Are you looking for a straightforward way to confirm your payment plan? Whether it's for a loan, mortgage, or any service, having a clear communication helps eliminate confusion and keeps everything on track. In this article, we'll explore a simple yet effective letter template that you can use to confirm your payment arrangements. So, let's dive in and make your payment plan smooth and hassle-free!

Payment Amount and Frequency

A structured payment plan confirmation clearly outlines the key details like payment amount and frequency. Total payment amount stands at $1,200, to be repaid in twelve installments. Each payment is $100 due on the first of each month, starting from December 1, 2023, through November 1, 2024. This systematic approach assists in budgeting and financial planning, ensuring that both parties adhere to the agreed schedule. Additionally, late payments may incur a fee of $15, promoting timely contributions and maintaining clear communication regarding financial obligations.

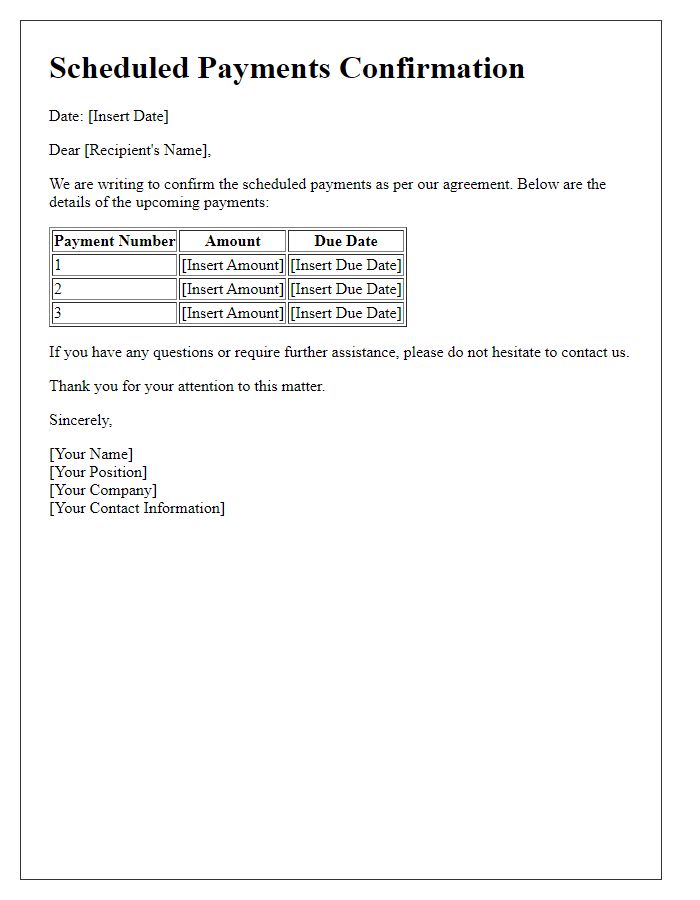

Due Dates and Deadlines

A payment plan confirmation outlines specific due dates and deadlines for financial obligations, ensuring clarity for both parties involved. Typically, the document will specify the total amount owed, breaking it down into manageable monthly installments, such as three payments of $200 each over a period of three months. Important deadlines include the date the first payment is due, often set at the first of the month, followed by subsequent payments on the same date in the following months. It may also highlight any grace periods, usually a five-day allowance, before late fees apply. Clear communication regarding payment methods, such as bank transfers, checks, or electronic payments, ensures seamless transactions. Additionally, the confirmation may contain penalties for missed payments, often a percentage of the unpaid balance, emphasizing the importance of adhering to the agreed-upon schedule.

Contact Information

Payment plan confirmation involves a clear outline of financial agreements, making details crucial for effective communication. The payment schedule typically includes specific payment amounts, due dates, and duration of the plan. A common timeframe is six months, with monthly payments ranging from $50 to $200 depending on the total owed. Important contact information usually includes the names of the parties involved, phone numbers, and email addresses, ensuring both parties can communicate effectively. Providing clear terms is essential, as it protects the interests of both the payer and the payee, fostering trust and accountability in the agreement.

Terms and Conditions

A payment plan confirmation outlines the terms and conditions agreed upon between the debtor and creditor regarding repayment. This document typically specifies crucial details such as the total outstanding amount, which may represent a loan or an outstanding balance from a purchase, the payment schedule including due dates, and the frequency of payments, ideally weekly, bi-weekly, or monthly. Interest rates may also be included if applicable, clarifying any additional costs incurred over time. Additionally, it may address consequences of missed payments, such as late fees or potential legal actions, ensuring both parties are aware of their rights and obligations. Communication channels for inquiries or issues should also be mentioned to foster transparency. The importance of keeping personal information secure during this transaction should not be overlooked, especially when involving financial institutions or online services.

Signature and Date

Payment plans established through agreements can streamline financial obligations, facilitating manageable repayment schedules for substantial amounts. Clear communication outlining terms and conditions, such as monthly installment figures and due dates, fosters accountability. A signature (a personal identifier affirming commitment) and date (indicating the agreement's initiation point) provide an official record. Both elements ensure legal validity, signifying alignment between parties involved. Additionally, maintaining organized records of payments enhances transparency, mitigating potential disputes throughout the repayment process.

Comments