Navigating the world of debt can be overwhelming, but a well-crafted debt solution proposal can be your beacon of hope. In this article, we'll explore how to create a refined proposal that clearly outlines your financial challenges and proposes viable solutions that resonate with creditors. With the right approach, you can present your case confidently and increase your chances of achieving a favorable outcome. So, let's dive in and discover the key elements to include in your proposal!

Tone and Language Consistency

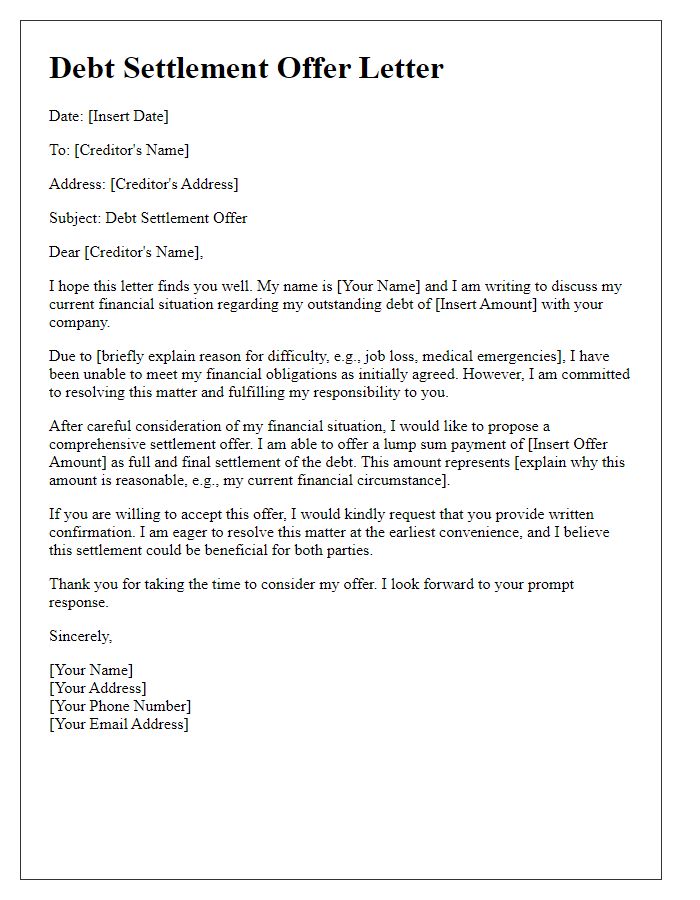

An effective debt solution proposal focuses on clarity and professionalism while addressing sensitive financial matters. The proposal highlights the specific financial issues faced, including total debt amounts (e.g., $30,000 in credit card debt), interest rates (average of 18% APR), and repayment timelines (typically over five years). The document outlines the proposed solutions, such as debt consolidation programs or negotiation of lower interest rates, and provides a clear path for payment plans (monthly payments of $600). Set against a backdrop of regulations (e.g., Fair Debt Collection Practices Act), the proposal emphasizes the importance of maintaining communication with creditors and the benefits of seeking professional financial advice from certified debt counselors. Consistent tone and language throughout ensure that the proposal reflects a respectful and hopeful approach to resolving financial difficulties, fostering trust and encouraging cooperation from all parties involved.

Comprehensive Financial Analysis

A comprehensive financial analysis reveals a structured approach to refined debt solutions tailored for individuals grappling with overwhelming financial obligations. This analysis encompasses a detailed evaluation of net income versus expenditures, highlighting the debt-to-income ratio, which is critical in assessing financial health. Furthermore, historical spending patterns inform potential budget adjustments, while credit score assessments identify eligibility for improved loan terms. Tools such as debt snowball and avalanche methods suggest systematic strategies for repayment prioritization, potentially leading to significant reductions in interest paid over time. Moreover, exploring options like debt consolidation loans or credit counseling services can provide professional guidance and mitigate stress associated with financial management, ultimately facilitating a more sustainable path toward debt resolution.

