Are you feeling overwhelmed by overdue debts and unsure how to approach your creditors? Crafting a thoughtful debt payment request letter can make all the difference in easing your financial burden. In this article, we'll guide you through the essential elements of an effective letter that conveys your situation with clarity and respect. Keep reading to discover the tips and templates that will help you take control of your debt management process.

Professional and respectful tone

A consistent pattern of missed debt payments can significantly affect credit ratings and financial stability. Timely payments (typically due on the last day of each month) ensure a solid credit score, vital for securing future loans and mortgages. The importance of a formal debt payment request becomes evident when addressing the debtor, where professionalism (maintaining respect) reinforces the seriousness of the request. Clear communication of the total amount owed, any applicable interest rates (often ranging from 5% to 30% annually), and the importance of settling by a specific date helps maintain transparency. Additionally, mentioning potential consequences, such as legal action, can encourage more prompt payment resolution while remaining within a courteous framework.

Clear description of the debt

The outstanding debt, amounting to $3,500, represents the balance for services rendered by ABC Consulting Ltd., a financial advisory firm, during the period of January 2022 to March 2022. This debt arises from three separate invoices numbered 101, 102, and 103, issued on February 15, March 1, and March 15, respectively. Each invoice details specific consulting services, including strategic planning and financial analysis, which were provided to XYZ Corporation, a mid-sized technology company based in San Francisco, California. The payment was originally due within 30 days of receipt, yet remains unpaid, contributing to a potential breach of contract under California state law. Prompt resolution of this matter is necessary to maintain a positive business relationship.

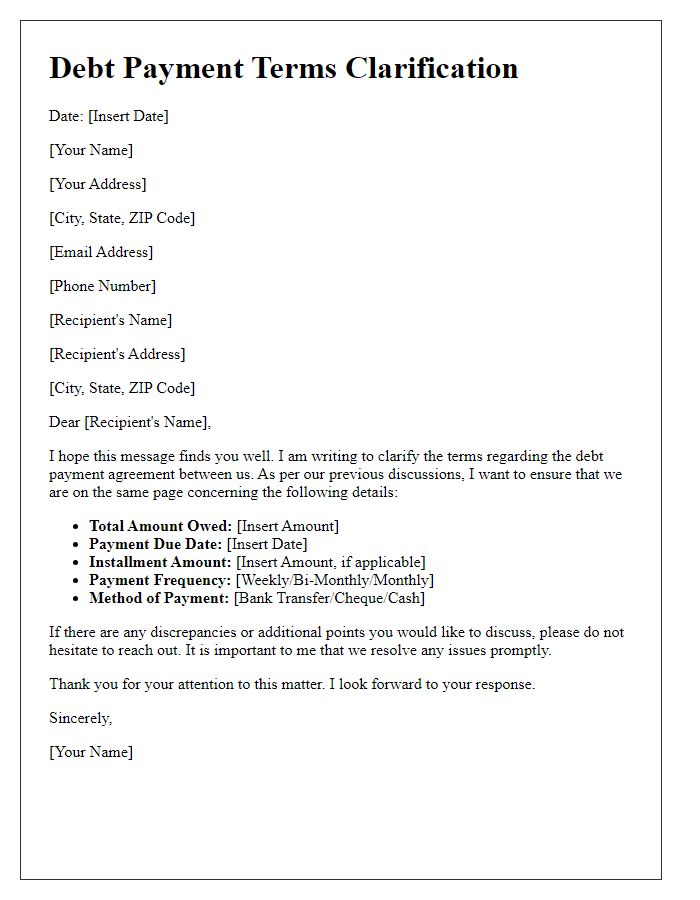

Specific payment terms and due dates

A structured payment plan is essential for managing debts effectively. Specific payment terms include amounts due, frequency of payments, and due dates, essential for clarity. For example, a monthly payment of $500 due on the first of each month until a total of $5,000 is paid off. Additionally, including a grace period of 10 days post due date allows for flexibility. Ensuring clear communication of these terms assists both parties in maintaining financial accountability and fosters a positive resolution to the debt situation. Establishing a formal agreement, possibly notarized, enhances the legal enforceability of the terms discussed.

Contact information for inquiries

Debt payment requests can significantly impact financial stability and often require clear communication. Proper contact information ensures that debtors have a direct line to address inquiries. Essential details include the name of the creditor organization (i.e. XYZ Financial Services), a phone number (e.g., +1 (555) 123-4567) for immediate assistance, and a dedicated email address (e.g., support@xyzfinancial.com) for written correspondence. Physical mailing address may also be important, especially for formal notices (e.g., 123 Finance St., Suite 100, Anytown, USA). Clarity in this information can facilitate timely payments and foster positive debtor relations.

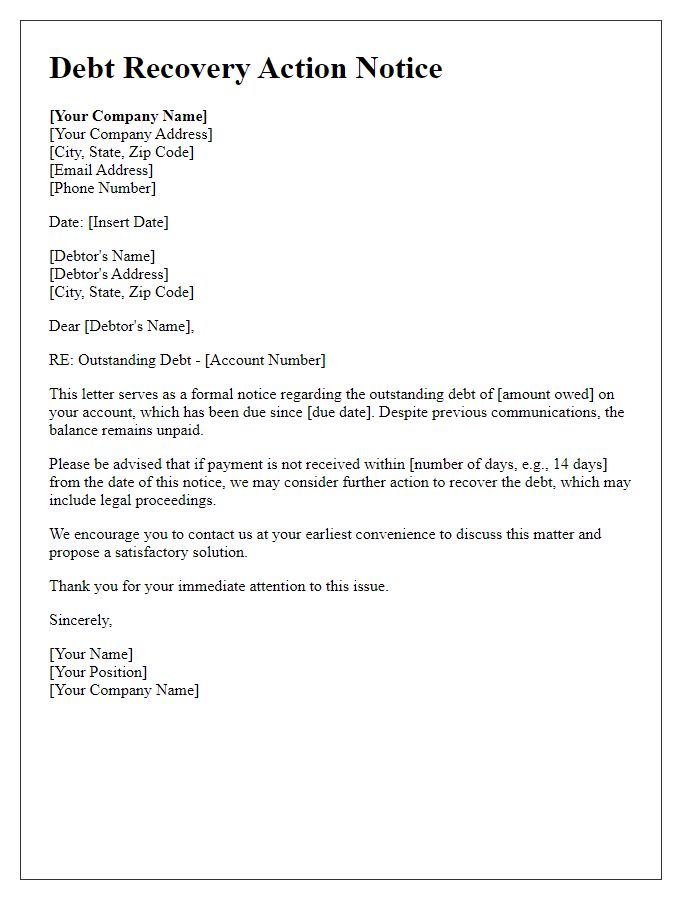

Consequences of non-payment

Consequences of non-payment can lead to severe financial repercussions, including mounting interest penalties that can exceed the original debt amount. In the United States, creditors may report delinquent accounts to major credit bureaus, such as Experian, Equifax, and TransUnion, significantly lowering a credit score, which impacts future borrowing capabilities. Additionally, legal actions may arise, with creditors pursuing court judgments that enable wage garnishment or bank account levies, exacerbating financial strain. In extreme cases, prolonged non-payment can result in asset seizures through lien enforcement against property, further complicating financial recovery efforts.

Comments