Are you feeling overwhelmed by a confusing debt situation? You're not alone, and seeking clarification is the first step toward regaining control. Writing a clear and concise letter requesting details about your debt can make all the difference. Dive into our guide to learn how to craft the perfect request and take charge of your financial clarity!

Clear Subject Line

A request for debt clarification is essential for understanding personal finances, particularly when dealing with organizations like credit bureaus or loan servicing companies. It is crucial to specify the amount (e.g., $1,500) and the original creditor's name (for instance, XYZ Bank) to ensure accurate communication. State the account number associated with the debt, which is vital for tracking purposes. Clarify the reasons for the request, such as discrepancies in billing statements or a lack of information regarding repayment terms. Include any relevant dates (like when the debt was incurred) to provide context and facilitate prompt investigation. Address the letter to the appropriate department (like customer service) and include your contact information for follow-up queries regarding your request.

Recipient's Details

Inaccurate debt information can create significant confusion and stress for individuals facing financial challenges. Debt clarification requests are often sent to creditors, outlining specific discrepancies related to account balances, payment history, or interest rates. Accurate details of the original loan agreement, which include the principal amount of $5,000 with a 5% annual interest rate, must be clearly communicated. Including dates such as the loan origination on January 15, 2021, and any additional fees incurred during this period is essential. Furthermore, providing identification reference numbers, such as account number 123456789, allows for precise tracking of the case. This detailed communication ensures that both parties can resolve outstanding issues effectively, fostering a better understanding of the financial obligations at hand.

Precise Debt Reference

A debt clarification request should be directed to the relevant financial institution, covering important details associated with the outstanding debt, including the precise debt reference number assigned by the creditor. The request must clearly articulate the need for clarification of the debt amount, associated fees, payment history, and terms of the agreement. It is essential to include pertinent identifiers, such as the account holder's name, relevant addresses, and the date the debt was incurred. Providing supporting documentation, such as previous correspondence or payment receipts, could facilitate quicker resolution. Direct communication is vital for understanding rights under the Fair Debt Collection Practices Act (FDCPA), which protects consumers when addressing debt-related inquiries.

Specific Clarification Request

Debt clarification requests can often revolve around specific details that require attention. When addressing a debt from a financial institution, such as a bank or credit card company, it is essential to request detailed information regarding the outstanding balance. This balance may stem from various charges including principle amounts, interest rates (which might vary significantly between 15% to 25% annually), late fees, or previous payment allocations that require clarification. A specific focus should be on the original contract terms outlined when the debt was incurred, particularly any changes over time that affect current obligations. Furthermore, it is beneficial to ask for a full statement of account demonstrating all transactions dating back to the inception of the loan or credit line, ideally within the last three to five years. Such thorough documentation aids in preventing misunderstandings and ensures accuracy in settling any outstanding debts.

Contact Information

A request for debt clarification requires comprehensive contact information to facilitate effective communication between the parties involved. Including essential details such as full name, address (including city, state, and zip code), phone number, and email address ensures accurate identification. Additionally, specifying account numbers related to the debt, the creditor's name, and any reference numbers associated with previous correspondence aids in prompt responses. Providing a clear subject line indicating the nature of the request, such as "Debt Clarification Request," maximizes the chances of a swift and organized reply from the creditor or collection agency.

