Are you feeling overwhelmed by debt and unsure where to turn? We understand that navigating financial challenges can be daunting, but with the right approach, a harmonious resolution is within reach. In this article, we'll explore effective strategies for advocating debt resolutions that prioritize understanding and compassion. Let's dive in and unlock the path to financial peace together!

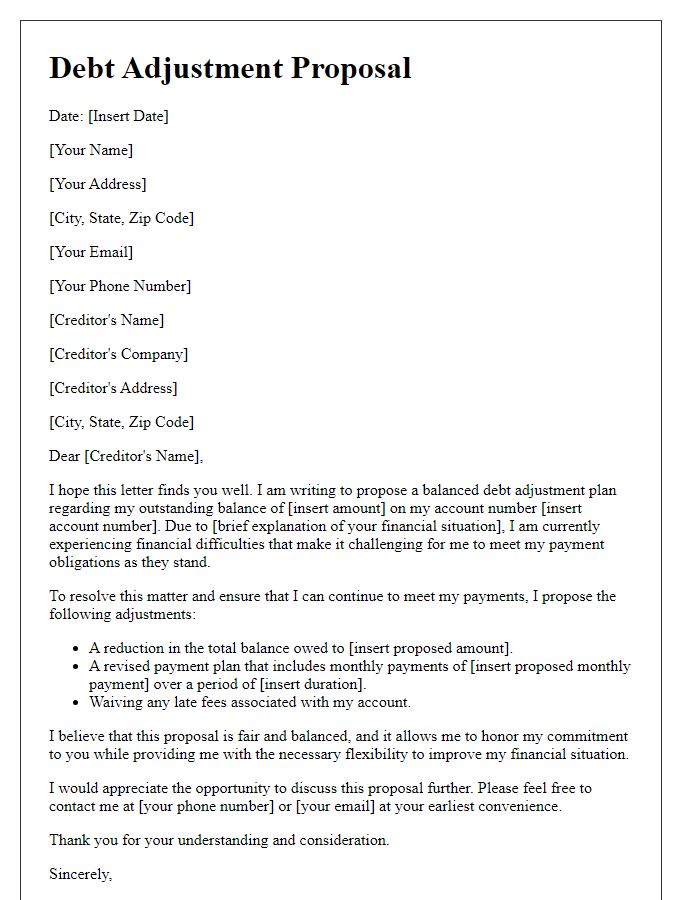

Clear and Respectful Language

