Are you feeling overwhelmed by debt and looking for ways to regain control? A debt reaffirmation agreement might be just what you need to secure a fresh financial start while keeping your essential assets. These agreements can provide clarity and peace of mind by reaffirming your commitment to pay back specific debts, even after filing for bankruptcy. Curious to learn more about how this process works and how it can benefit your situation?

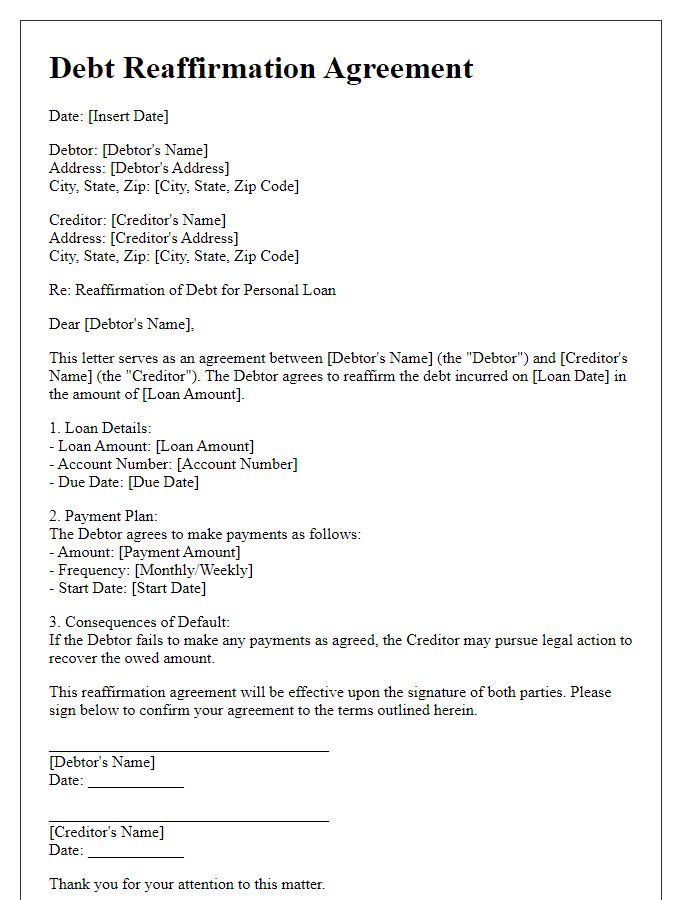

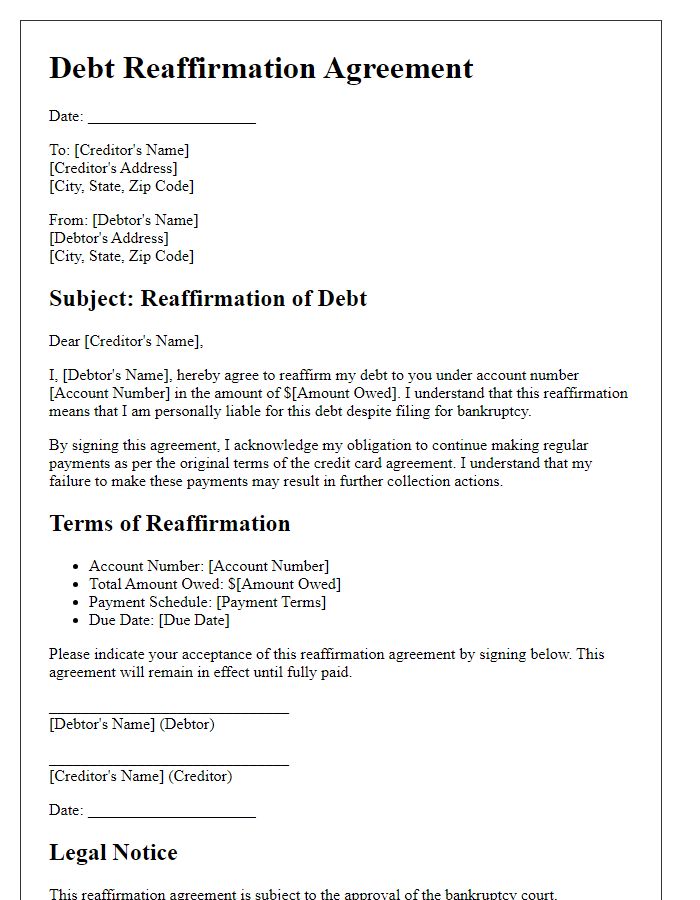

Clear identification of parties involved.

