Have you ever found yourself needing to reconcile your accounts but weren't sure how to request the necessary information? You're not alone; many individuals and businesses face this challenge. Crafting a clear and concise letter for account reconciliation can help streamline the process and ensure you receive the information you need. Let's explore the essential elements of an effective account reconciliation request that will make your task easierâread on to discover more!

Account Information

Account reconciliation involves a detailed examination of financial transactions to ensure accuracy and consistency. This process typically requires the account number, which serves as a unique identifier for financial statements linked to specific customers or vendors. The reconciliation requests often involve reviewing previous months' transaction records, identifying discrepancies, and confirming balances as of particular dates, such as the end of the fiscal quarter on March 31 or December 31. Additionally, documents such as bank statements, invoices, and payment receipts are crucial in verifying the accuracy of the accounts. Various software tools, like QuickBooks or Excel, enhance the efficiency of this process by providing features for data comparison and error tracking, ensuring that any misalignments are addressed promptly.

Reconciliation Period

During the reconciliation period, typically spanning from January 1 to March 31, discrepancies between account statements may arise. Financial institutions, like banks, often issue monthly statements. These statements require comparison against internal records. Any inconsistencies identified during this review may relate to transactions such as deposits, withdrawals, and service fees. Account reconciliation is crucial for accurate financial tracking, ensuring alignment between the bank's records and personal or business financial activities. Regular reconciliation prevents errors, helps identify fraud, and ensures compliance with accounting standards. Utilizing tools like spreadsheets can facilitate this process, providing a clear overview of account balances and outstanding transactions.

Detailed Transactions Summary

The account reconciliation request requires a detailed transactions summary that outlines all financial activities related to the specified account within a defined period. This summary should include key information such as transaction dates, unique transaction identifiers, amounts, transaction types (e.g., deposits, withdrawals, fees), and the current balance resulting from these activities. For instance, bank statements from the last quarter (July to September 2023) should reflect interactions, including significant deposits from clients or vendors, recurring monthly expenses, and any irregular transactions that may require further explanation. This comprehensive overview promotes clarity and accuracy when aligning your records with those of the financial institution involved.

Contact Details for Clarification

Account reconciliation requests often require clear communication regarding discrepancies. Providing contact details for clarification is essential for ensuring a smooth resolution process. Relevant information may include names of financial representatives, their job titles, and specific phone numbers (typically formatted in international standards, such as +1-XXX-XXX-XXXX for the United States). Email addresses (often using institutional domains) facilitate prompt electronic correspondence. It is also advisable to include office hours (typically 9 AM to 5 PM, Monday to Friday in many business contexts) for availability, ensuring that inquiries occur at convenient times. Clear contact details expedite the clarification process and enhance accuracy during account reconciliations.

Request for Prompt Response

Account reconciliation involves verifying financial records, ensuring accuracy between two sets of records, typically from different parties. In accounting practices, discrepancies can arise due to data entry errors, timing issues, or missed transactions, leading to significant financial misstatements. For instance, checking bank statements from financial institutions, such as Chase or Bank of America, against internal records often reveals these discrepancies. When conducting reconciliations for accounts, companies may analyze transaction dates, amounts, and descriptions, which frequently involve invoices from suppliers like Amazon or payments to clients. Urgent requests for reconciliation often emphasize the need for a swift response to maintain accurate financial reporting and comply with auditing standards, especially during quarterly or annual financial reviews.

