Have you ever found yourself staring at a credit card statement, puzzled by a charge you don't recognize? Unauthorized debt charges can be not only confusing but also frustrating, leading to unnecessary stress in your financial life. In this article, we'll explore how to effectively contest these charges and regain control over your finances. So, let's dive in and walk through the steps you need to take in order to dispute those unwarranted fees!

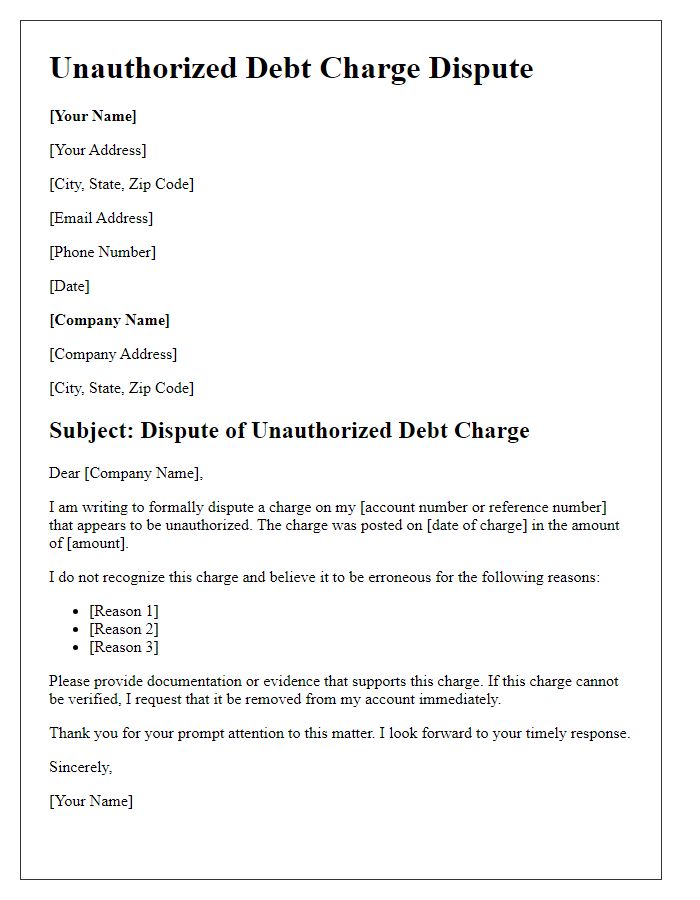

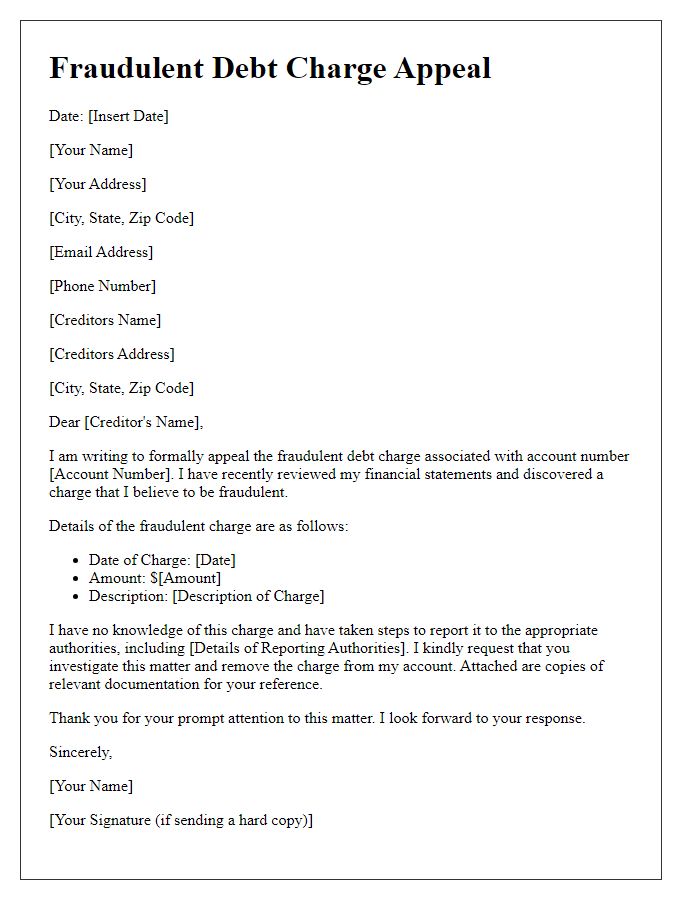