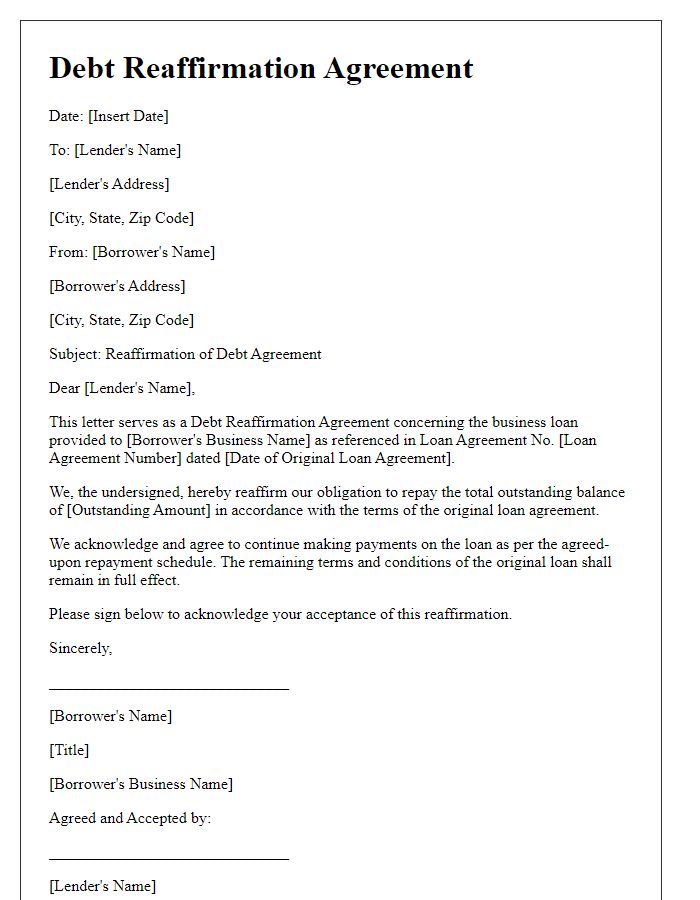

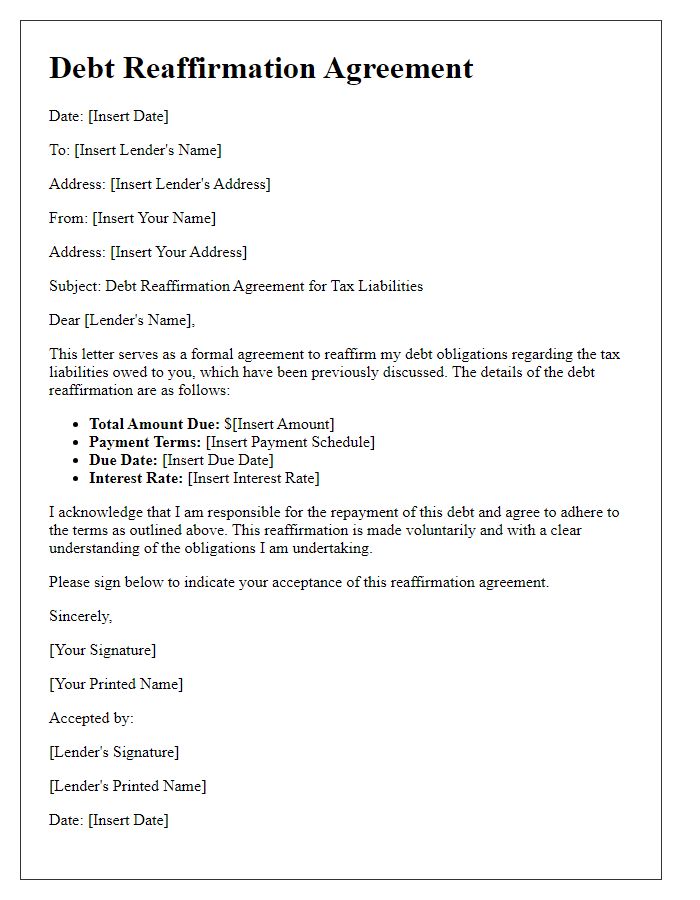

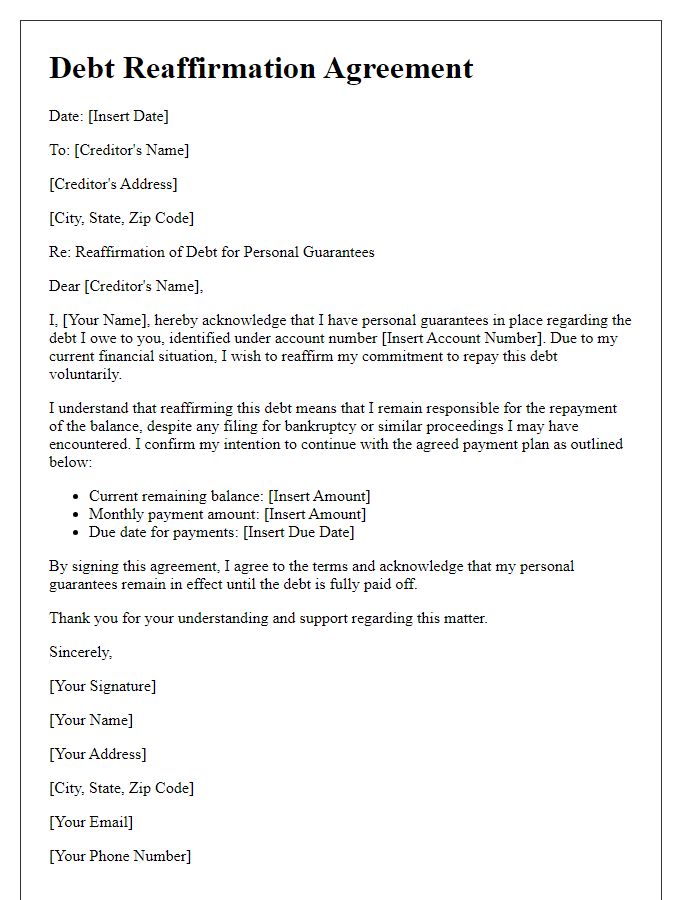

A debt reaffirmation agreement serves to solidify the commitment of a debtor to repay a specific debt, usually in the context of bankruptcy proceedings. Essential parties involved in this agreement typically include the debtor (individual or business filing for bankruptcy protection) and the creditor (bank, financial institution, or lender providing the loan or credit). Clear identification of the debtor should include their full legal name, address, and any associated identification number such as Social Security Number or Employer Identification Number. Similarly, the creditor's identification should include the full legal name, address, and relevant account details, ensuring that all involved parties are clearly recognized. This clarity is fundamental for enforceability and for updating credit records post-agreement.

