Are you considering refinancing your mortgage but unsure where to start? In today's ever-changing financial landscape, refinancing can be a smart move to lower your monthly payments or access some of your home's equity. With the right approach and understanding of the process, you can navigate through the options available to you. Keep reading to discover our comprehensive guide on crafting the perfect letter for your mortgage refinancing journey!

Clear Subject Line

Refinancing mortgage debt can significantly reduce monthly payments, allowing homeowners to alleviate financial burdens. Interest rates, often fluctuating, can range from 2.5% to 4.5% depending on various factors including credit score and lender. The refinancing process typically involves a loan application, appraisal of the property, and underwriting, all of which may take four to six weeks. Homeowners in regions such as California, where median home prices exceed $700,000, could benefit immensely from this financial strategy. It is important to evaluate the long-term savings versus closing costs, which can vary significantly, often ranging from 2% to 5% of the loan amount. Consulting with financial advisors or mortgage brokers, who can provide tailored advice based on current market conditions, is advisable for making informed decisions.

Personal Information

Navigating the process of refinancing mortgage debt often requires clear communication of personal information to lenders. Key details include the applicant's full name, which is essential for identification purposes, along with the Social Security number, offering proof of identity and credit history. Additionally, providing the current residential address, typically a critical factor in assessing the mortgage status, helps lenders evaluate the property involved in the refinancing. The current mortgage account number details the existing loan, while the employment information, such as the employer's name and duration of employment, offers insight into financial stability. Income details, including monthly or annual earnings, are crucial for determining eligibility for better loan terms. Lastly, any additional assets, such as bank accounts or investment portfolios, supplement the financial profile, enabling lenders to make informed decisions regarding new mortgage options.

Loan Details

Refinancing mortgage debt can provide significant financial relief to homeowners in various situations. Current loan amounts, often structured over 15 to 30 years, affect monthly payments and interest payments considerably. Shifting from a higher interest rate, such as 5.5% or 6%, to a lower rate, for example 3.25%, can save thousands of dollars over the life of the loan. Locations with increasing home values, such as Austin, Texas, have become hotspots for refinancing, allowing homeowners to tap into their equity, often exceeding 80% of the property's value. Key elements, such as the new loan term (e.g., 30 years), fixed or adjustable rate options, and associated fees (often ranging between $2,000 to $5,000), should be carefully evaluated to ensure a strategic financial decision.

Reason for Refinancing

Refinancing mortgage debt often provides homeowners a pathway to financial flexibility and savings. Home equity (the difference between the property's current market value and outstanding mortgage balance) can create opportunities for lower interest rates, which might reduce monthly payments significantly. For instance, a homeowner with a $300,000 mortgage at a 4.5% interest rate could save thousands over the loan's lifespan by refinancing to a 3.5% rate. Additionally, refinancing can consolidate existing high-interest debts, such as credit card balances, by leveraging home equity to secure a lower overall interest rate. Homeowners in financial distress may also pursue refinancing to adjust the term length of their mortgage, transitioning from a 30-year plan to a 15-year plan, ultimately reducing total interest paid and building equity faster. Understanding local market conditions, such as interest rate trends and lending requirements, plays a vital role in determining the optimal timing for refinancing decisions.

Request Summary

Refinancing mortgage debt involves a financial strategy to improve payment terms on existing home loans, often aiming for lower interest rates. Homeowners may engage with lenders such as Wells Fargo or Bank of America to assess loan options, potentially reducing monthly payments significantly, sometimes by hundreds of dollars depending on the amount borrowed. Key factors include current credit scores, typically ranging from 300 to 850, which influence the interest rate offered. The loan-to-value ratio (LTV), calculated by dividing the remaining mortgage balance by the appraised property value, plays a crucial role as well, with many lenders preferring an LTV below 80% to minimize risk. The refinancing process may incur closing costs ranging from 2% to 5%, which homeowners should consider against the savings gained from lowered payments or reduced loan terms, often measured in 15 or 30 years.

