When it comes to managing our finances, staying informed about our debt status is crucial for making sound decisions. A reflective debt status notification can serve as a helpful reminder of where we stand and guide us toward effective financial planning. Whether you're navigating student loans, credit card debt, or mortgages, understanding your current situation can empower you to take the necessary steps for a healthier financial future. Dive into our article to explore the ins and outs of creating a meaningful debt status notification and how it can benefit you!

Personalization and Personal Details

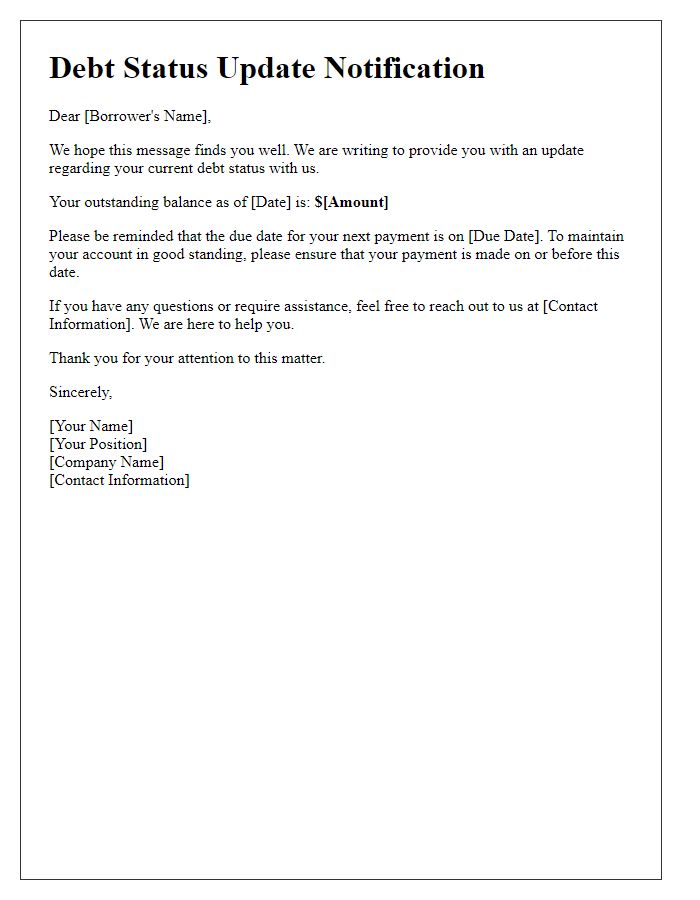

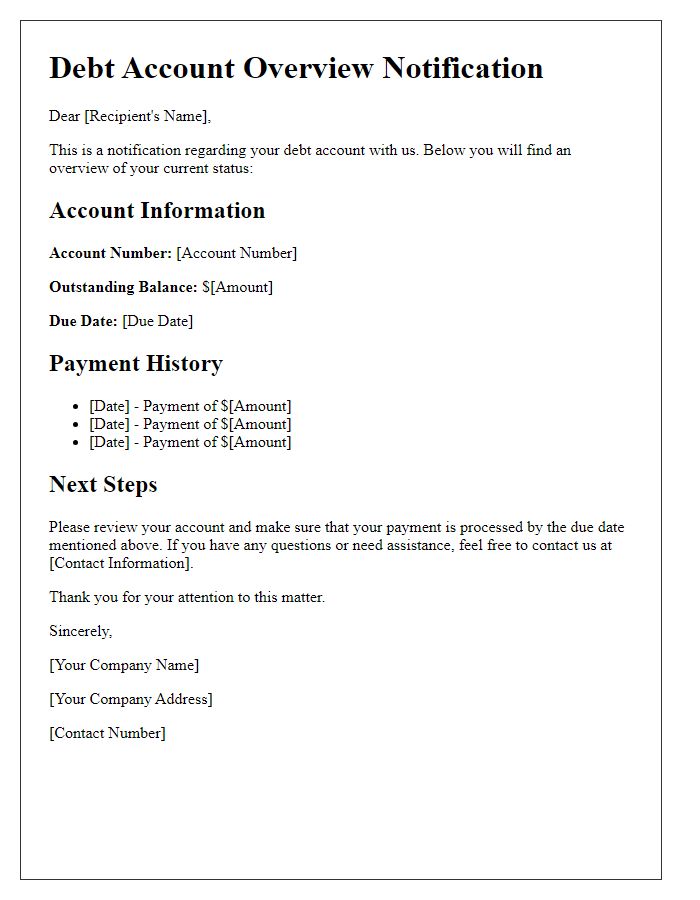

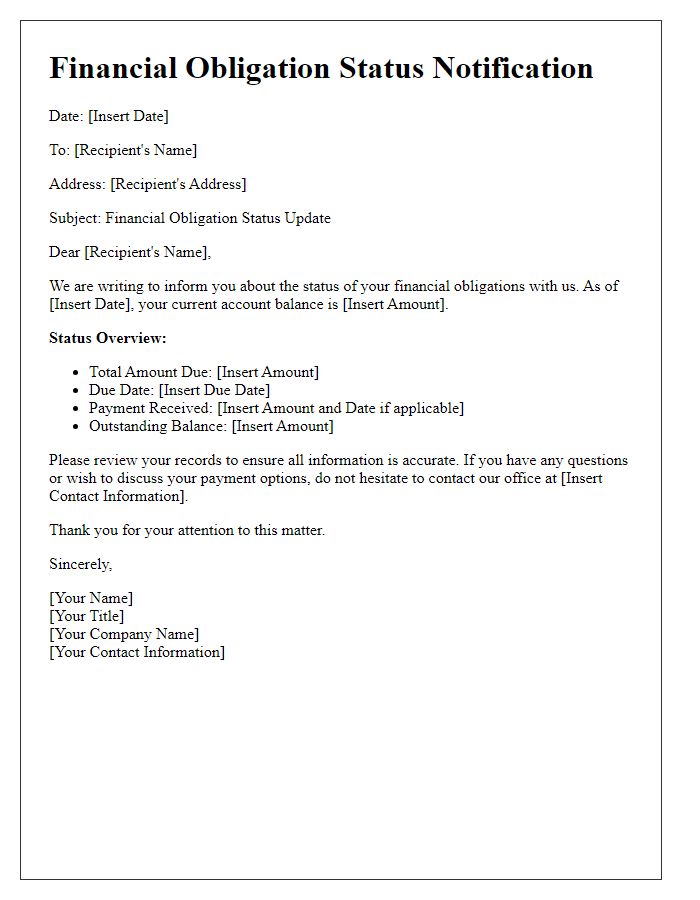

Personalization in debt status notifications is crucial for effective communication, particularly when addressing individuals facing financial obligations. Reflective debt status notifications often include specific information such as current account balances, payment due dates, and interest rates associated with debts like credit cards or personal loans. Tailoring the message to the recipient involves using their full name, account number, and outlining any recent transactions or payment history. Location also plays a role; for instance, if the notification pertains to a local bank branch in Miami or a national lender, this detail enhances relevance. Providing a clear summary of the individual's overall debt situation, including total owed and any missed payments, reinforces transparency and encourages proactive engagement with financial options available for debt management.

Clear Explanation of Debt Status

Consumers often receive notifications regarding their financial obligations, specifically concerning their debt status. Debt refers to the amount of money borrowed that must be repaid, often accompanied by interest rates. Clear communication of this status is crucial for responsible financial management. Timely notifications help individuals, especially those in the United States, understand their outstanding balances, payment history, and any potential penalties for late payments. With figures typically totaling hundreds or thousands of dollars, maintaining accurate knowledge of debt levels is essential. This financial clarity supports individuals in making informed decisions regarding budgeting, payments, and overall financial planning.

Reflective Tone and Acknowledgment