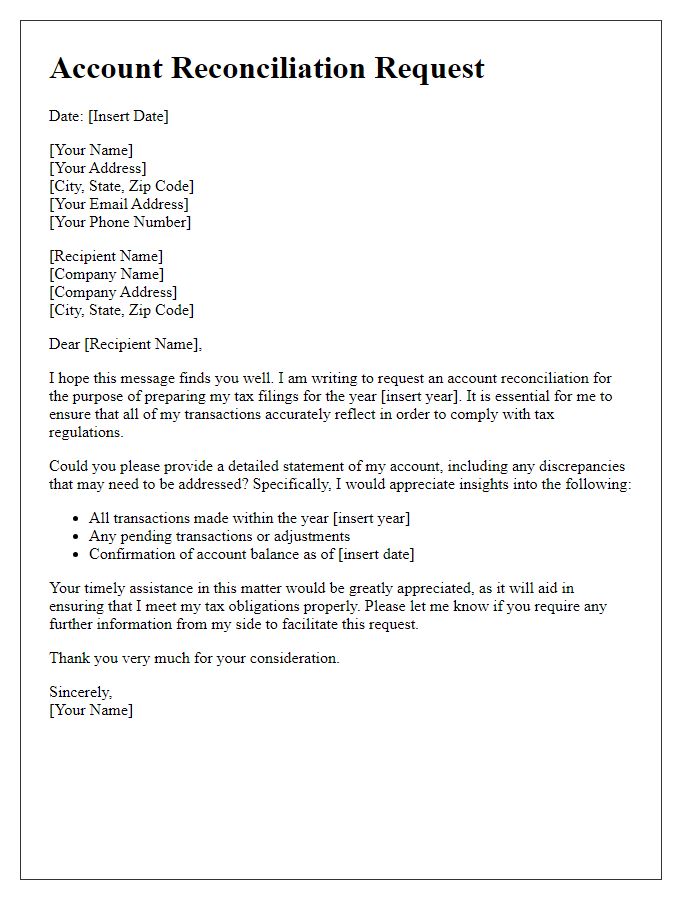

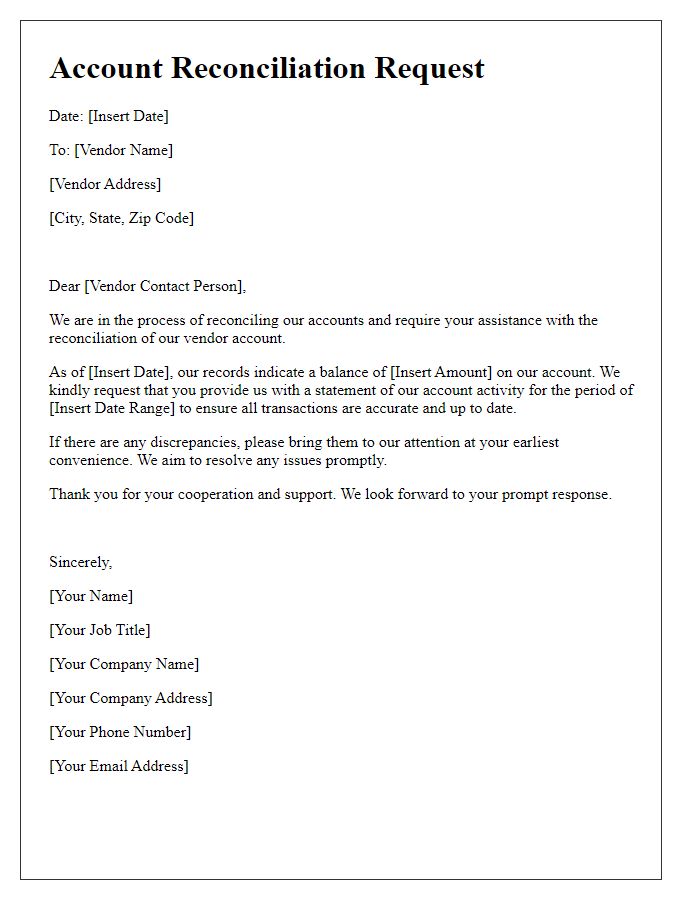

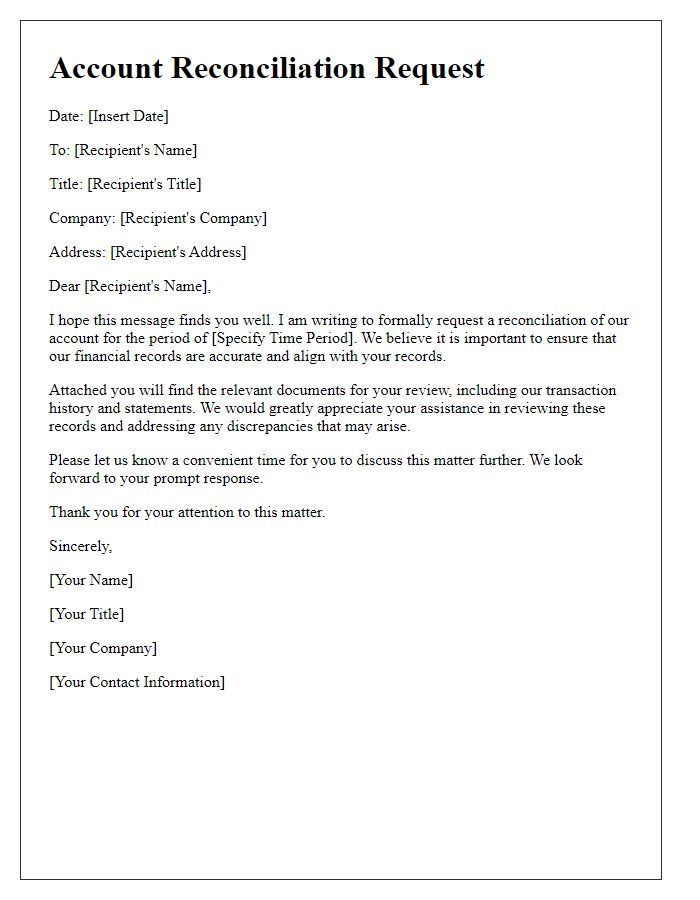

Letter Template For Account