Are you feeling a bit overwhelmed by the complexities of joint debt responsibilities? You're not alone! Many individuals find themselves navigating the often murky waters of shared financial obligations, and clearing up any confusion can be a vital step toward financial stability. So, let's dive deeper into the essential aspects of joint debt and how to clarify your responsibilitiesâread on!

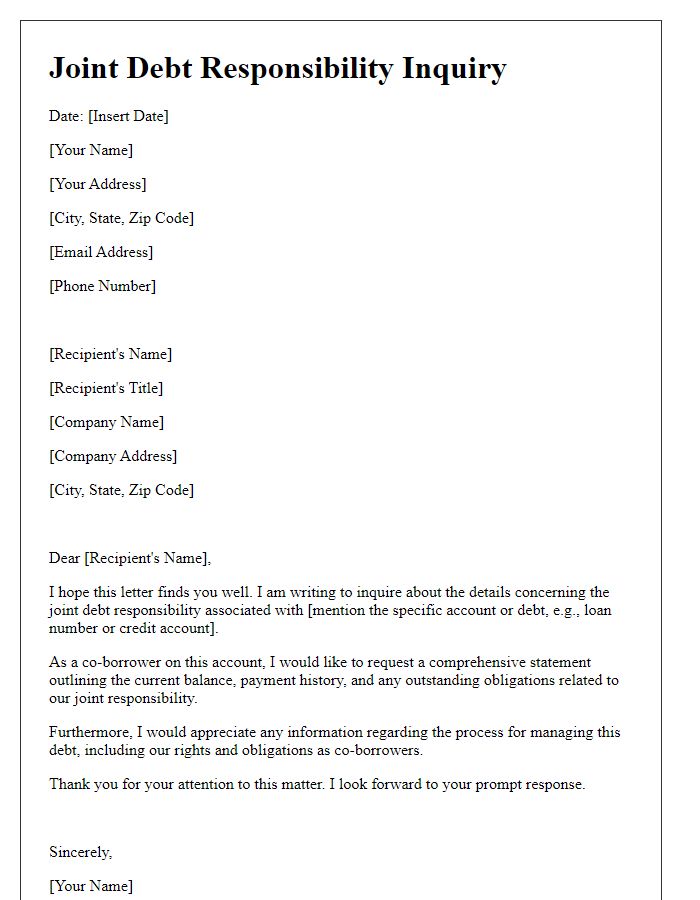

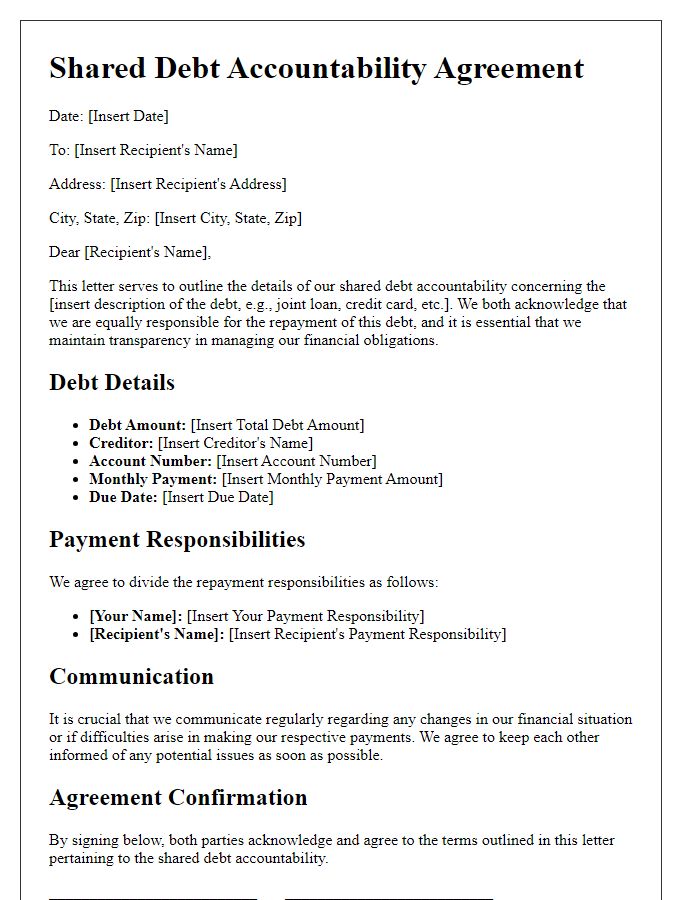

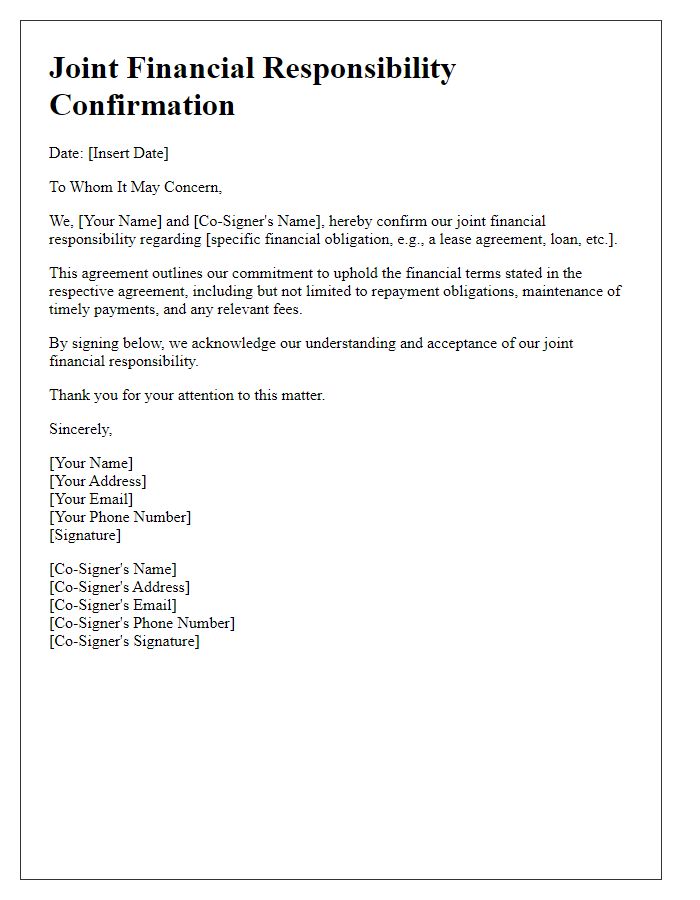

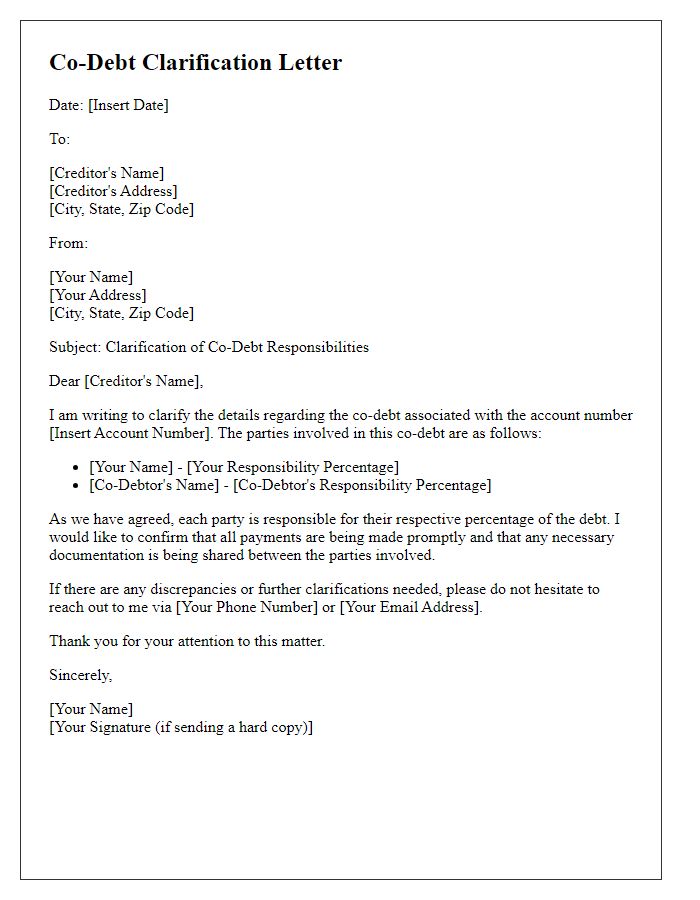

Clear Identification of Parties

Clear identification of parties is essential in joint debt responsibility agreements. In this context, the involved parties include the primary borrowers, typically identified by full legal names and contact information, such as John Smith residing at 123 Main Street, Anytown, USA, and Jane Doe located at 456 Oak Avenue, Sometown, USA. The financial institution, for example, First National Bank, should also be clearly identified with its relevant details, including address and account number associated with the joint debt. This clarity ensures all parties understand their obligations and rights, reducing potential disputes regarding responsibility in the event of non-payment or financial hardship. Additionally, defining the roles of guarantors or co-signers, if applicable, can provide further context and accountability among all involved.

