Hey there! If you've ever wondered how to efficiently update your credit report, you're in the right place. Keeping your credit report accurate is essential for making the most of your financial opportunities, and taking the right steps can make all the difference. In this article, we'll walk you through a simple letter template that can help you communicate effectively with credit bureaus. So, let's dive in and get your credit report updated!

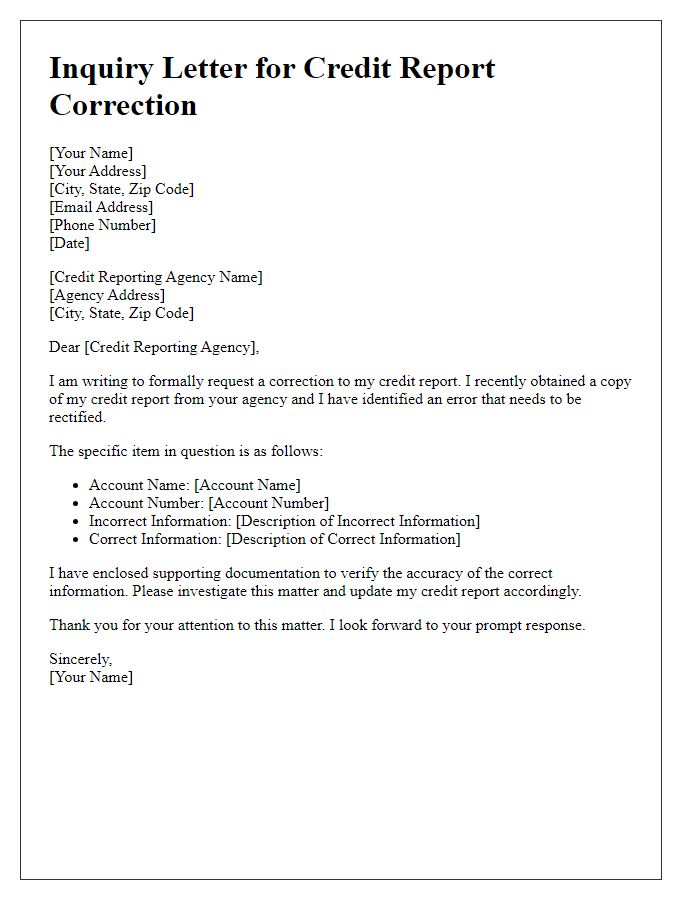

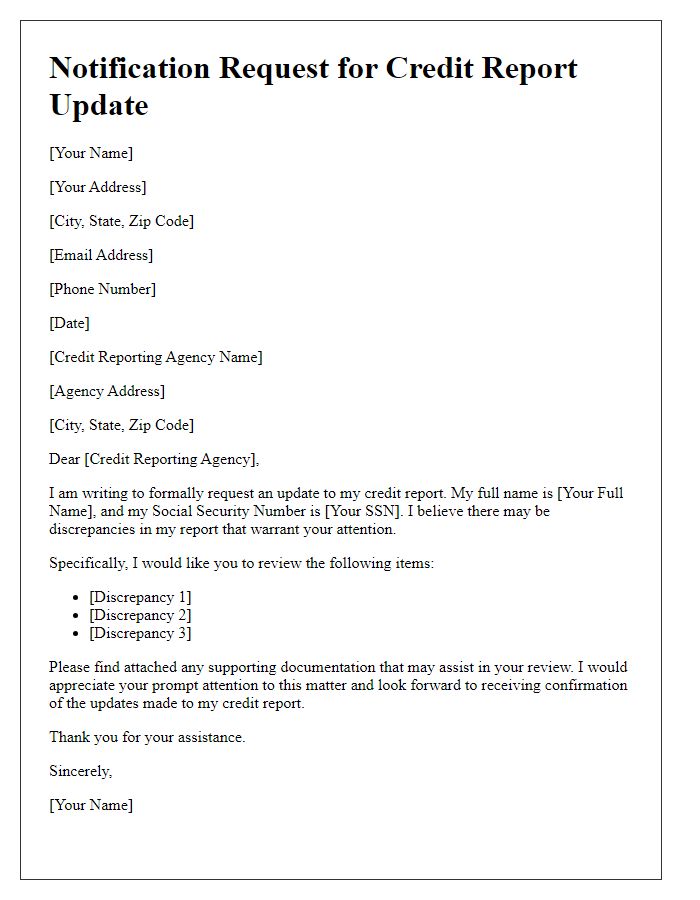

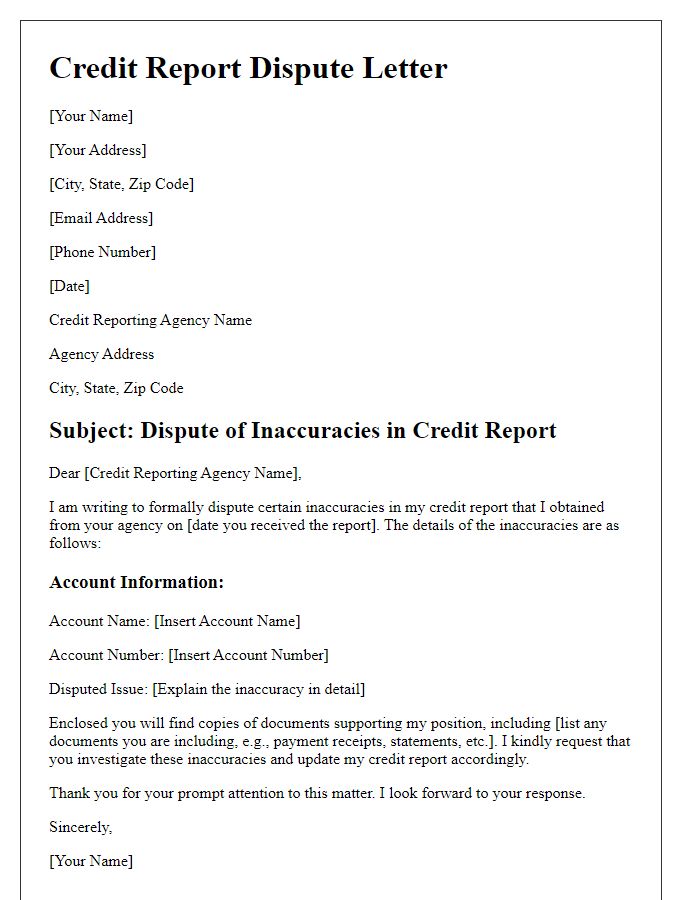

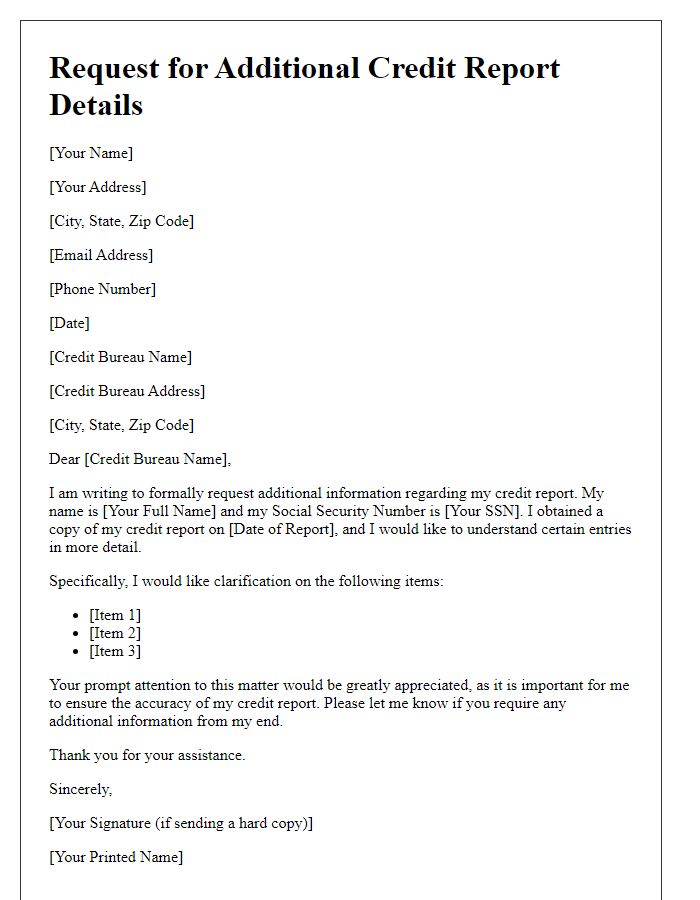

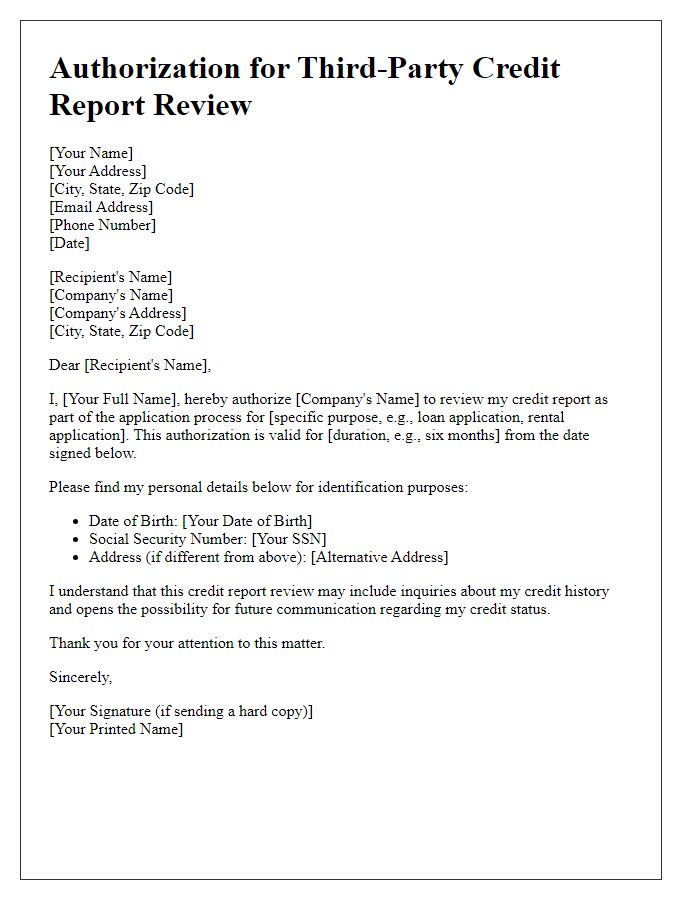

Contact Information

Credit report updates require accurate contact information to ensure proper processing. Current phone numbers, email addresses, and mailing addresses need to be specified clearly. For instance, a mobile number (with area code) allows for immediate communication, while an official email address ensures timely updates regarding the credit status. Mailing addresses should include street number, street name, city, state, and zip code to avoid misdirection. Inaccurate or outdated information can delay updates in important financial databases such as Experian, TransUnion, or Equifax, impacting credit scores and future lending opportunities.

