Are you feeling overwhelmed by managing your debts? Transferring debt responsibility can be a daunting task, but it's a crucial step towards regaining control of your finances. This article will guide you through the process, breaking down the steps and highlighting key considerations to ensure a smooth transition. So, let's dive in and explore how you can take charge of your financial future!

Debtor Information

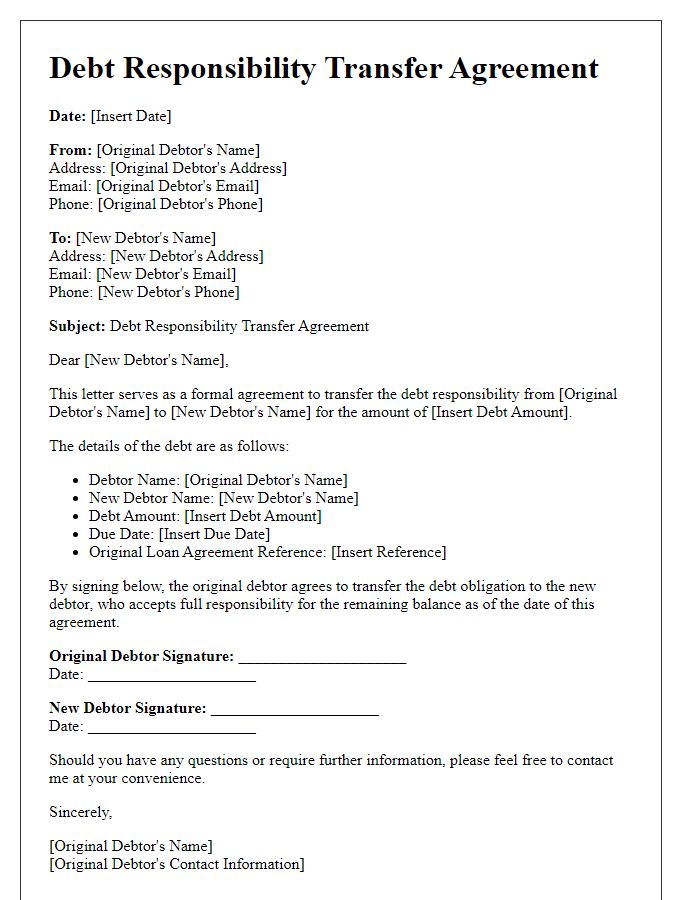

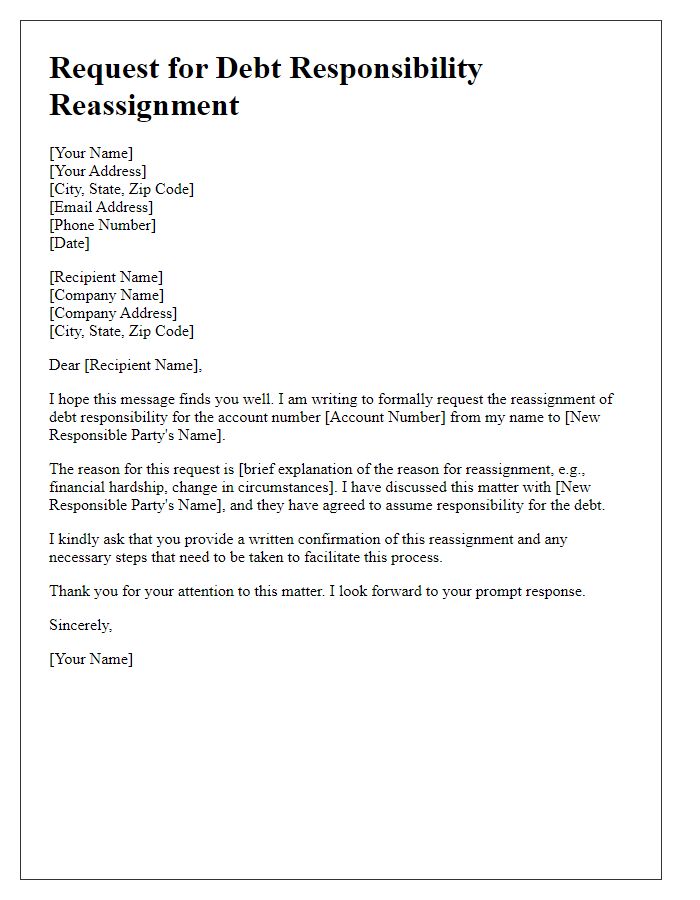

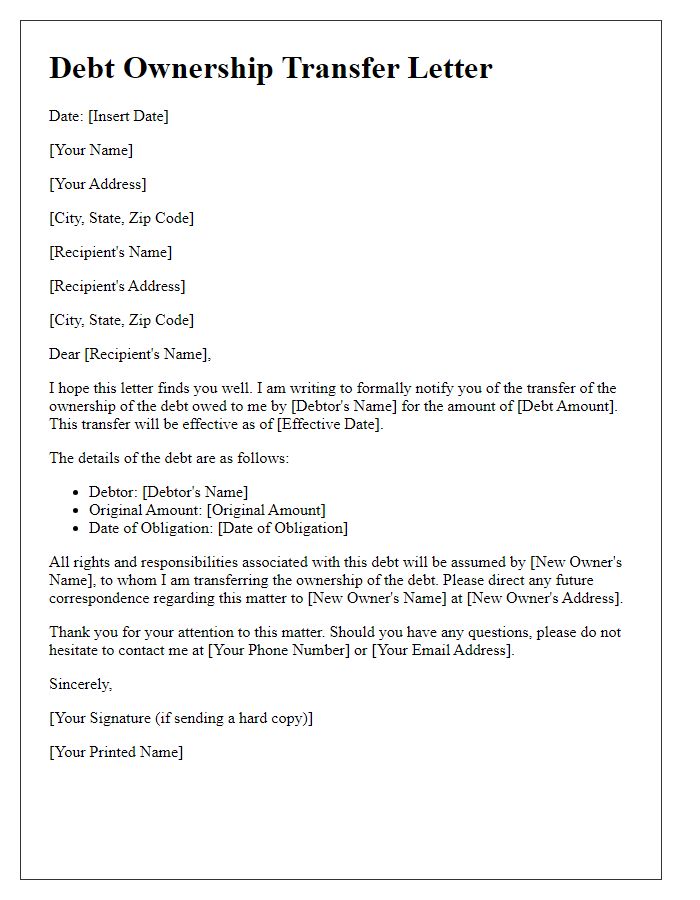

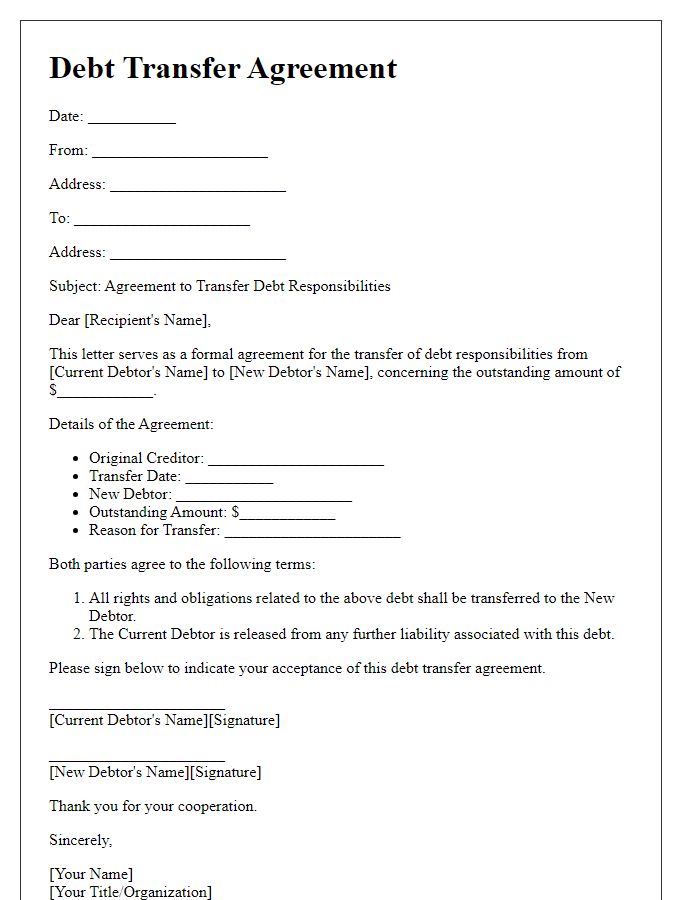

Transferring debt responsibility can significantly impact the financial obligations of individuals, especially in circumstances involving personal loans or credit card balances. In such cases, the debtor, often identified by their full name, social security number, and contact information, must provide a clear statement regarding the transfer of debt responsibilities. This process typically includes details about the original creditor, outstanding amount (detailed in dollars), and any associated account numbers. Furthermore, it is crucial to outline the new responsible party's information, including their full name and contact details, to ensure proper documentation and communication. A formal agreement should clarify that all responsibilities, including repayment terms and timelines, will be duly transferred to the new debtor, thereby relieving the original debtor of further obligations.

