Navigating debts across different jurisdictions can feel overwhelming, especially with varying regulations that come into play. It's essential to understand not only your legal obligations but also the potential for conflicts that may arise. With so many nuances involved, having a well-structured letter template can simplify the communication process and ensure clarity in your intentions. Curious to learn more about how to effectively manage cross-jurisdictional debts? Read on!

Compliance with International Laws

The regulation of debts across jurisdictions necessitates compliance with international laws, particularly in the context of cross-border financial transactions involving entities in countries such as Canada, Germany, and Japan. Legal frameworks, including the United Nations Convention on Contracts for the International Sale of Goods (CISG) enacted in 1988, dictate the obligations and rights of parties involved in international agreements. Additionally, local laws must align with regulatory standards set by bodies like the Financial Action Task Force (FATF), which monitors money laundering and terrorist financing risks. Organizations must utilize tools such as the World Bank's "Doing Business" reports to navigate the legal landscapes and ensure adherence to regulations. Escalating legal complexities often require consultation with legal experts specializing in international law to mitigate risks related to jurisdictional disputes and enforcement challenges in debt recovery processes.

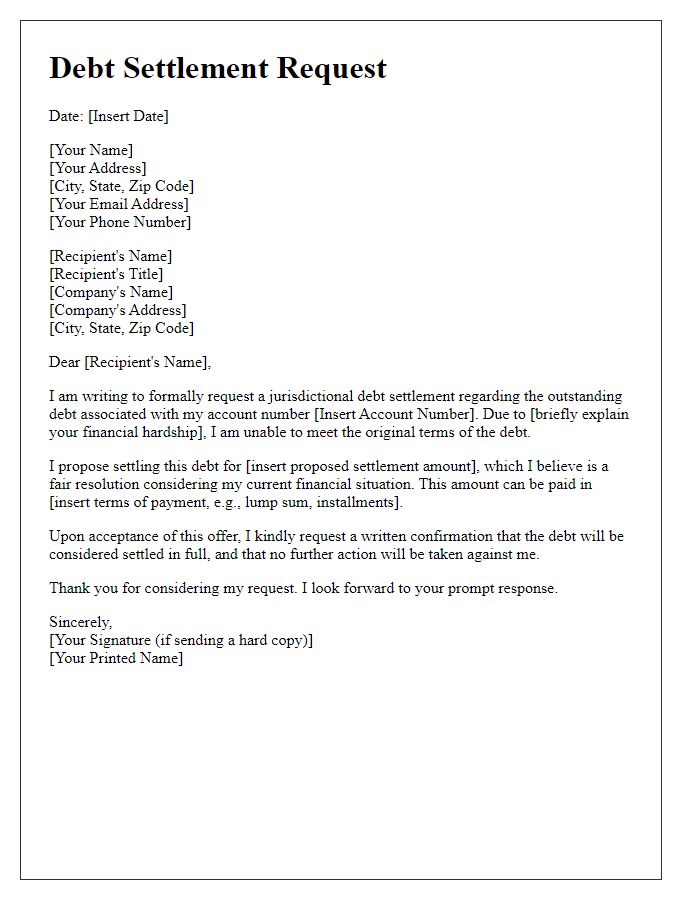

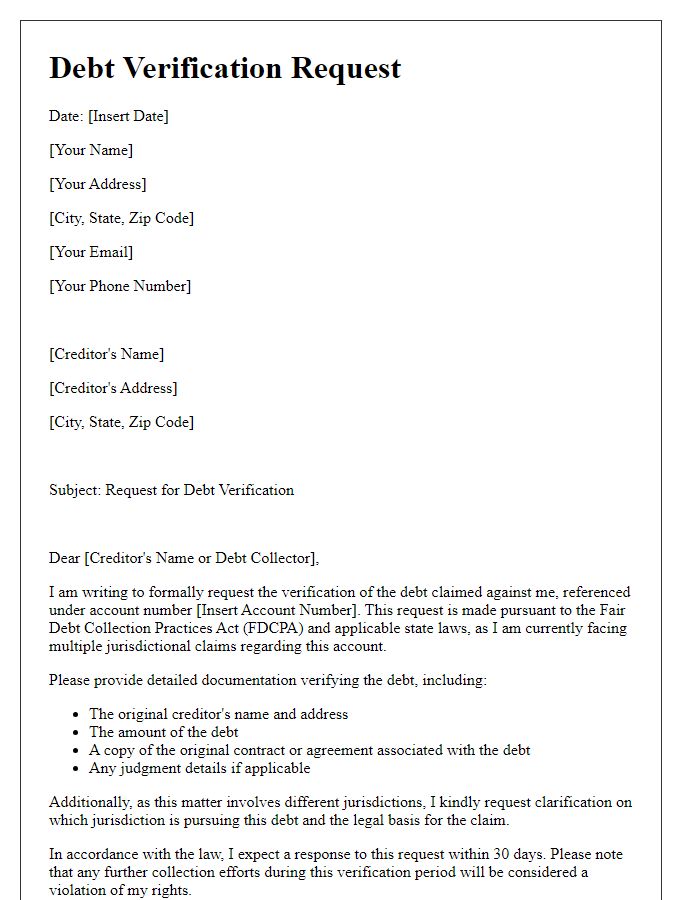

Jurisdiction-Specific Regulations

Jurisdiction-specific regulations regarding debt collection often vary significantly between regions and can influence both the processes and strategies used by creditors. In the United States, for instance, the Fair Debt Collection Practices Act (FDCPA) establishes guidelines for collection agencies, ensuring that practices remain ethical and fair, prohibiting harassment and deceptive practices. In contrast, European jurisdictions may follow the European Union's Directive on consumer credit, which imposes transparency requirements on lenders, enhancing consumer protection when dealing with debts. Countries like Germany employ more rigorous regulations, requiring creditors to provide comprehensive documentation before initiating any collection action, while jurisdictions such as Singapore emphasize mediation as a means for dispute resolution before legal actions can ensue. Understanding these nuanced regulations is essential for stakeholders, including creditors, debtors, and legal professionals, to navigate the complexities of debt collection across different jurisdictions effectively.

Cross-Border Enforcement Mechanisms