Reconciliation Request Samples

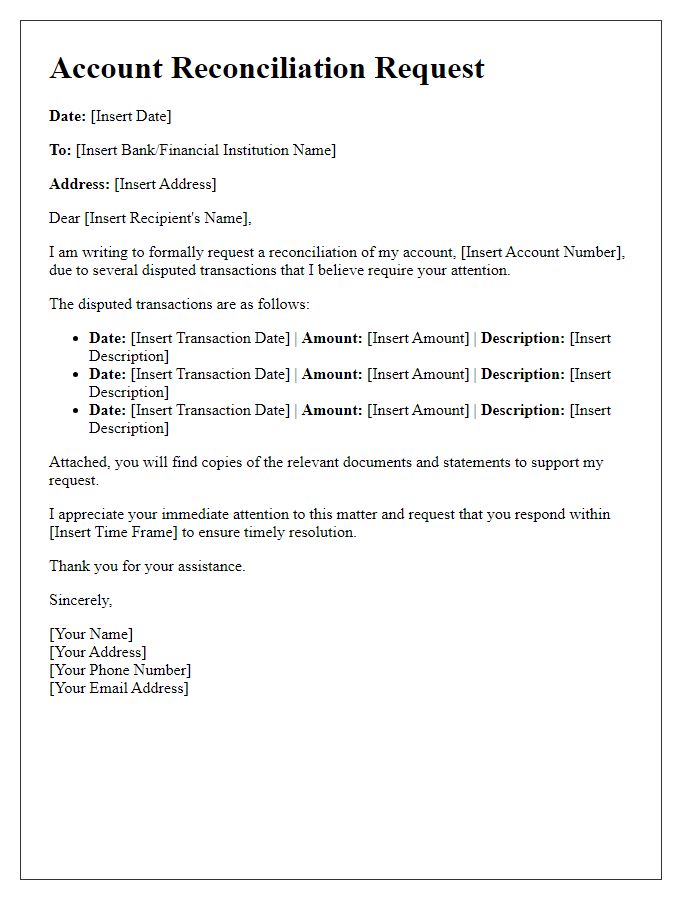

Letter template of account reconciliation request for disputed transactions.