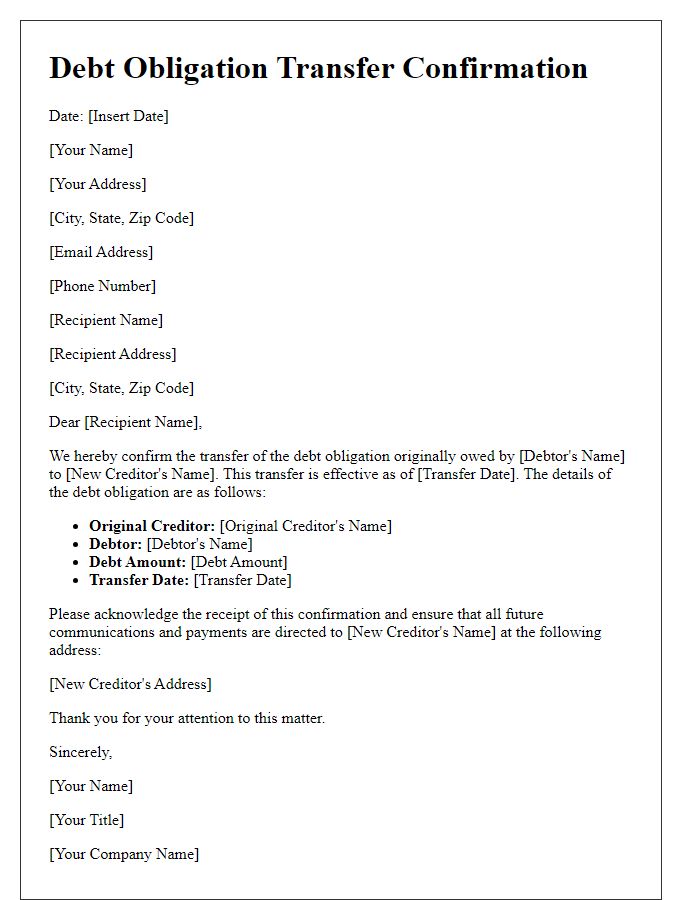

Creditor Details

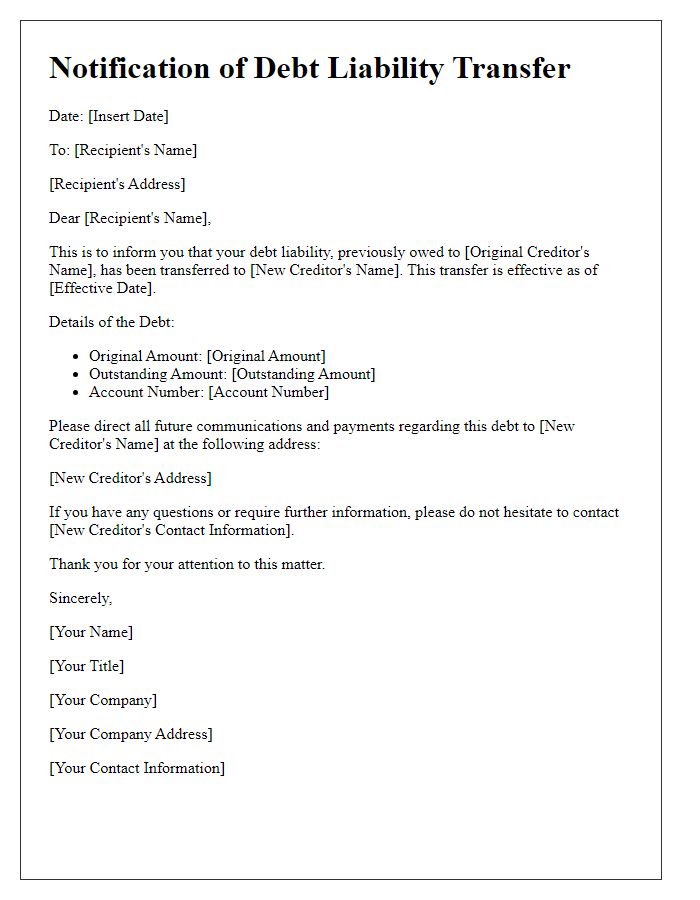

In the process of transferring debt responsibility, accurate documentation of the creditor's details is essential. For instance, the creditor's name, such as ABC Financial Services, should be clearly stated. The official address, like 123 Main Street, Cityville, State, ZIP Code, must be included for verification purposes. Additionally, the contact number, for example, (555) 123-4567, ensures easy communication regarding the debt transfer. Including the account number associated with the debt, such as Account Number: 7890123456, is critical for tracking purposes. Lastly, specifying the type of debt, whether it is a personal loan, credit card debt, or mortgage, provides clarity on the nature of the obligation being transferred.

Original Debt Terms

Debt responsibility transfer involves the assignment of original debt obligations from one party to another. In this scenario, the original debt terms include a principal amount of $10,000, with an interest rate of 5% per annum, due in monthly installments. The loan originated from ABC Bank, established in New York City, on January 15, 2020. The repayment schedule was structured over 36 months, with the final payment due on January 15, 2023. All payment details, including the account number (1234567890) and borrower's identification details, should be documented during the transfer process to ensure clarity and compliance with both the lender's and borrower's agreements. Proper legal documentation is essential to validate the transfer and protect both parties involved in the transaction.

