Hey there! If you're dealing with a tricky debt situation, you're not alone. Many people find themselves needing to follow up on their financial obligations, and having a well-crafted letter can make all the difference. In this article, we'll explore effective templates and tips to help you communicate clearly and confidently about your debt situationâso stick around to discover valuable insights!

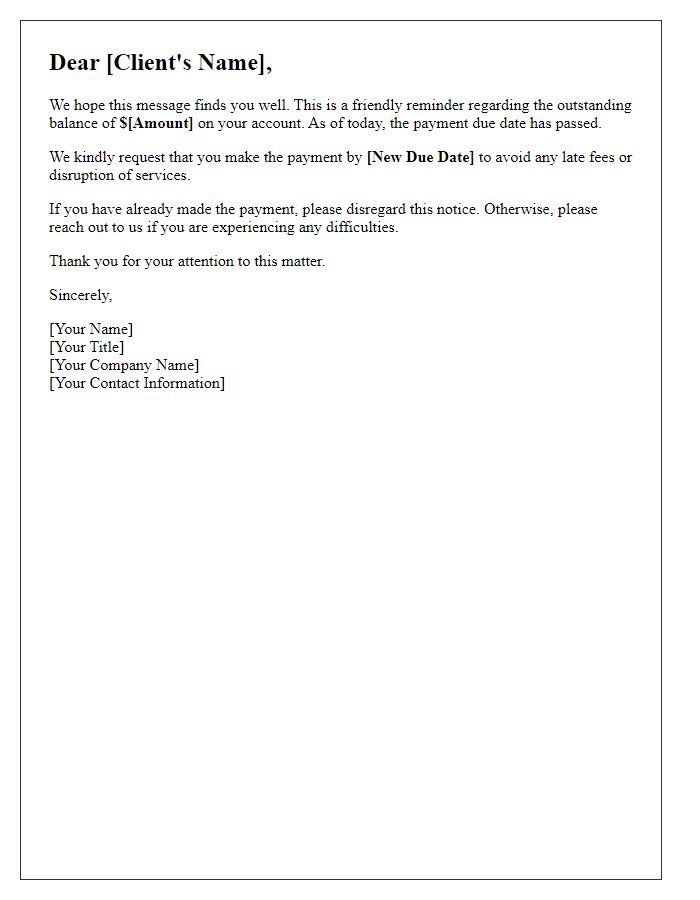

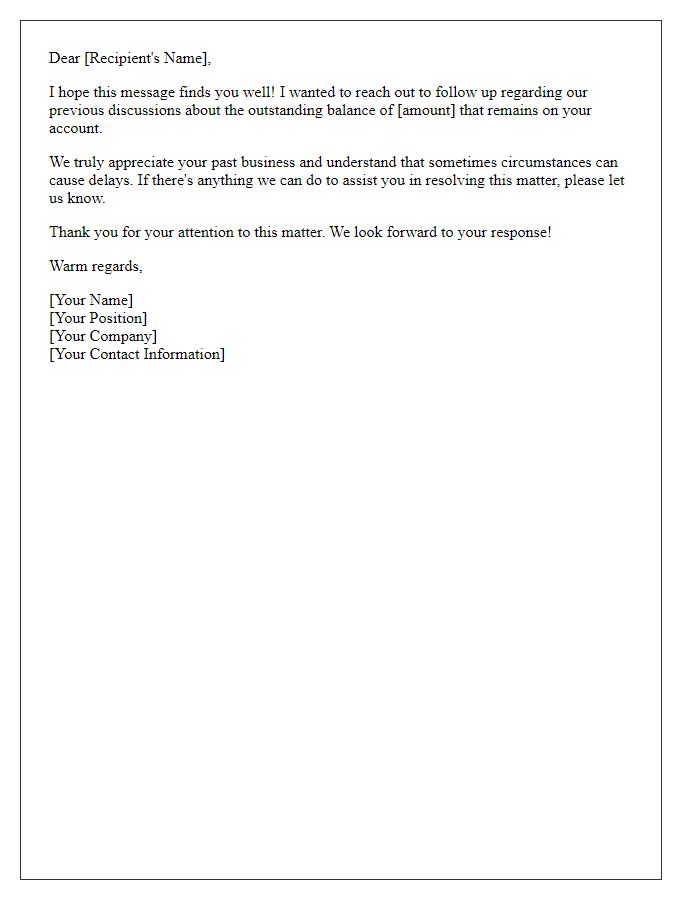

Polite Salutation

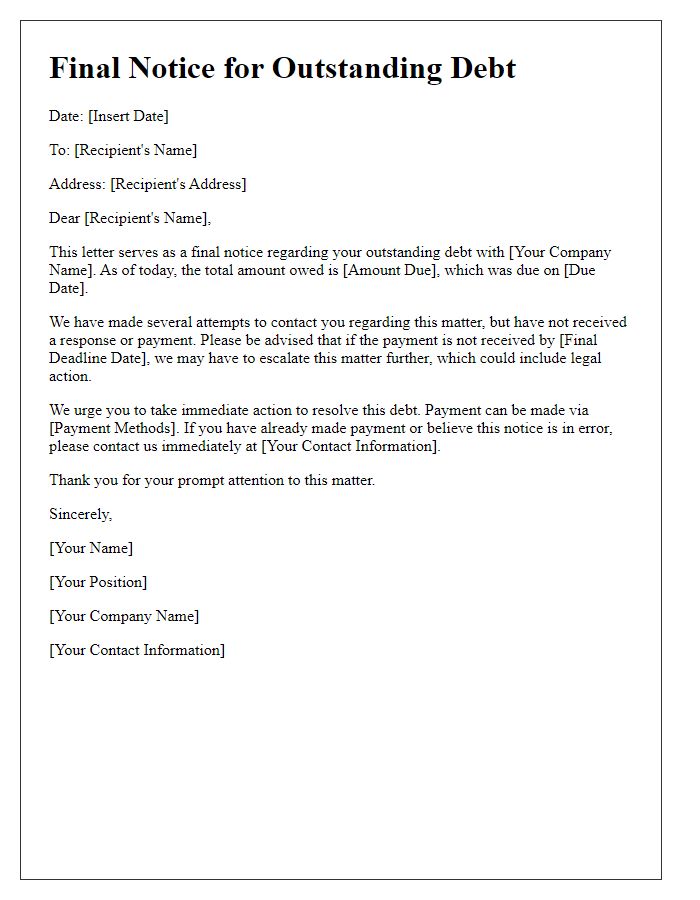

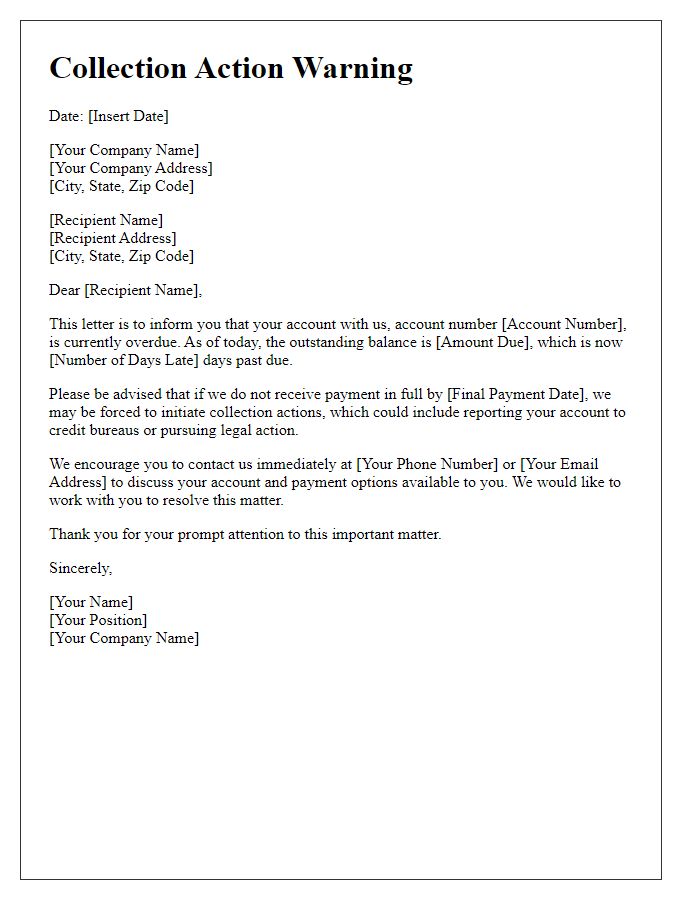

Inquiring about an outstanding debt situation requires clear communication and professionalism. A polite approach starts with a respectful salutation, addressing the individual or organization by their name or title. Acknowledging previous correspondence can provide context to the follow-up. Clearly stating the purpose of the letter, such as seeking an update on the account balance or payment arrangements, is essential. Emphasizing the importance of resolving the debt amicably and maintaining a positive relationship can foster goodwill. Concluding with a gracious thank you for their attention and assistance can reinforce a courteous tone, prompting a timely response.