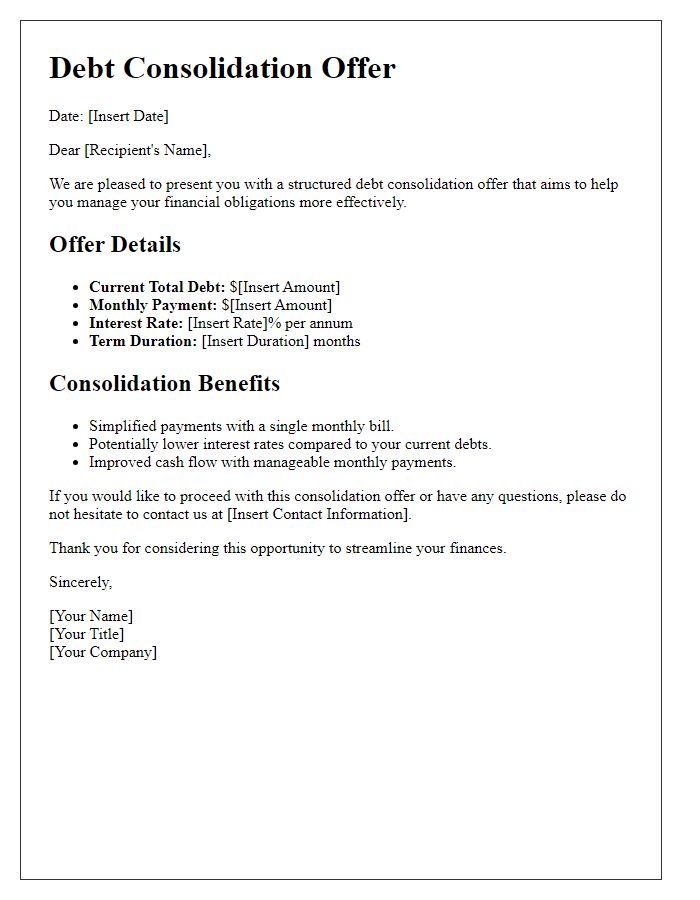

Clear Repayment Terms and Conditions

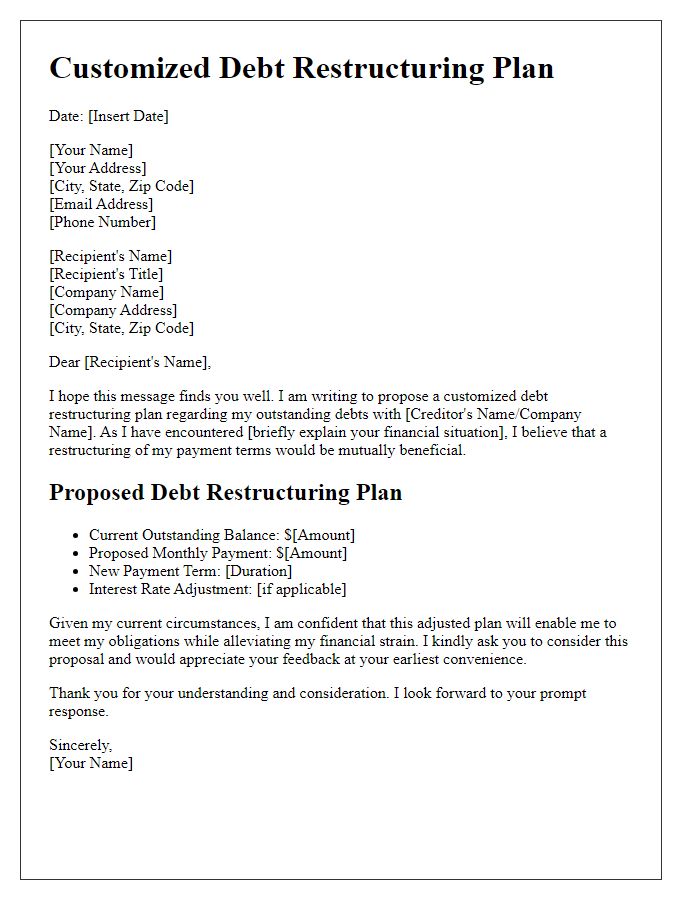

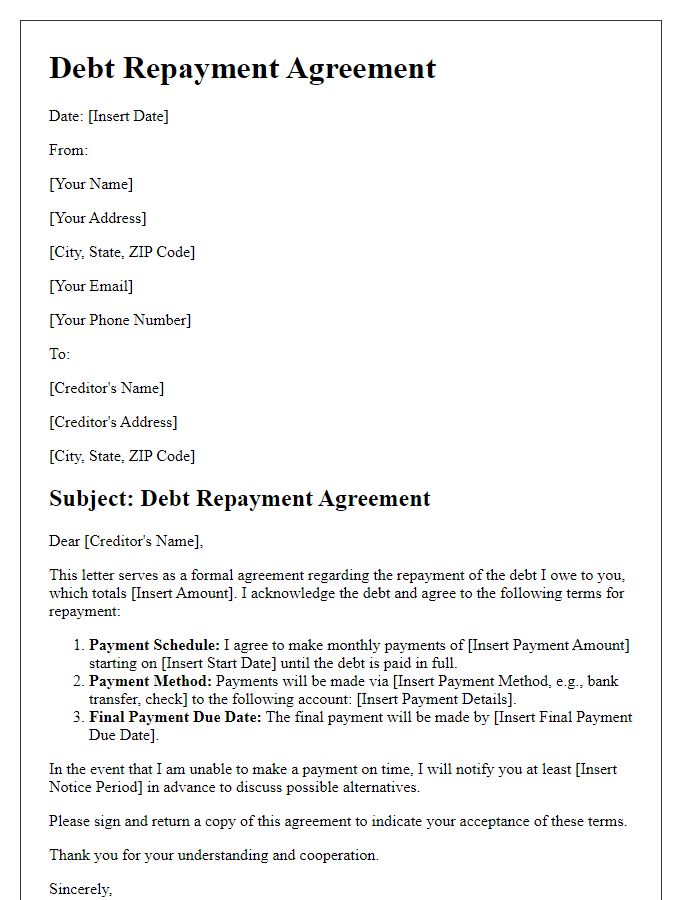

A refined debt solution proposal includes clear terms and conditions that outline the repayment schedule, total amount owed, and interest rates. Detailed repayment terms specify monthly payment amounts, due dates, and acceptable payment methods such as bank transfers or credit card payments. The total amount owed should be itemized, showcasing principal balances, accrued interest, and any applicable fees. Interest rates attached to the debt can vary based on factors such as credit score or loan type, with fixed or variable options impacting overall payments. A comprehensive agreement emphasizes the responsibilities of both parties, any consequences for missed payments, and options for renegotiation if financial circumstances change. This transparency fosters trust and helps establish a productive dialogue between the debtor and creditor.

