Are you feeling overwhelmed by debt and unsure where to turn? Crafting a debt negotiation proposal can be a powerful step towards regaining control of your financial future. In this article, we'll explore effective strategies to communicate with creditors and negotiate better terms that work for you. Join us as we dive deeper into the process and equip you with the tools to navigate this challenging journey!

Clear explanation of financial situation.

Individuals facing debt often experience stress due to financial strain. Analyzing total debt amount (for example, $15,000) provides insight into the situation. Monthly income (for instance, $2,500), when compared to monthly expenses (approximately $2,200), reveals limited disposable income available to manage debt obligations effectively. Critical components, such as medical bills, credit card debt, and personal loans, contribute significantly to the overall financial burden. Establishing a clear communication channel with creditors regarding inability to meet full payment terms is essential for negotiating more manageable repayment plans. Exploring options like reduced interest rates, extended repayment timelines, or partial debt forgiveness can alleviate financial pressure and facilitate a sustainable path towards financial recovery.

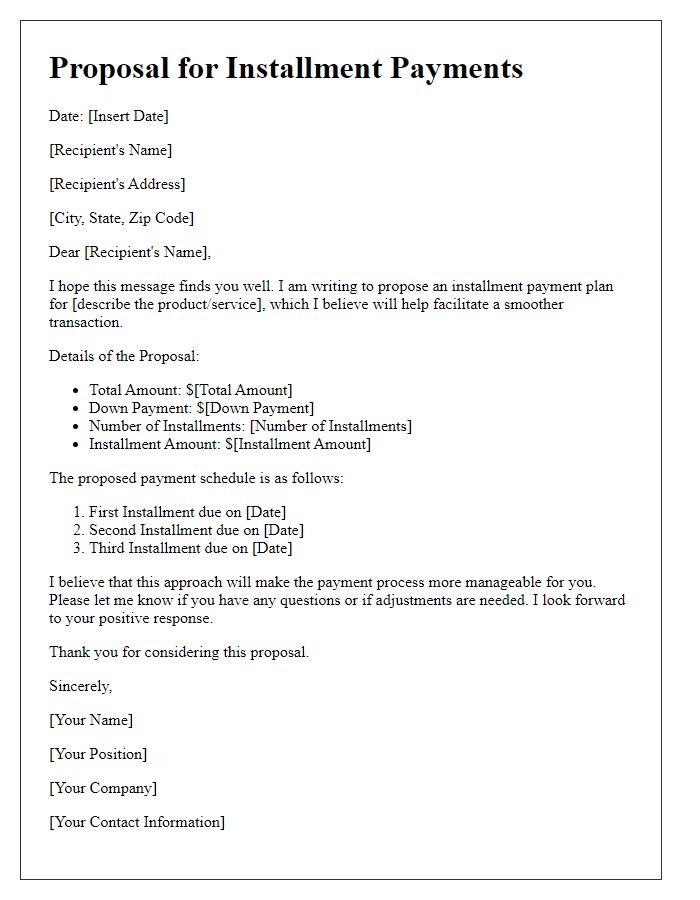

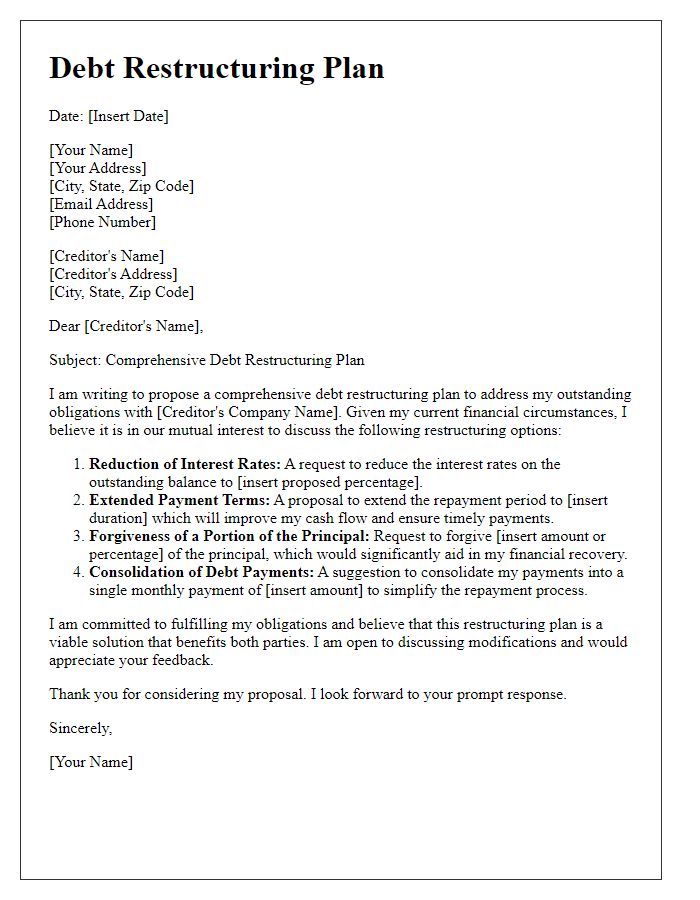

Proposed new payment terms.

Negotiating debt can lead to mutual agreements benefiting both parties. Proposed new payment terms may include a reduced monthly payment amount, potentially lowering it from $500 to $300, allowing for better cash flow management. Extended repayment periods might be suggested, such as a shift from 12 months to 24 months, offering flexibility for budgeting. Adjustments could also involve interest rate modifications, moving from the current 8% APR to a more favorable 5% APR, thus decreasing overall repayment costs. These strategies aim to ensure timely payments while sustaining financial stability, preventing defaults, and fostering a positive lender-debtor relationship.

Justification for the proposed terms.

Debt negotiation proposals require a well-structured justification to persuade creditors. Highlights of the economic state should be emphasized, including rising inflation rates, which reached 8.5% in 2023, affecting the ability of debtors to meet original obligations. Additionally, mention personal circumstances such as unexpected medical expenses due to a serious condition, which contributed to financial distress. Include relevant statistics on unemployment rates, which hovers around 4.2%, illustrating the challenging job market. Justify the proposed terms by emphasizing a sustainable payment plan, like offering a monthly payment that is 25% lower than current obligations, ensuring long-term viability. Strengthening the argument with references to maintaining ongoing communication and commitment to repayment could further enhance the proposal's appeal.

Assurance of commitment to repay.

Debt negotiation proposals can require a thoughtful assurance of commitment to repay. Effective proposals often highlight the total debt amount, monthly payment suggestions, specific timelines for repayment, and a clear intent to restore financial stability. Additionally, including relevant personal circumstances that led to the current financial situation, such as job loss or medical expenses, may foster understanding from creditors. Highlighting previous timely payments and setting a realistic budget can further emphasize genuine intentions for repayment. Open communication channels with creditors can help facilitate a collaborative approach to resolving debts.

Contact information for further discussion.

Contact information for further discussion includes the name of the primary contact person, their direct phone number, email address, and physical address of the organization. For example, John Doe, Senior Negotiation Specialist can be reached at (555) 123-4567 or johndoe@example.com. The organization's headquarters located at 123 Business Lane, Suite 100, Cityville, State 12345 provides a formal setting for in-person discussions. Additionally, a dedicated customer service line may offer assistance, emphasizing the willingness to engage in dialogue and facilitate resolution.

Comments