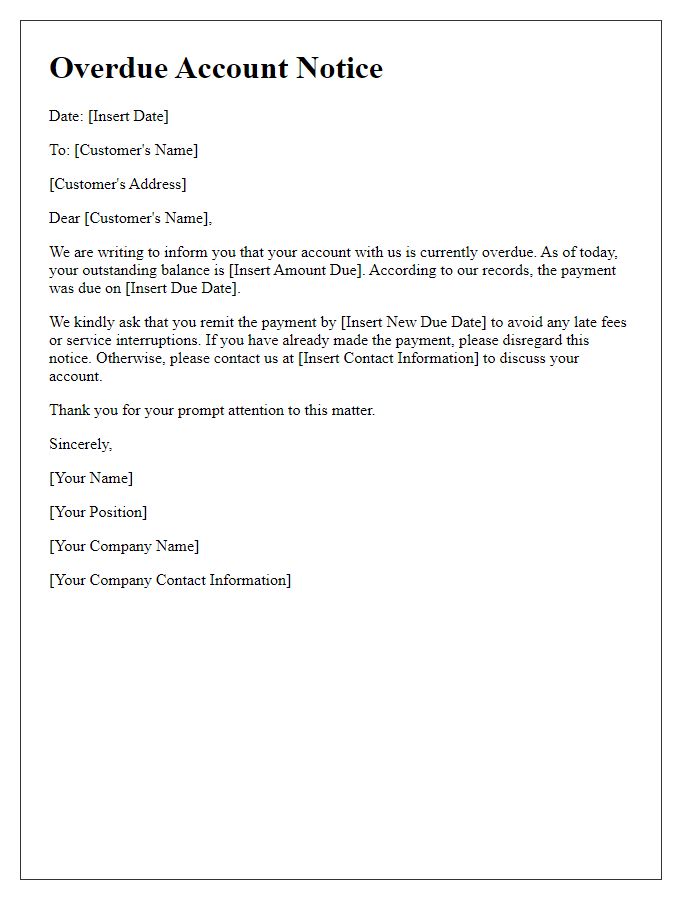

Account Summary

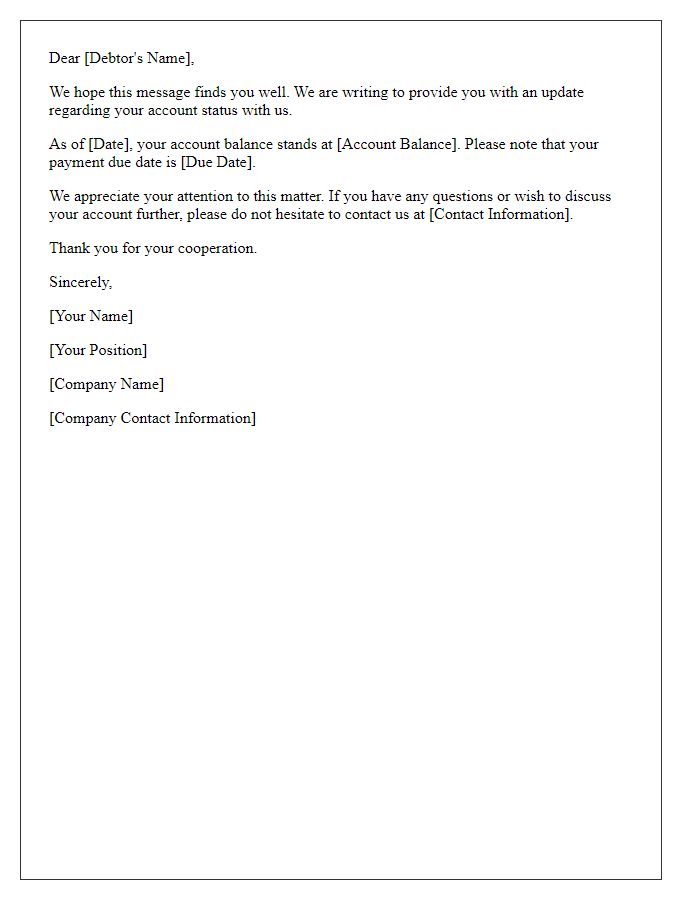

Understanding a debt situation requires a comprehensive account summary that outlines the total balance owed, recent transactions, and payment history. The outstanding balance, often categorized into principal, interest, and fees, can significantly impact financial health. For instance, a significant delinquency recorded, such as a 90-day late payment, can lead to increased interest rates and affect credit scores. Key dates, like the last payment made on March 15, 2023, and next due date on April 30, 2023, should also be noted for timely follow-up. Analyzing creditor details, including the lender's name and contact information, is essential for maintaining communication. Other vital factors such as minimum payment thresholds and any available repayment plans can guide consumers toward effective resolution strategies.

Payment History

Monitoring the payment history of addressed debt situations is crucial for effective financial management. Records indicate specific timestamps (like monthly payment dates or missed due dates) when payments were due, helping to analyze consistency in financial behavior. A consistent payment history can reflect positively on credit scores, while missed payments (potentially leading to a lapse beyond 30 days) can result in penalties and increased interest rates. Notably, major credit bureaus--Equifax, Experian, and TransUnion--track such histories, impacting an individual's creditworthiness. Engaging with creditors to secure updated statements can enhance understanding of current balances and any discrepancies in reported data. Regular reviews of debt repayment status foster accountability and pave the way for improved financial health.