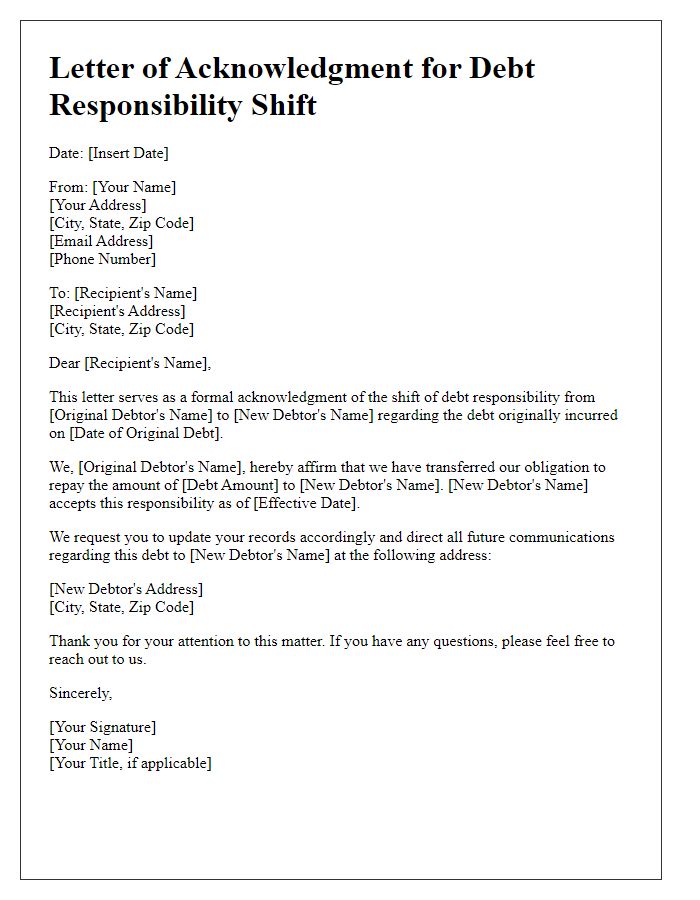

New Responsible Party Information

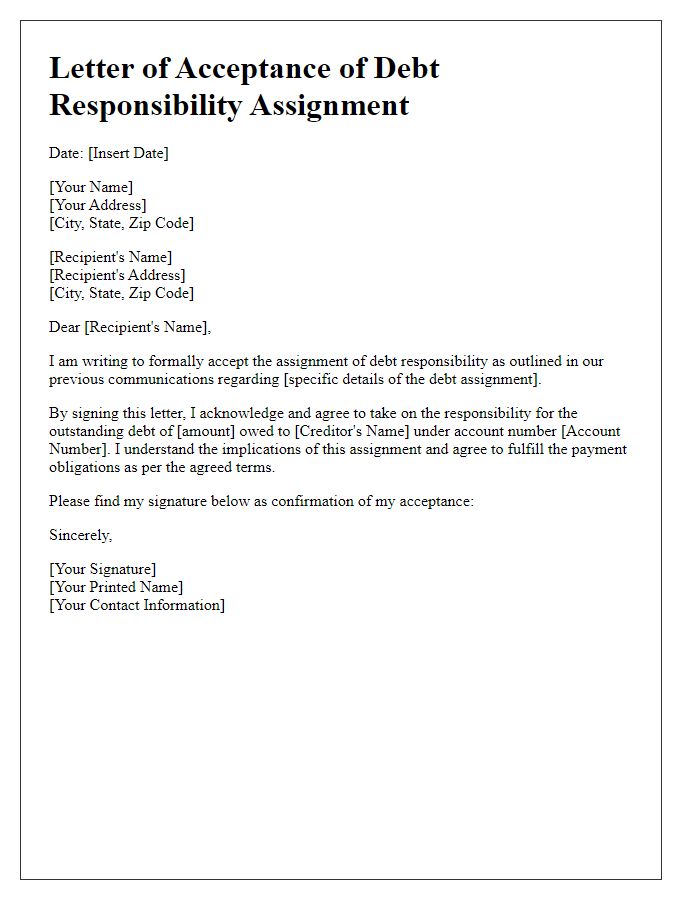

The transfer of debt responsibility can significantly impact credit scores for both parties involved. A new responsible party (individual or entity assuming the debt) should be clearly identified, including full legal name, Social Security number (or Tax ID for businesses), and current address. Accurate transfer documentation is essential, detailing the original creditor's name, account number, and the specific terms of the debt, such as balance owed and payment schedule. It is crucial to notify credit bureaus to update records, ensuring that the new responsible party's credit report reflects the change appropriately. This process helps establish accountability and clarifies the obligations for repayment, providing a clear framework for financial responsibility moving forward.