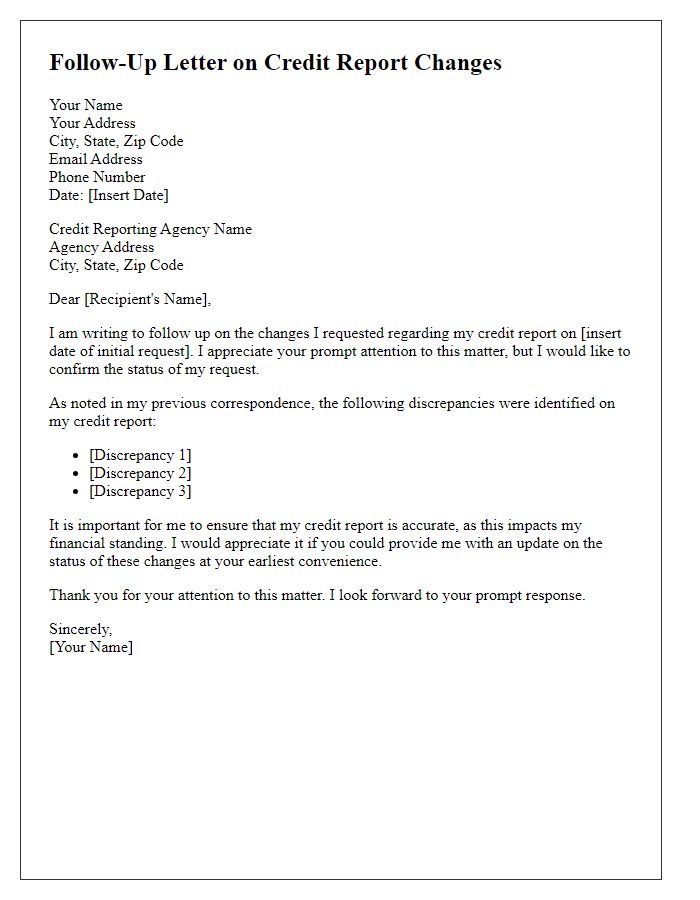

Subject Line

Credit report updates can be crucial for maintaining financial health. A credit report, which details an individual's credit history and current credit status, is routinely generated by major credit bureaus like Experian, TransUnion, and Equifax. Changes, such as alterations in credit card balances or the addition of late payments, significantly impact credit scores (which range from 300 to 850). Correcting inaccuracies can improve eligibility for loans or favorable interest rates. Regular reviews of your report, ideally at least once a year, help identify errors that can be disputed for resolution, ensuring that your financial reputation remains strong and accurate.