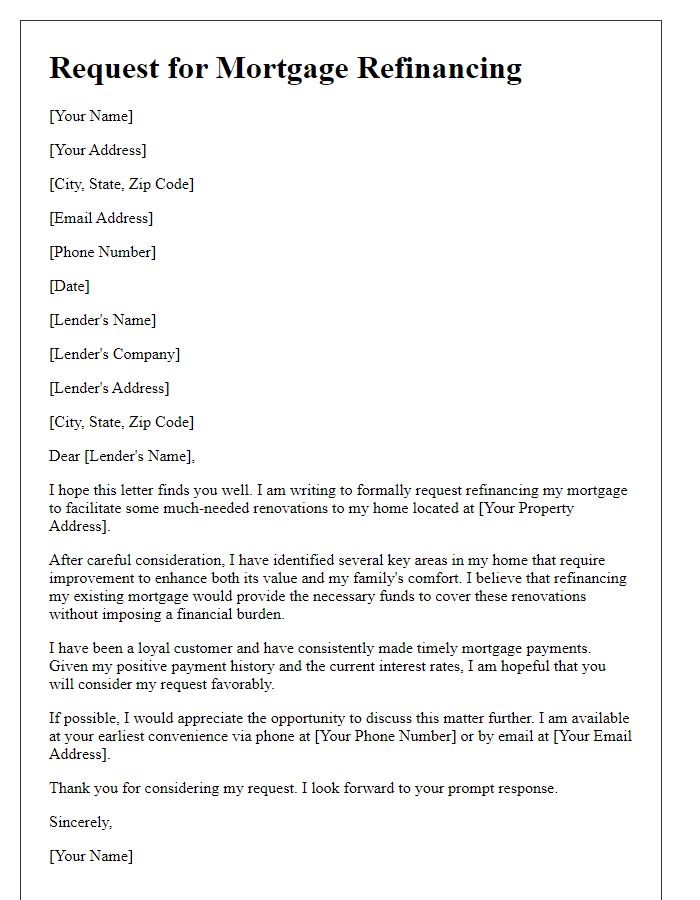

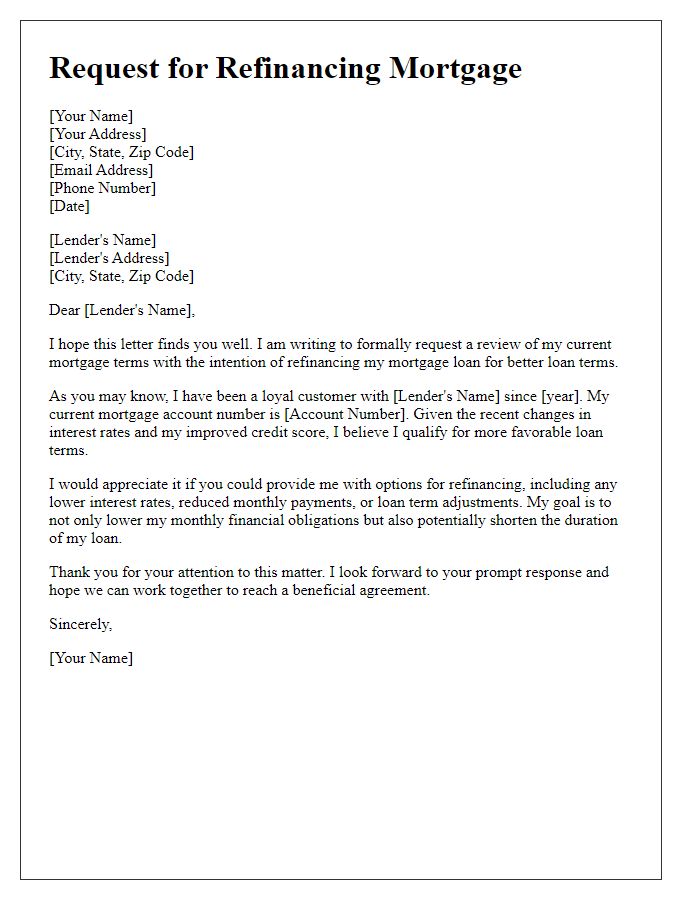

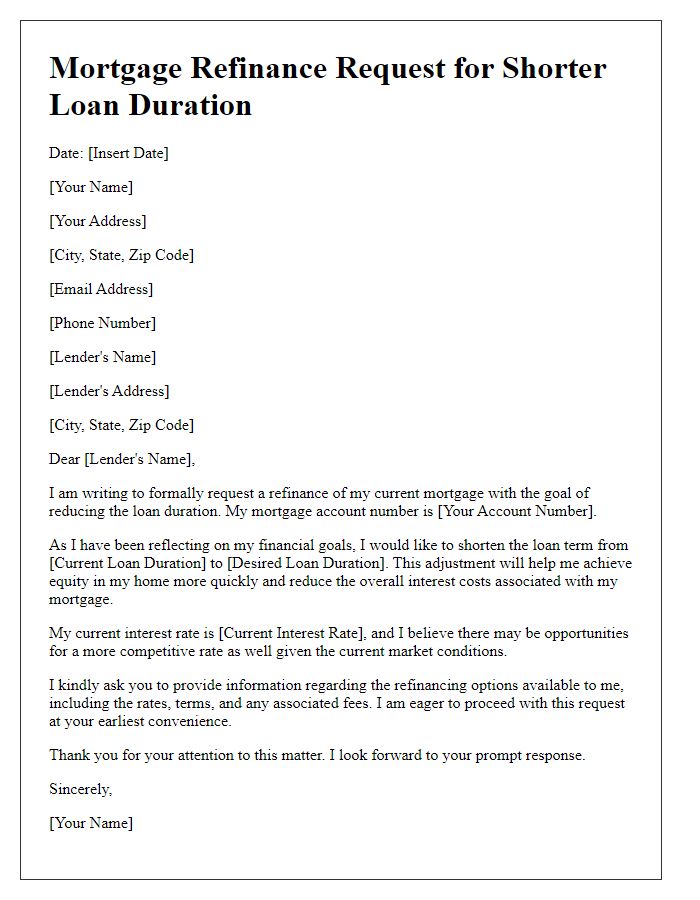

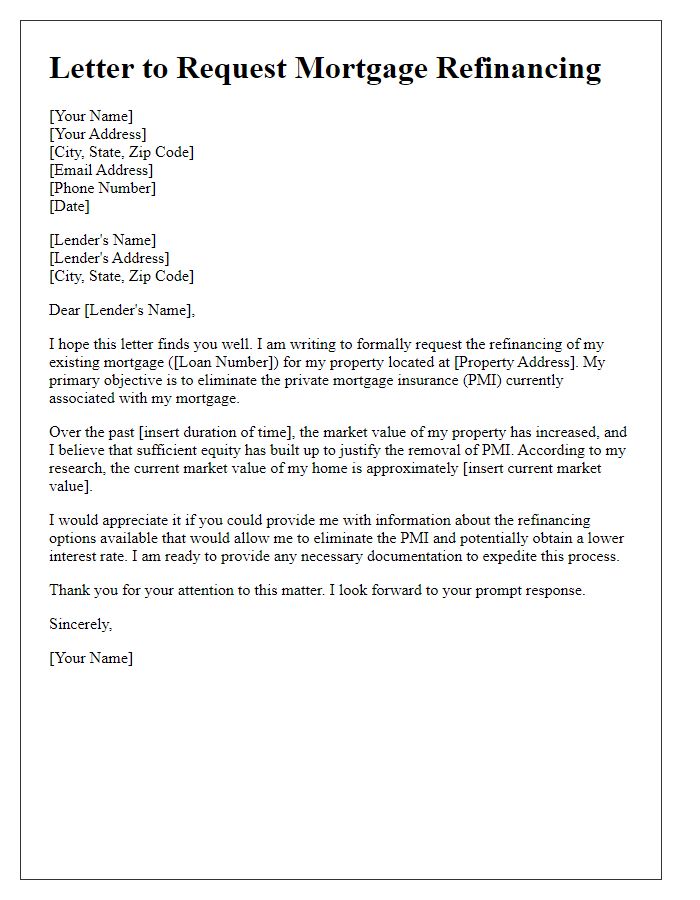

