Have you ever been caught off guard by an unexpected subscription renewal? It's frustrating when you realize that your account has been charged for a service you didn't even intend to continue. In this article, we'll explore how to effectively draft a complaint letter for unauthorized subscription renewals, ensuring that your voice is heard and your concerns are addressed. So, let's dive in and learn how to take control of those sneaky charges!

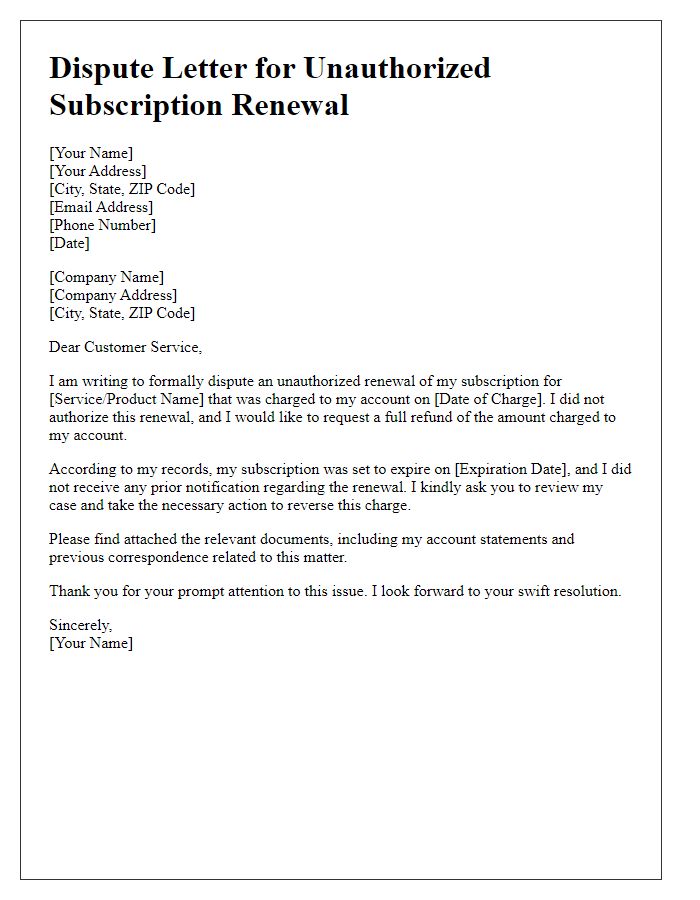

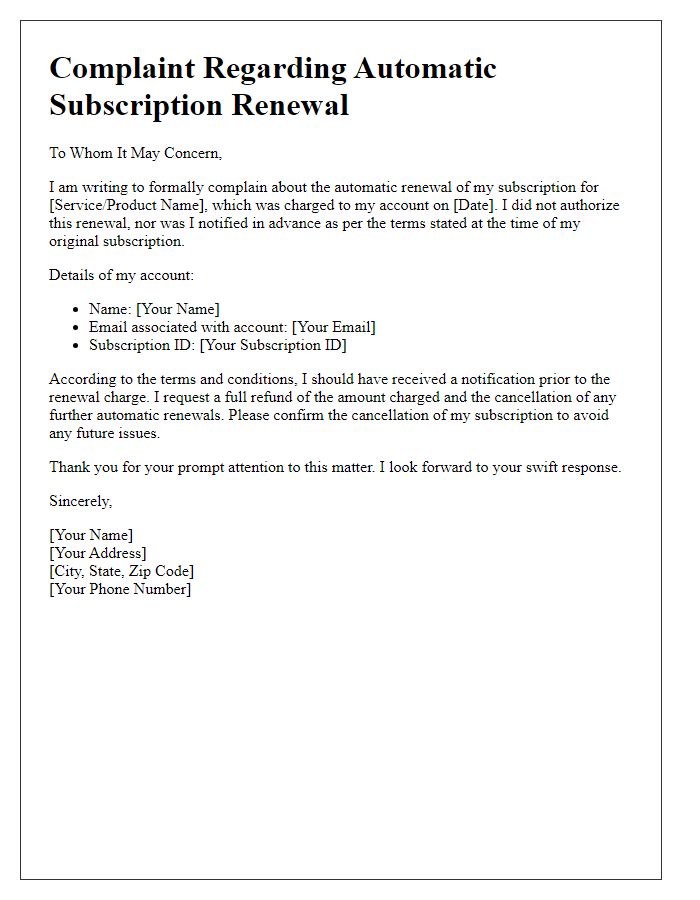

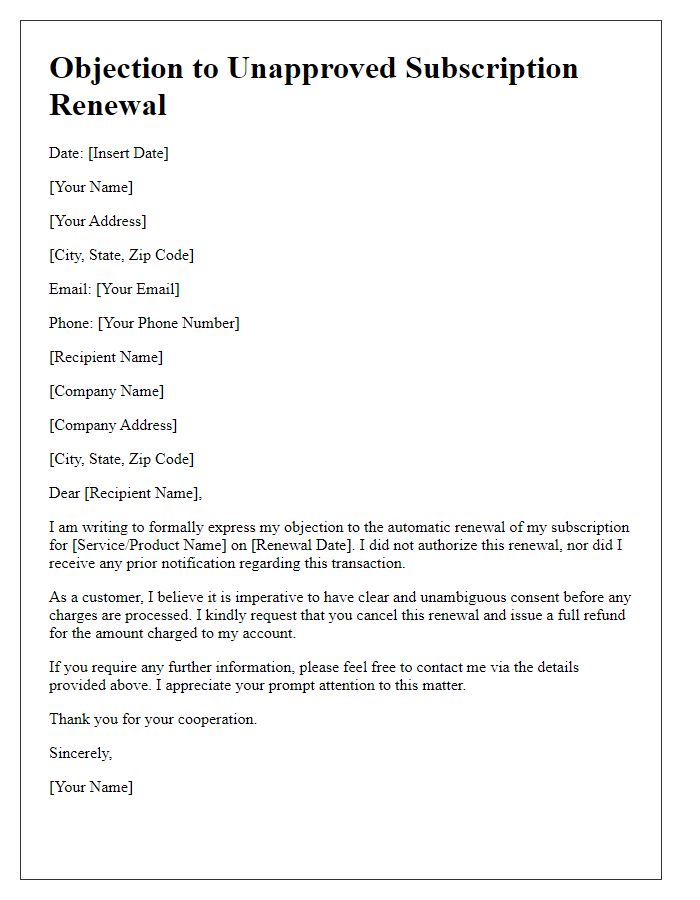

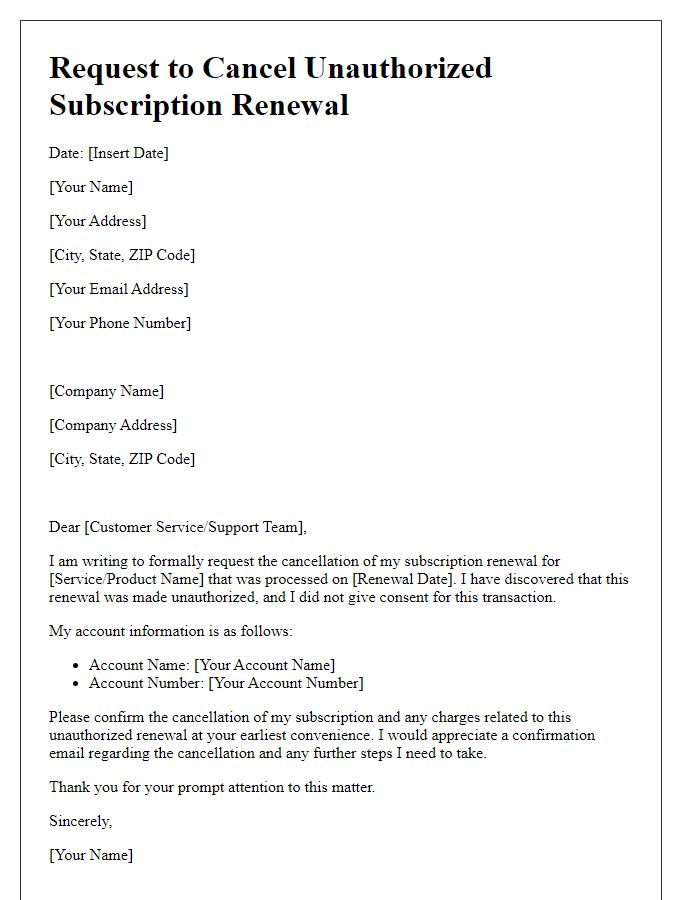

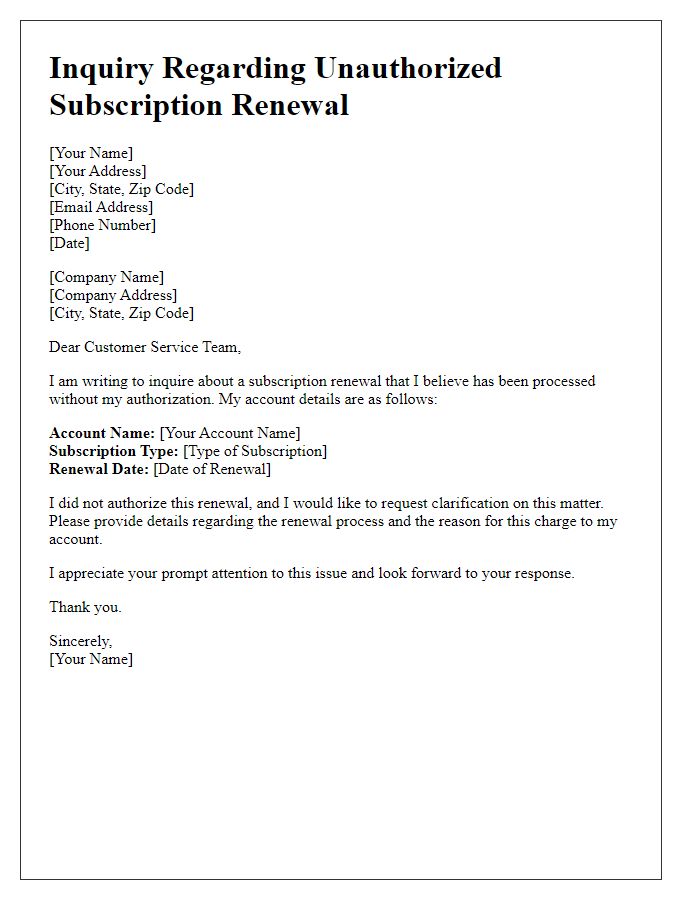

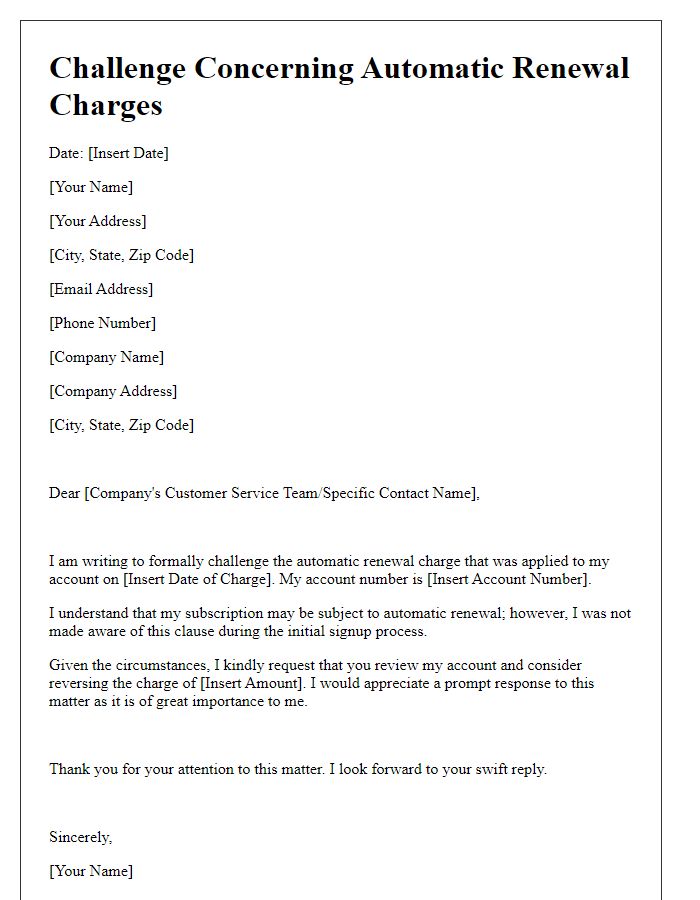

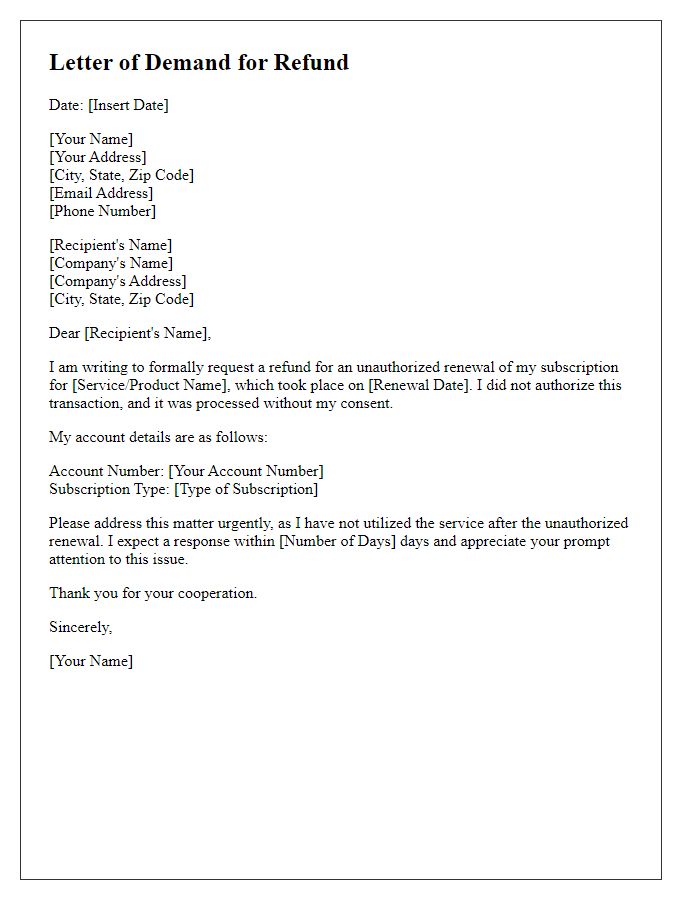