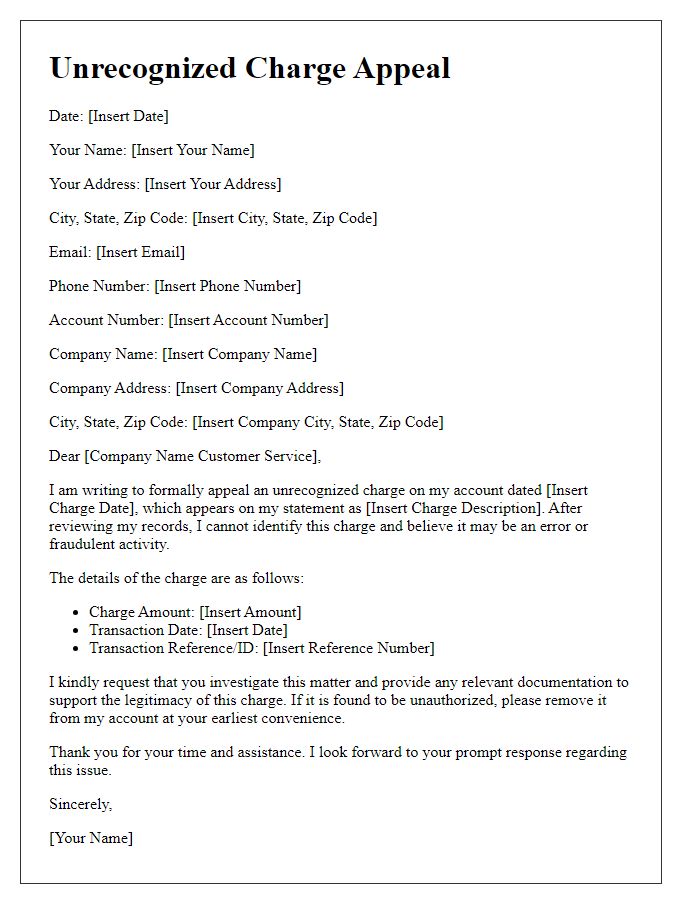

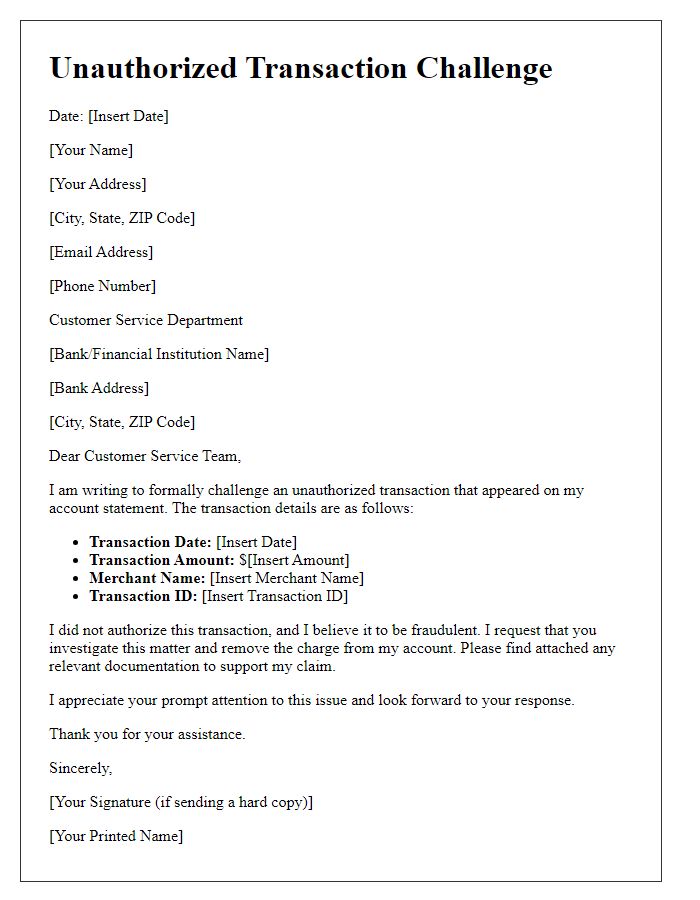

Account Information

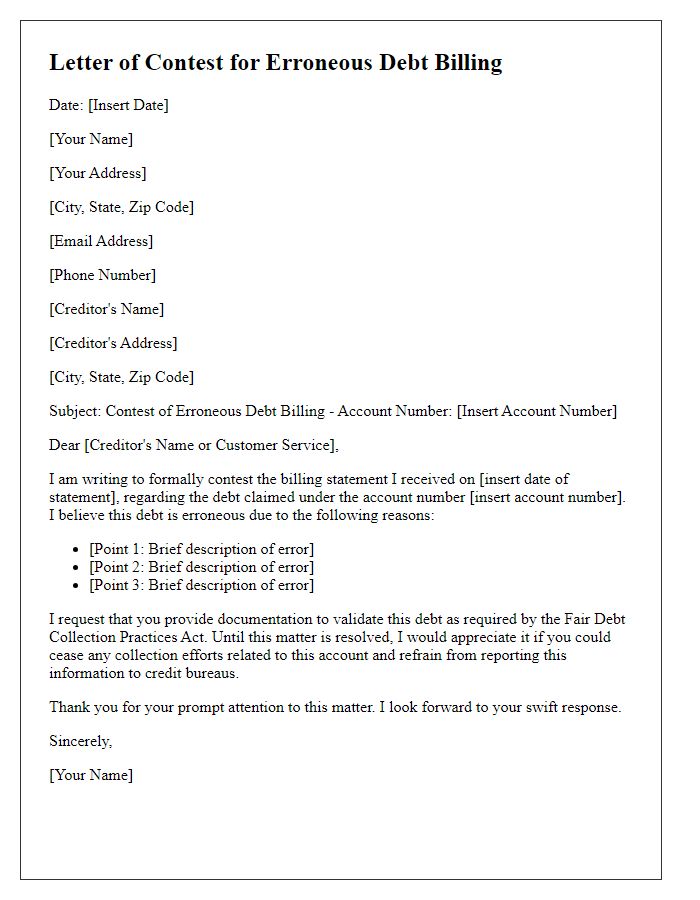

Unauthorized debt charges can lead to significant financial distress for consumers. Account information, such as the account number linked to the dispute, needs to be precisely documented for clarity. Relevant transactions, typically occurring within the past 30 days, should be meticulously outlined for accurate assessment. Financial institutions, including banks or credit card companies, require detailed evidence to substantiate claims, including all transaction dates and amounts listed on financial statements. Additionally, relevant consumer protection laws, such as the Fair Debt Collection Practices Act (FDCPA), provide legal frameworks to challenge these charges effectively. Effective contesting often involves submitting a formal complaint to the financial institution and may require escalation to regulatory bodies if initial resolutions are unsatisfactory.