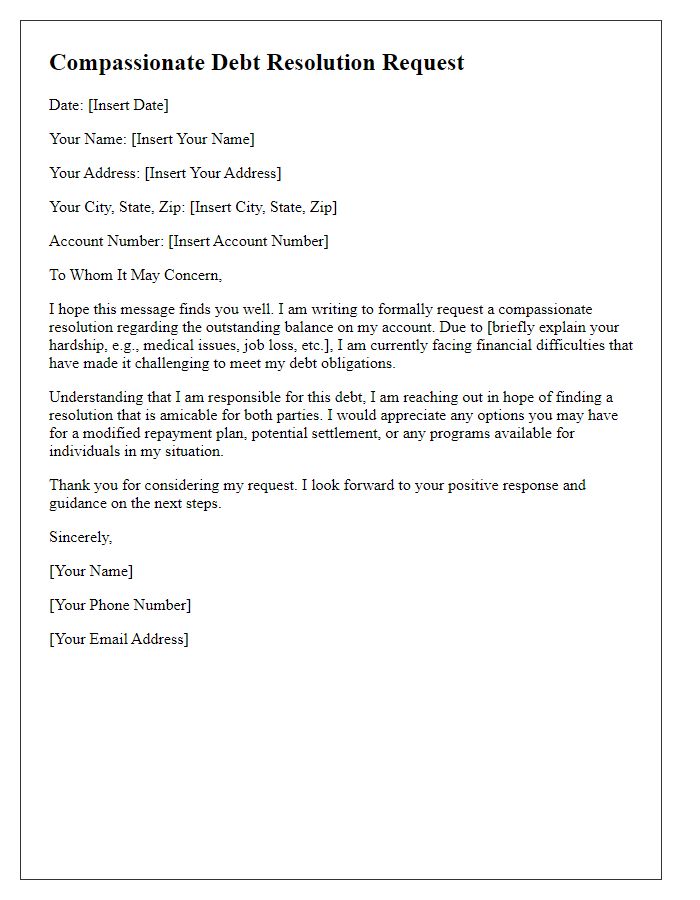

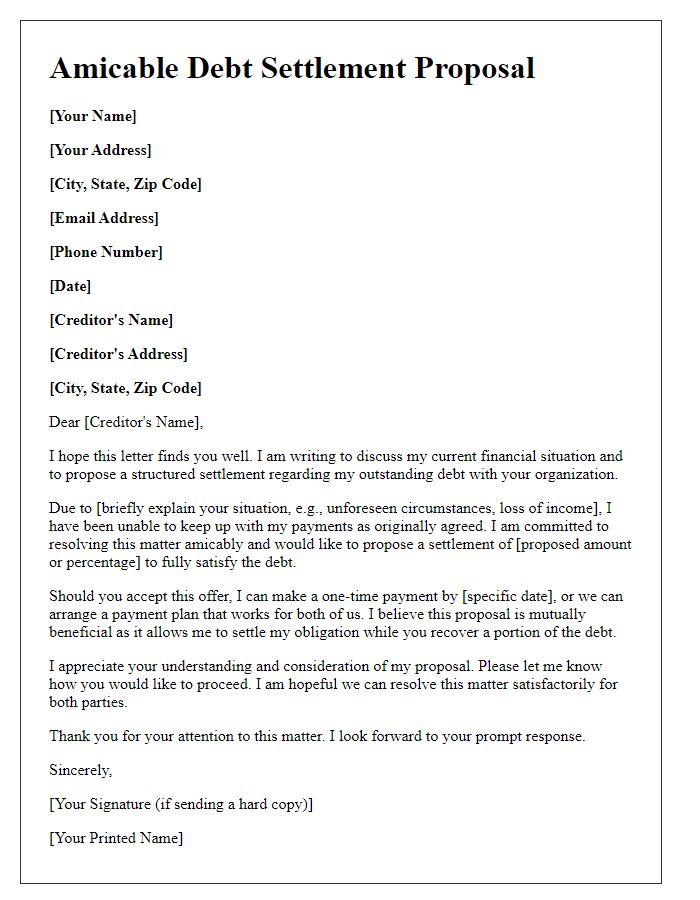

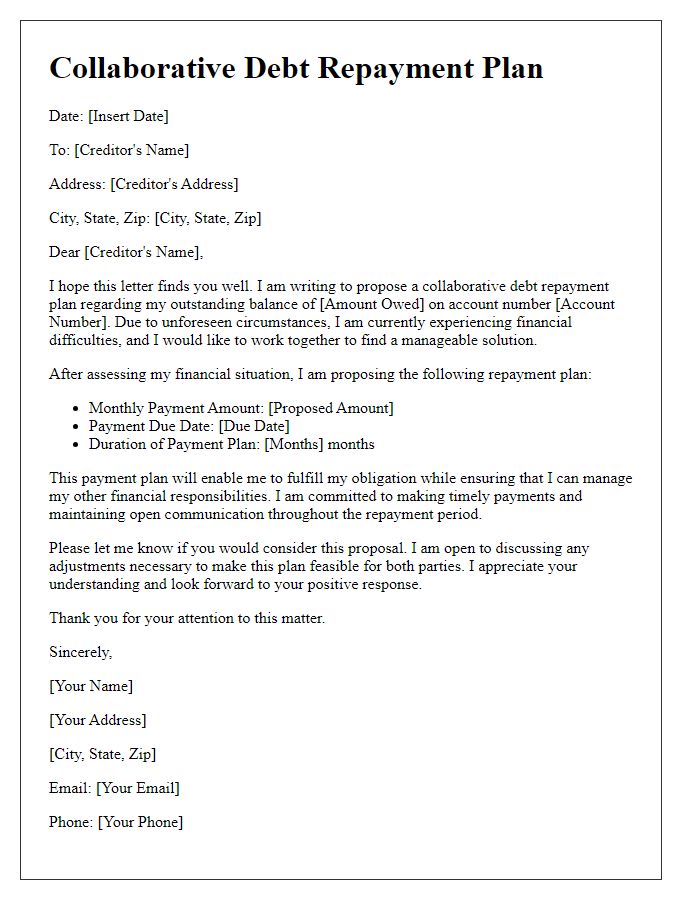

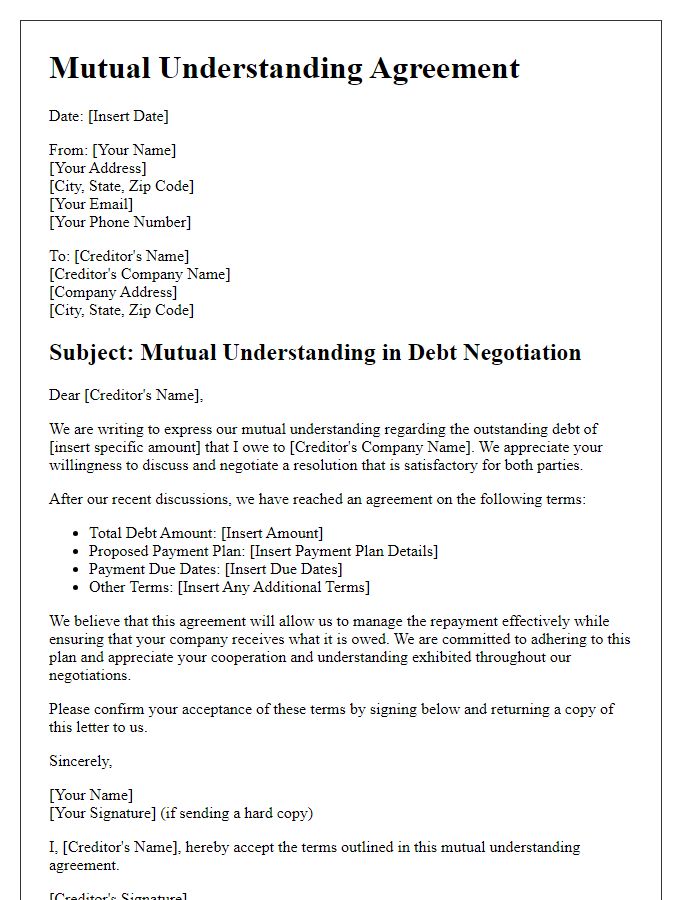

Harmonious debt resolution requires clear communication and an understanding of both parties' circumstances. A respectful tone fosters a productive dialogue. A well-structured plan includes specific details, such as the amount owed (e.g., $5,000), the original due date (e.g., January 15, 2023), and any previous payment agreements. Highlighting intent to resolve the situation amicably is crucial. Offer potential solutions, such as a revised payment plan over six months, ensuring flexibility to accommodate repayment capacity. Emphasizing the importance of maintaining a positive relationship can encourage cooperation and mutual understanding in the resolution process. Clear documentation and acknowledgment of each step can further support the goal of achieving a harmonious agreement.