Recipient's contact information

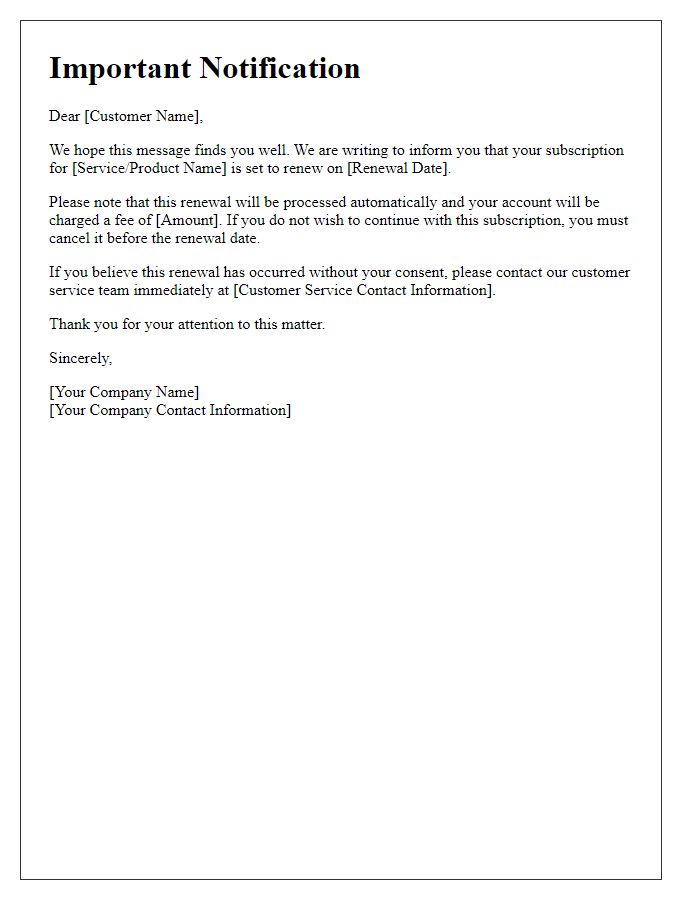

Unauthorized subscription renewals can cause significant disruptions in personal finances and lead to unwanted charges on credit cards. Cases often arise when companies, such as digital streaming services or software providers, employ automatic renewals without proper consent. Consumers experience issues especially when notification emails go to spam or are overlooked, leading to surprise charges. It is important for users to keep track of all subscription services, verify renewal policies, and review billing statements carefully to avoid financial pitfalls associated with these practices.

Subscription details (service name, account number)