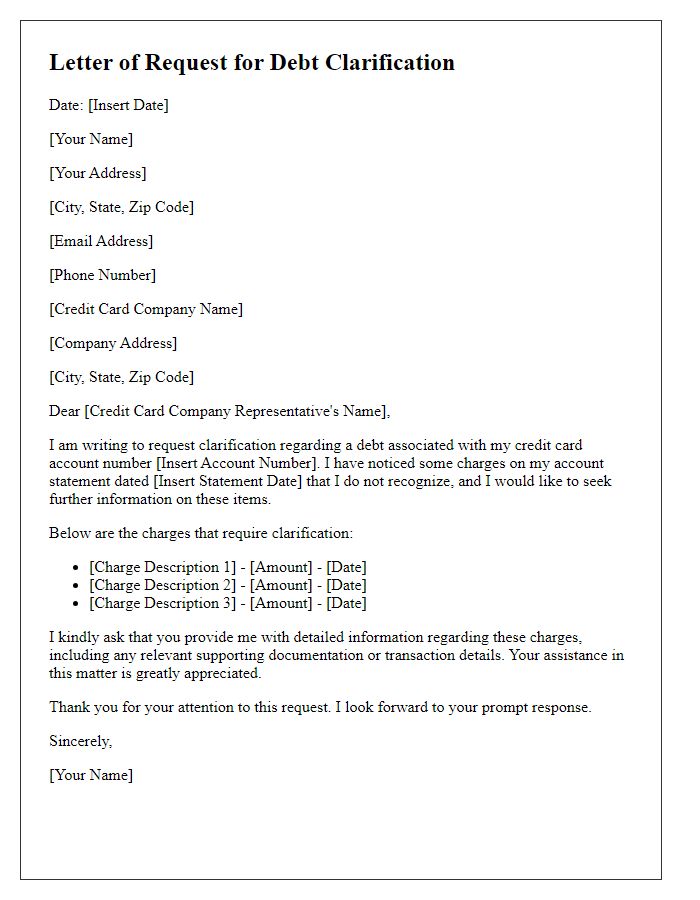

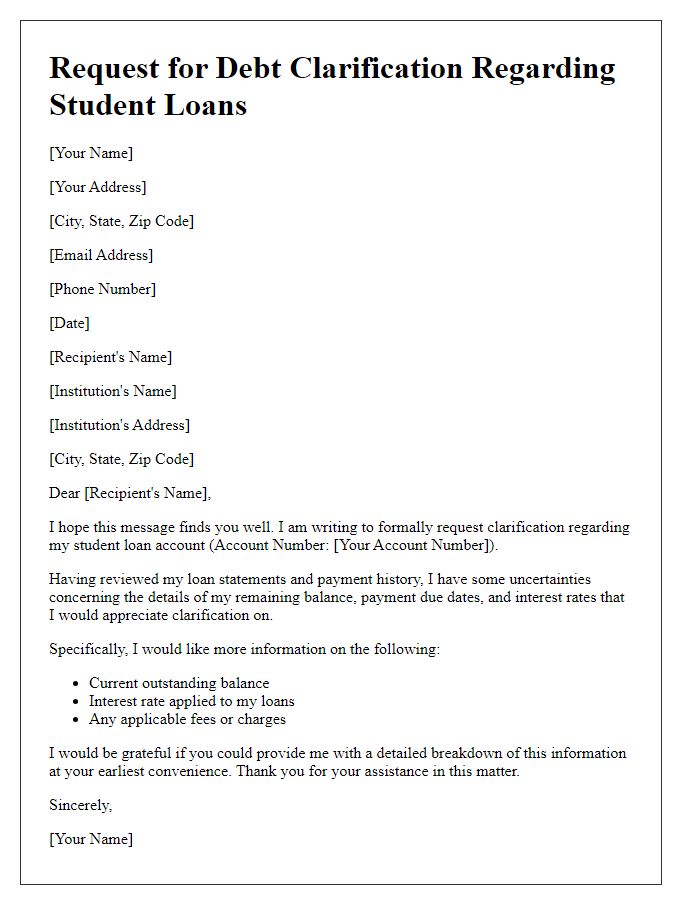

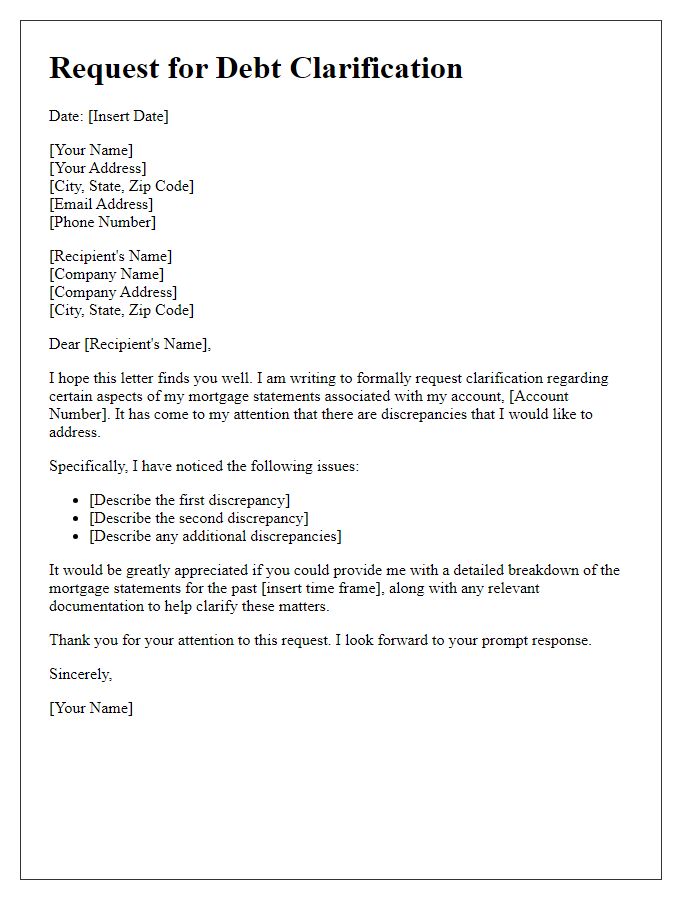

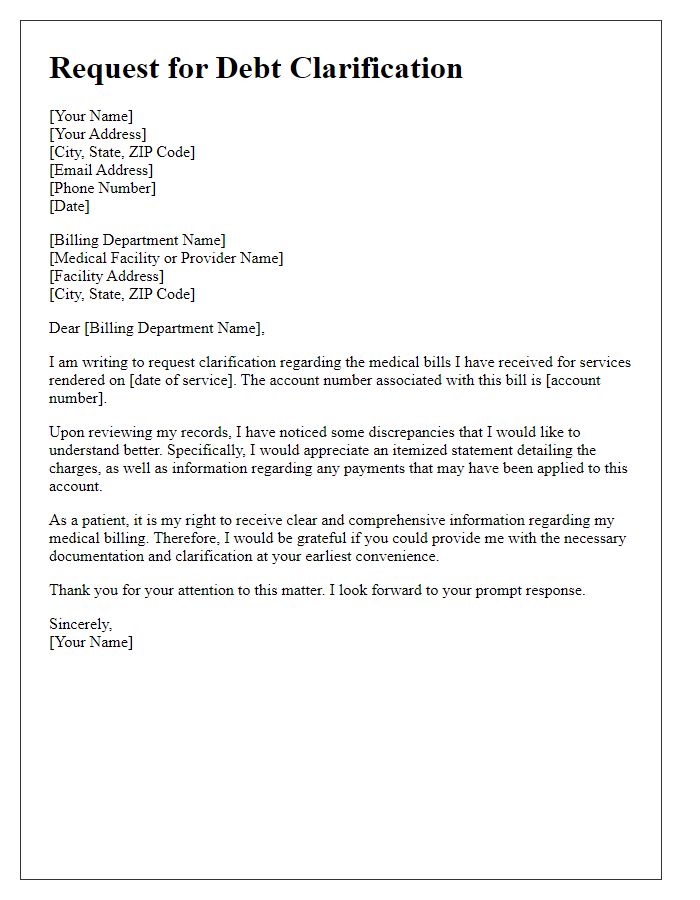