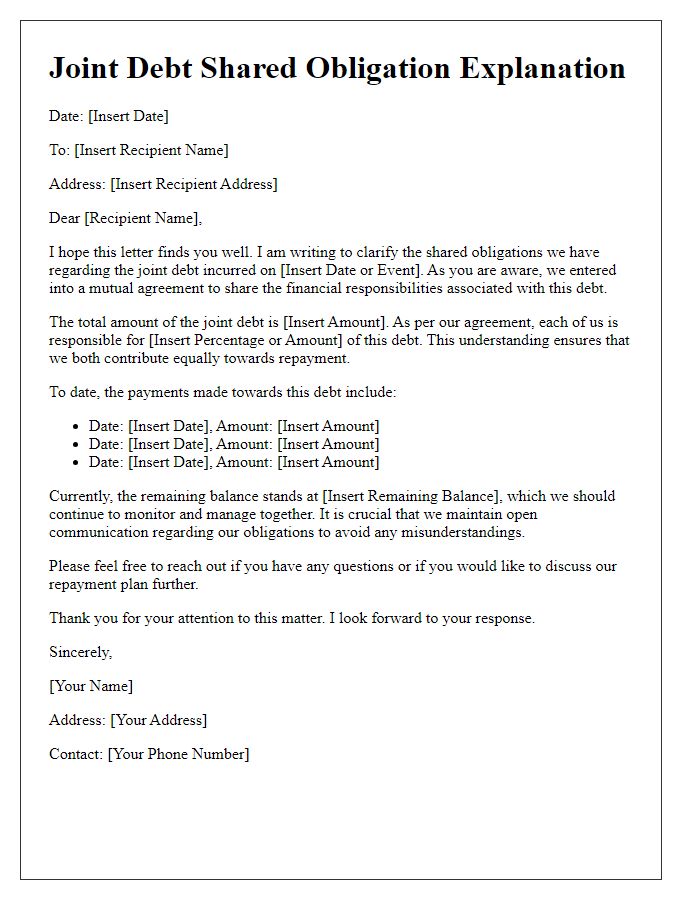

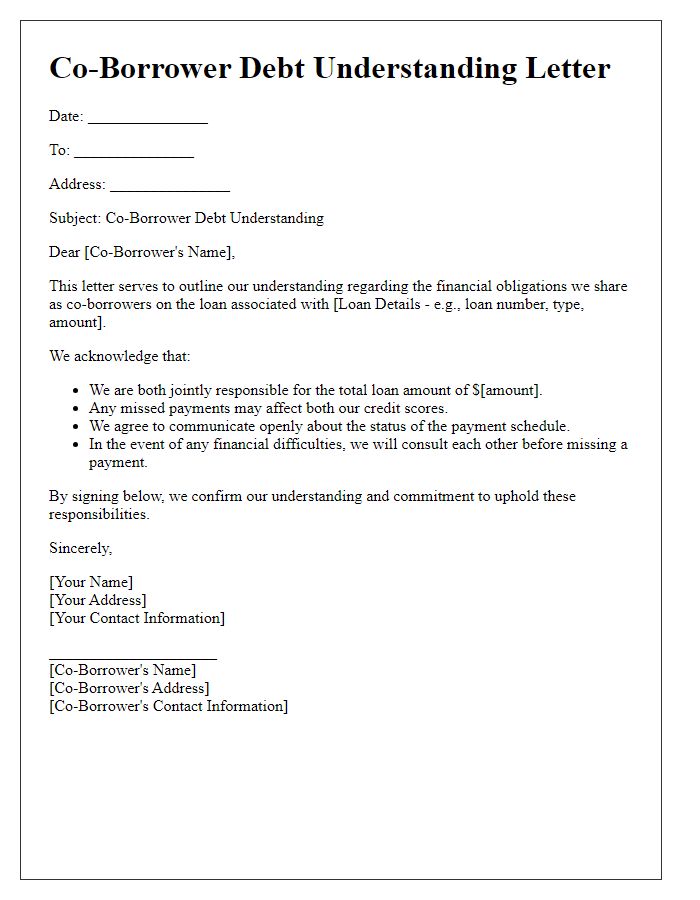

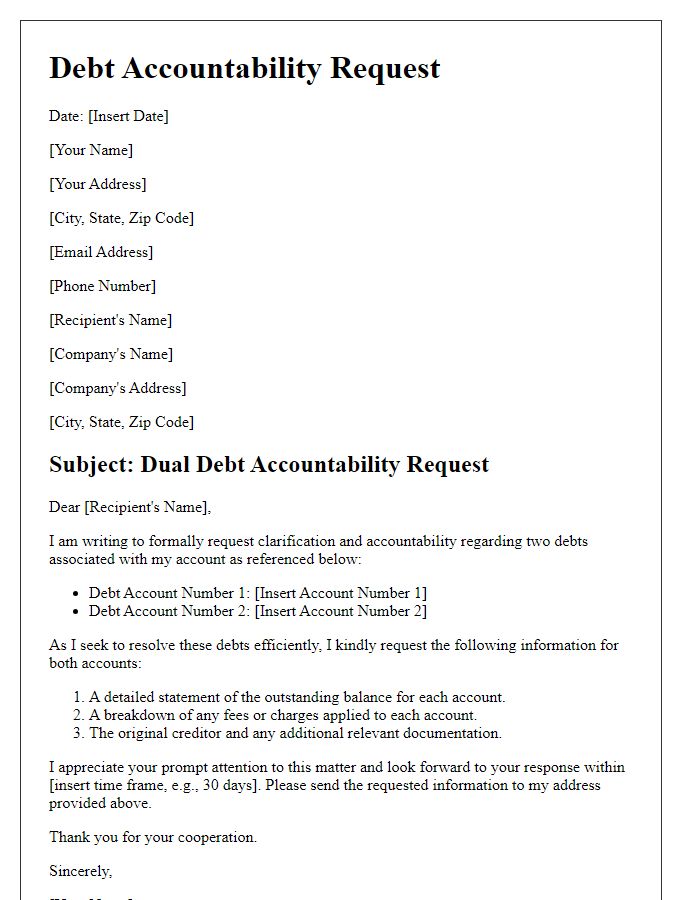

Detailed Description of Debt

Joint debt responsibilities often arise from shared financial engagements, such as a home mortgage taken out on a property located in Seattle, Washington, or a car loan for a vehicle purchased in January 2022. This type of debt typically involves multiple parties legally accountable for repayment, with lenders like American Express issuing credit cards or loans. The agreed-upon total debt amount, such as $30,000 for home renovations or $15,000 for the car, should be documented. Monthly payment obligations, averaging $500 for the mortgage and $300 for the car loan, must be adhered to by all parties involved. The consequences of default, including potential foreclosure or repossession, further emphasize the legal and financial implications of shared debt responsibility. Awareness of credit scores from agencies like Experian can also influence future borrowing capabilities.