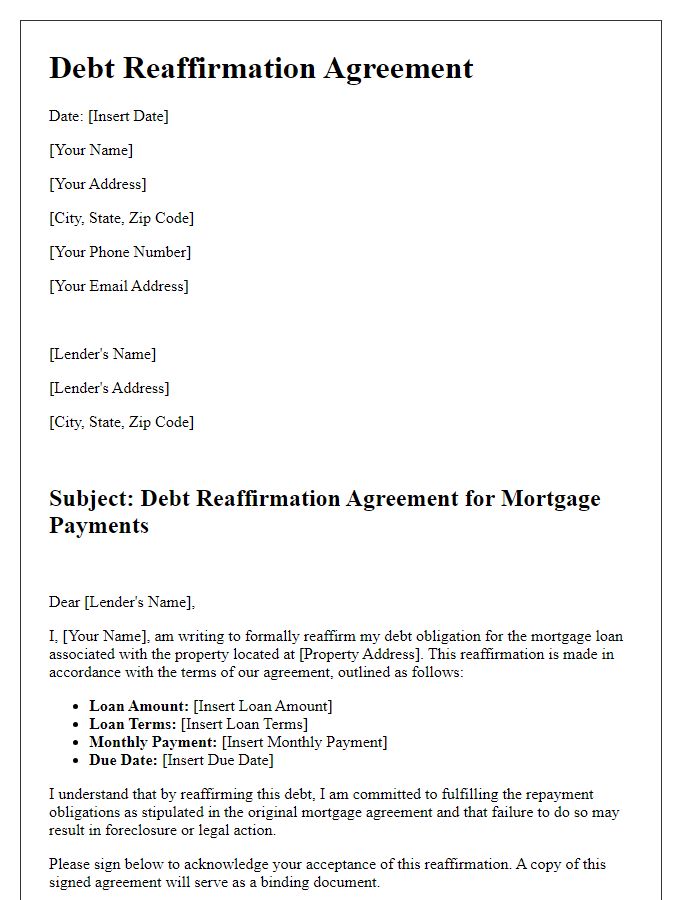

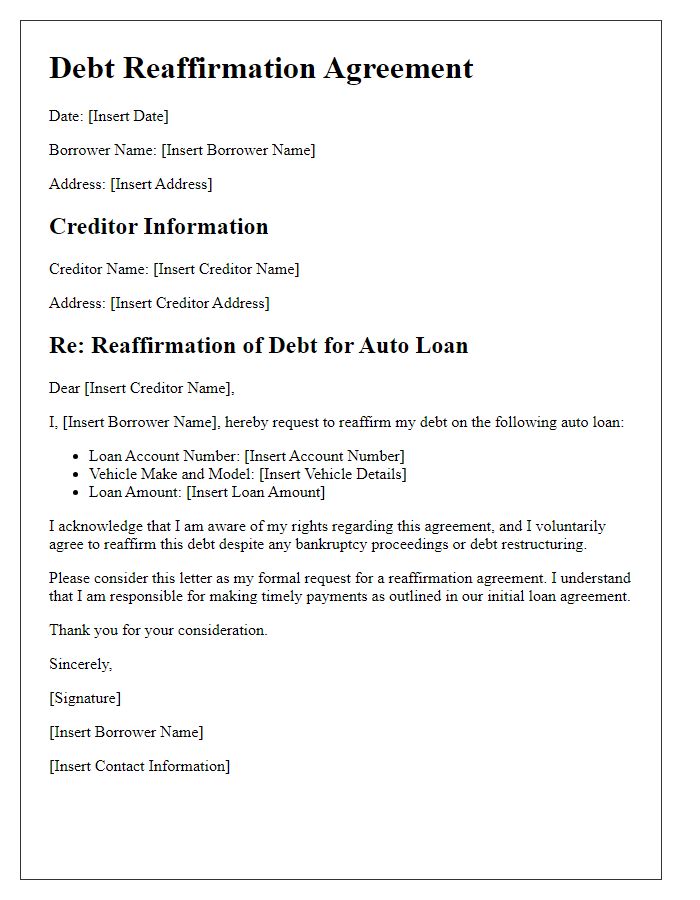

Detailed description of the debt being reaffirmed.