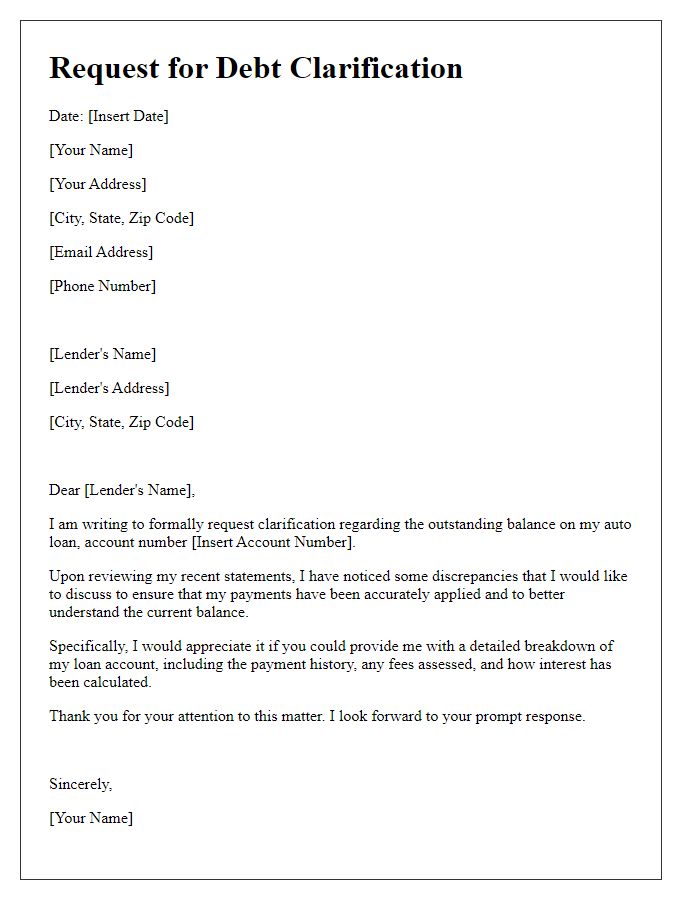

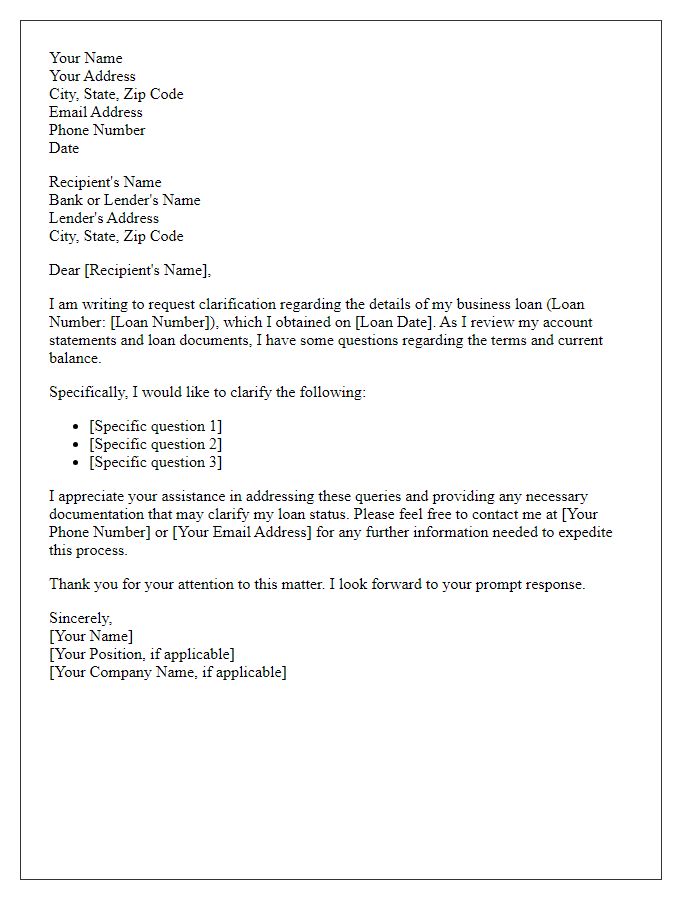

Letter Template For Request For Debt Clarification Samples

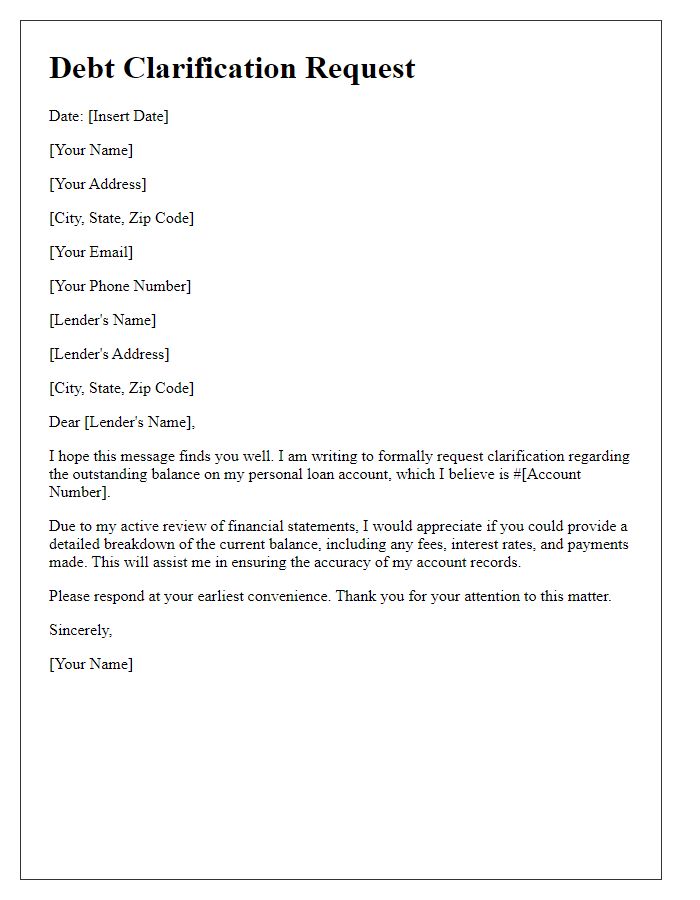

