Setting up a direct debit can make managing your finances so much more convenient, allowing you to automate your regular payments without the hassle of manual transactions. Whether it's for your utilities, mortgage, or subscription services, confirming your direct debit ensures peace of mind and helps you stay on top of your monthly budgeting. In this article, we'll guide you through a sample letter template to confirm your direct debit setup, providing you with clear and concise wording to make the process smooth. Ready to simplify your payment process? Let's dive in!

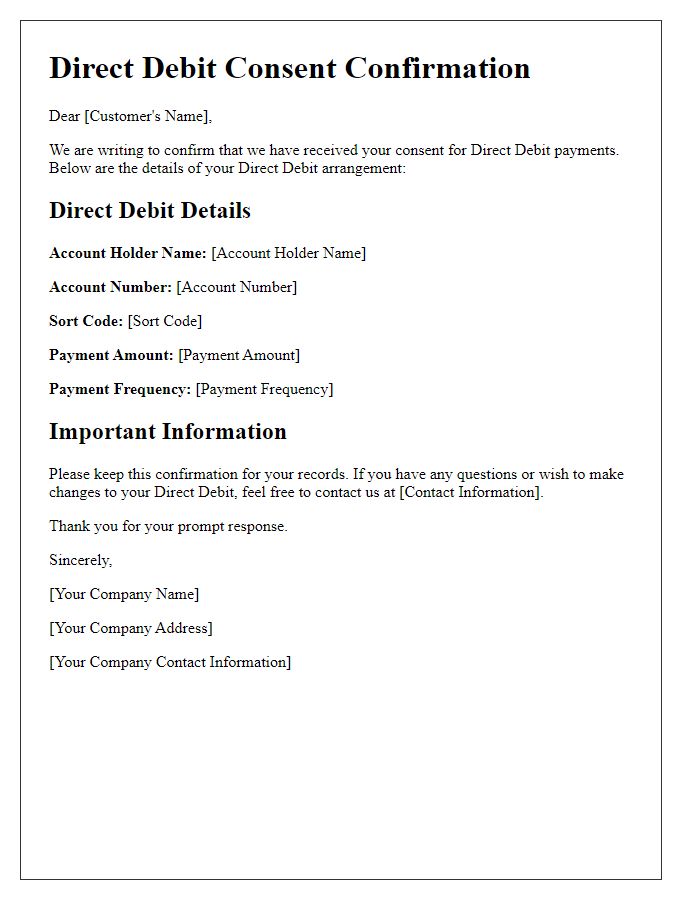

Account and Billing Information

Direct debit setup confirmation ensures secure and convenient management of financial transactions associated with service subscriptions. Customers receive notifications detailing account numbers (commonly 10 to 16 digits), billing cycles (monthly, quarterly, annually), and amounts (fixed or variable). Providers specify bank information, including sort codes (six-digit codes identifying UK banks), and indicate the next payment date (often the first of the month) to facilitate timely transactions. Detailed documentation helps prevent unauthorized withdrawals, enhancing customer confidence in managing their accounts effectively while promoting transparency throughout the billing process.