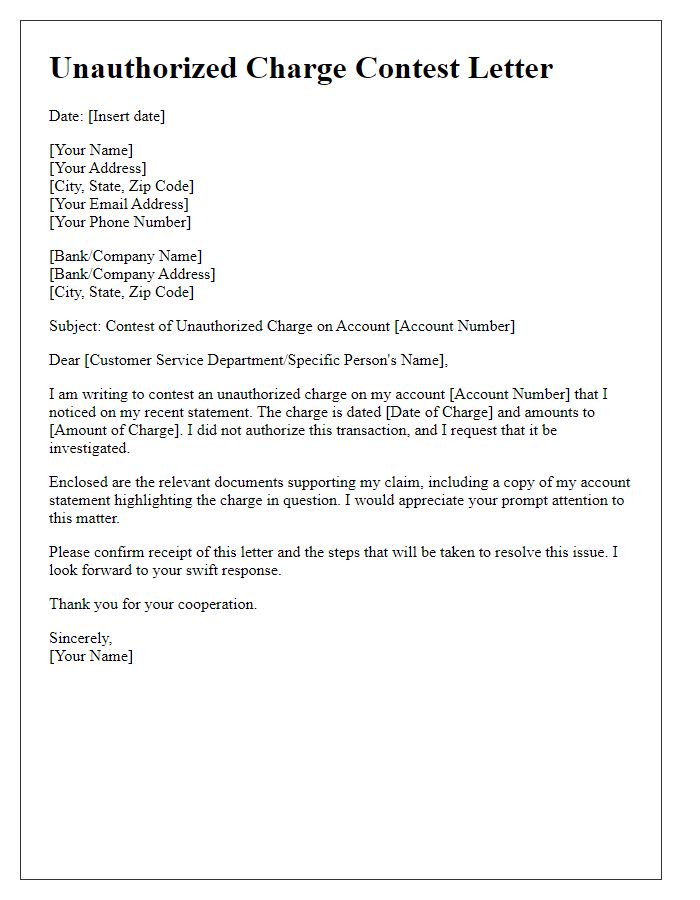

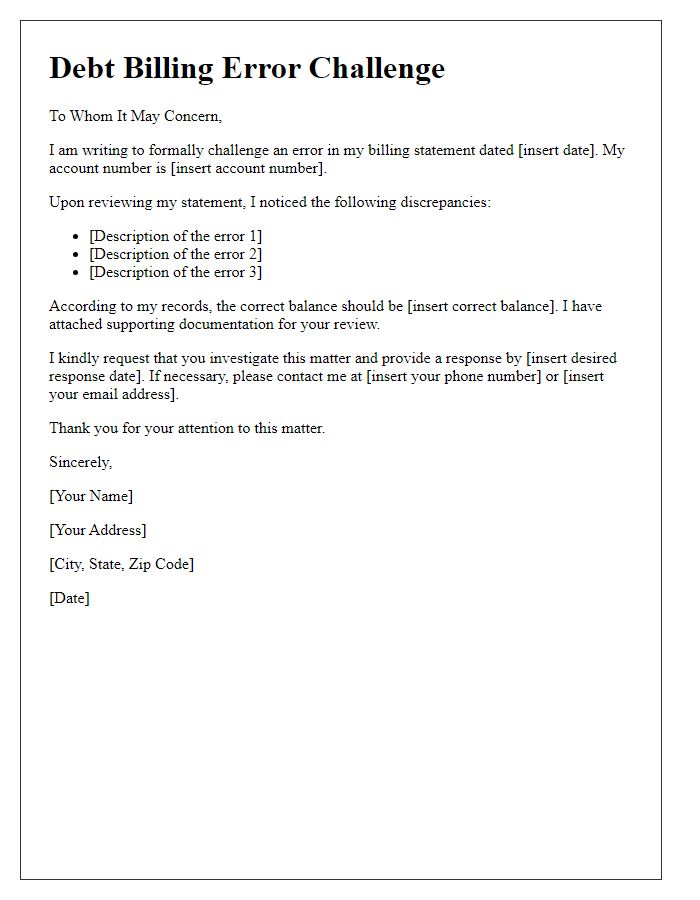

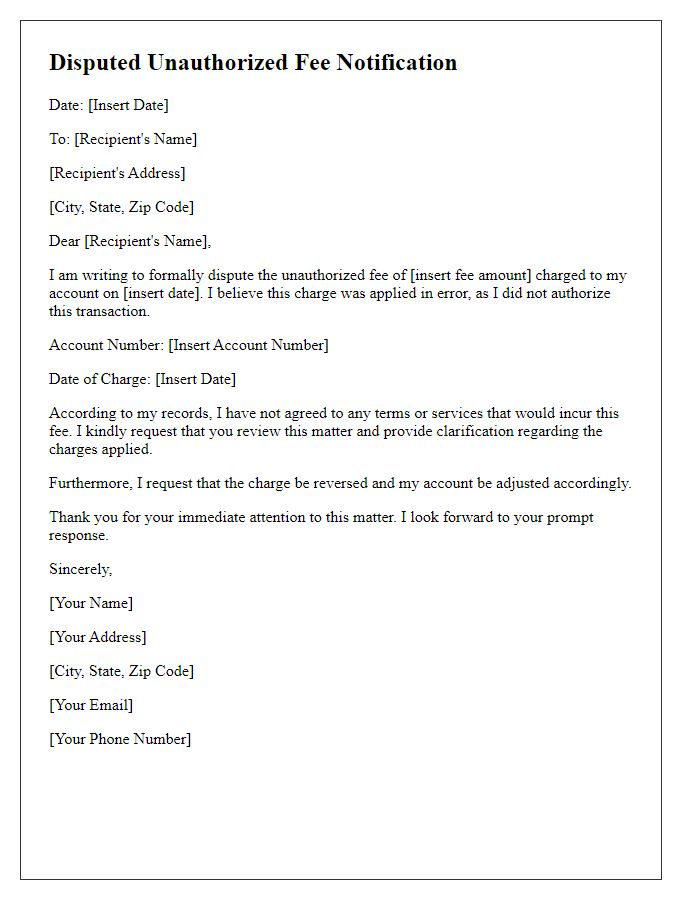

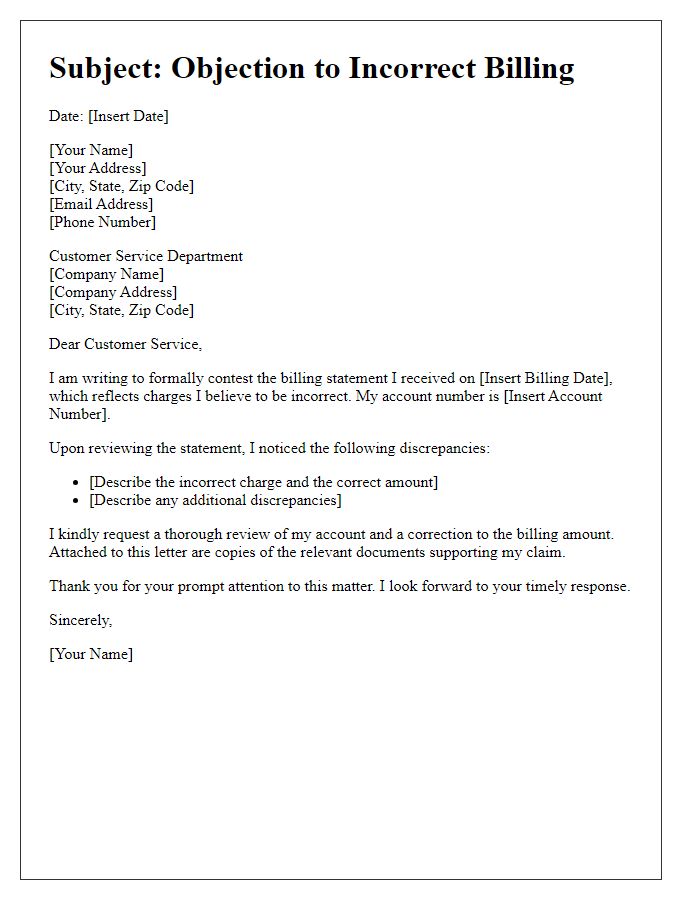

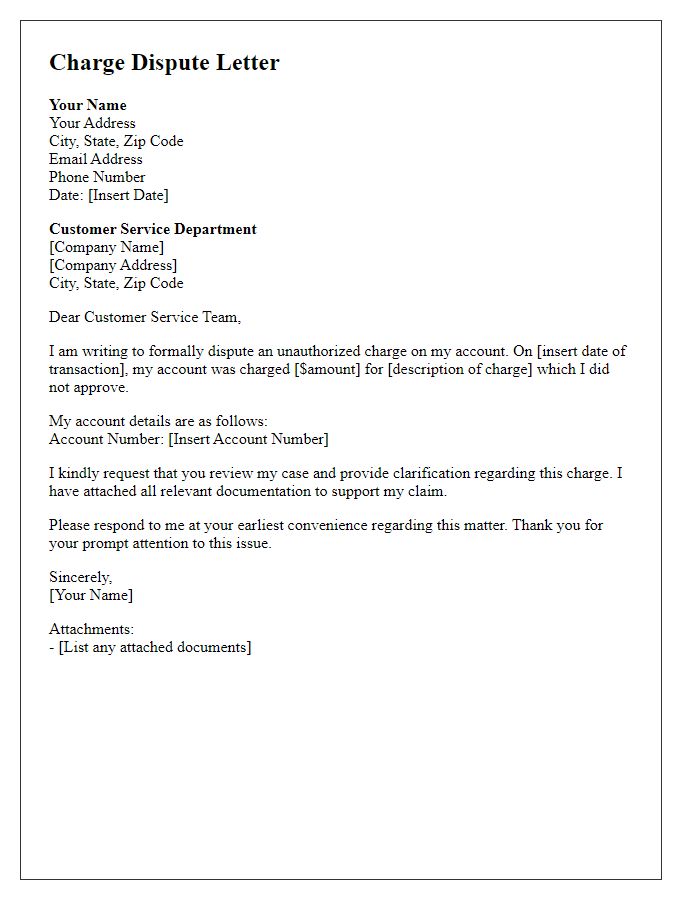

Unauthorized Charge Details

Unauthorized debt charge issues often arise when a financial transaction appears on an individual's bank statement or credit report without consent. Identifying the specific unauthorized charge, such as a transaction on a bank statement dated March 15, 2023, for $150 from a previously unknown merchant, is crucial. It is important to gather evidence, such as transaction receipts and communication with the service provider, to support the contestation. Additionally, noting the relevant laws, such as the Fair Credit Billing Act, which protects consumers against erroneous billing, can strengthen the case. Informing the financial institution, such as Bank of America, can initiate a formal investigation into the disputed charge while also protecting the consumer's rights.

Dispute Explanation