Letter Template For Refinancing Mortgage Debt Samples

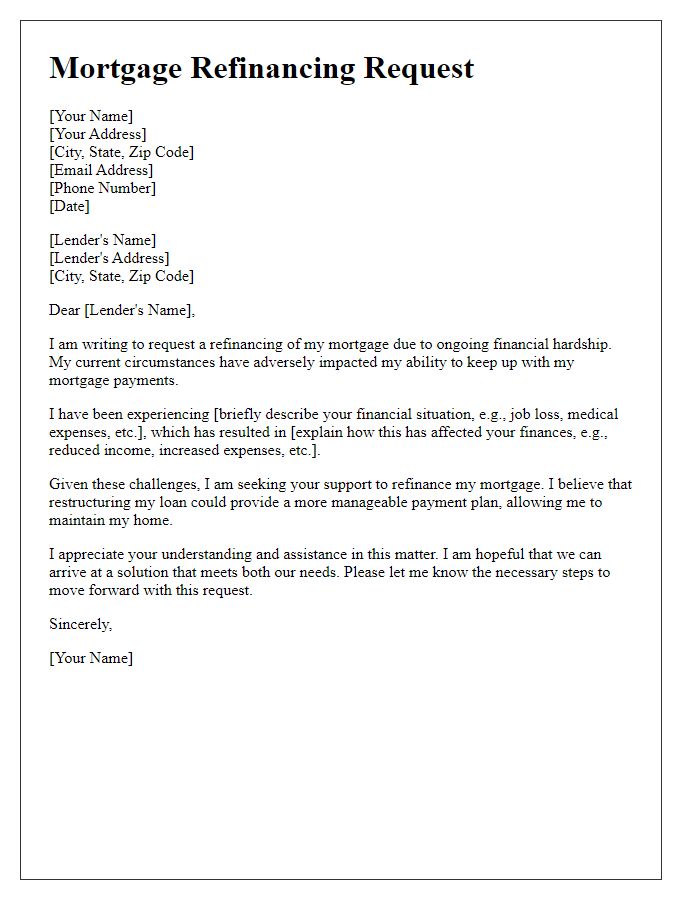

Letter template of mortgage refinancing request