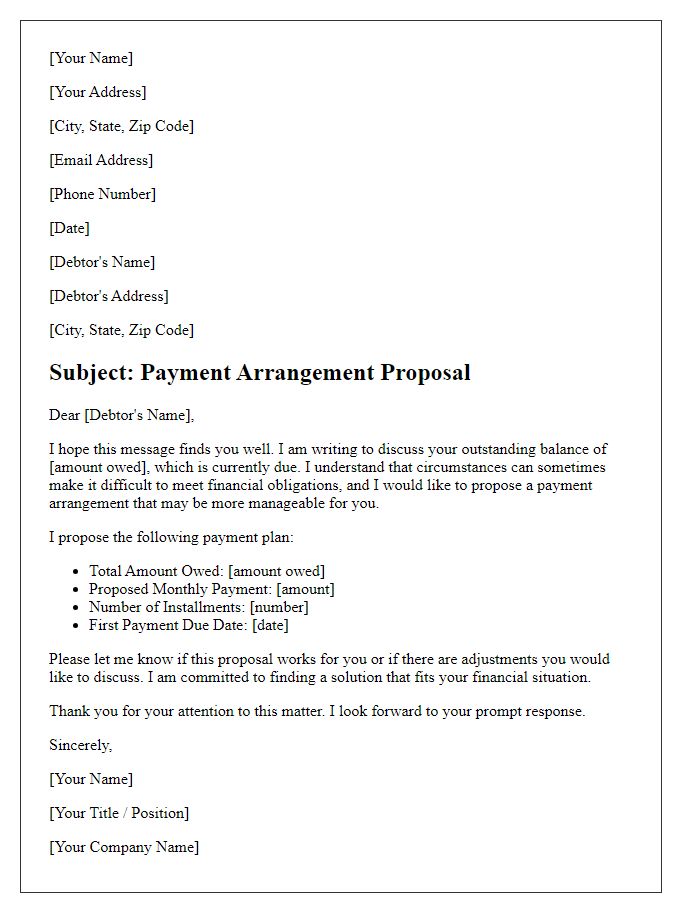

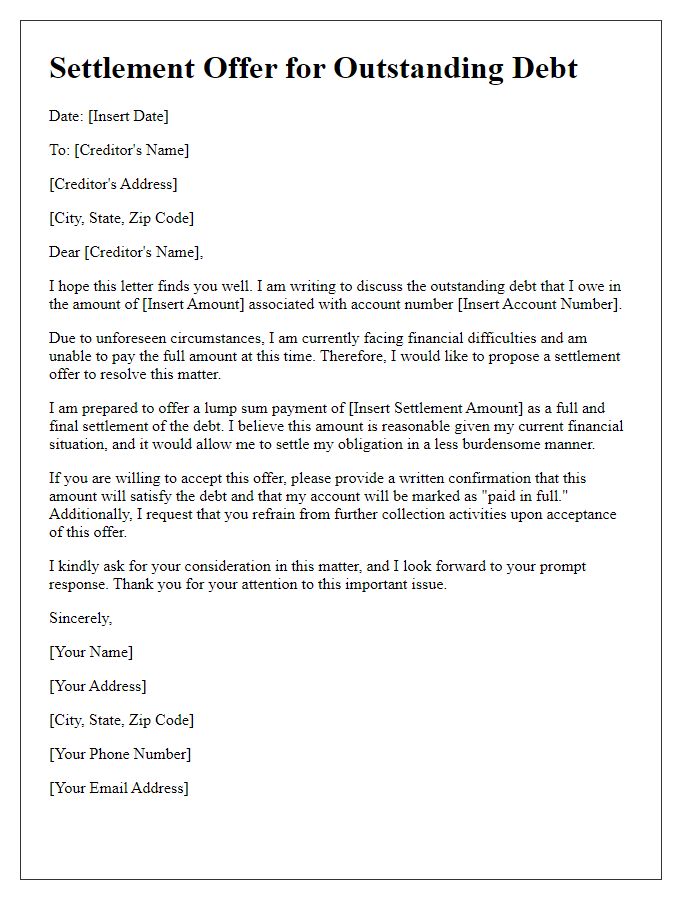

Payment Options or Plans

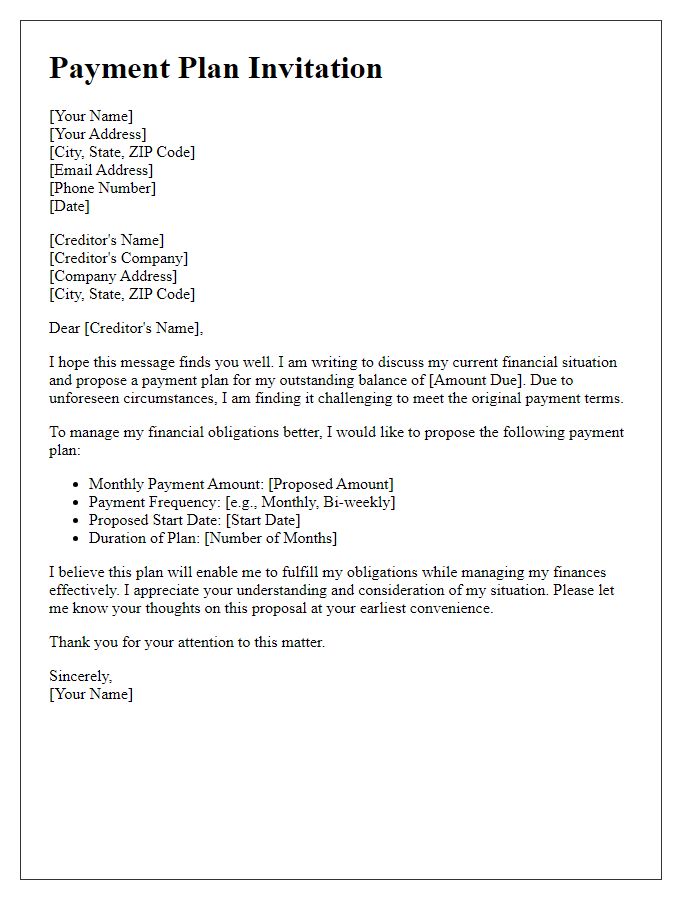

Debt resolution processes often involve exploring various payment options or plans tailored to individual circumstances. These plans, such as structured installment agreements, can help manage outstanding balances effectively. For example, a common option might include a three-month payment plan, breaking a total debt of $1,500 into manageable monthly payments of $500. Direct communication with creditors, such as banks or collection agencies, often leads to more favorable negotiations, potentially resulting