Are you finding yourself in a situation where you need to clarify outstanding debts? Understanding how to craft a debt confirmation letter can make all the difference in ensuring clear communication with your creditor. This simple yet vital document not only verifies what you owe but also helps both parties stay on the same page regarding repayment terms. Ready to learn more about the essential components of a debt confirmation letter? Let's dive in!

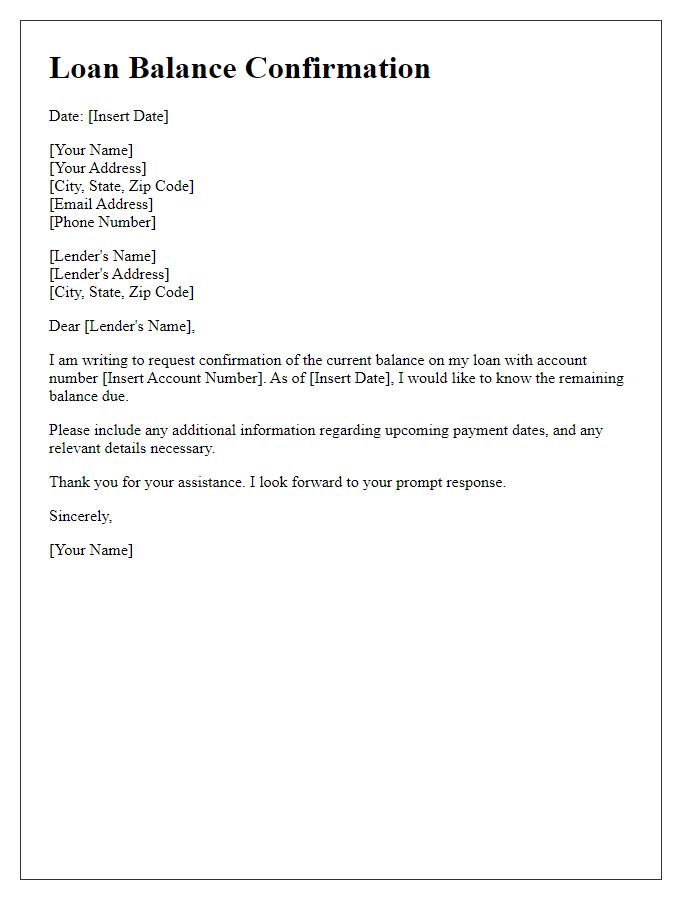

Debtor and creditor information

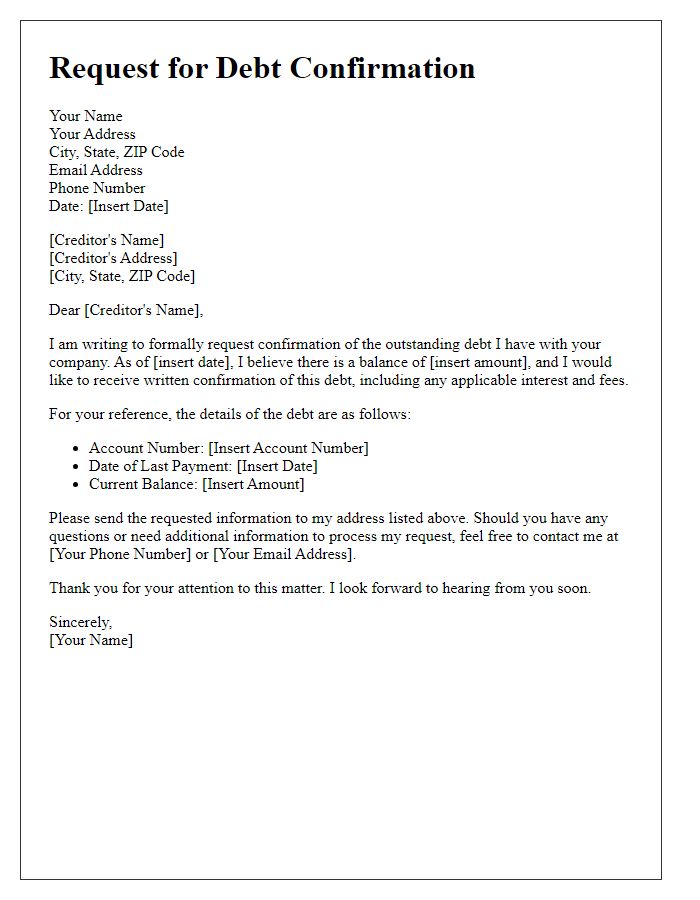