Precise and Relevant Information

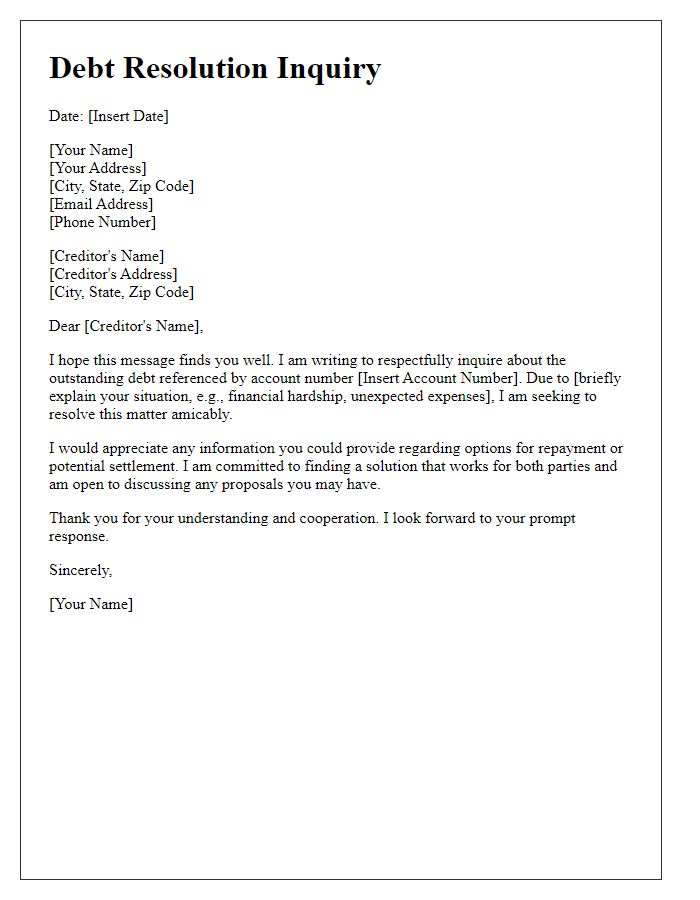

Harmonious debt resolution advocacy focuses on amicable solutions to financial obligations while maintaining respectful dialogue. Effective communication is crucial, as seen in cases involving mediation services like the American Arbitration Association (AAA) or similar organizations. Key factors include understanding local laws such as the Fair Debt Collection Practices Act (FDCPA) that protect consumers in the United States. Engaging in negotiation meetings often held at neutral sites, such as community mediation centers, allows for constructive dialogue. Utilizing financial management resources or consulting with nonprofits specializing in debt counseling, such as the National Foundation for Credit Counseling (NFCC), can provide essential guidance and strategies for both debtors and creditors to achieve a mutually beneficial outcome.

