Are you looking to close your account but don't know how to communicate that with your bank or service provider? Writing a clear and courteous account closure notice is essential to ensure that your request is processed smoothly. In this article, we'll guide you through the steps to craft an effective letter, providing tips and templates to make the process hassle-free. So, let's dive in and streamline your account closure experience together!

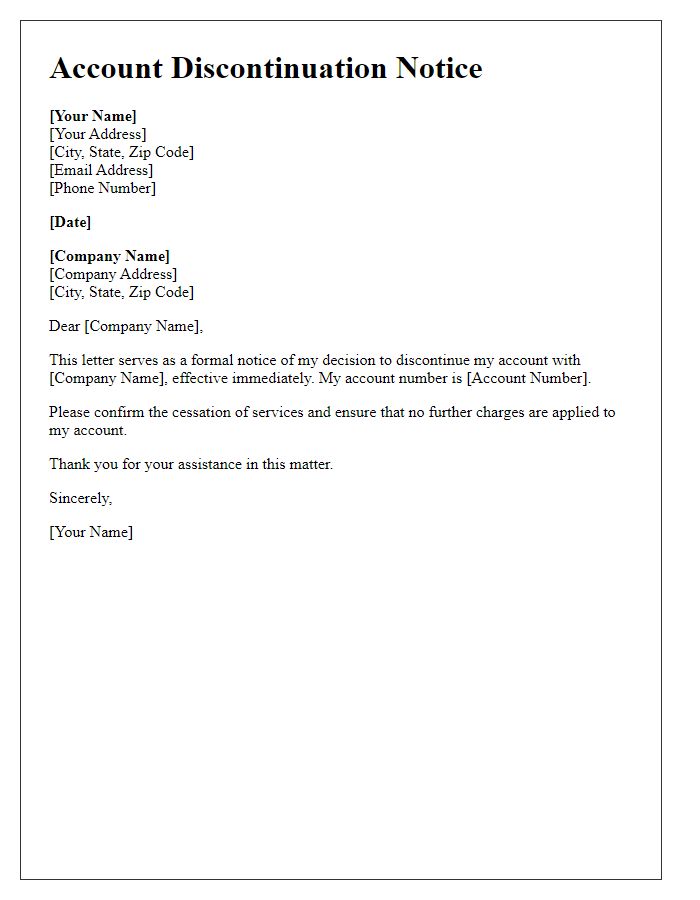

