Are you struggling with debt and unsure how to navigate your options? Negotiating revised debt terms can be a daunting task, but it's a vital step toward regaining financial stability. In this article, we'll explore key strategies and a sample letter template to help you communicate effectively with your creditors. So, let's dive in and empower you to take control of your financial future!

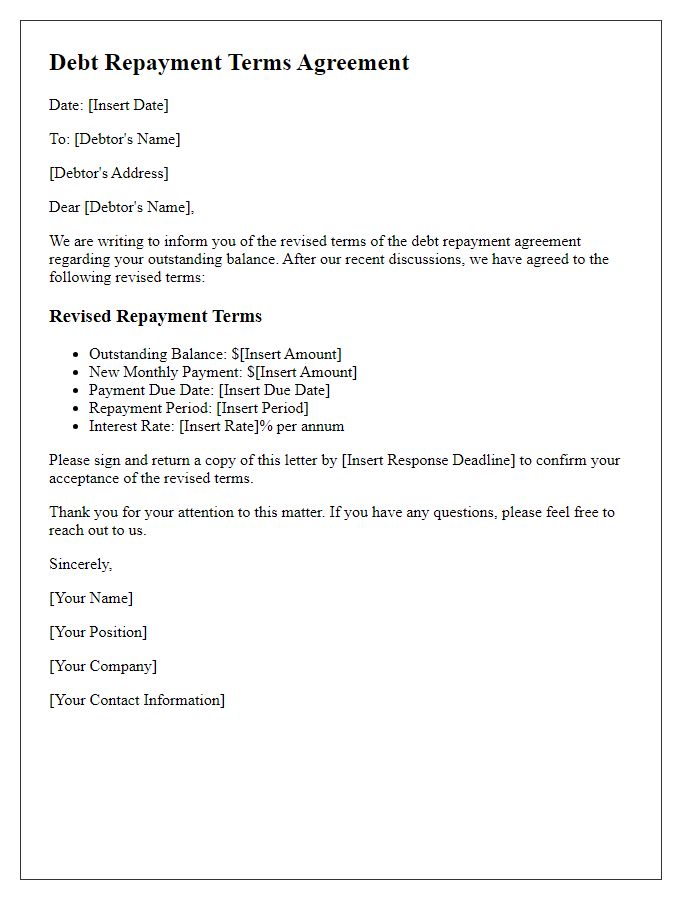

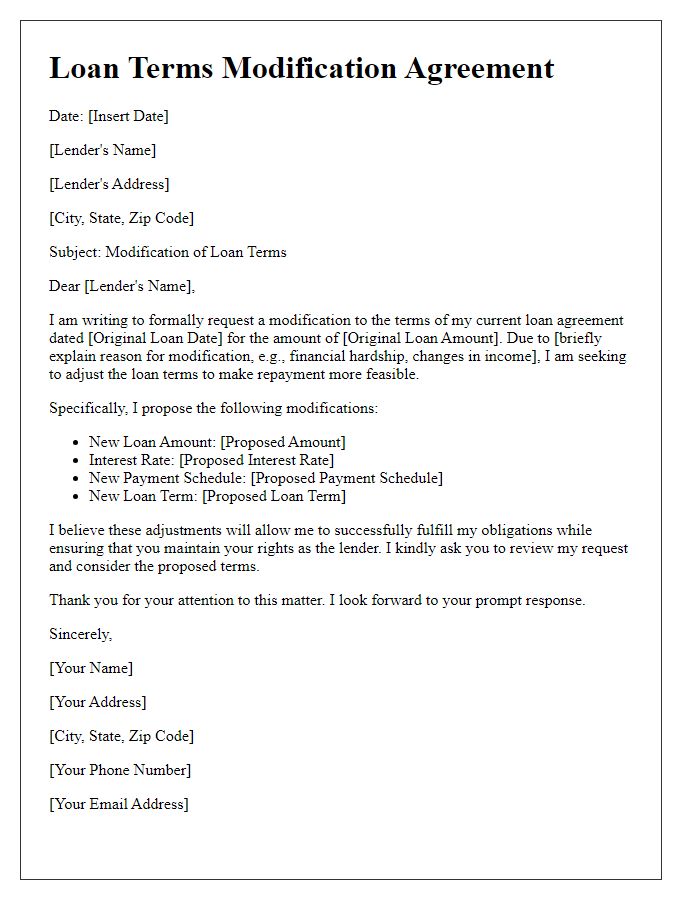

Clear identification of parties involved

In a revised debt terms agreement, clear identification of parties involved plays a crucial role in ensuring legal clarity and accountability. This includes full legal names of the individuals or entities engaged in the agreement, such as Borrower (for example, John Doe, residing at 123 Elm Street, Springfield) and Lender (for instance, ABC Financial Corporation, located at 456 Oak Avenue, Metropolis). Each party's role must be explicitly stated, including their respective responsibilities and obligations within the agreement. Furthermore, contact information, including phone numbers and email addresses, is vital for effective communication regarding the terms. The agreement also outlines the specific terms of the debt, including total amount owed (for instance, $10,000), interest rates (such as 5% annually), and repayment schedules to ensure mutual understanding and enforcement.