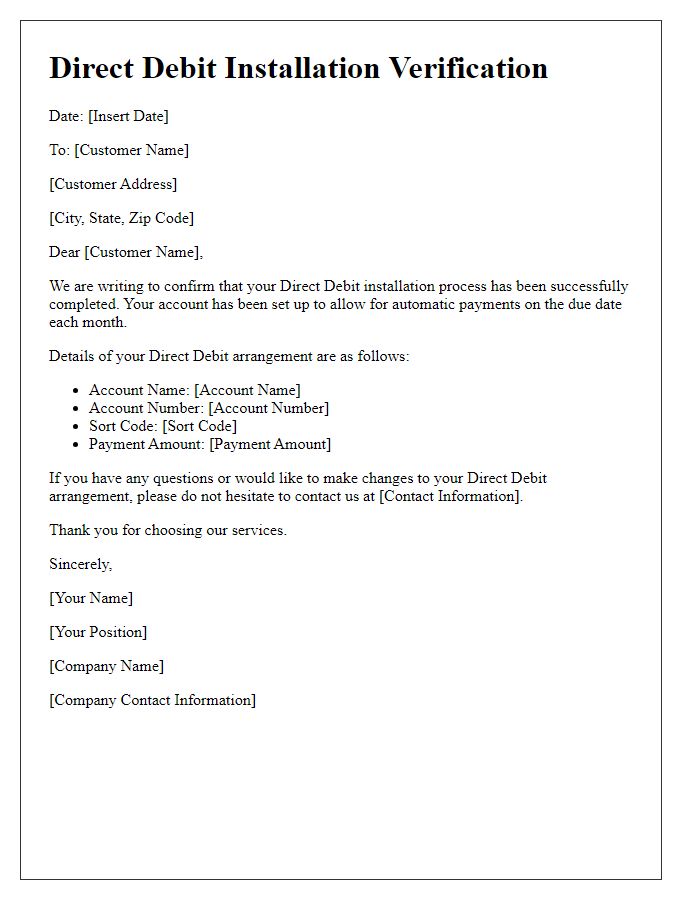

Direct Debit Authorization Details

Direct Debit setup confirmation ensures secure transaction processing for recurring payments. The customer's bank account (typically with institutions like HSBC or Chase) is linked to authorize automatic withdrawals on specified dates. This arrangement often facilitates bill payments, subscriptions, and loan repayments, ensuring timely transactions. The confirmation will include essential details such as the payment amount, frequency (monthly, quarterly), and each transaction's due date. Additionally, regulatory compliance will be ensured under frameworks like the UK's Direct Debit Guarantee, protecting users against errors and unauthorized transactions. Verification through unique reference numbers often helps in tracking and managing payments effectively.

Effective Date and Frequency

A direct debit setup confirmation outlines essential details regarding the arrangement. The effective date, often specified as the starting date (e.g., March 15, 2024), marks when the first payment will be deducted from the account. The frequency refers to the regularity of these payments (e.g., monthly, quarterly, or annually). Understanding the schedule is crucial for budgeting, as it ensures that customers are aware of when funds will be withdrawn. Additionally, the confirmation should include the total amount of each payment (e.g., $100) and information regarding any potential changes in fees or terms. Moreover, bank details such as the account number and sort code are vital for processing the direct debit smoothly and securely.

Customer Service Contact Information

The confirmation of a direct debit setup marks a significant step towards streamlining financial transactions for both customers and service providers. Typically, this process involves a customer's bank account authorizing a predetermined amount to be automatically withdrawn by a specified entity, such as a utility company or subscription service. Important details include the account number, which provides a unique identifier for banking purposes, and the reference number, facilitating proper tracking of payments. This is often accompanied by clear information regarding the payment schedule, ensuring customers are informed of when deductions will occur, such as monthly on the 1st or bi-weekly on Fridays. Moreover, the notification includes customer service contact information, allowing customers to address any concerns or queries that may arise regarding their direct debit arrangement. Secure systems ensure that personal and banking data remain protected throughout this automated process, fostering trust and reliability in the service.

Security and Privacy Assurance

When establishing a direct debit arrangement, it is crucial to emphasize security and privacy assurances in the communication. Financial institutions and payment processors typically implement advanced encryption protocols, such as AES-256, to safeguard sensitive information. Compliance with regulations like the General Data Protection Regulation (GDPR) ensures that personal data is handled with care, providing clear guidelines on data usage and rights. Organizations often employ two-factor authentication (2FA) to add an extra layer of security, significantly reducing the risk of unauthorized access. Regular audits and compliance checks further enhance trust, ensuring that only authorized personnel have access to crucial account information during the transaction process.

Comments