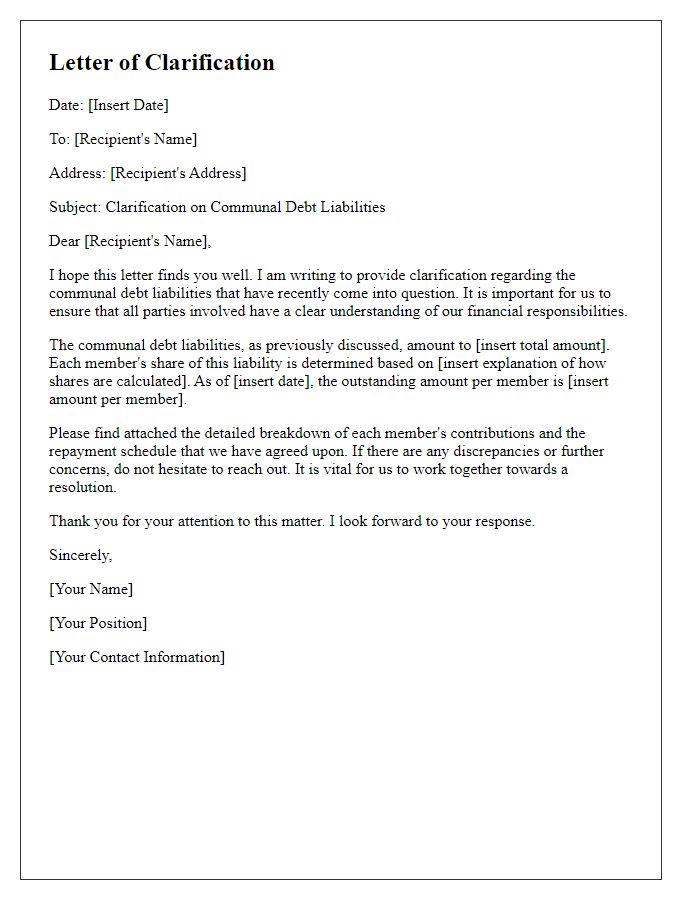

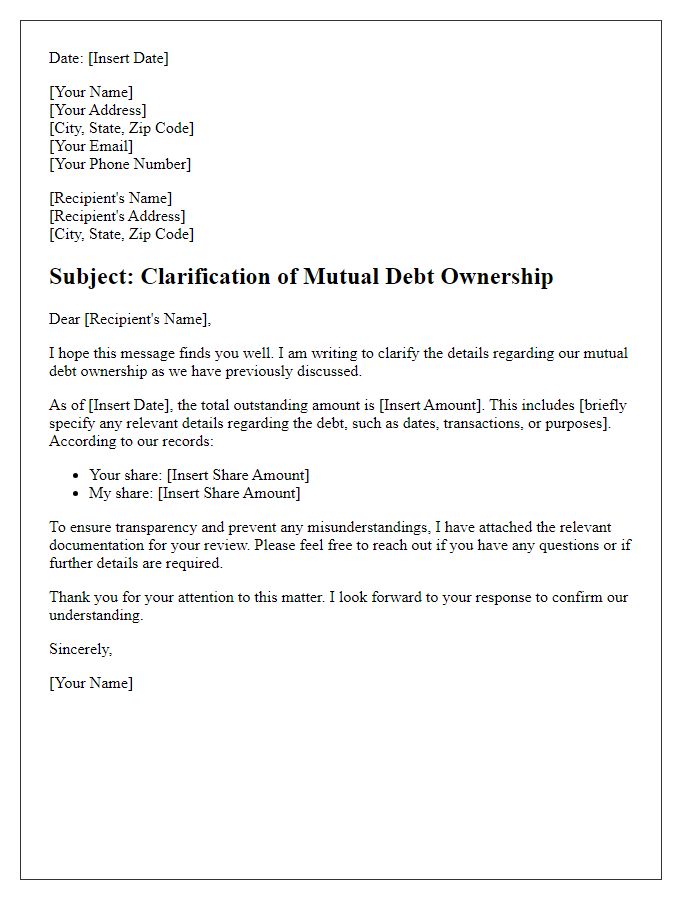

Statement of Shared Responsibility

A Statement of Shared Responsibility often clarifies the obligations of two or more parties regarding joint debts. Clear terms are essential to avoid confusion and ensure accountability. The statement should outline specific debts, including account numbers, total amounts owed, and payment terms. Parties should list their names, addresses, and contact information to establish identities and communication paths. The date of agreement and signatures from each party are crucial for validity. Additionally, conditions for dispute resolution should be included to address any potential disagreements. Such a document serves as a legal safeguard, ensuring mutual understanding of financial responsibilities.

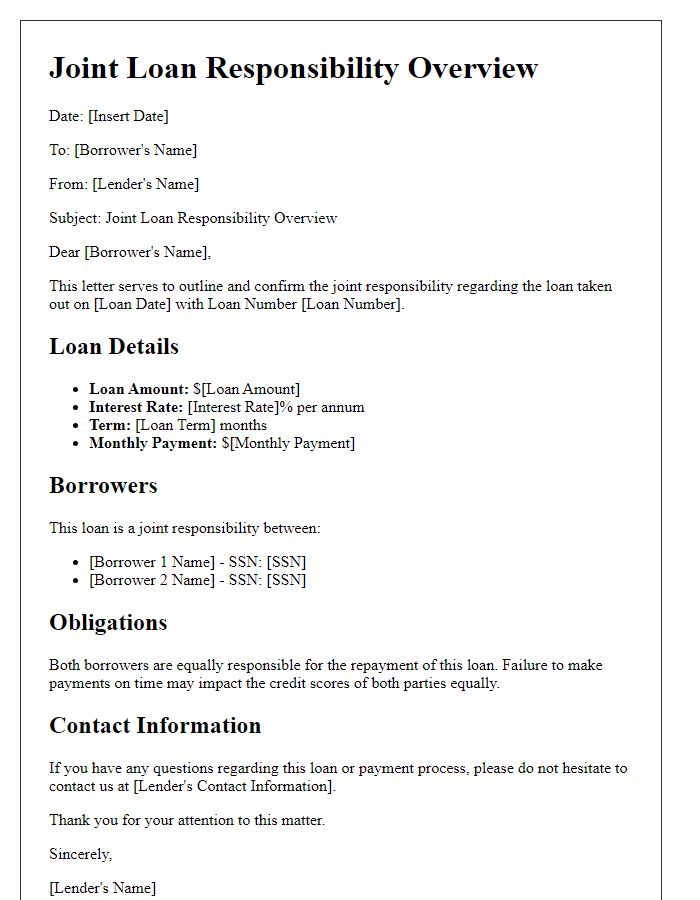

Payment Terms and Conditions

Joint debt responsibility often involves the clarity of payment terms and conditions for all parties involved. Agreements concerning debts, such as credit card balances or loans, necessitate detailed documentation outlining responsibilities. Specific terms may include interest rates, payment due dates, and consequences for late payments. For instance, a loan with an interest rate of 5% requires monthly payments by the 15th of each month. Clarity on shared obligations helps prevent misunderstandings and legal disputes. Furthermore, detailing each party's liability ensures that both individuals are aware of their financial responsibilities, fostering accountability in shared financial commitments.

Contact Information for Clarifications

Joint debt responsibilities often involve multiple parties sharing financial obligations. Clearly defining contact information for clarifications can help ensure accountability and transparency in managing the debts. This includes mentioning the primary account holder, typically listed on the loan documentation, along with additional co-signers, who may be accountable for the debt repayment. Specifying phone numbers, email addresses, or postal addresses for each party involved is crucial for effective communication. A designated point of contact can streamline inquiries, resolve discrepancies, or facilitate discussions regarding payment plans or refinancing options, ultimately promoting a better understanding of shared financial commitments.

Comments