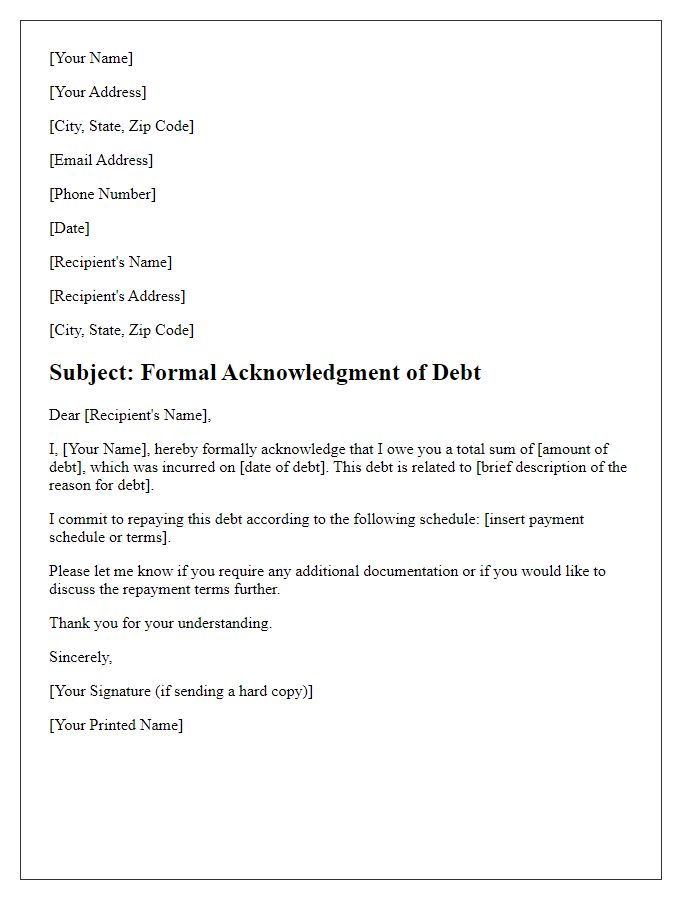

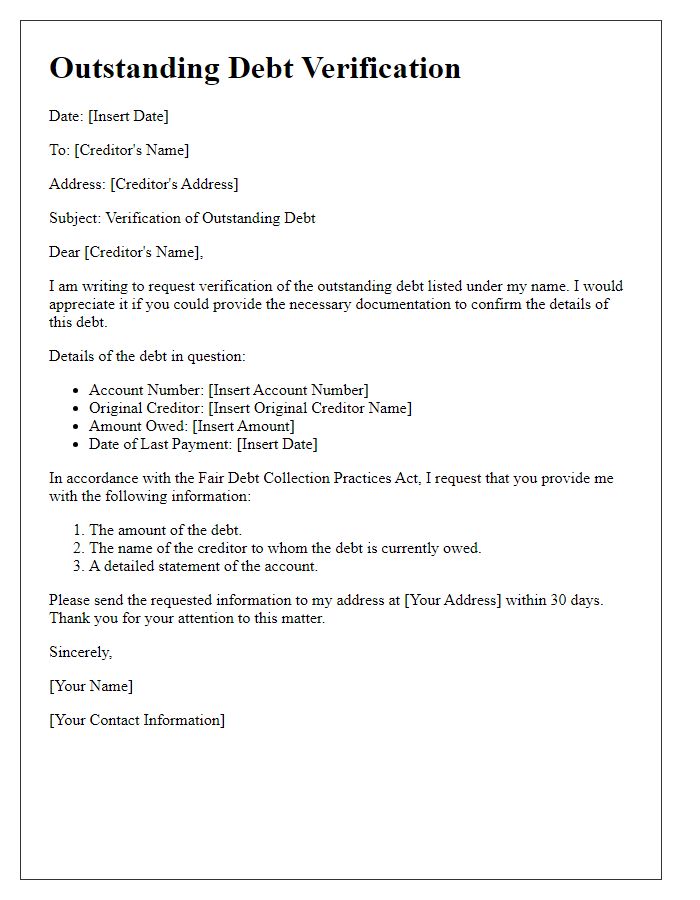

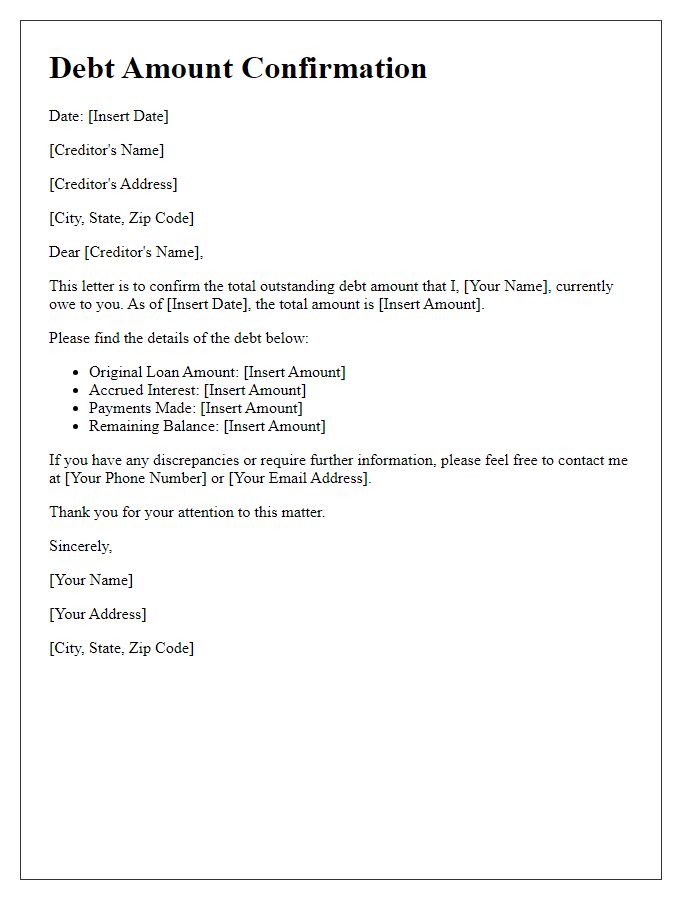

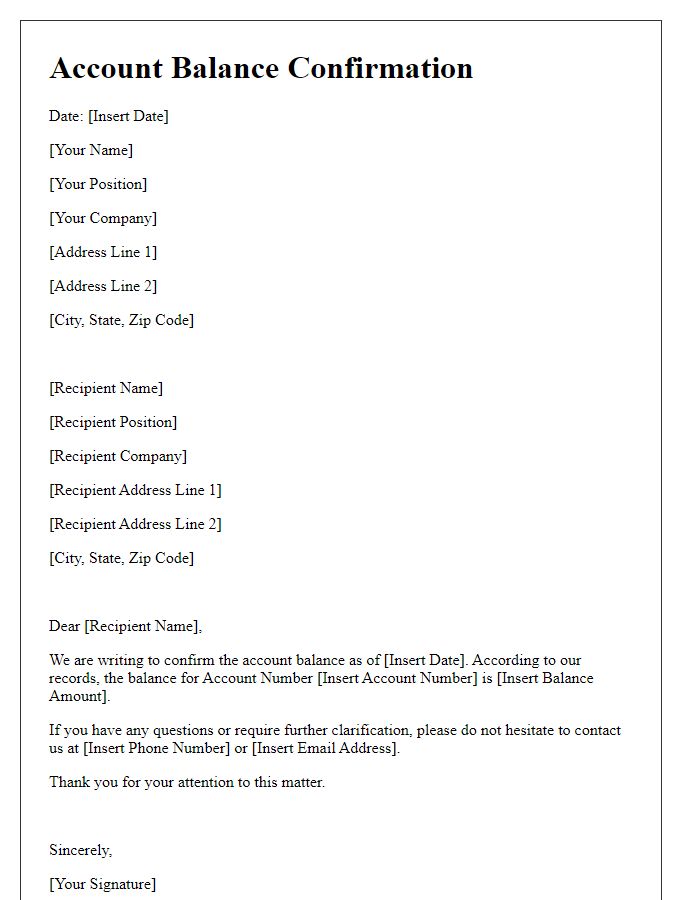

A debt confirmation letter typically includes crucial details regarding the debtor and creditor, along with specific terms of the debt. Debtor information includes the full name, address, and any identification number (such as Social Security Number or Tax ID) for the individual or entity owing money. Creditor information encompasses the full name and address of the lender, which could be a bank, financial