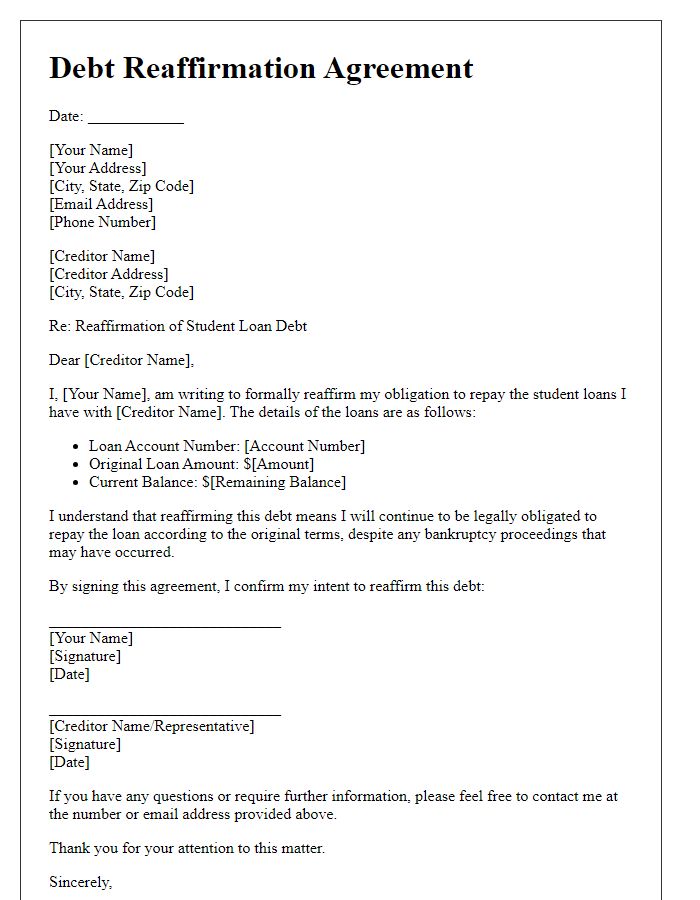

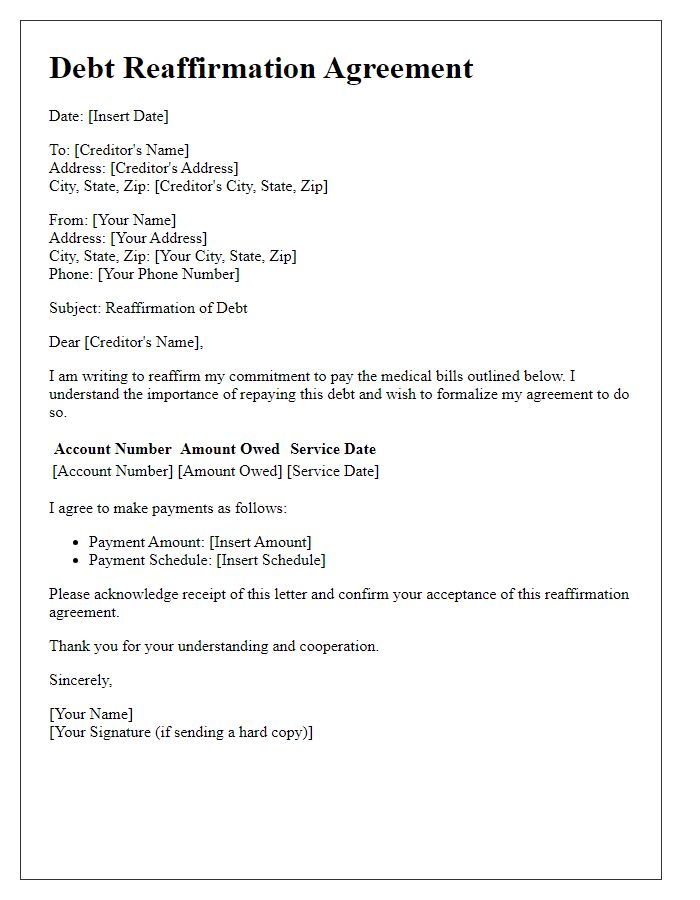

A debt reaffirmation agreement outlines specific details regarding the debt being reaffirmed, such as the outstanding amount owed, dates of origination, and associated interest rates. For instance, a secured loan of $15,000 taken out in March 2020 for purchasing a vehicle from Ford Motors possesses an annual interest rate of 5%. This agreement also includes the term length, which is five years, culminating in monthly payments of $300 due by the first of each month. In addition, details regarding any collateral involved, such as the vehicle's VIN (Vehicle Identification Number), can offer further clarity on what the lender retains in case of default. Furthermore, the reaffirmation agreement may specify the rights and obligations of both the debtor and creditor, ensuring the continuation of favorable terms and the potential for improving the debtor's credit rating post-bankruptcy.

Specific terms of the reaffirmation agreement.