Clear Subject Line

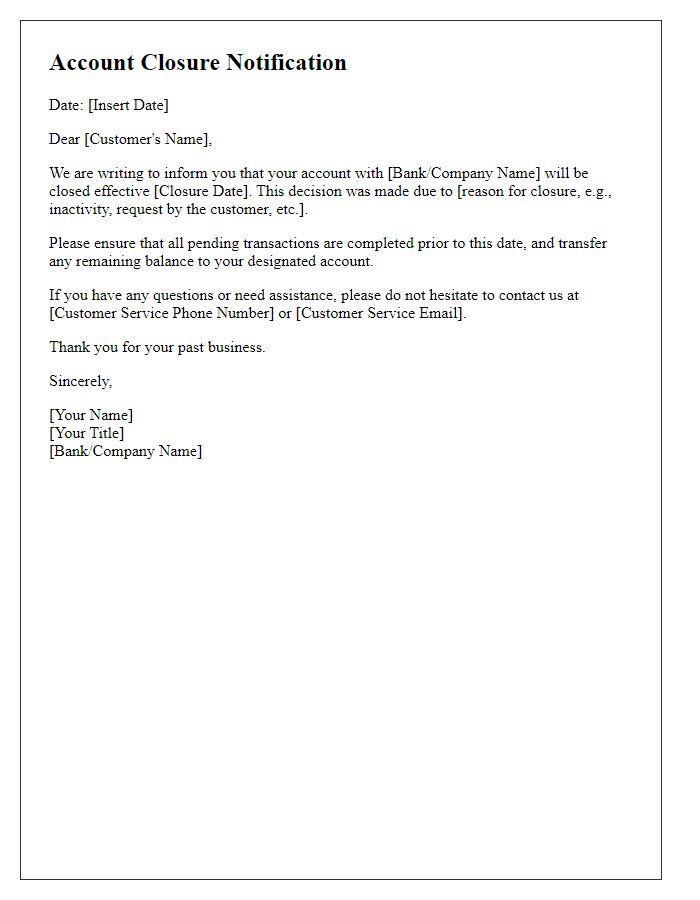

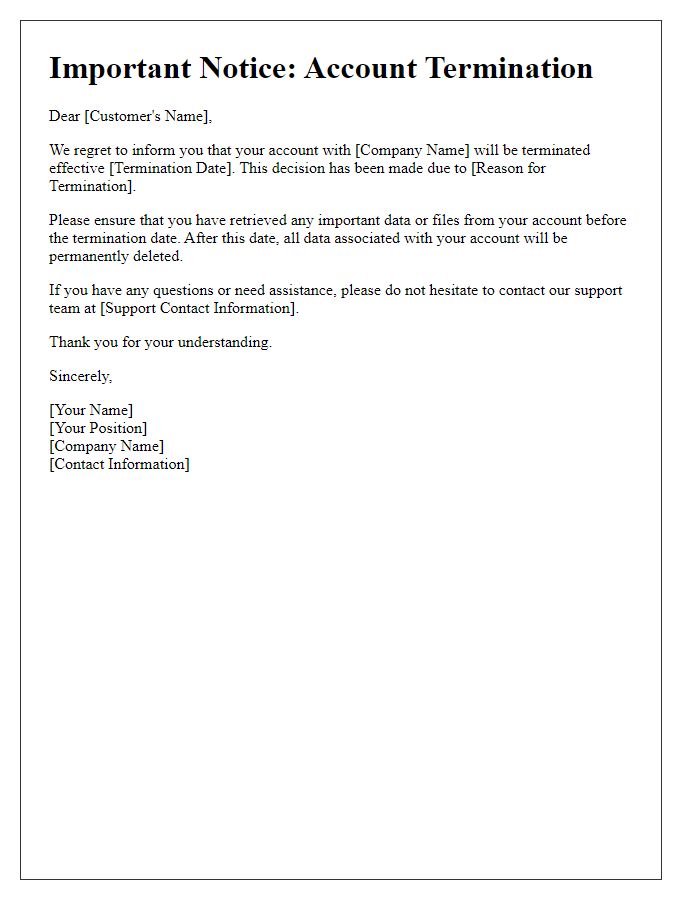

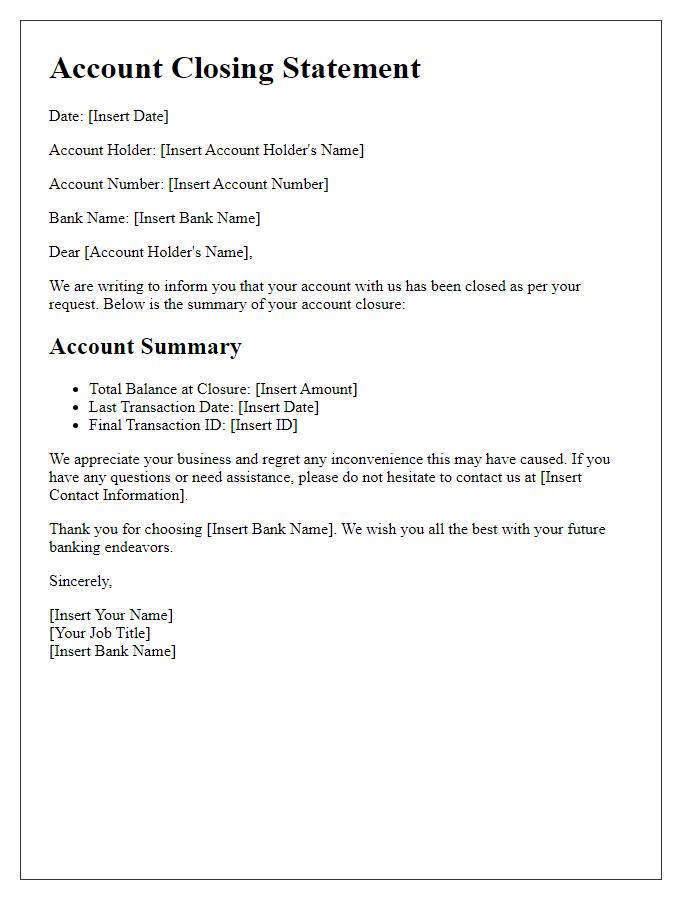

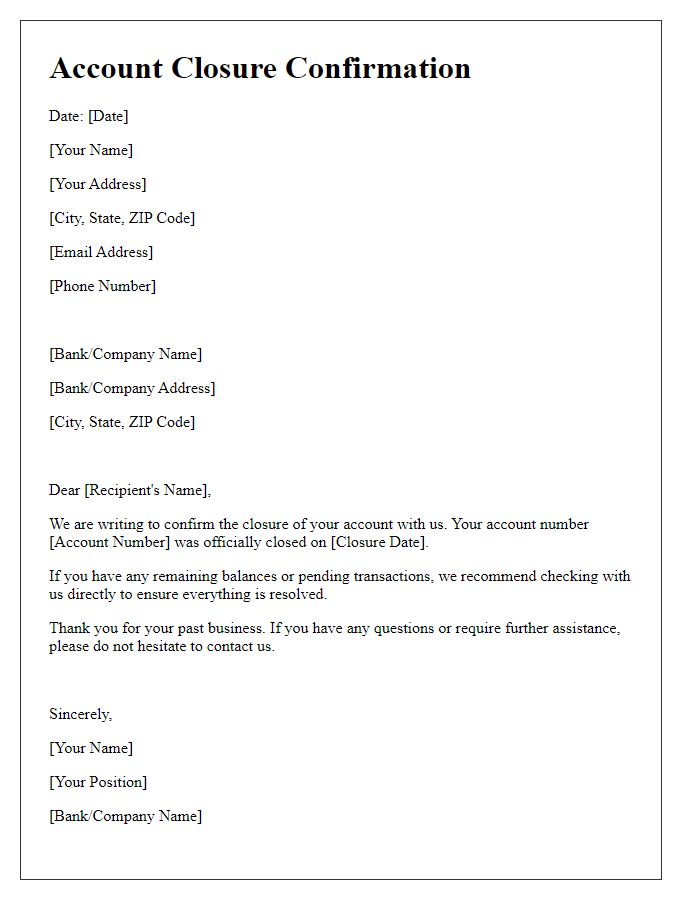

Account closure notices are official communications, usually sent via email or postal mail, to inform a customer that their account with a specific service or institution will be closed. These notices typically include critical details such as the account holder's name, account number, closure date, and any outstanding balances. For example, a bank might send a closure notice to a customer who failed to meet minimum balance requirements, detailing instructions for withdrawing any remaining funds before the account closes. Additionally, the notice may provide information regarding the reasons for the closure, potential impact on credit scores, or required actions to prevent account closure, ensuring the customer is fully informed.

