Are you facing the challenging situation of managing incomplete debt payments? It's a reality many people encounter, and understanding the next steps can help ease the stress. In this article, we'll explore essential tips on how to approach your creditors with a letter template that serves as a warning for incomplete payments. So, grab a cup of coffee and read on to discover how to effectively communicate your situation and find a path forward!

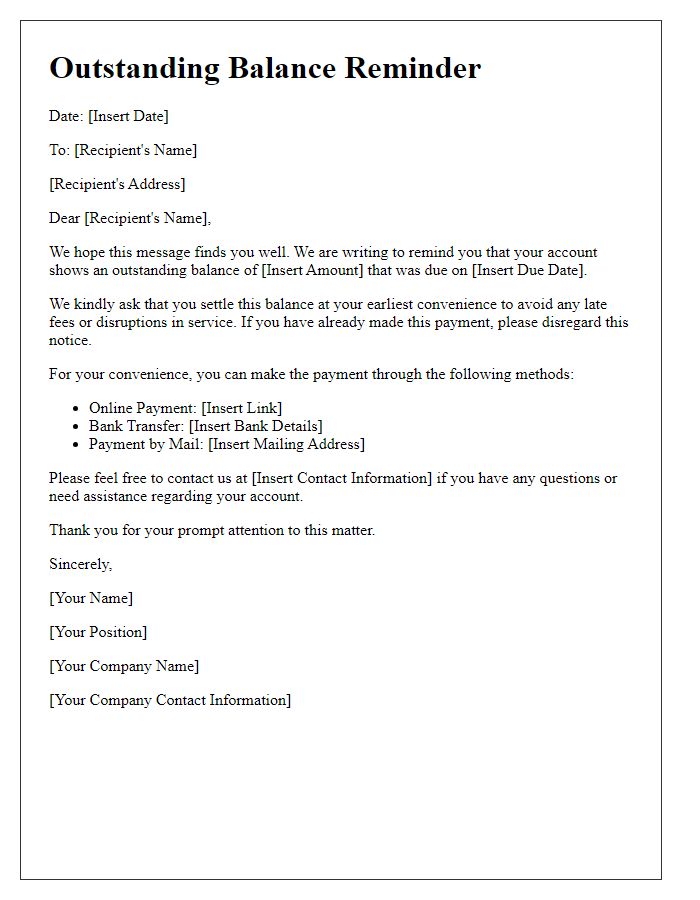

Clarity of Payment Details

Unsettled debts can lead to significant financial repercussions, such as increased interest rates. Incomplete payments, typically defined as partial amounts not covering outstanding balances, must be addressed promptly. For instance, a credit card bill totaling $1,500 with a partial payment of $800 leaves a remaining balance of $700. Late fees, often around $30 for missed payments, can accrue after due dates. Consistent late payments may also affect credit scores, lowering them by 100 points or more. It is crucial to clarify payment details, including exact amounts owed and due dates, to avoid potential collection actions from agencies like Experian or TransUnion, which can further complicate financial health.

Consequences of Non-Payment

Individuals receiving incomplete debt payment warnings face significant consequences that can impact both financial stability and creditworthiness. Missed payments can lead to increased interest accrual on outstanding balances, making it harder to settle debts, especially with high-interest loans from institutions such as banks or credit unions. In some instances, failure to address payment issues can result in accounts being sent to collections, where third-party agencies may pursue recovery aggressively. Furthermore, credit scores can drop significantly (often by 100 points or more), affecting an individual's ability to secure future loans or mortgages. Legal actions may also be initiated by creditors, including lawsuits or wage garnishments, which can have long-term repercussions on personal finances. Being aware of these potential outcomes ensures individuals understand the importance of maintaining communication with creditors to avoid escalating situations.