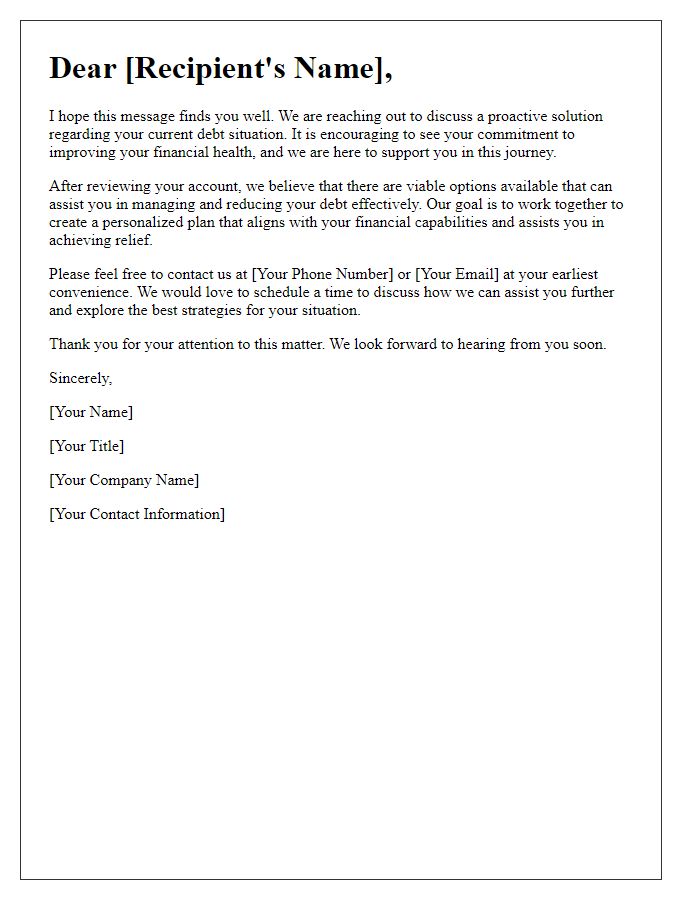

Empathy and Understanding Tone

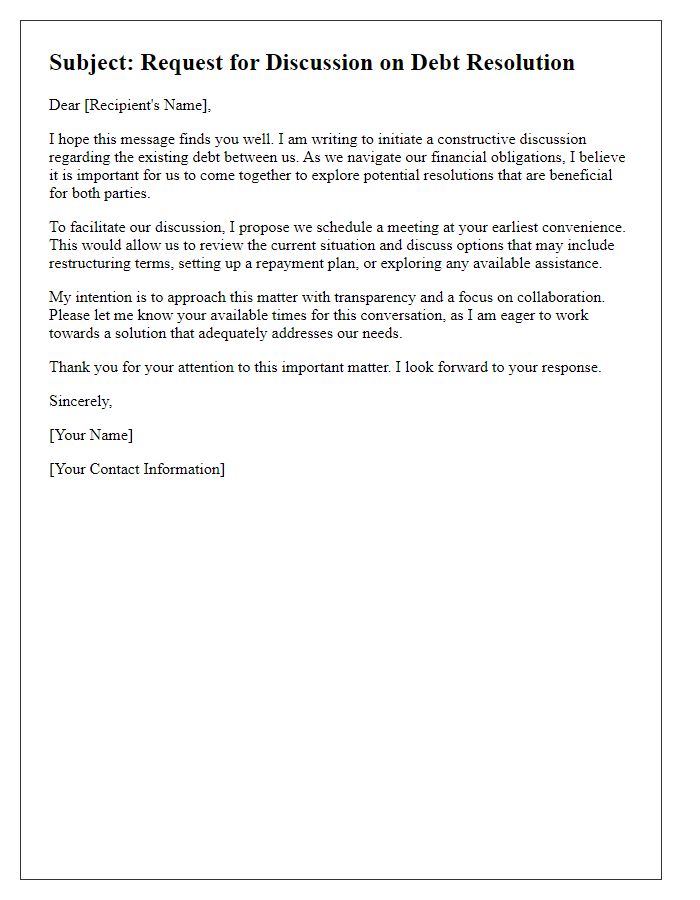

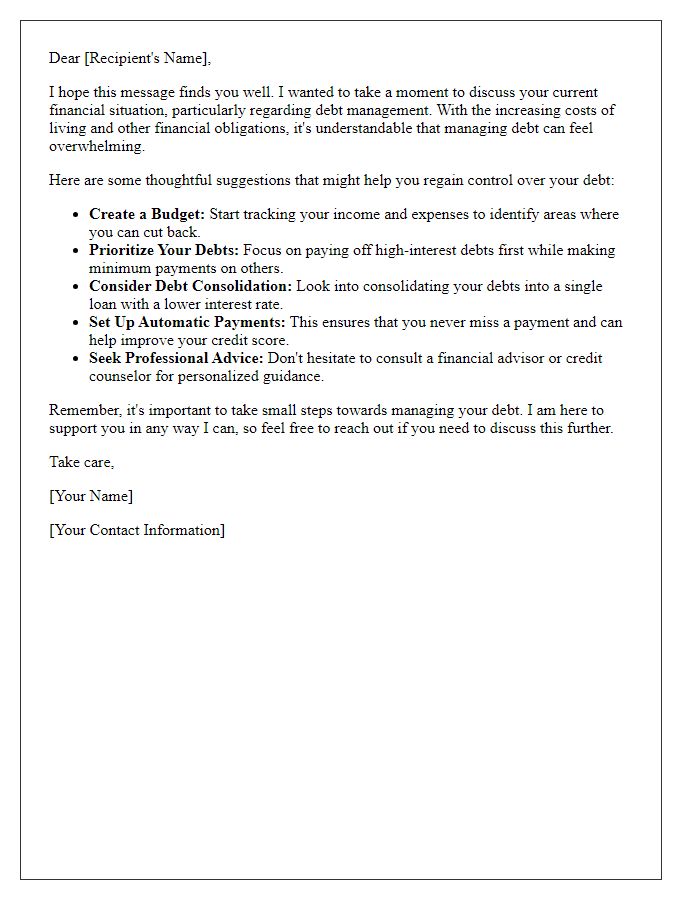

Financial difficulties often arise unexpectedly, creating stress and hardship for individuals and families. Compassionate communication is essential in addressing debts, particularly for those facing challenging circumstances. The advocacy for harmonious debt resolution emphasizes understanding the debtor's situation, acknowledging feelings of anxiety and uncertainty that accompany financial strain. Establishing a dialogue allows for the exploration of feasible repayment options, such as reduced monthly payments or extended timelines, enabling debtors to regain stability without overwhelming pressure. This approach fosters a cooperative atmosphere, essential for building trust, which can lead to mutually beneficial outcomes for both creditors and debtors. Prioritizing empathy can transform the debt resolution process into one of support rather than conflict.

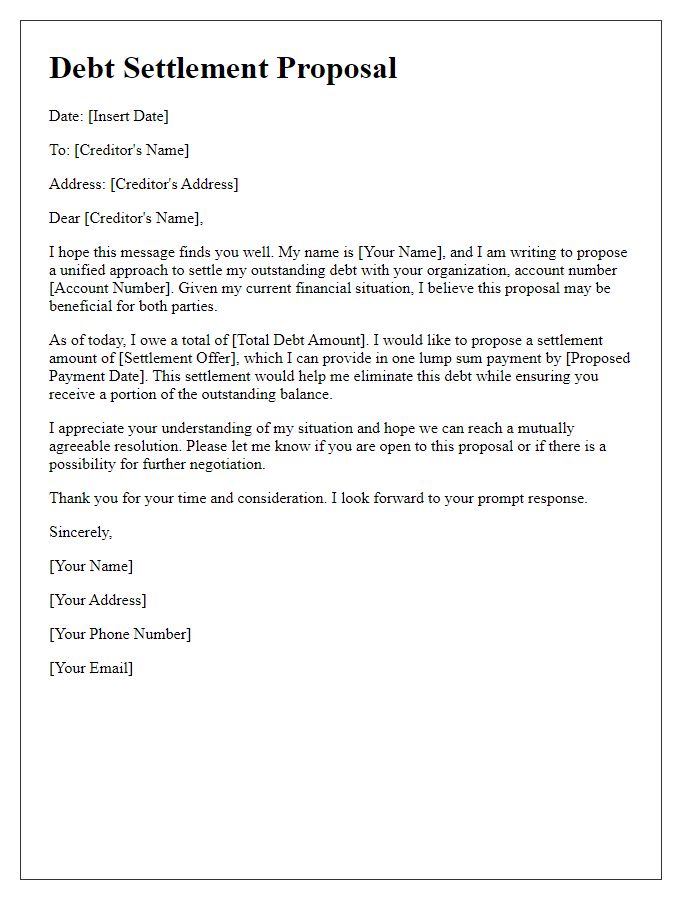

Concise Request or Proposal

Debt resolution advocacy can lead to effective solutions for individuals facing financial difficulties. In situations where large debts, such as credit card balances or personal loans, accumulate, a structured approach can foster better communication with creditors. During negotiations, proposing manageable repayment plans based on a borrower's financial capacity can alleviate stress and promote a sense of cooperation. Providing documentation detailing income, essential expenses, and potential negotiation goals can facilitate understanding and lead to mutually beneficial arrangements. Successful debt resolution often involves establishing an open dialogue, emphasizing a commitment to repayment, ultimately fostering financial recovery and stability for the affected individuals.

Collaborative and Solution-oriented Approach

Harmonious debt resolution involves strategic communication and mutual understanding between creditors and debtors. A collaborative approach prioritizes open dialogues, enabling both parties to explore feasible repayment options. In pursuit of solutions, stakeholders such as financial counselors and negotiation experts play a vital role in facilitating discussions that aim for win-win outcomes. Structured repayment plans may include reduced interest rates or extended payment terms, enhancing debtors' ability to meet obligations while ensuring creditors receive consistent payments. Successful resolutions often result in strengthened relationships and improved financial literacy for debtors, fostering a more sustainable economic environment for all involved.

Comments