Cross-border enforcement mechanisms play a vital role in regulating debts across jurisdictions, ensuring compliance and collection in accordance with international legal standards. Various treaties, such as the Hague Convention on the Choice of Court Agreements, facilitate the recognition of foreign judgments, enabling creditors to pursue unpaid debts in different countries effectively. Specific national laws, including the United States' Uniform Enforcement of Foreign Judgments Act, streamline this process by allowing for the enforcement of a judgment from another state or country, thereby reducing legal complexities. Entities like the International Chamber of Commerce provide guidelines and arbitration services, assisting businesses in navigating disputes related to cross-border debts. Furthermore, technological advancements have led to the emergence of online platforms, improving communication and documentation sharing between creditors and debtors, regardless of their geographical location.

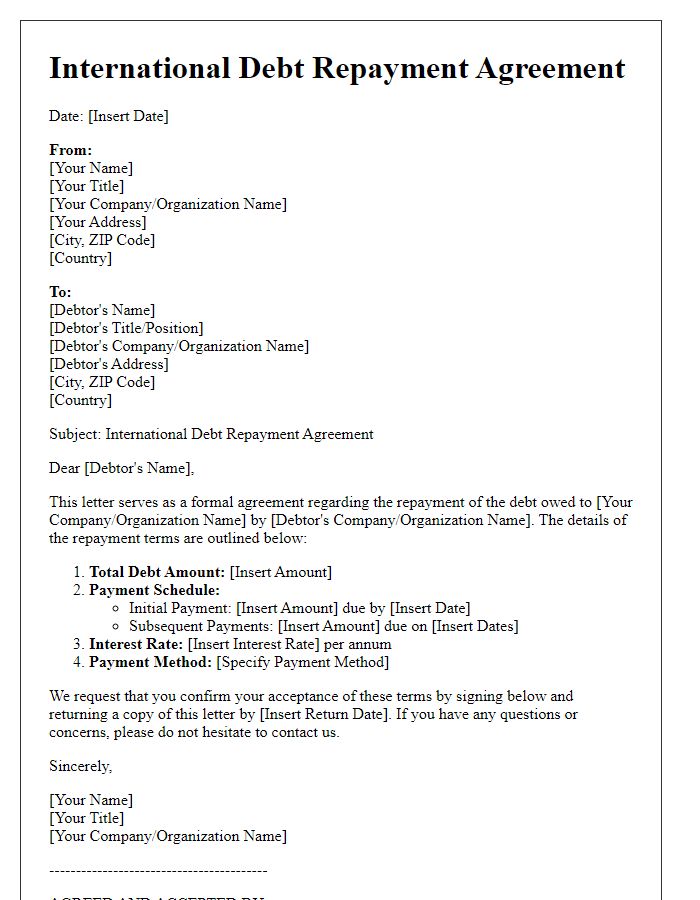

Debt Repayment Terms and Schedules

Debt repayment terms and schedules are crucial elements in managing financial obligations across diverse jurisdictions. Different countries, such as the United States, Canada, and the United Kingdom, enforce varying regulations that govern repayment timelines, interest rates, and default penalties. For instance, in the United States, the Fair Debt Collection Practices Act (FDCPA) outlines specific practices for debt recovery, while in Canada, the Bankruptcy and Insolvency Act offers structured repayment options through consumer proposals. Jurisdictional differences can lead to complexities with international loans and cross-border agreements, requiring careful navigation of each region's legal requirements. Accurate record-keeping of payment schedules, including due dates and amounts, is essential for maintaining compliance and ensuring transparency in each jurisdiction's financial practices.

Currency Exchange and Conversion Rates

Currency exchange rates play a critical role in the regulation of debts across jurisdictions, influencing how obligations in one currency translate into another. Fluctuations in foreign exchange markets can significantly affect the total amount owed, making it essential for parties to consider up-to-date conversion rates from reliable financial institutions, such as the European Central Bank or the Federal Reserve. Legal frameworks often stipulate the use of specific conversion methodologies, such as the spot rate on a particular date or an average rate over a defined period, ensuring clarity and fairness in financial transactions. Additionally, discrepancies in currency valuation and economic stability across countries, particularly for emerging markets, can lead to unforeseen alterations in debt obligations, necessitating thorough risk assessments and hedging strategies. These factors underpin the importance of regulatory compliance in cross-border financial agreements to maintain transparency and protect involved parties' interests.

Comments