stability to a bank involves presenting a clear picture of your income, expenses, and efforts to manage your finances responsibly. Provide evidence of consistent income from employment or self-employment, highlighting average monthly earnings (for example, $4,000) over the past three months which shows reliability in cash flow. Include documentation such as pay stubs or bank statements, reflecting regular deposits. Present a detailed budget outlining monthly expenses (like rent $1,200, utilities $300, groceries $400) to showcase your responsible spending habits. Mention any recent initiatives taken, such as starting a savings plan with specific goals, or attending financial literacy workshops, to underscore your commitment to improving financial management. Finally, reaffirm your intention to keep your account in good standing and request a waiver for the overdraft fees, citing your proactive approach and consistent efforts towards maintaining financial health.

Expression of Customer Loyalty

The long-standing relationship between customers and financial institutions is often marked by milestones of trust and commitment. Banks, such as Chase Bank and Bank of America, recognize the value of customer loyalty, especially when clients demonstrate responsible financial behavior over several years. Recent overdraft fees, potentially in the thousands of dollars, can create undue stress for loyal customers. These fees, assessed when account balances drop below zero, may result from unforeseen circumstances like medical emergencies or unexpected job loss. In highly competitive markets, many banks, including Credit Union of America, are beginning to review and waive these charges for long-time customers in order to maintain goodwill and uphold positive client relations. Acknowledging customer loyalty is vital for fostering trust and encouraging long-term financial partnerships.

Comments