Debt negotiation can often feel like navigating a rocky road, but it's important to understand that you're not alone in this journey. Many individuals and businesses seek to find relief from overwhelming financial obligations, and successfully negotiating your debt can lead to a fresh start. In this article, we'll explore the key outcomes of debt negotiations, providing insights and tips to help you make informed decisions moving forward. So, if you're ready to gain a clearer understanding of your financial future, keep reading!

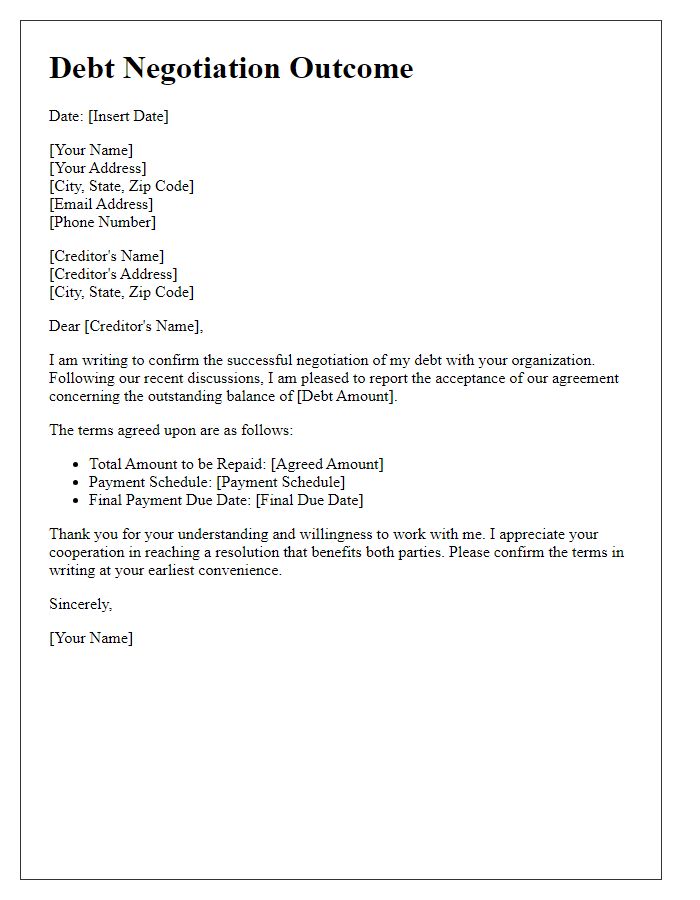

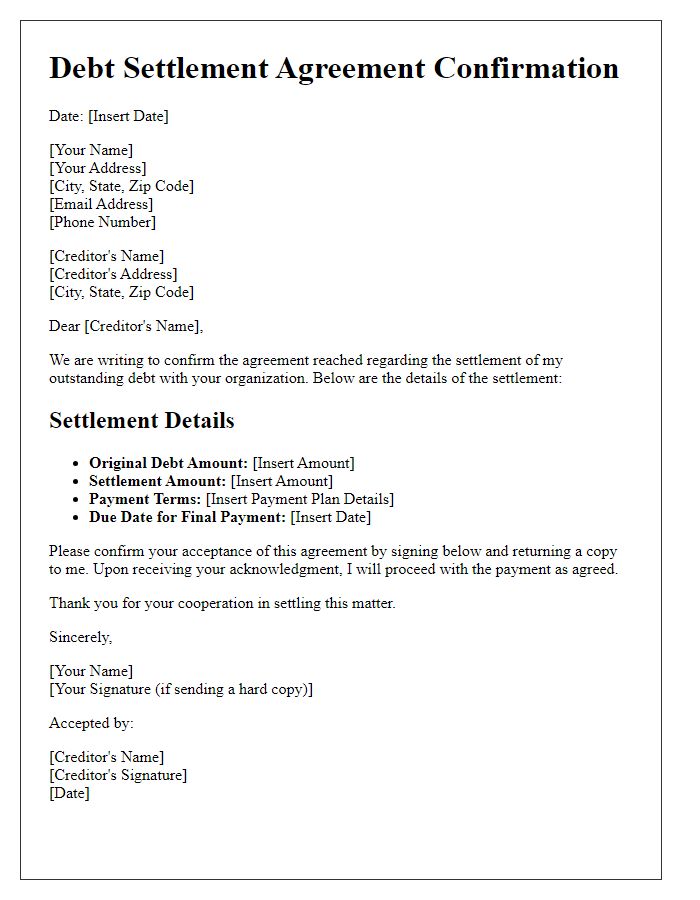

Clear Identification of Parties

In a debt negotiation outcome, it is crucial to clearly identify the involved parties to establish responsibility and agreement terms. The creditor, representing the entity owed money, may be a financial institution like Bank of America or a private lender, while the debtor may be an individual or company, such as John Doe or XYZ Corp. The location of the negotiation can also impact the outcome, with jurisdictions like California or New York having specific laws governing debt settlements. Documenting the identities including full names, addresses, and any relevant account numbers ensures clarity throughout the negotiation process and assists in mitigating future disputes. This identification serves as an essential foundation for binding agreements and terms of repayment arrangements.