in reduced interest rates or even forgiveness of part of the debt under certain hardship conditions. Understanding the implications of each option, including how late payments could impact credit scores (often by 30 to 100 points) and overall financial health, is crucial for informed decision-making. Establishing a clear repayment timeline and maintaining consistent payments can significantly alleviate financial stress and lead to a gradual improvement in creditworthiness.

Contact Information

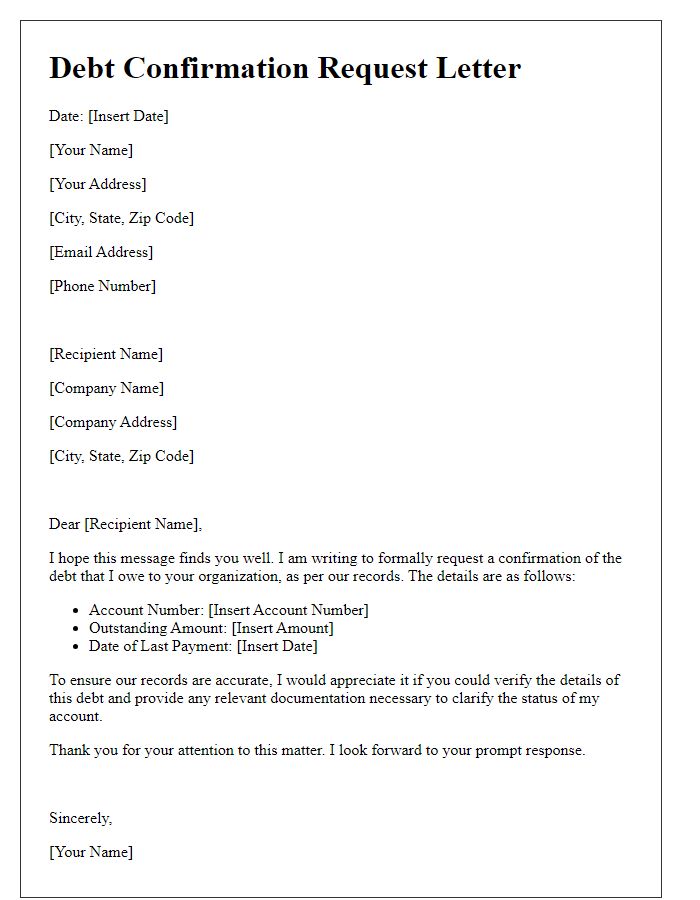

In a debt situation follow-up, detailed contact information is crucial for clarity and efficiency. Identify parties involved clearly, such as the creditor's company name, which might be ABC Financial Services, and their official contact number, often format (555) 123-4567. Include an email address, like support@abcfinancial.com, enabling prompt communication. The debtor's details should also be accurate, with full name, mailing address, and phone number, ensuring that communications reach the correct recipient. Additionally, specify the amount owed, date of the last payment, and any reference numbers necessary for tracking the account within the creditor's system. This comprehensive approach streamlines the follow-up process and enhances resolution efficiency.

Comments