Account Details

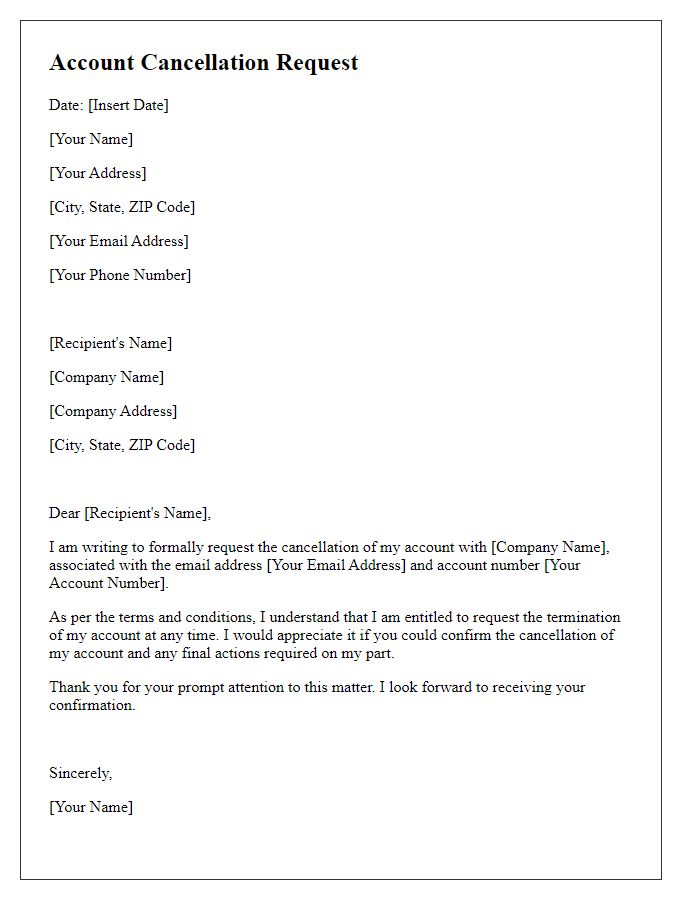

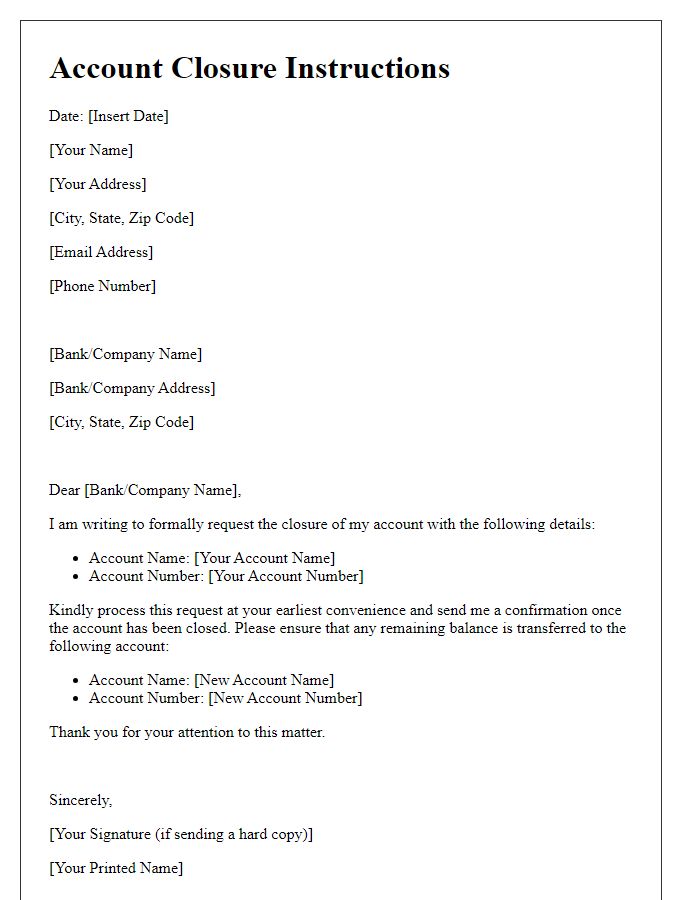

Account closure procedures are often initiated for various reasons, including inactivity or personal choice by the account holder. In many financial institutions, such as banks, the process typically involves notifying the service provider about the intention to close the account. Essential account details to include in such notifications typically involve the account number, the name associated with the account, and the type of account, such as savings or checking. It's crucial to mention the current balance, any pending transactions, and instructions regarding the disbursement of remaining funds, ensuring a smooth transition. Proper communication is vital to avoid unforeseen fees or complications during the closure process. Many organizations provide specific forms or recommend a written request for record-keeping purposes.