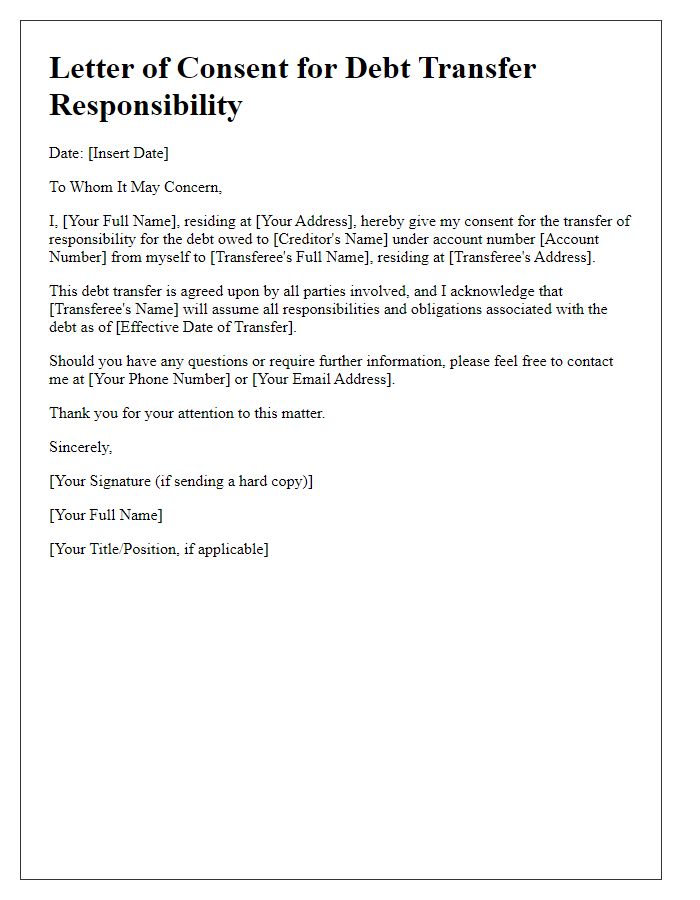

Legal Authorization Statements

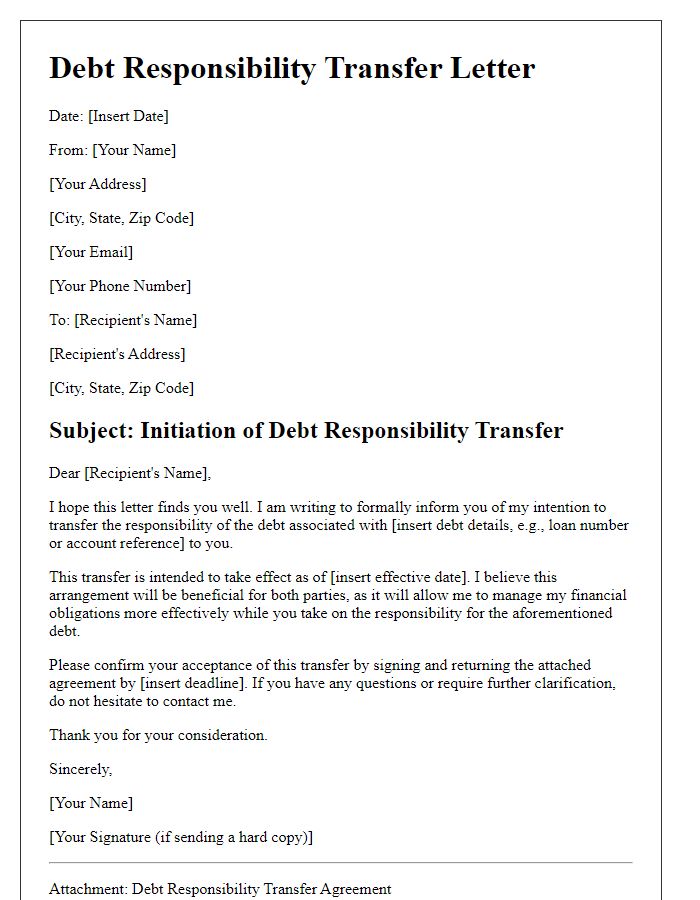

Debt responsibility transfer involves intricate legal implications and requires clear documentation to ensure proper authorization. This process typically entails defining terms outlining the exact debt amount, alongside the names of both the creditor (the original lender) and the debtor (the individual or entity assuming responsibility). Notable legal documents such as a Transfer of Debt Agreement may need to be drafted, specifying the effective date of transfer, any applicable interest rates, and payment terms. It's crucial to include statutory language to affirm that the assignor (the current debtor) consents to the transfer, while the assignee (the new debtor) acknowledges responsibility for the debt, thereby releasing the original debtor from further liability. Legal professionals often recommend notarization to validate the document, alongside potential registration with relevant financial institutions to prevent disputes.

Comments