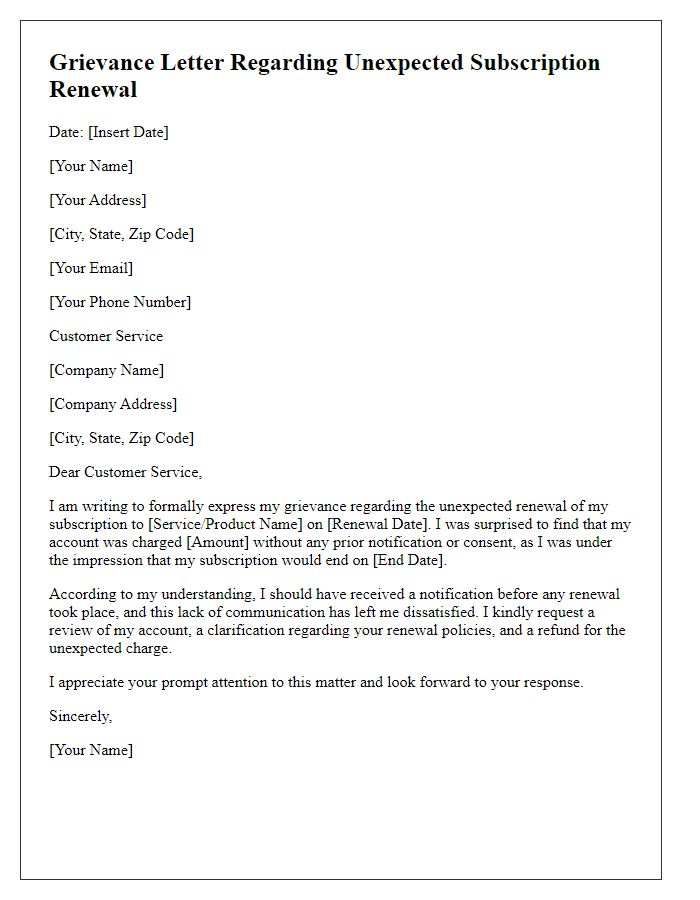

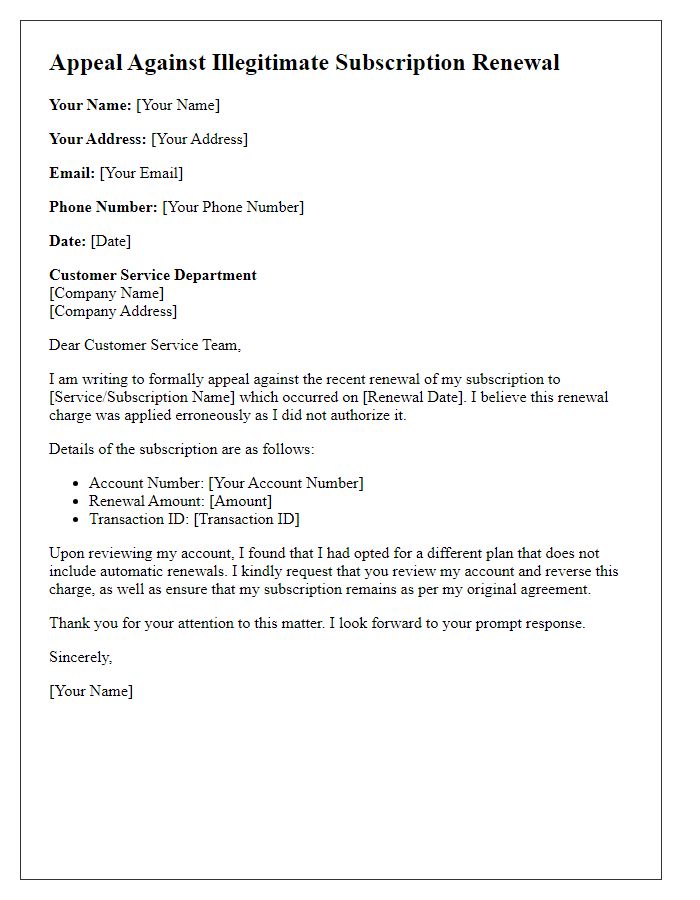

Unauthorized subscription renewals can lead to unexpected charges on personal accounts, causing significant financial inconvenience. For example, a streaming service like Netflix may automatically renew its monthly subscription for $15.99, linked to an account number like 123-456-789. Customers often overlook this renewal, leading to confusion and frustration. When submitting a complaint, essential details must include the specific service name, the unique account number, and the transaction date of the renewal. Clear communication is crucial for requesting a refund for the unauthorized charge and preventing future renewals without consent.

Clear statement of unauthorized renewal

Unauthorized subscription renewals can lead to unexpected charges on financial statements, causing distress for consumers. Many individuals experience surprise charges when companies automatically renew services without prior consent, often bypassing the notification protocols required by consumer protection laws. Such instances frequently happen with digital platforms, subscription boxes, or app services, where users may overlook terms and conditions. For example, streaming services, like Netflix or Hulu, commonly implement auto-renewal policies that can catch customers off guard. Additionally, recent trends indicate a rise in complaints to regulatory bodies, highlighting consumer frustrations over these practices. Addressing unauthorized renewals promptly is crucial for reclaiming funds and preventing further issues.

Request for cancellation and refund

Unauthorized subscription renewals can lead to unintended charges on credit cards, often resulting in frustration for consumers. The subscription service, typically associated with digital platforms such as streaming services or software applications, may continue billing after a trial period or without the user's explicit consent. Customers frequently report being charged various amounts, sometimes exceeding $100 annually, without adequate notification. In many cases, the terms of service may not clearly outline the renewal process, complicating the cancellation efforts. A formal complaint should emphasize the need for immediate cancellation of the service and request a full refund for any unauthorized charges made. Documentation, such as transaction records and communication logs, can strengthen the case against the service provider to ensure a swift resolution.

Contact information for follow-up

Unauthorized subscription renewals can lead to unexpected charges and frustration for customers. For example, a digital service like Spotify may automatically renew an annual premium plan at a cost of $119.88 without prior notification. This practice often violates terms of service or consumer protection laws, particularly if cancellation procedures are not prominently displayed. Consumers should maintain detailed records of subscription dates, service agreements, and any communication with the service provider. Contacting customer service or the billing department via email or phone with explicit details of the complaint is crucial to expedite resolution. Furthermore, documenting any follow-up communications ensures a trail that can assist in potential disputes with financial institutions or regulatory agencies.

Comments