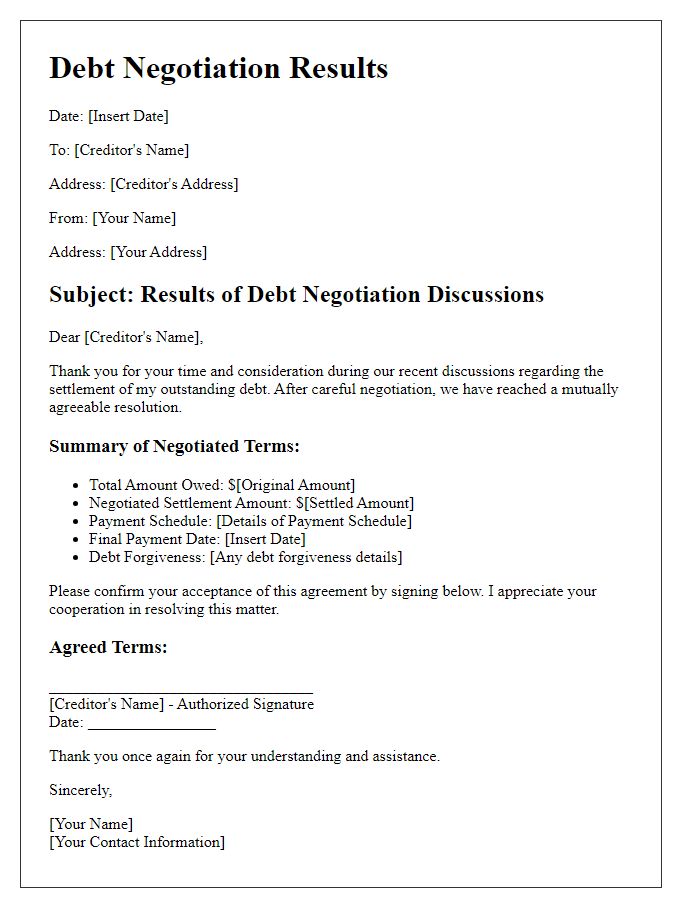

Summary of Negotiation Process

The negotiation process regarding debt resolution involved multiple discussions between the creditor, a financial institution specializing in consumer loans, and the debtor, an individual facing financial hardship due to unforeseen circumstances such as medical emergencies. The initial negotiations began on March 15, 2023, with both sides presenting their financial situations, highlighting the need for a feasible repayment plan. The creditor proposed various alternatives, including reduced interest rates and extended repayment terms, making it easier for the debtor to meet obligations. After several rounds of amendments, a final agreement was reached on April 30, 2023, resulting in a sustainable plan where the debtor would pay 50% of the outstanding balance over a two-year period, along with a waiver of late fees, while the creditor consented to a small reduction in the total amount owed. This resolution allowed the debtor to regain financial stability and the creditor to recover a portion of the loan amount in a more manageable timeframe.

Agreed Terms and Conditions

After a successful debt negotiation process, both parties have reached an agreement, outlining specific terms and conditions. The total debt amount, previously recorded at $50,000, has been reduced to a more manageable figure of $30,000. The repayment schedule consists of six monthly installments of $5,000 each, commencing on January 15, 2024. Interest rates have been eliminated entirely, providing significant financial relief. Furthermore, the lender has agreed to report the account as "settled in full" to credit bureaus, contributing positively to future credit scores. This agreement aims to foster a renewed financial relationship, promoting stability and collaboration moving forward.

Payment Plan Details

A debt negotiation outcome often leads to a detailed payment plan, which outlines the agreed-upon terms to repay outstanding amounts. This agreement may include the total debt amount, for instance, $10,000 owed to a creditor, with a proposed repayment period of 24 months. The monthly payment might be set at $416.67, allowing the debtor to manage finances effectively without overwhelming impact. Key details such as interest rates, frequently lowered to around 5% for better affordability, and any potential penalties for missed payments, which may include a fee of $50 or additional interest, should be clearly stated. Additionally, the payment schedule might include specific due dates each month, ensuring both parties understand the timeframe for fulfilling the debt. These structured arrangements aim to provide a clearer path toward financial stability while maintaining open lines of communication between the debtor and the creditor.

Contact Information for Further Queries

Debt negotiations can significantly impact financial stability, leading to revised payment plans and potential debt forgiveness. For example, successful negotiations could reduce outstanding balances by up to 50%, allowing debtor individuals or businesses to regain financial footing. Creditors involved, such as banks or collection agencies, often require comprehensive documentation of income and expenses during this process to assess the debtor's ability to meet new obligations. Following negotiations, parties may receive formal agreements detailing new payment terms, interest rates, and timelines. Maintaining open lines of communication is essential for clarifying concerns and addressing any further queries related to the outcome, ensuring a smoother transition into the new financial arrangement.

Comments