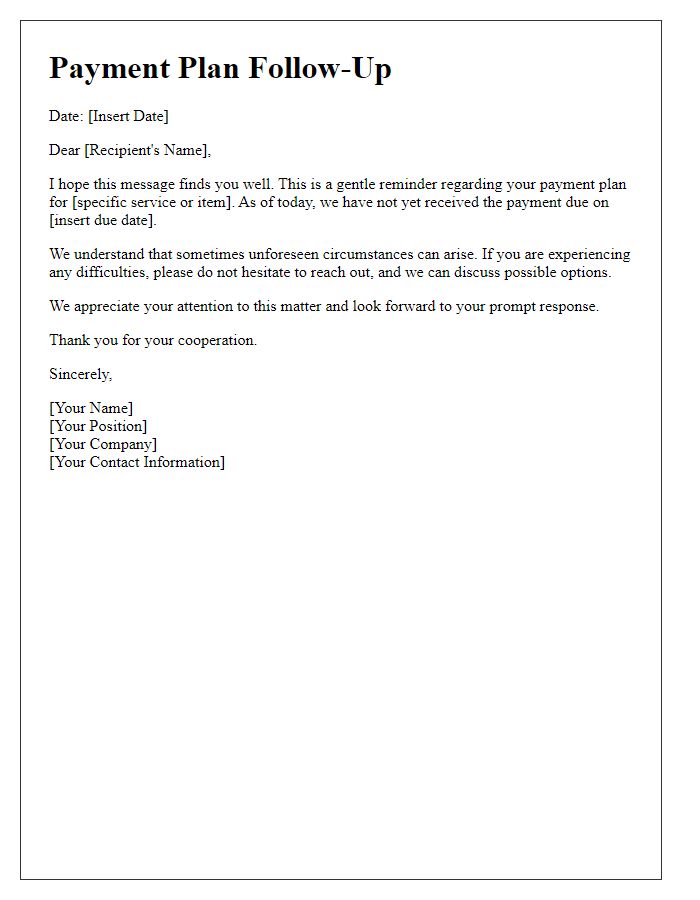

Deadline for Payment Completion

A pending debt payment might result in severe consequences for individuals and organizations alike. A specific deadline, often thirty days from the initial notice, is typically provided for payment completion. Failure to meet this deadline can lead to late fees, additional interest accruement, or even legal proceedings, possibly culminating in court-ordered judgments. The creditor, which could be an institution like a bank or a credit union, will often escalate communication efforts, including reminders through emails or phone calls, emphasizing the importance of addressing the outstanding amount. Consequently, it is crucial for debtors to be aware of their obligations and adhere to set timelines to avoid detrimental repercussions on their financial standing.