for lower interest rates

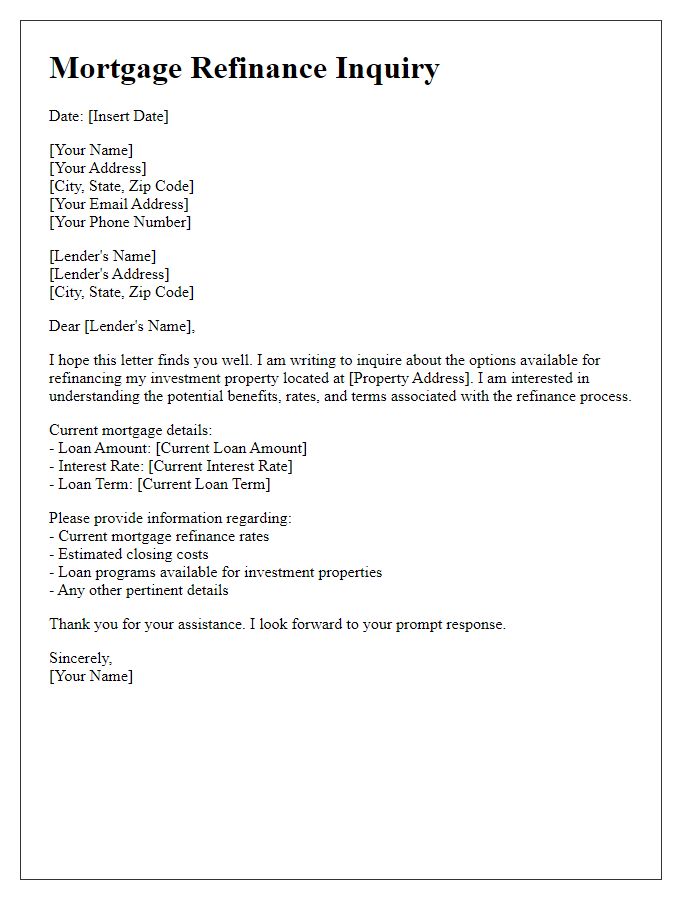

Letter template of mortgage refinance application for adjustable-rate conversion

Comments