Reflective debt status notifications play a crucial role in financial communication, ensuring clarity and understanding in personal finances. For individuals tracking their credit obligations, such notifications detail the current balance owed, due dates, and minimum payment requirements. They often include a summary of recent transactions, emphasizing any missed payments that may have occurred within the last billing cycle. This information assists consumers in reflecting on their spending habits and overall financial health. Furthermore, these notifications frequently provide personalized tips for debt management and links to resources that can aid in navigating financial difficulties, fostering a proactive approach to debt repayment and financial stability.

Proposed Solutions or Next Steps

Outstanding debts can lead to significant financial stress for individuals and businesses alike. Reviewing options for debt resolution is crucial in these situations. Several solutions, including debt consolidation, offer the possibility of combining multiple debts into a single payment, often with lower interest rates, potentially decreasing overall monthly payments. Negotiating directly with creditors can also present opportunities for reduced payoffs, extended payment plans, or even settlements for less than the owed amount. Additionally, exploring financial counseling services could provide tailored strategies for budgeting and debt management. It is essential to assess each option's implications on credit scores, future borrowing capacity, and financial health to make informed decisions.

Contact Information for Assistance

Debt status notifications can often indicate a significant change in financial circumstances, impacting individuals' credit ratings and overall financial stability. These notifications frequently stem from events such as missed payments or accumulated balances exceeding credit limits, prompting communication from creditors. Clients facing these challenges can seek assistance by reaching out to designated support services, often available through websites or customer service lines of lending institutions. Contact information typically includes phone numbers, email addresses, and management offices located in major cities, providing essential resources for negotiating repayment plans or financial counseling. Timely responses and resolution efforts can mitigate potential legal actions and help restore financial health.

Comments