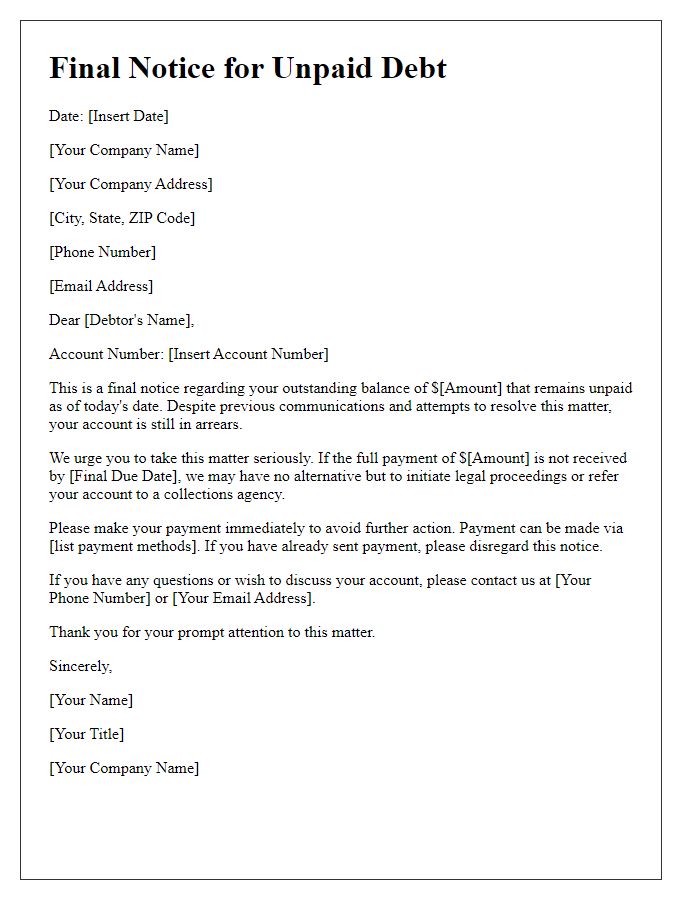

Contact Information for Support

In the context of outstanding finances, a debt payment warning serves as an essential reminder for individuals or businesses with incomplete payments. Financial institutions typically require specific contact information to facilitate clear communication. A valid phone number, such as (555) 123-4567, is crucial for direct inquiries. An email address, like support@financialinstitute.com, enables prompt responses to queries. Furthermore, physical mailing addresses, including 1234 Finance Lane, Suite 100, Cityville, ST 12345, can be used for formal correspondence. Accurate contact details ensure that debtors receive timely notifications regarding payment deadlines, potential penalties, and available support options. These communications are vital to maintain transparency and encourage the resolution of outstanding debts efficiently.

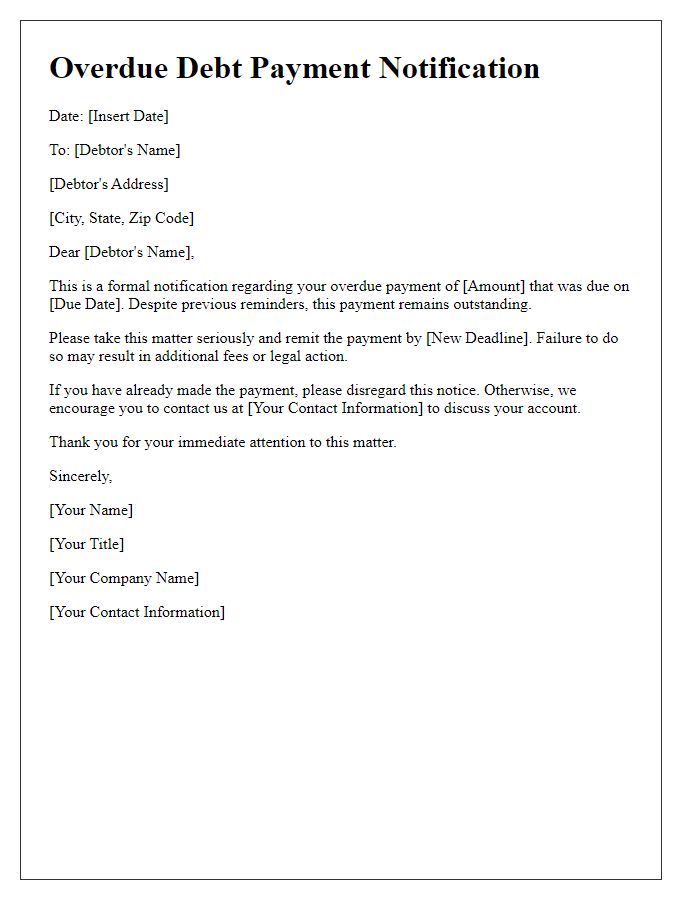

Formal and Professional Tone

A formal notification regarding an outstanding debt can emphasize the importance of maintaining timely payments to avoid negative repercussions. An account balance, such as $1,500, has been overdue since January 15, 2023. Failure to address this payment may result in additional late fees and potential impacts on credit scores. Collection processes may also be initiated if the balance remains unsettled beyond the agreed timeframe. Communication is encouraged to discuss potential payment plans or any discrepancies related to the account.

Comments