Detailed description of revised terms

The revised debt terms agreement outlines significant modifications affecting both the repayment schedule and interest rates. The new repayment schedule extends the duration from the initial 36 months to 60 months, providing borrowers with lower monthly payment obligations and improving cash flow. The interest rate has been adjusted from the original 8% APR to a more manageable 5% APR, benefiting debtors with decreased financial pressure. Additionally, late fees have been reduced from $50 to $25, encouraging timely payments. Furthermore, there is now a grace period of 15 days before any penalties are applied, offering borrowers increased flexibility. The revised terms aim to enhance the financial viability for borrowers facing economic challenges while ensuring lenders can maintain a healthy return on their investments.

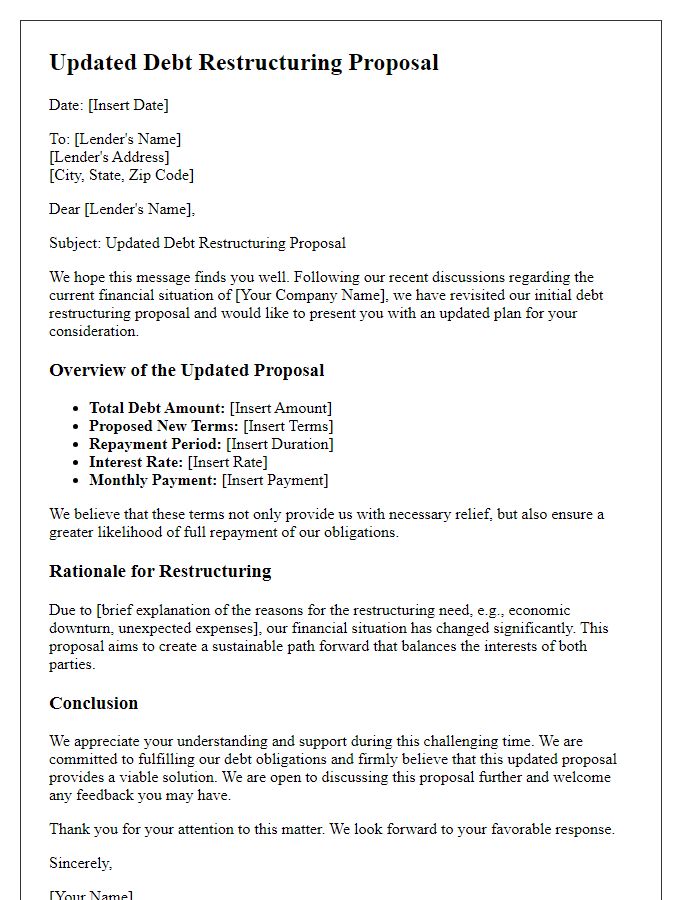

Justification for amendments

The revised debt terms agreement outlines critical amendments aimed at providing a more sustainable repayment structure for the borrower. These adjustments are necessary due to changes in the borrower's financial circumstances, including a significant decline in revenue (approximately 30% compared to the previous fiscal year) caused by market fluctuations and economic downturns. The new terms offer a grace period extending up to six months to reduce immediate financial strain, alongside an extended repayment plan over 60 months, ensuring manageable monthly installments while maintaining the lender's interests. Additionally, adjustments to interest rates align with current market conditions (where the Federal Reserve's setting falls between 2% and 3%), providing a more favorable rate for repayment. This proposal ultimately benefits both parties by promoting timely repayments and reducing the risk of default.

Signatures of all parties

The revised debt terms agreement outlines the updated financial obligations between the involved parties, detailing specific conditions such as repayment schedules, interest rates, and amounts owed. This document requires signatures from all parties, including the creditor and debtor, to confirm mutual consent and legal binding. Each signature serves as a formal acknowledgment of the agreed terms, ensuring compliance and facilitating future enforcement. The agreement also stipulates the date and place of signing, emphasizing the importance of mutual agreement in financial transactions.

Include effective date of revised agreement

Revised debt terms agreements establish new conditions for repayment between parties to optimize financial arrangements. The effective date for any revised agreement is crucial as it marks the commencement of the new terms. For instance, if the revised agreement stipulates a new interest rate of 5% instead of the previous 7%, this adjustment might significantly impact total repayment amounts over the course of the loan duration, which could span several years. Additionally, clear documentation of obligations, such as monthly payment schedules and due dates, ensures transparency and accountability. Proper acknowledgment of all parties involved, along with signatures, solidifies the agreement's enforceability under legal standards, ensuring compliance through the enforcement of the updated terms beginning on the specified effective date.

Comments