Letter template of request for debt clarification for credit card charges.

Letter template of request for debt clarification regarding student loans.

Letter template of request for debt clarification concerning mortgage statements.

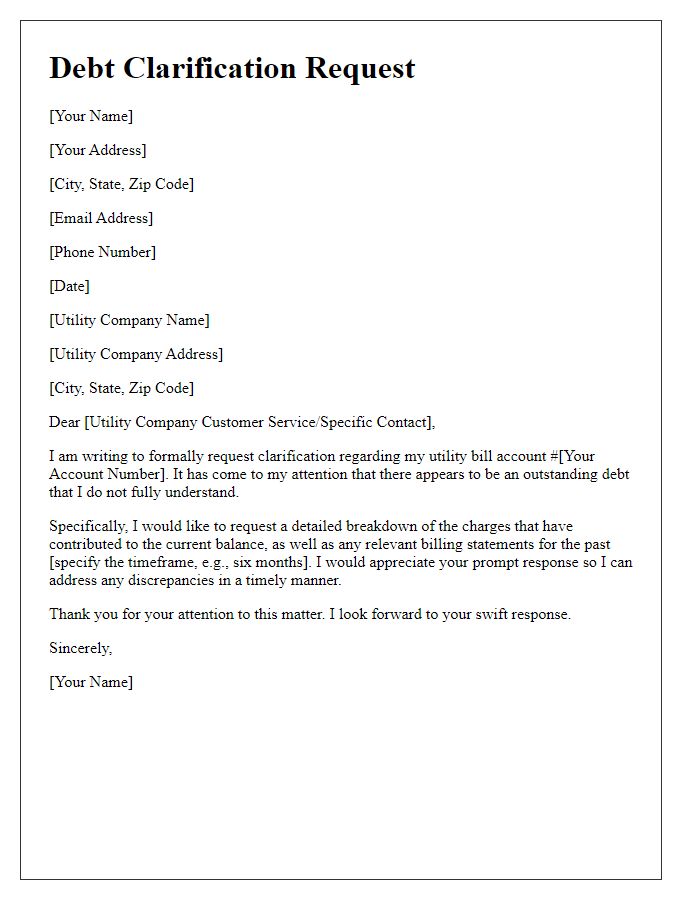

Letter template of request for debt clarification related to utility bills.