institution, or individual. The letter should also detail the total amount owed, including principal and any accrued interest or fees. Additionally, it is often helpful to include the date the debt was incurred and any repayment terms or deadlines associated with the obligation. This letter serves to formally acknowledge the debt from the creditor's perspective, providing clarity for both parties involved in the financial agreement.

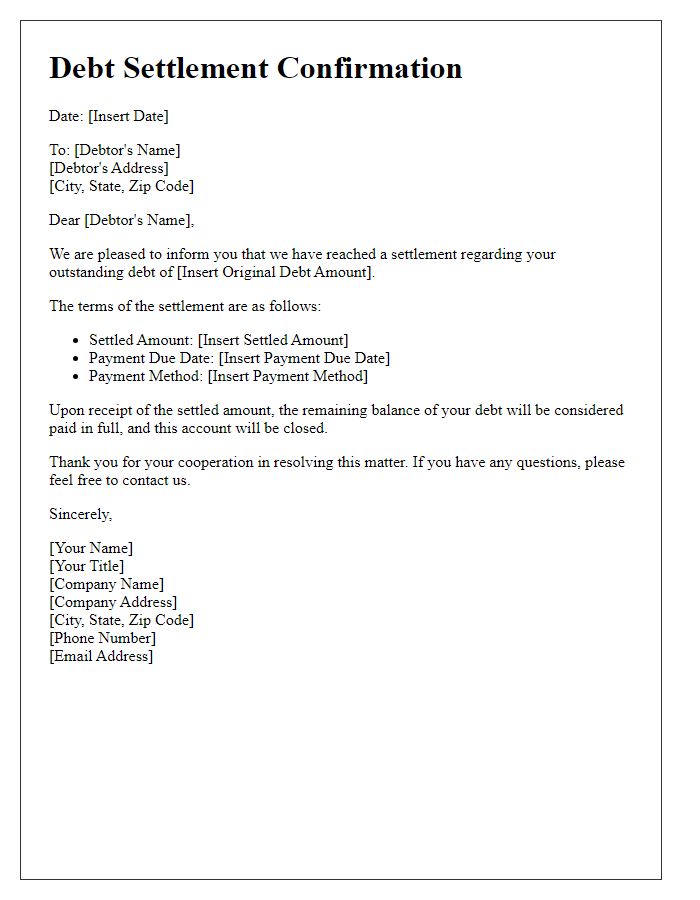

Outstanding debt amount

Outstanding debts can significantly impact both personal and business finances. For instance, a person may have an unpaid credit card balance of $5,000, accruing interest at 18% annually. This growing debt can deteriorate credit scores, affecting loan approval chances for significant purchases, like homes or vehicles. Additionally, businesses with outstanding invoices--averaging around $10,000--may face cash flow issues, hindering operations and investment opportunities. Prompt communication regarding debt status can prevent escalated collection efforts and maintain positive relationships with creditors, crucial for financial stability.