Unauthorized debt charges can lead to significant financial distress, impacting individuals' credit scores and financial stability. In situations where a consumer, such as a resident of New York, discovers a charge on their credit card statement or bank account for a service not rendered or goods not received, it is crucial to act swiftly. The Fair Credit Billing Act, enacted in 1974, protects consumers by allowing them to dispute erroneous charges within 60 days of the statement date. Important information to include in a dispute includes the charge date, amount, merchant name, and a detailed explanation of the unauthorized nature of the transaction. Documentation, such as receipts or communication records with the merchant, strengthens the dispute claim, providing a clear basis for the request for reversal of the charge. Failure to address unauthorized charges can result in long-term damage to financial health, so it is essential to monitor accounts regularly and report any discrepancies immediately.

Request for Resolution

A prompt resolution is sought regarding an unauthorized debt charge, specifically pertaining to the account number 123456789 at XYZ Financial Institution. On October 15, 2023, a transaction of $500 appeared, which was never authorized by the account holder. Documentation supporting this claim includes bank statements and correspondence. Timely investigation is requested, adhering to the Fair Debt Collection Practices Act to protect consumer rights. This resolution request emphasizes accountability and transparency in financial transactions.

Contact Information

Unauthorized debt charges can lead to significant financial strain for consumers, often resulting in unfair practices employed by credit card companies, like Capital One. Many individuals report charges appearing on their monthly statements without prior notification or consent. Consumer protection agencies, including the Federal Trade Commission (FTC), emphasize the importance of investigating these discrepancies immediately. Documentation such as account statements, charge details, and communication records should be meticulously collected to support the contestation process. Filing a formal dispute with both the creditor and relevant financial institutions is crucial to safeguarding one's financial well-being. Prompt action can prevent further unauthorized charges and protect credit ratings as well.

Comments