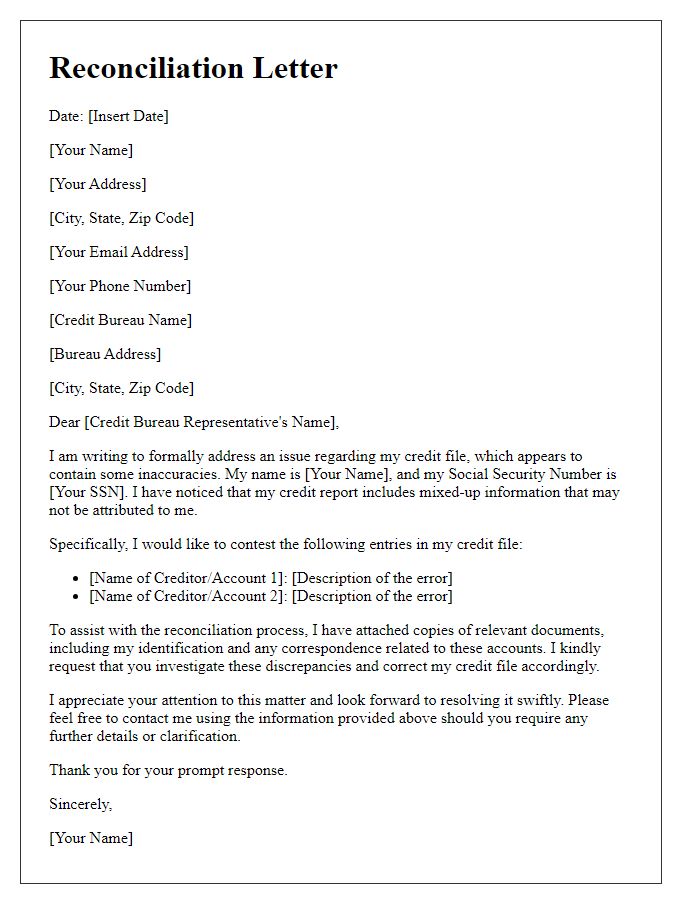

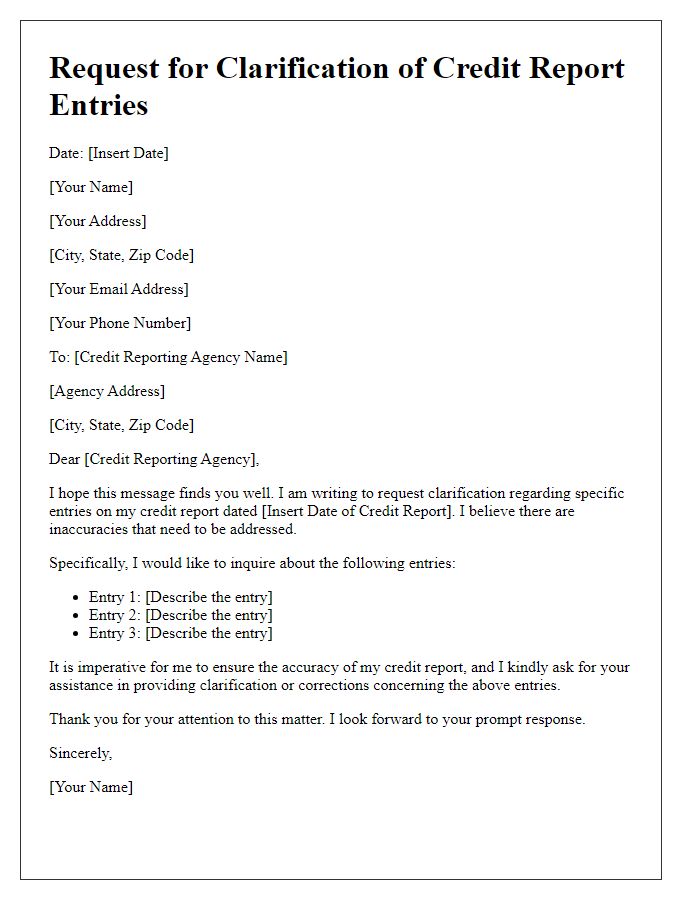

Accurate Account Details

Accurate account details in credit reports play a crucial role in maintaining an individual's creditworthiness. Factors such as payment history, account balances, and credit utilization ratios significantly impact a credit score, which lenders (financial institutions evaluating loan applications) often reference. Mistakes in these account details can lead to unfavorable loan conditions or application rejections. For instance, a discrepancy in payment history might reflect late payments that never occurred, subsequently lowering the credit score. Timely updates and accurate information in credit bureaus (such as Experian, TransUnion, and Equifax) are essential for ensuring reliable assessments of creditworthiness and future financial opportunities.