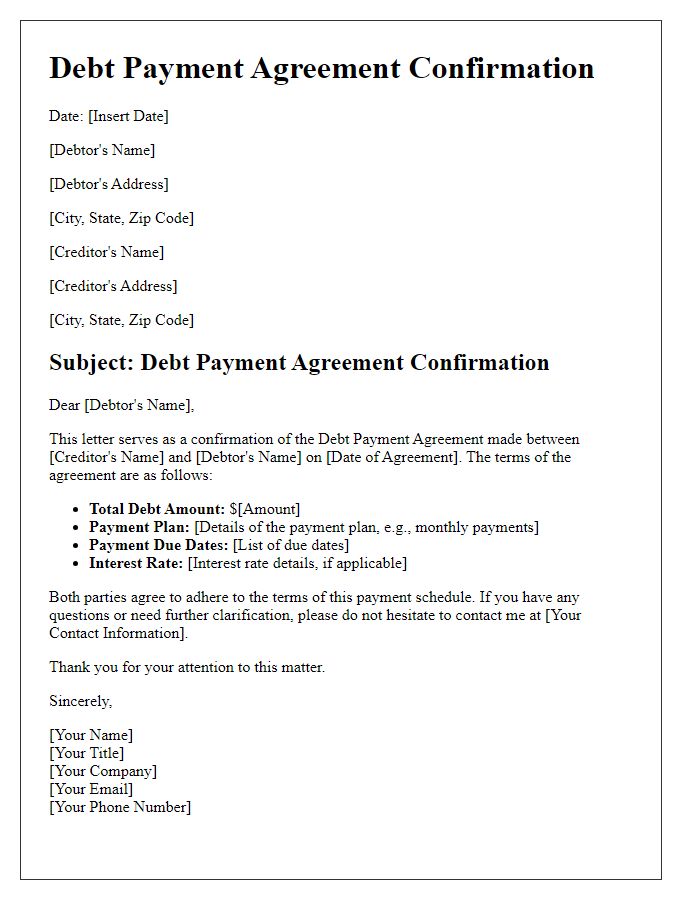

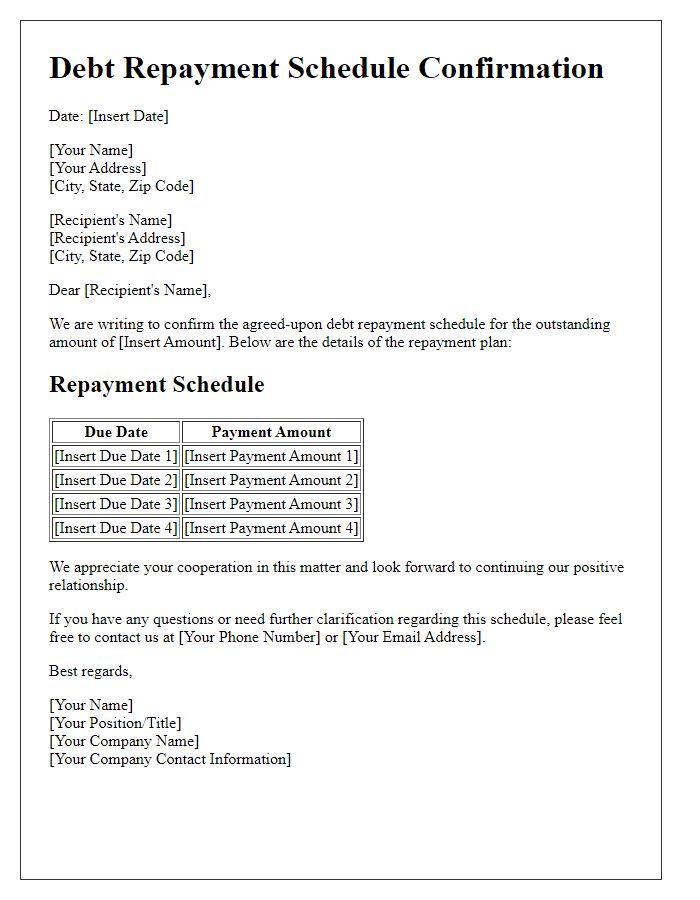

Payment terms and conditions

A debt confirmation letter clearly outlines the payment terms and conditions agreed upon between parties involved, such as a borrower and a lender. This letter includes specific details such as the total amount owed, which may include principal plus interest calculated at a certain percentage, due dates for each payment, payment methods accepted (like bank transfers, checks, or online payment platforms), and any late fees that may be applied if payments are not made on time. Additionally, it may specify the consequences of default, such as potential legal action or alterations to the repayment plan. Clear identification of both the lender and borrower, including their respective addresses and contact information, is crucial for maintaining formal communication. Furthermore, acknowledging the date of the agreement can help both parties have a mutual understanding of their obligations and the timeline for repayment.

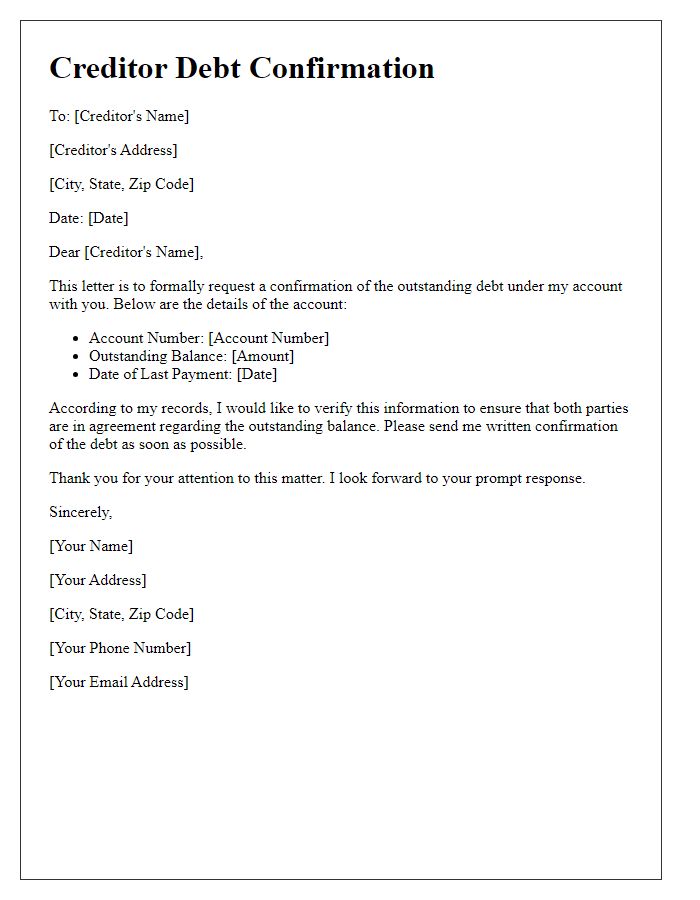

Confirmation date and signatures

Debt confirmation letters serve as formal acknowledgments between parties regarding outstanding financial obligations. Typically, these letters outline key details such as the exact amount owed (including any accrued interest) and the specific due date for repayment. Additional information may include terms of repayment, such as installment arrangements or deadlines. The confirmation date usually reflects the day both parties agree to the terms outlined in the letter. Signatures from both the debtor and creditor validate the document, establishing a mutual understanding and agreement on the debt's existence and stipulations. Properly executed, these letters provide essential records for future reference.

Contact information for inquiries

A debt confirmation letter serves as an official document outlining the details of an outstanding balance owed by an individual or entity. This letter should include essential contact information, enabling the recipient to address inquiries effectively. For example, it is crucial to list a dedicated customer service phone number, such as (555) 123-4567, available during standard business hours (9 AM to 5 PM, Monday to Friday, excluding holidays). Additionally, provide an email address, like support@debtcollectionagency.com, ensuring timely responses to queries. Include a physical address, such as 123 Financial Way, Suite 200, Cityville, State, Zip Code, which allows for written correspondence regarding the debt. This clear and organized contact information facilitates communication and ensures proper handling of any concerns the recipient may have about their debt situation.

Comments