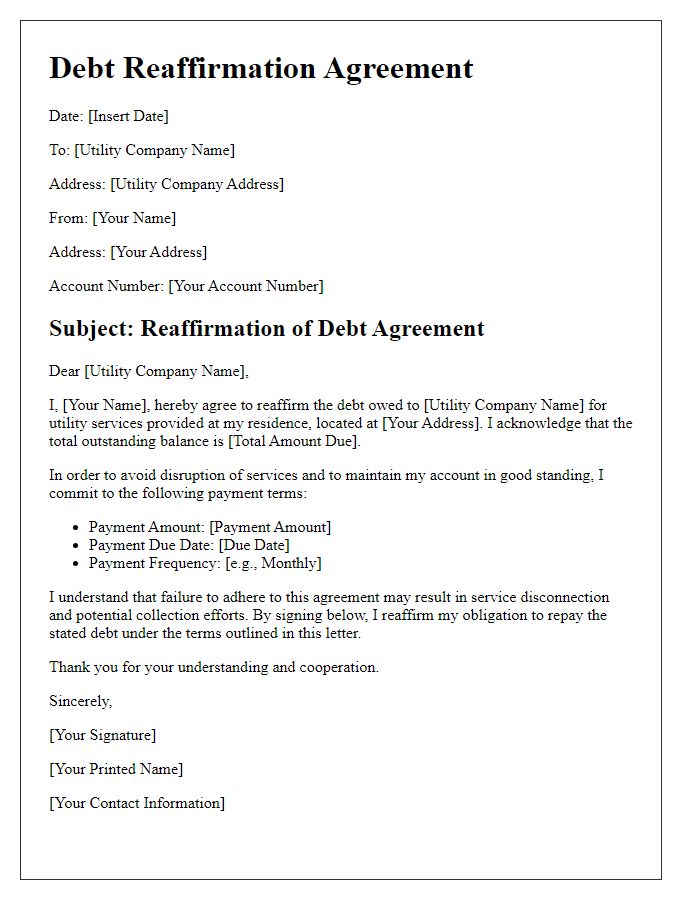

A debt reaffirmation agreement outlines the specific terms under which a debtor agrees to continue paying a debt despite bankruptcy proceedings. Key aspects include the total amount owed, typically expressed in dollars, the specific interest rate applicable to the debt, which may impact the overall repayment amount, and the repayment schedule detailing monthly payment amounts and due dates. The agreement also highlights the description of the secured property, such as a home or vehicle, serving as collateral for the loan, along with any obligations of the debtor and lender, including maintenance responsibilities. Additionally, the document may specify the consequences of default, such as potential repossession or foreclosure, and it may require the signatures of both parties to validate the agreement legally.

Legal clauses and obligations.

A debt reaffirmation agreement serves as a legal document wherein a debtor agrees to continue repaying a debt despite filing for bankruptcy protection under Chapter 7, ensuring the creditor retains the right to pursue outstanding obligations. Key clauses in this agreement may include the reaffirmation of the debt amount, specifying principal, interest rates, payment schedules, and any fees accrued, such as late payment charges. Additionally, it may encompass the creditor's waiver of certain legal claims, stipulations regarding the obligations of both parties, and consequences of default, including potential loss of collateral, which could include assets like a vehicle or real estate. Importantly, the debtor must execute the agreement voluntarily and meet the court's requirements under Section 524(c) of the Bankruptcy Code, thereby acknowledging legal protection options are relinquished despite reaffirmation. Furthermore, the document should include an acknowledgment of understanding the rights being waived and the potential impacts on financial standing in the future.

Signatures with date of agreement.

A debt reaffirmation agreement is a legal document that allows a debtor to retain specific property while agreeing to pay their debts, typically in the context of a bankruptcy proceeding. This agreement must be accompanied by the signatures of both the debtor and the creditor, along with the date of the agreement, which solidifies the terms of the reaffirmation. Often, this document includes important details such as the amount of the debt, payment terms, and descriptions of the secured property, usually including specific assets like vehicles or real estate. The reaffirmation enables the debtor to regain a favorable standing with the creditor while reaffirming the obligation to repay the debt under agreed-upon conditions.

Comments