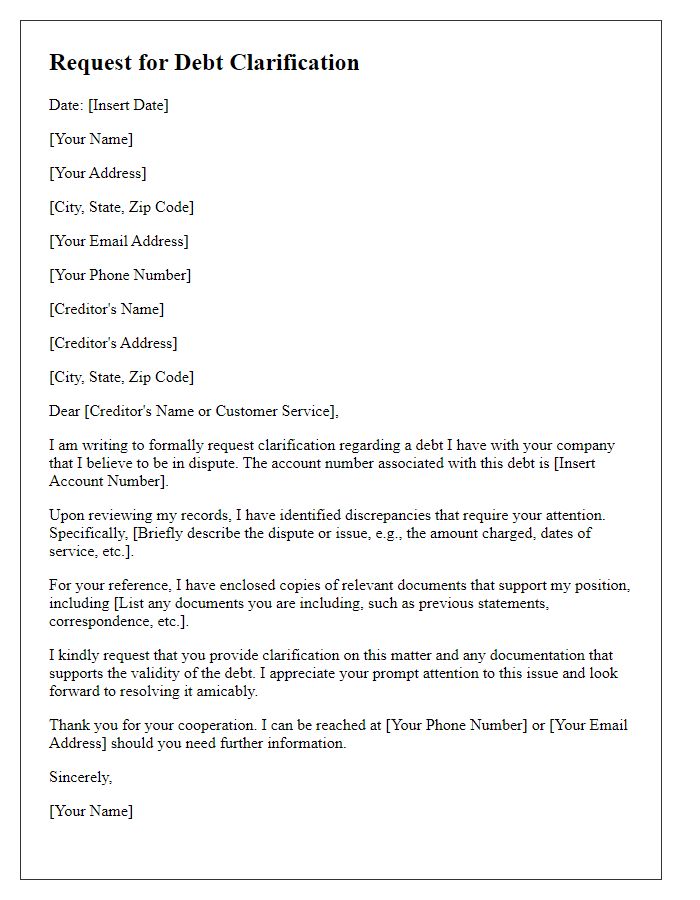

Letter template of request for debt clarification for disputed accounts.

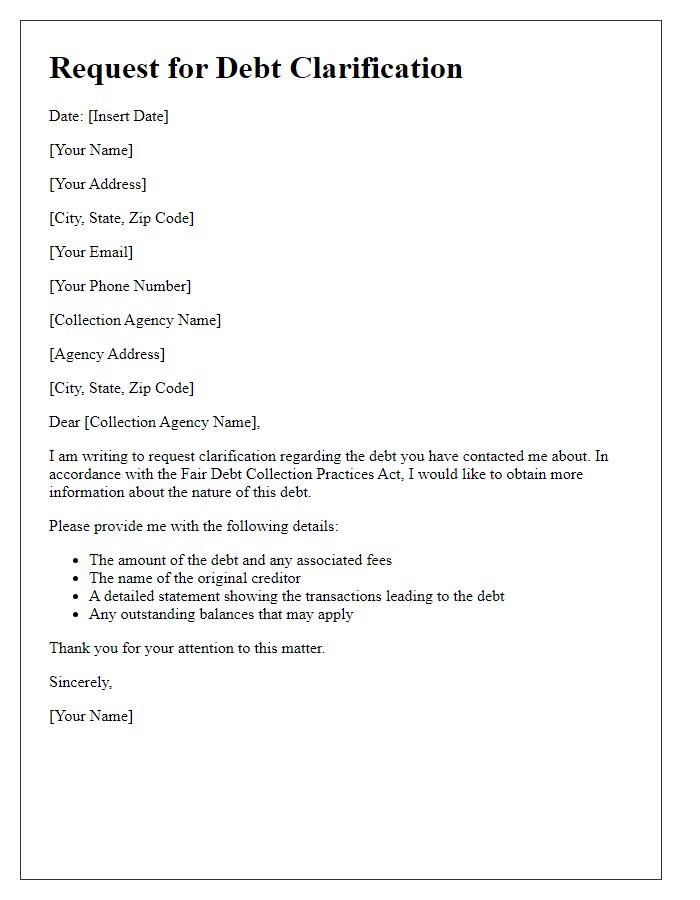

Letter template of request for debt clarification for collection agency communications.

Comments