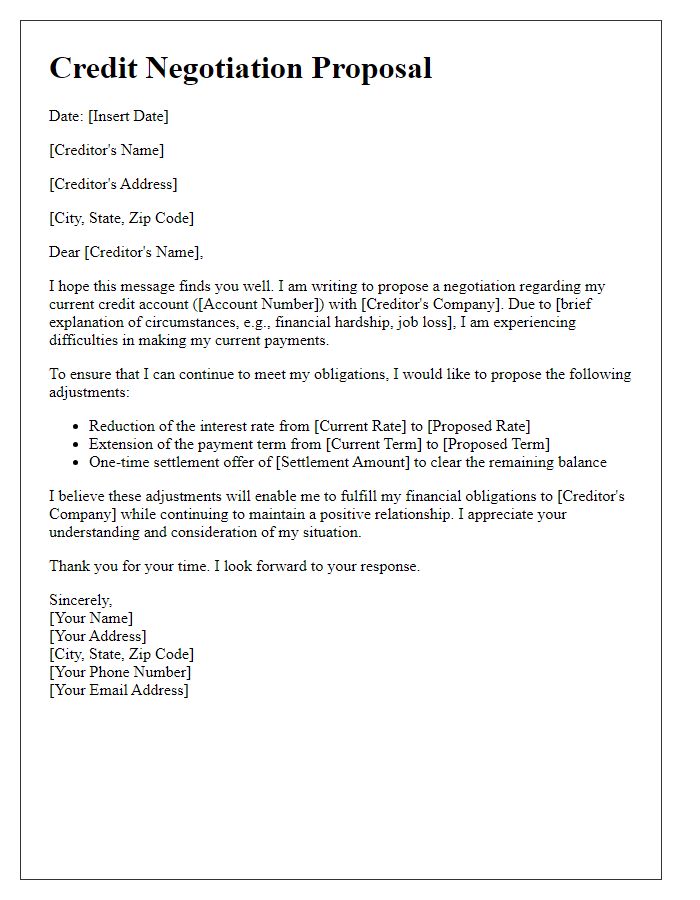

Creditor Engagement Strategy

A well-structured creditor engagement strategy is crucial for successfully negotiating debt solutions. This strategy should include detailed outreach plans, schedules, and targeted communication channels. Key stakeholders, such as financial advisors, legal representatives, and credit counselors, must be involved to ensure comprehensive engagement. Specific metrics should be established to measure the effectiveness of interactions, such as response rates or settlement amounts. Consideration of industry trends, such as the fluctuating credit market or changes in interest rates, will provide insights into optimizing negotiations. Establishing trust through transparency and providing regular updates to creditors can significantly enhance the likelihood of favorable outcomes. Creating a timeline that outlines critical milestones in the negotiation process can aid in maintaining momentum and focus throughout the engagement.

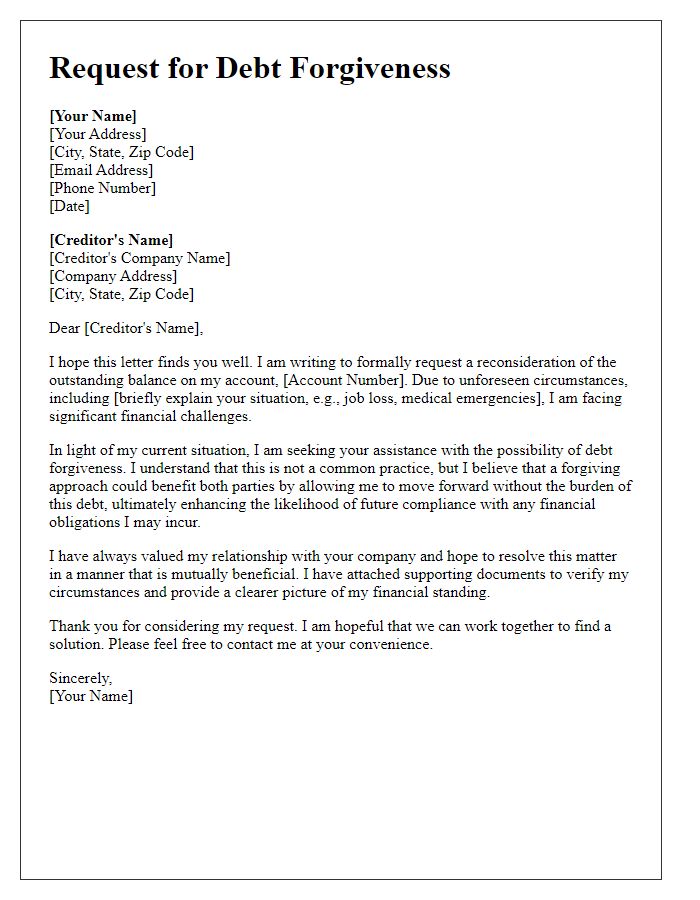

Personalization and Customization

A refined debt solution proposal focuses on a tailored approach to address individual financial challenges effectively, ensuring optimal outcomes. Personalization involves assessing specific financial situations, including total debt amounts, interest rates, monthly payments, and income sources for each individual. Customization may include unique repayment plans designed to fit personal budgets, prioritizing high-interest debts to minimize overall financial burden. Utilizing advanced analysis tools, such as budgeting software or debt management calculators, helps create a clear pathway towards financial stability. This strategic framework emphasizes maintaining open communication channels between clients and debt counselors, enhancing the support clients receive throughout the process, thereby fostering a stronger understanding of personal finance and responsibility.

Comments