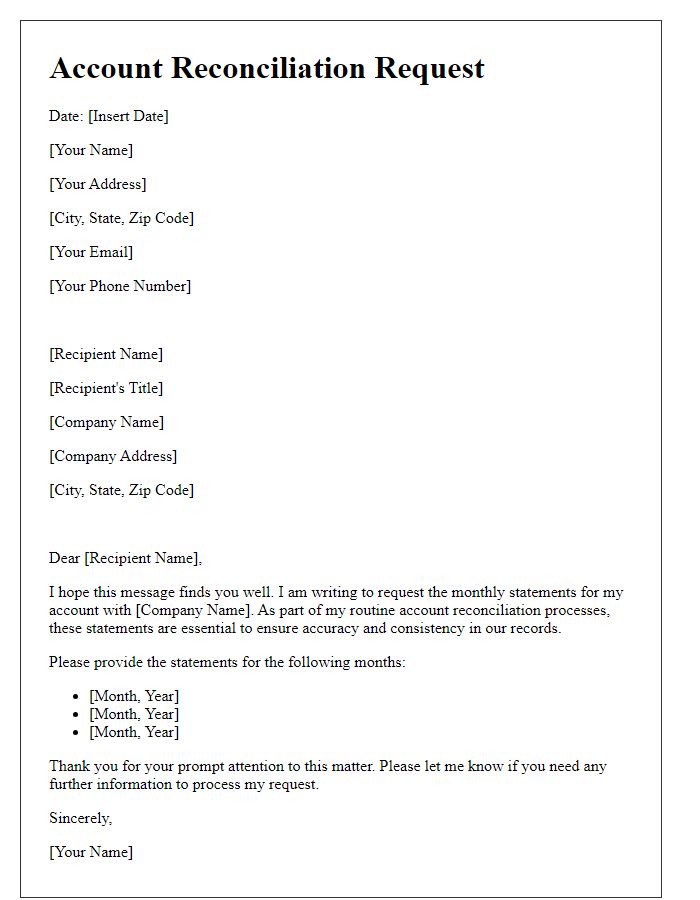

Letter template of account reconciliation request for monthly statements.

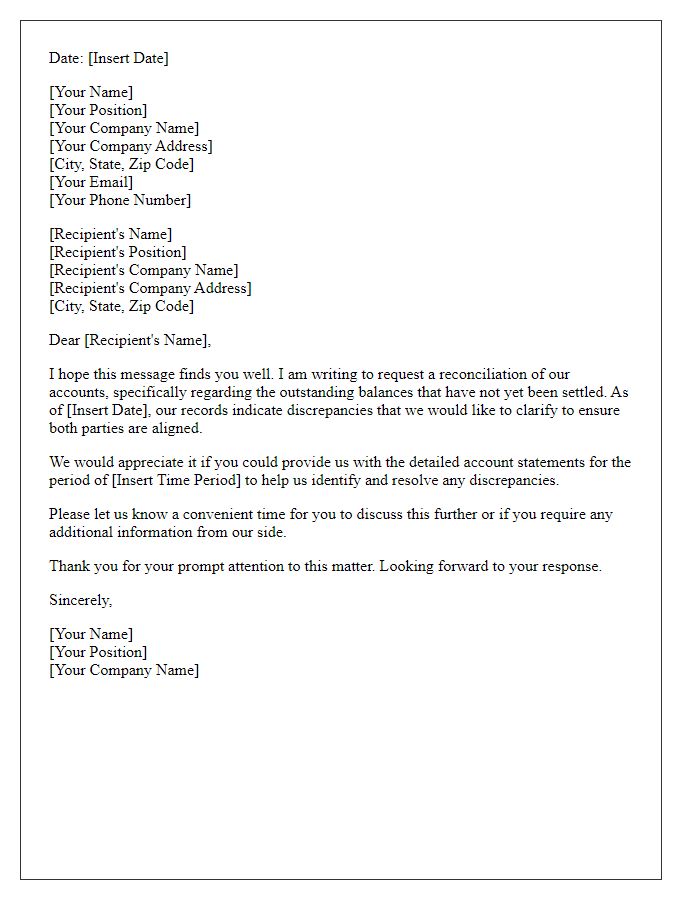

Letter template of account reconciliation request for outstanding balances.

Letter template of account reconciliation request for partnership accounts.

Comments