Reason for Closure

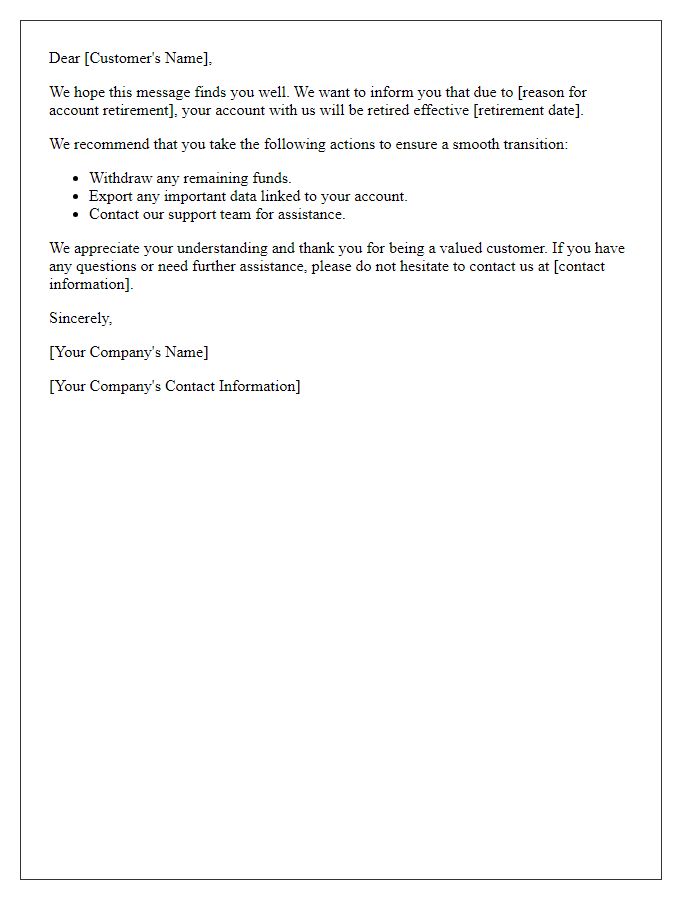

Account closure can occur due to various reasons such as inactivity, maintenance policies, or customer requests. Inactive accounts, typically those not accessed for over six months, may be flagged for closure to streamline services. Maintenance policies often involve regular audits conducted by financial institutions or service providers to ensure compliance with regulatory requirements, leading to account closures in cases of discrepancies. Additionally, customers might request closure for personal reasons, such as a change in financial circumstances or switching to a different service provider. Each reason hinges on specific policies and procedures unique to each organization involved.

Important Dates

Account closure notices serve as formal notifications that an account will be closed, typically by a financial institution or service provider. Essential information includes the account number, closure date (often specified as 30 days from the notice), customer service contact details, and instructions for redeeming any remaining balances. Important dates may involve the final transaction date, withdrawal deadlines, and the timeline for the processing of any pending transactions. Customers are advised to ensure all automatic payments are canceled and to retrieve any important documents stored electronically. Failure to comply with these date parameters may result in difficulties accessing funds or services following the account's closure.

Contact Information

Notice of account closure requires clear identification of the involved parties. Account Holder (Customer's Name) must include personal details such as address, phone number, and email for verification. Financial Institution (Bank or Service Provider) should be specified by name, along with its official contact details, including branch address and customer service phone number. A well-defined closure request clearly states the account number and any relevant dates to facilitate processing. Final statements may include balance reconciliation and withdrawal instructions, ensuring account holder's awareness of any outstanding transactions.

Comments