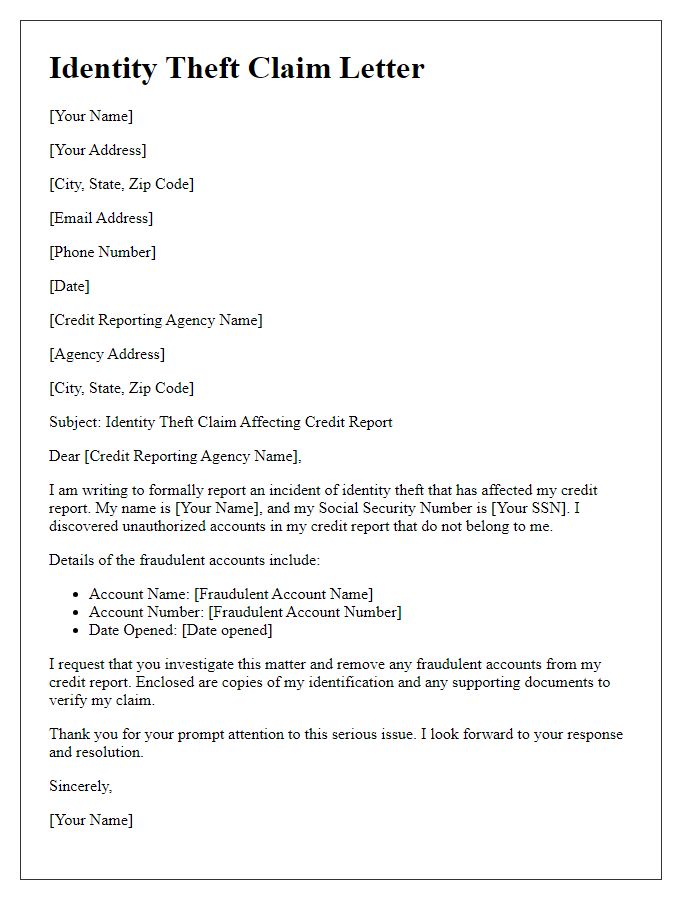

Specific Update Request

Contacting credit reporting agencies (such as Experian, TransUnion, and Equifax) for specific update requests on personal credit reports requires a clear and concise format. A well-structured letter should include personal identification details like your full name, address, and Social Security number (last four digits). Specify the item needing correction, such as an inaccurate account status or misleading payment history. Include supporting documentation to validate the claim, like bank statements or payment confirmations. State the desired outcome clearly, whether that is an update, a correction, or removal of the specific entry. Ending with a request for prompt follow-up can enhance communication with the agency.

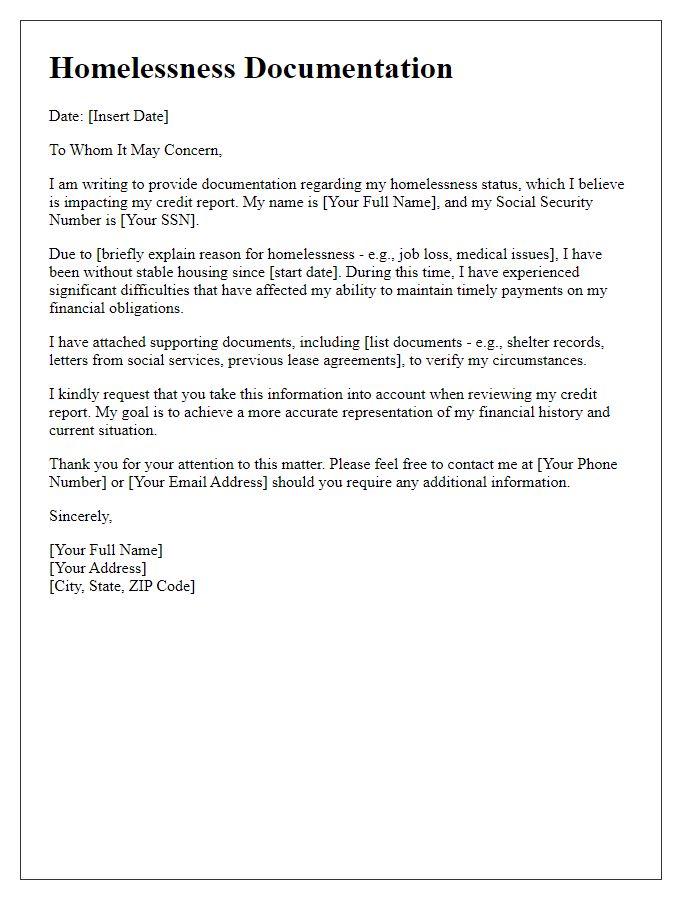

Supporting Documentation

When requesting a credit report update, it is essential to include supporting documentation to verify your claims effectively. Key documents may encompass recent credit card statements (reflecting outstanding balances), loan agreements (showing account details and payment history), and any relevant correspondence from creditors or collection agencies. Additionally, identification documents such as a government-issued ID (e.g., driver's license, passport) can establish your identity. Each document serves to provide context and substantiate the request, ensuring that the credit reporting agency can accurately update your records based on validated information, thereby facilitating a fair representation of your creditworthiness.

Comments